by Sara Rosner, James Russo, & Henna Nordqvist, AllianceBernstein

AI’s rapid growth is driving demand not only for electricity but also for the clean water needed to run its physical infrastructure. As data centers expand, rising water intensity is straining supplies and testing long-term sustainability. In our analysis, these pressures create both risks and opportunities for active investors.

How Cool Is AI?

AI’s explosive growth shows little sign of ebbing, with a record $350 billion projected for AI-focused business investment in 2025 alone. As a result, global capacity for AI’s server-housing facilities, or data centers, is expected to rise 23% in each of the next five years, with the US dominating.

The build-out is expected to spike data-center electricity demand by 160% in the US, contributing to a 25% increase in overall power demand through 2030, according to the International Energy Agency. Meeting greater global power needs will have distinct challenges. But we also see a variety of potential risks stemming from water becoming either more scarce or less pure.

This is because AI’s powerful data centers tend to run extra hot, and many of them require a lot of ultrapure water to constantly chill them. Consequently, a data center’s success will likely depend as much on access to ample and clean water as on reliable power sources.

Rising Water Risk as a Market Disrupter

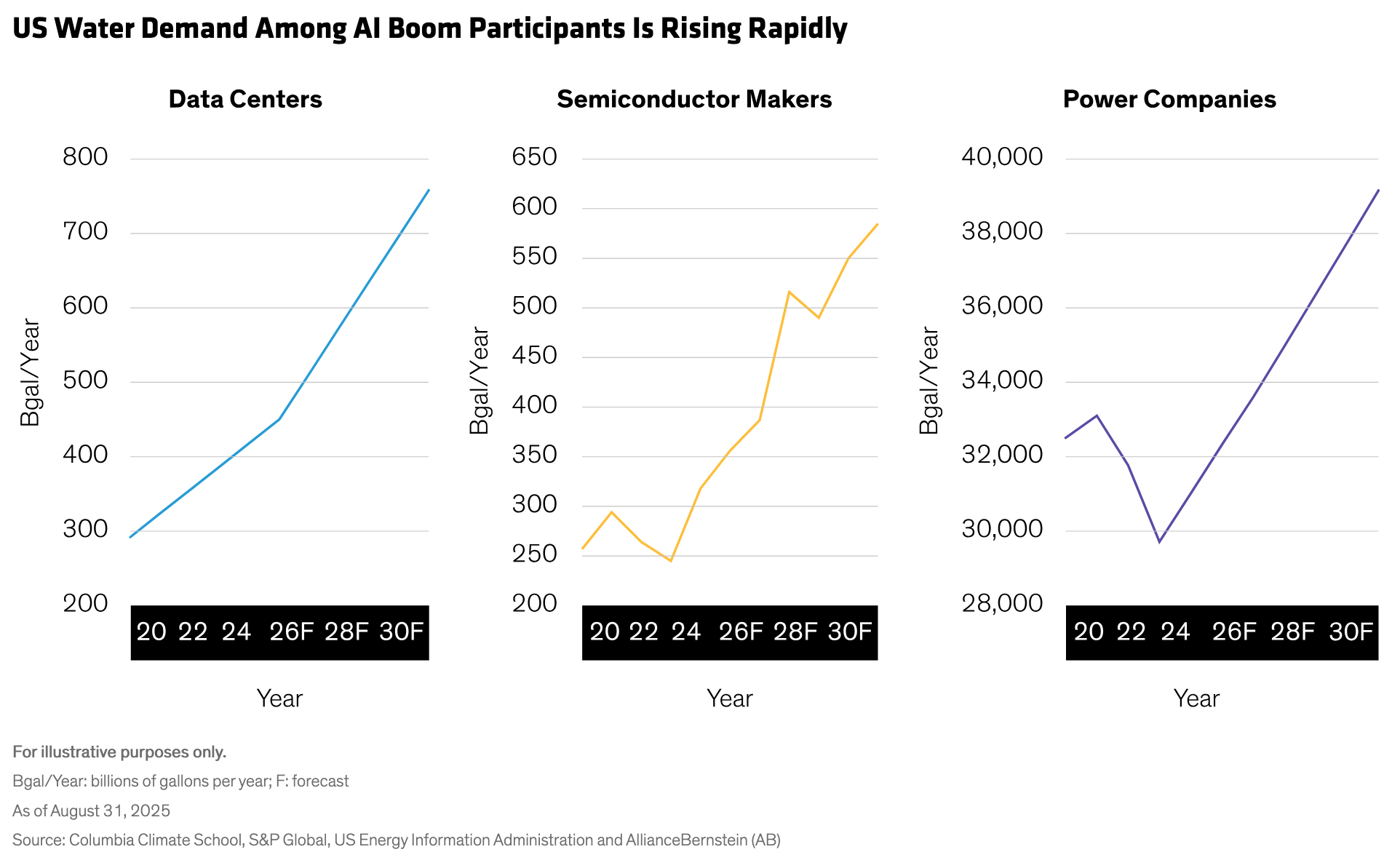

Data centers aren’t the only AI boom participants in search of water. Semiconductor manufacturers and utilities are also intensive water users and are likely to need even more of it (Display). US power generation—particularly coal and nuclear—accounts for about 70% of all freshwater withdrawals, though most is returned to its source after cooling.

Research we conducted with the Columbia Climate School shows that these three areas combined are expected to grow demand for clean water by 33% through 2030. Location can also add material risk, since many data centers are either situated in or planned for regions already stressed for water, our findings show.

We see a continued ramp-up in data center build-out, chip production and power generation in the near term. And water risk is emerging as a key constraint for these and other industries—potentially more disruptive than climate change itself. For instance, a Bloomberg study found that about $70 trillion in global GDP could be directly exposed to high water stress by 2050.

We’re already seeing companies change up their long-term playbooks due to near-term water concerns—Constellation Brands’ now-abandoned beer plant in Mexico and Google’s nixed plans for a data center in Chile, for example.

That’s why we believe water stewardship is integral to active investment selection. By the same token, company engagement is crucial to determining a business’s water-risk exposure and whether it’s helping to solve the problem for its own benefit and in some cases for others.

Assessing a Company’s Chill Factor

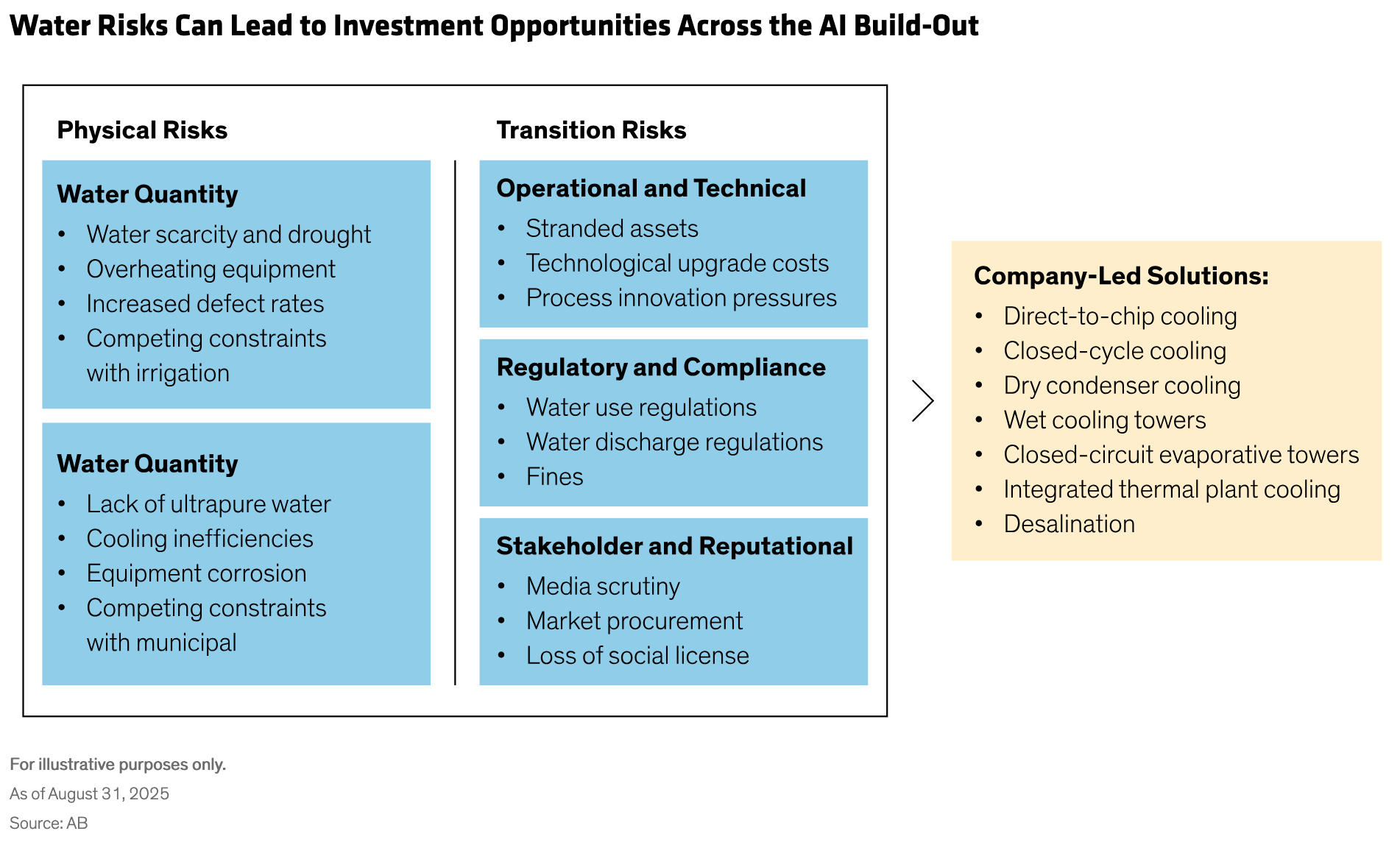

Many companies outside of the tech industry—whether household names or unfamiliar start-ups—are participating in the AI boom in some fashion. But we think progress will come more readily to innovators that share lasting solutions to AI’s biggest challenges, including water scarcity (Display).

We see a significant milestone in harnessing the ocean for cooling solutions. Though costlier than purifying water from municipal sources, desalinating seawater is very effective in semiconductor fabrication. The process uses either evaporation or membrane filters to remove minerals that harm equipment and microchips. Companies such as DuPont Water Solutions, LG Chem and Flowserve are among the key enablers in this growing market, which is expected to top $50 billion by 2032.

Direct-to-chip liquid cooling also has potential in a water-stressed world. This method places metal cooling plates in direct contact with processors to dissipate heat while low amounts of water carry the heat off through grooves. Asetek is one of the leading public companies in this space, which is currently dotted with private firms.

Yet another innovation is closed-cycle cooling, which is highly water efficient and environmentally friendly. The process lowers heat by circulating liquid coolant—mostly water—throughout a system that can range from evaporative towers to condensers. SPX Technologies stands out as a global pioneer in the public markets. However, numerous privately held companies are also leading advancement in this space, such as Kelvion and Hamon Group.

Global water scarcity isn’t a risk unique to AI, but the race for AI domination is increasingly revealing its hidden dangers and potential costs. And with so much of today’s market value tied to a handful of AI leaders, responsible investing requires recognizing water-risk exposure at every level—as well as the opportunities created by it.

The authors would like to thank Maxwell Lulavy, Responsible Investing Research Analyst at AB, for his significant contributions to the research behind this blog.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

About the Authors

Sara Rosner is a Senior Vice President and AB’s Director of Responsible Investing Research. She leads the Responsibility team’s work with AB’s investment teams and clients on identifying, researching and engaging with material environmental and social issues that arise in the investment process. Rosner also leads AB’s collaboration with the Columbia Climate School, which focuses on enhancing investors’ ability to integrate climate change considerations into their decision-making and investment processes. She has developed and is implementing AB’s approach to managing material risks and opportunities stemming from the global transition to a lower carbon economy and has managed firmwide initiatives on climate scenario analysis, carbon offsets, and ESG education and training. Prior to joining the firm in 2018, Rosner performed research for the Columbia Center on Sustainable Investment, where she worked on projects related to the United Nations Sustainable Development Goals and renewable energy alternatives in the extractive industry. She spent most of her early career as a journalist covering energy and infrastructure finance in the Americas for Euromoney Institutional Investor. Rosner holds a BS (magna cum laude) in international studies from Pepperdine University and an MS in sustainability management from Columbia University. She is a global member of 100 Women in Finance and a member of Women Investing in a Sustainable Economy (WISE). Rosner was named one of Crain’s New York Business Notable Leaders in Sustainability 2023. Location: New York

Jim Russo is a Senior Vice President and Senior Research Analyst on the Strategic Core Equities investment team. Russo focuses his coverage on the technology sector, including the software, semiconductor, services and fintech industries. He has more than 20 years of experience investing in technology companies at firms, including Fidelity Investments, Voya Investment Management and TimesSquare Capital Management. Russo holds a BS in finance and economics from Boston College, and an MBA from Columbia Business School. Location: New York

Henna Nordqvist is a Vice President and Corporate Credit Analyst on the Fixed Income team at AB, primarily focusing on investment-grade technology, media and telecom (TMT); healthcare and pharmaceuticals; and utilities. She joined the firm in 2022. Before that, Nordqvist was a senior research analyst at AIG Investments, where she focused on investment-grade TMT and oversaw a team of analysts responsible for the coverage of industrial companies. Earlier in her career, she served as an analyst on the High Yield and Equity Research teams at UBS, and at Fitch Ratings. Nordqvist holds an MSc in accounting and finance from the Turku School of Economics at the University of Turku, Finland. She is a CFA charterholder. Location: New York

Copyright © AllianceBernstein