by Hubert Marleau, Market Economist, Palos Management

Last week I wrote: “The research work of Mokyr, Aghion and Howitt, suggests - perhaps proves - that the AI boom may turn out to be a bonanza for it is a general purpose technology like the printing press, internal combustion engine, electrification and the internet: a macro-invention that may potentially, over time, be complemented by a string of micro-inventions, disseminated on a broad basis. This is where digital innovation, which happens abstractically on screens, transfers to physically real innovation like drones, driverless cars and robots.”

There is growing evidence that recent productivity gains are due to the role that AI is having on the labour market. For instance, the Atlanta Fed’s GDPNow model estimate for real GDP growth in Q3 is 3.9%, with little contribution from higher levels of employment, suggesting that the bulk of the expansion stems from large productivity gains, which in turn has kept a lid on unit labour cost inflation, preventing Trump’s tariffs from boosting inflation but prohibiting it from falling to 2.0%.

Indeed, many companies (Amazon, Meta, Rivian, General Motors and others) have been announcing white-collar headcount reductions attributing them to AI. Indeed, a lower new normal employment market is emerging thanks to a restructuring of head office staff of middle managers, consultants and other layers of workers,who are given pink slips to make room for blue-collar or specialized workers. These cuts do not appear to be linked to weaker demand but to the impact of tech advances on middle management. AI is changing the nature of work quickly as this generation of AI is enabling companies to innovate and implement specialisation fast.

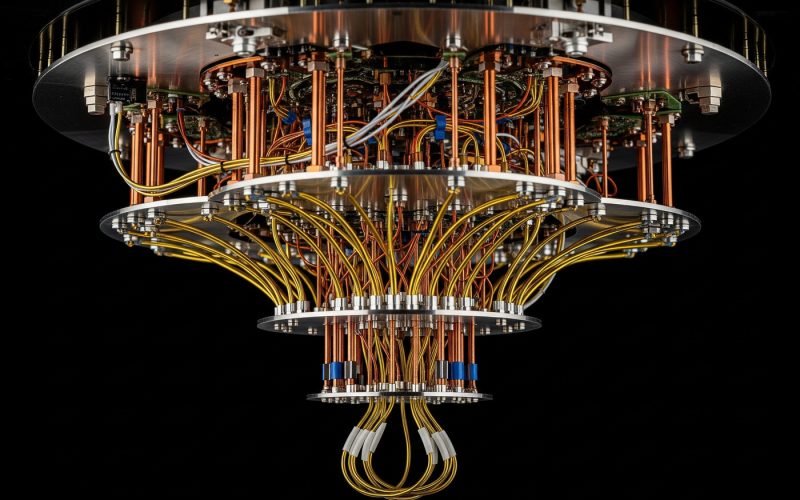

Meanwhile, quantum computing, which is currently a physics experiment confined to the laboratories of a few mega-cap companies like Google, Microsoft, Honeywell Quantum Solutions, IBM, and a small bunch of single-purpose pure plays like D-Wave, Regetti, IonQ and CCCX, is about to explode into a major revolutionary technology that will work alongside traditional AI processors - a scientific advancement that could be transformative in anything that has until now been unsolvable and metaphorical for such fields as weather forecasting, autonomous vehicles, biotechnology, space exploration, mineral explorations, pharmaceutical research, and material science.

This week, Google said it ran a breakthrough algorithm on its "Willow" quantum-computing chip that cleared the way for a range of potential users in medicine and science and an IBM quantum processor was used by HSBC to achieve a world-first breakthrough in applying the technology to real-world algorithmic bond trading, both showing that quantum computers can run thousands times faster than classic supercomputers. Indeed, McKinsey estimates that quantum technology could generate up to $97 billion in revenue by 2035, which explains why large sums of money have piled up in private quantum-computing companies: $6.0 billion in the 9 months ended September 2025.

N.B. Quantum technology harnesses the mind- boggling mechanics of quantum physics - the science of how particles behave at the atomic level - to build new kinds of computers, sensors and communication systems that can solve complexity where thousands of variables are interacting simultaneously with each other: a critical next-generation technology and perhaps the next frontier in national security.

What Took Place in the week ended October 31?

On Sunday, U.S. stock-market futures registered strong gains as top negotiators expressed optimism that a new trade deal was in reach, including rare earths, which could reduce volatile bouts of escalations and cool-downs, ahead of a key meeting later in the week between President Trump and President Xi.

On Monday, the S&P 500 was on fire, notching another record high. It rose 1.2% to 6875 as investors saw the likelihood of big-tech earnings, certainty of a forthcoming rate cut by the Fed, and signs of progress on trade negotiations between the U.S. and several Asian nations, including China.

On Tuesday, stocks kept on hitting record highs, the S&P 500 increasing 0.2% to 6891. This time the rally was driven by Microsoft’s new partnership with OpenAI, an arrangement that valued its 27% stake at $135 billion with rights that extended through 2032, plus a commitment from OpenAI to spend $250 billion on Azure cloud-computing service; and by Nvidia’s declaration that it was partnering with Eli Lilly to build an AI supercomputer for drug discovery, while investing $1.0 billion in Nokia as the companies work together on AI computing infrastructure.

Meanwhile, tech enthousiasts couldn't care less about Cathie Wood’s warning of AI wheeling and dealing, let alone the University of Michigan’s October survey of consumer confidence that showed that expectations had slipped to 71.5 - a measure which has been in the dumps since last February that is historically associated with the onset of recessions within 12 months.

On Wednesday, the market was searching for direction as investors braced for headlines for the Fed’s interest rate decision and earnings from the tech heavyweights. In order to safeguard a weakening job market, the Federal Reserve decided to cut hawkishly its policy rate by 25 bps and tee up to end its program of “quantitative tightening" in December because banks no longer had excess reserves. However, new oppositions to ease emerged, making a December cut not a foregone conclusion. Chairman Powell added bluntly during his press conference that a December cut was not a done deal, which in turn moved the yield on 2-year Treasury notes up sharply: 11 bps to 3.60%. Interestingly, the neutral rate is now only 23 points lower than the higher range of the target rate (4.00%), suggesting that only one more cut should be expected over the next 12 months. The S&P 500 fell immediately, ending the day unchanged from the day before at 6891.

On Thursday, shares of Meta and Microsoft dropped in the pre-market as both disclosed growing spending on AI infrastructure, which is testing the nerves of those traders and investors getting anxious to see a cash return on these firms’ humongous capital expenditures. As a result, stocks spent the day trending lower and lower as the tech selloff bled into the S&P 500, falling 1.0% to 6822.

On Friday, the S&P 500 wobbled all day, but the 12% Amazon boom lifted it 0.3% to 6840.

The Near-Term Stock Market outlook:

Last week I wrote: “The S&P 500 has been just marking time being for the past 2 weeks. Given that the U.S. economy is moving forward, profit margins are holding, and inflation is holding steady, and the monetary stance is easing, the consolidation period has probably ended, thereby enhancing my conviction that the benchmark will reach 7000 by the end of this year.”

From a contrarian point of view, the S&P 500 is due for a pullback because it is more than 10% above its 200-day moving average while the Investors Intelligence Bull/Bear Ratio is over 4.00, a combination that suggests that there are too many bulls in the play pen.

Nonetheless, I’m not shying away from my prediction of 7000 by year-end, for I agree with Jerome Powell, Chairman of the Federal Reserve, that the AI boom is not a speculative bubble like the dot-com era, when many companies were flyers of ideas without proof of concept rather than genuine businesses, generating revenue and earnings.

Incidentally, I bought a few shares of CCCX, a SPAC that will merge with Infleqtion, a global leader in neutral-atom quantum technology.

Copyright © Palos Management