by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

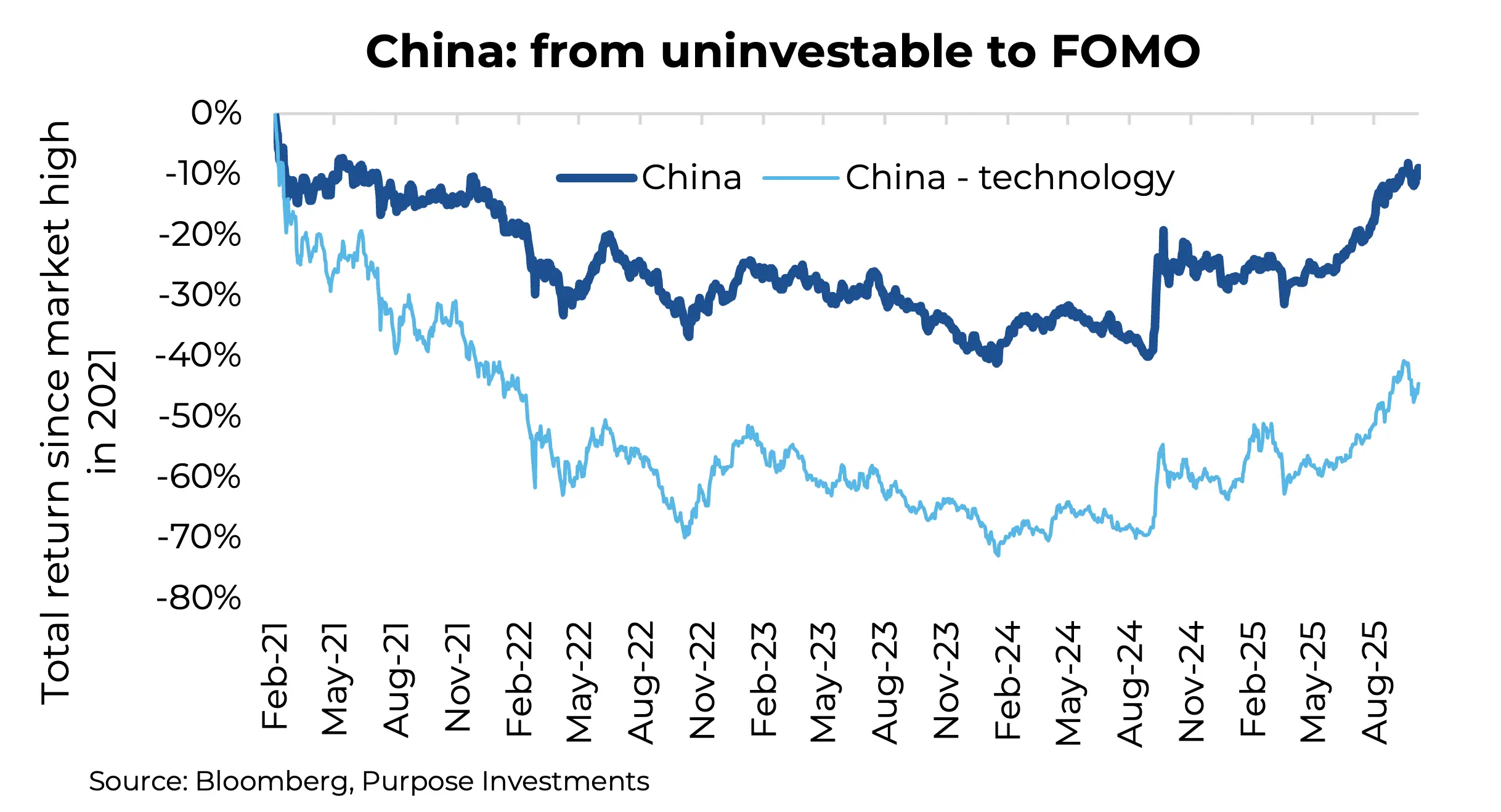

A few years ago, headlines abounded calling China “uninvestable.” And it wasn’t just the press; many famous market prognosticators and portfolio managers echoed the sentiment. The popularity of strategies “ex-China” increased. Many sound factors contributed to this consensus: deflationary pressures due to overcapacity, regulatory crackdowns, and a collapse in the property sector topped the list, as did fear over an increasingly polarized world.

The pain in China’s equity market was apparent. After outsized positive returns in 2020 and peaks in early 2021, China’s equity market tumbled over the next three years, bottoming out at a -47% drop in early 2024. The Chinese tech sector, based on a popular China technology ETF, fell 74% during this period. This culminated in the valuation of the Chinese equity market, based on the Bloomberg China Equity Index, falling to below 10x earnings while global equities traded at 17x. That’s a hefty discount for any emerging market.

But since early 2024, the Chinese equity market has been on a tear, up +47%. And those saying “uninvestable” have largely gone silent as investors have been coming back to this $19 trillion dollar equity market (including Hong Kong) that sits atop the world’s second-largest economy.

But since early 2024, the Chinese equity market has been on a tear, up +47%. And those saying “uninvestable” have largely gone silent as investors have been coming back to this $19 trillion dollar equity market (including Hong Kong) that sits atop the world’s second-largest economy.

So is it all smooth sailing ahead? Hardly, but it’s certainly more constructive.

The Chinese equity market has historically been very volatile, not just because of the underlying companies but also varying interest from both domestic and foreign investors. This is a bit of a generalization, but a number of years ago, Chinese investors flocked to equities, which drove their market higher. Stats on the number of brokerage accounts opened each month were a metric of this rising risk appetite for equities. But when equities collapsed into a bear market in 2015, capital went elsewhere, namely, real estate. And when that collapsed after phenomenal gains in 2021-23, investors again went elsewhere, including gold. But now it seems equities are back, with the caveat that changes in investor appetite can certainly add to volatility.

Demographics and debt are certainly still sizeable risks. No question due to previous policies and immigration, China has a rapidly aging population, and debt levels are pretty high. Speculation, overbuilding, and debt accumulation started a property crisis that still isn’t over. But is a three-year-old crisis still a crisis? Companies that were going to fail may have already done so, which can reduce the risk of new market-moving events.

Despite these headwinds, there are some very material tailwinds of late helping this rally in China’s equity market. Perhaps the most positive are recent policies labelled “anti-involution,” which require some understanding of how China’s economy operates: it’s more influenced by centralized initiatives.

One of my favourite analogies comes from a research provider that focuses on China, which refers to it as a Hunger Games approach. Leadership determines an industry they would like to develop, and directives are given to provinces to foster said industry. As a result, companies in the industry pop up all over the country, often too many of them. This leads to overcapacity, but as time progresses, clear winners rise up. The industry consolidates as many can’t compete, and the best model(s) become the last one(s) standing, often resulting in global leadership.

Electric vehicles are a good example. In 2019, there were an estimated 500+ EV manufacturers registered in China. This was whittled down to less than 50 by 2024, as natural selection continued. The upside is that this process fosters the creation of globally competitive companies. The downside is that it creates too much capacity and likely destroys a lot of investment capital along the way. This process has been evident in many other industries in China.

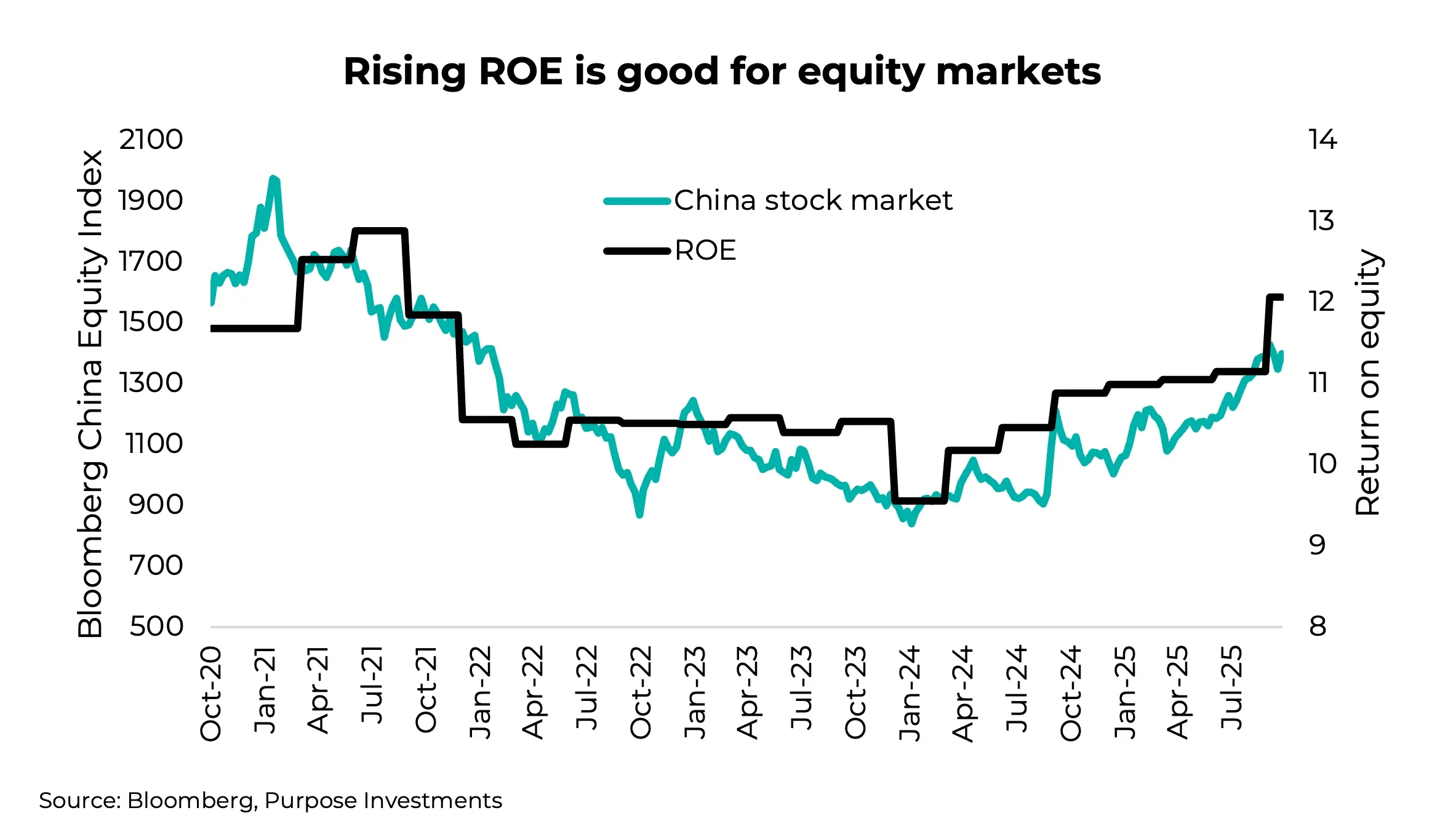

Anti-involution, which is a new direction started in 2024, is attempting to tackle overcapacity to better balance growth, innovation, and sustainability. By reducing excessive competition, the policy is attempting to help promote pricing power through consolidation. For equity markets, this is more friendly and has already started to lift return on equity.

Then there’s artificial intelligence. It’s safe to say the U.S. is currently the leader in AI, but China is clearly in second place. And if it really comes down to electricity generation to drive data centres, China certainly knows how to build capacity in things rather quickly. The Three Gorges Dam, the largest in the world, required the resettlement of 1.2 million people. In North America, we have trouble building pipelines. Hard to say which is the better way – it probably depends on whether you’re one of the 1.2 million who had to move. Regardless of preference, China has the lead in faster building, sometimes to their detriment with overcapacity.

Final Thoughts

China has attracted about $38B in flows during the past three months. To put that number into context, that was 15% of global equity flows, with the U.S. attracting $105B. 15% of global flows is certainly evidence that China has shed the uninvestable label. And perhaps investors are instead starting to feel a little FOMO (fear of missing out).

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Copyright © Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.