by Cheryl Frank, Damien McCann, Brittain Ezzes, and Mark Casey, Capital Group

The U.S. economy has demonstrated surprising resilience in the six months since President Trump unveiled a long list of tariffs against virtually every trading partner. In the aftermath of “Liberation Day,” fears of an imminent recession have eased as investors have started to envision a future without a tariff-induced trade war.

“Tariff uncertainty hasn’t fully abated but the administration has moved away from brinkmanship in favour of negotiations,” says portfolio manager Cheryl Frank.

Slowing job growth and consumer spending patterns suggest the economy is weakening. However, there are reasons for optimism, Frank notes. From the passage of the tax bill to declining interest rates, there is less uncertainty on many fronts compared to earlier this year. Below are five forces that could pave the way for continued economic expansion.

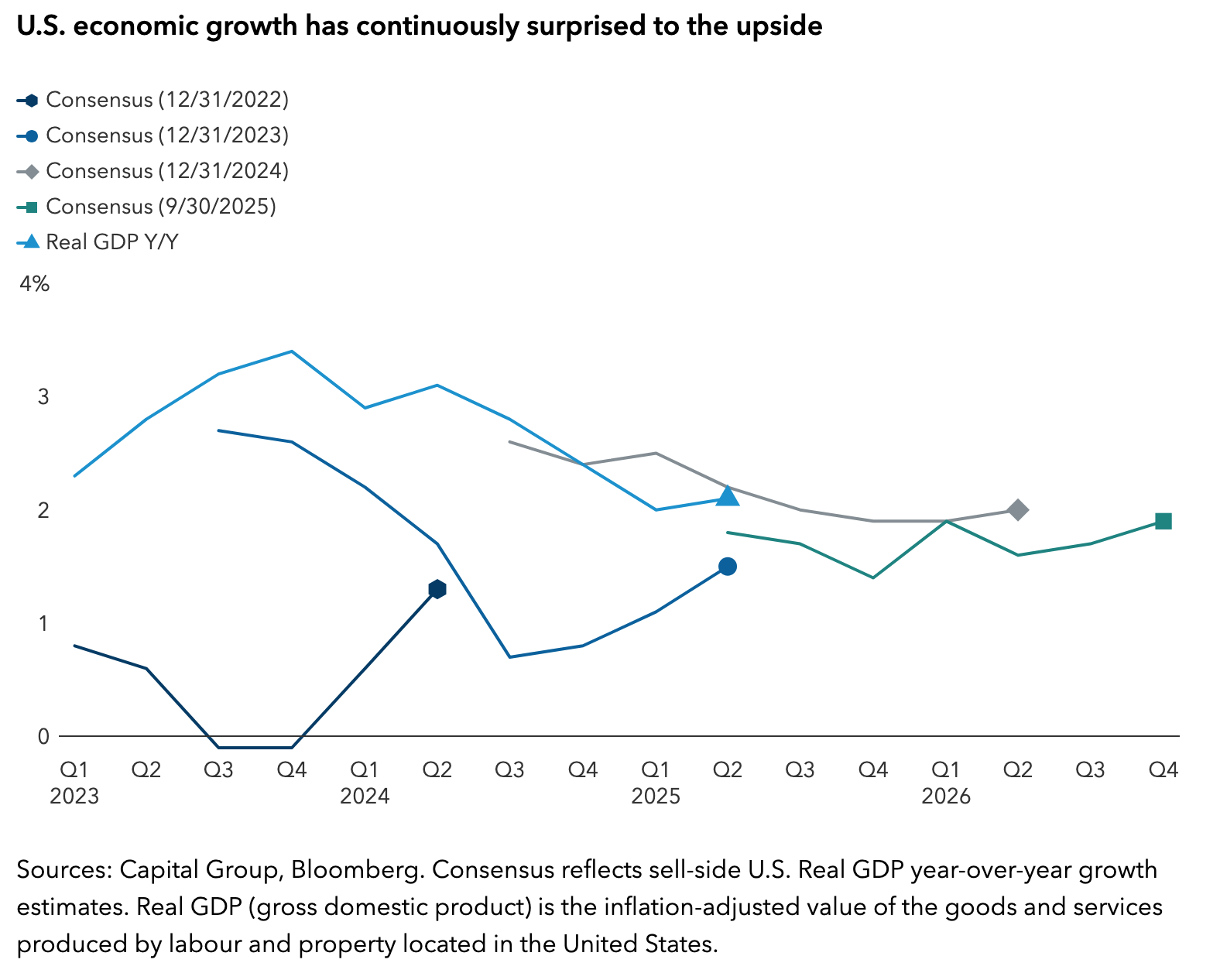

U.S. economic growth has continuously surprised to the upside

A line chart showing real GDP year-over-year growth rate consensus estimates from December 31st, 2022, December 31st, 2023, December 31st 2024 and September 30, 2025. The chart highlights the resilience of the U.S. economy, which has consistently exceeded sell-side GDP growth expectations. Real GDP growth has been decelerating, from a peak of 3.4% in Q4 2023 to most recently 2.1% in Q2 2025. Current estimates anticipate a continued deceleration, reaching a low of 1.4% in Q4 2025, followed by a gradual recovery to ~2% by the end of 2026.

1. A dovish Fed starts rate-cutting cycle

The Federal Reserve’s latest rate cut arrived at a moment of economic softness — namely sluggish job growth. Officials guided additional cuts through 2028, signifying a dovish stance.

Rate cuts usually lead to higher company spending and hiring, and more sales of big-ticket items such as cars and homes. “There’s a long list of U.S. companies waiting for rates to drop, especially those tied to the housing market,” Frank notes. Potential beneficiaries include retailers such as Home Depot, heating and cooling system manufacturers such as Carrier Global and paint companies such as Sherwin-Williams.

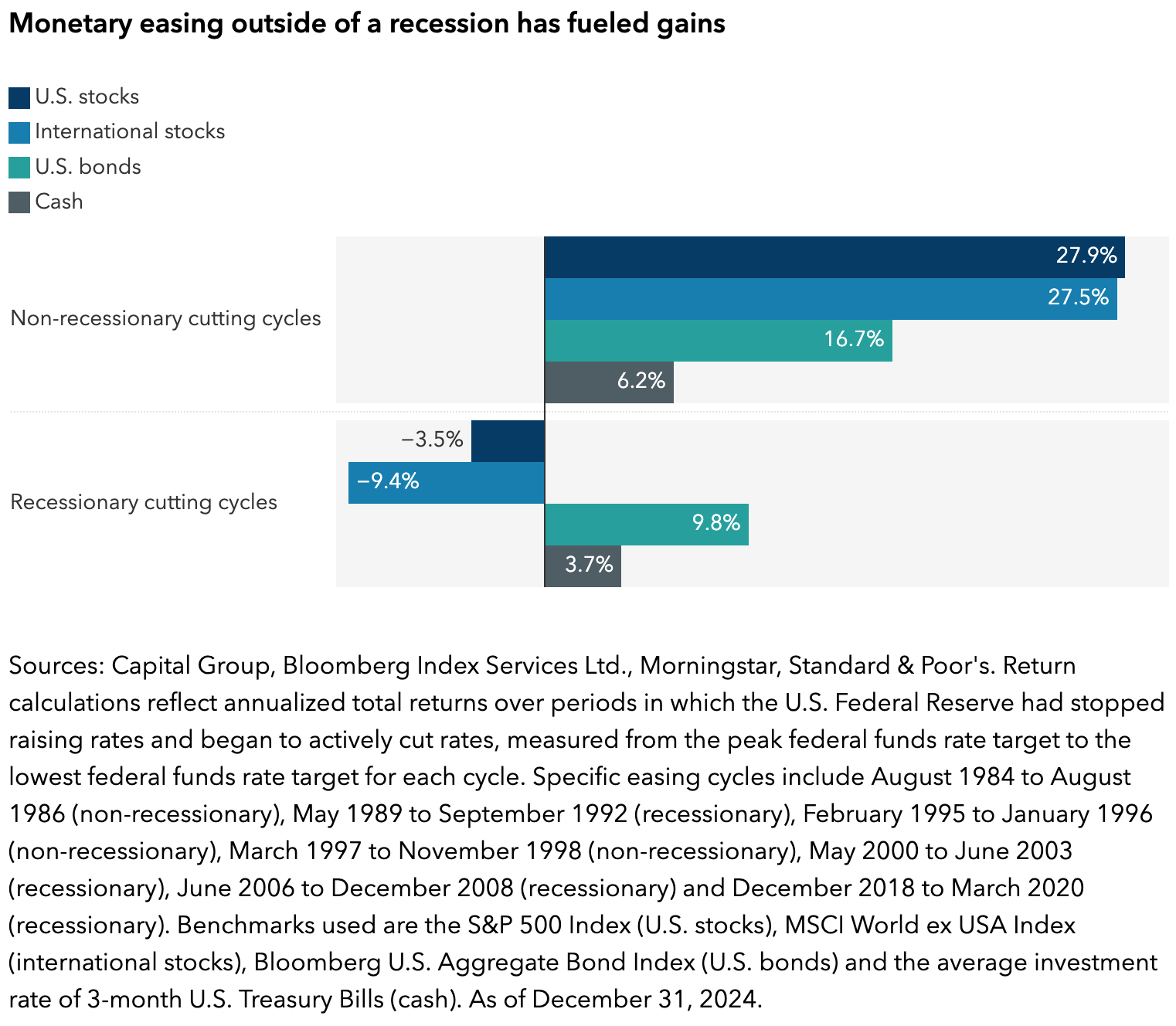

Markets have rewarded investors when rate cuts happen outside of a recession. On average, the S&P 500 Index returned 27.9%, while the Bloomberg U.S. Aggregate Bond Index returned 16.7%.

Monetary easing outside of a recession has fueled gains

Two horizontal bar charts compare average annualized returns across U.S. stocks, international stocks, U.S. bonds, and cash during the last seven Federal Reserve interest rate easing cycles. One chart represents non-recessionary cutting cycles, the other recessionary. Returns are notably higher in non-recessionary periods: 27.9% for U.S. stocks, 27.5% for international stocks, 16.7% for U.S. bonds, and 6.2% for cash. In contrast, recessionary cycles show lower or negative returns: -3.5% for U.S. stocks, -9.4% for international stocks, 9.8% for U.S. bonds, and 3.7% for cash.

Still, there are concerns borrowing costs may not decline to levels that rekindle spending. After all, the Fed cut interest rates in September 2024, only to see the benchmark 10-year U.S. Treasury, which underpins borrowing costs, rise instead. The culprit? A string of unexpectedly strong economic data prompted investors to recalibrate policy expectations, pushing rates higher.

So far this year, the 10-year Treasury has declined over half a point to 4.13% on October 8, from a level of 4.79% in January. A more amiable Fed, particularly if the administration has more sway with rate setters, could explore unconventional tools to suppress long-term yields, says Damien McCann, fixed income portfolio manager for Capital Group Multi-Sector Income FundTM (Canada) and Capital Group Multi-Sector Income Select ETFTM (Canada). “It’s not a prediction, but a possibility worth considering.”

2. U.S. tax bill functions as a “massive stimulus check”

A notable feature of the One Big Beautiful Bill Act is the inclusion of retroactive tax cuts for 2025, with refunds to taxpayers expected in early 2026.

Other aspects of the bill, such as exemptions for overtime and tips, translate to unusually large tax refunds totaling over US$200 billion in early 2026. “It could function as a massive stimulus check,” Frank says. The one-time cash infusion may serve as a powerful psychological boost to consumer confidence and provide some relief to tariff-related inflation.

The bill also favours companies that invest in the U.S. by lowering their taxable income. Specifically, companies can quickly expense spending on research and development, capital investments and new factories. As a result, technology and defence companies may see a boost in free cash flow.

Not all sectors are winners, as the bill rolls back some prior subsidies for clean energy and health insurance. Moreover, the plan increases the national debt significantly over the long run, which could fan inflation and weigh on growth.

3. Deregulation can spur growth outside of AI

A deregulatory environment could benefit some companies, including those left out of the artificial intelligence boom.

“Many businesses not on the cutting edge of technology have been left behind,” says portfolio manager Brittain Ezzes. "Broadly speaking, companies in the energy, industrials and telecommunications sectors could be helped by deregulation."

Investors are also closely tracking bank deregulation since it could increase lending activity across industries — a potential tailwind for the economy. Wells Fargo Bank, for example, has faced years of regulatory scrutiny and was limited in its ability to grow revenue. But Ezzes sees potential: The bank hired a new management team in 2019 that worked to restore its reputation. The removal of its asset growth restriction coupled with a more favourable regulatory climate could expand the company’s lending base and earnings potential.

“With the deregulation push by the U.S. administration, companies may feel less constrained in making investment decisions,” McCann adds.

So far this year, cable giants Charter Communications and Cox Communications are set to merge, and Union Pacific aims to forge a coast-to-coast rail system via its acquisition of Norfolk Southern. Both deals underscore a broader wave of consolidation that may test the boundaries of antitrust concerns. On the flip side, McCann notes, fewer regulatory eyes mean investors need to be vigilant of potential risks.

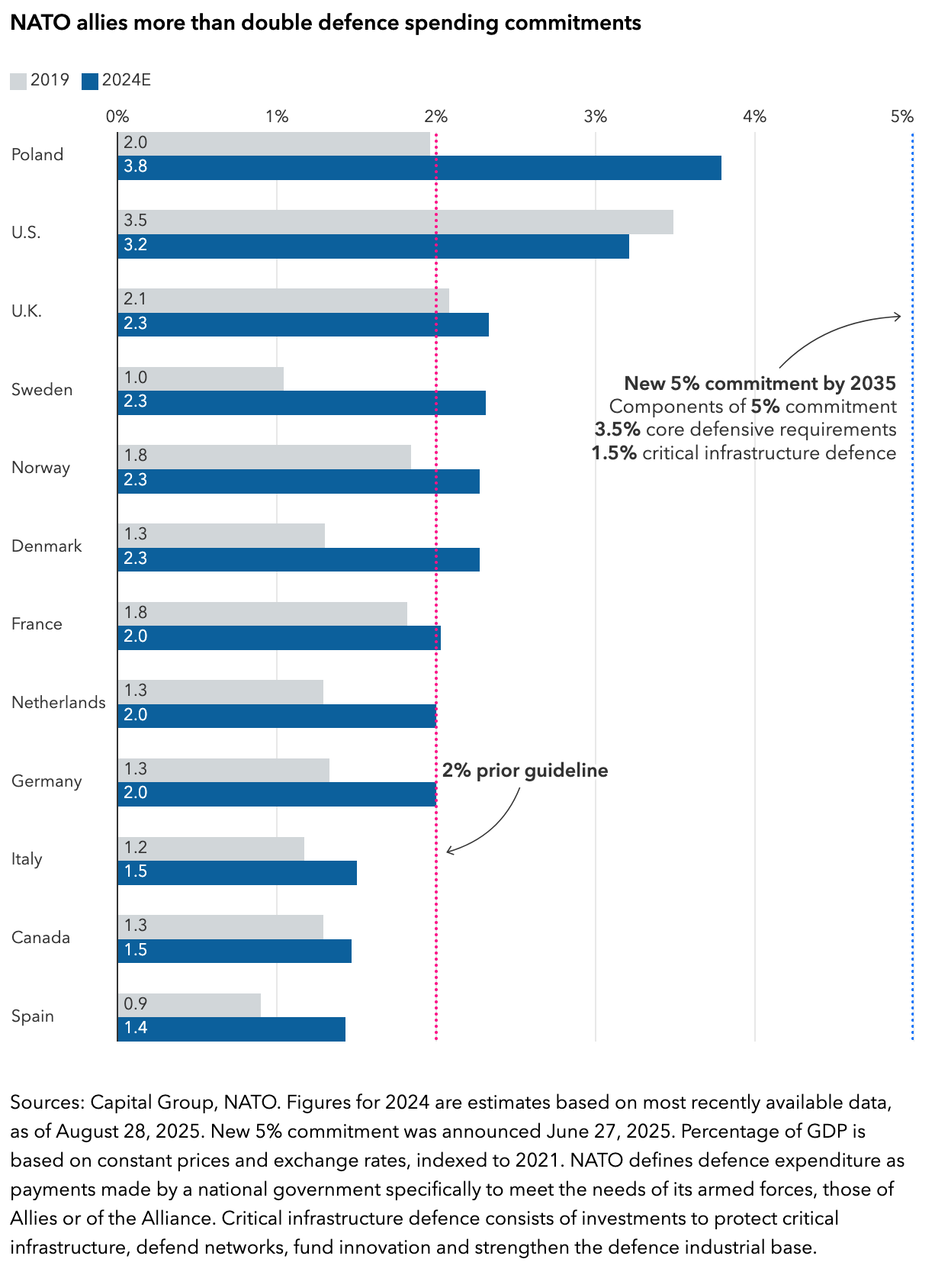

4. Rising defence budgets are a long-term tailwind

As NATO partners boost defence budgets, demand for products across a range of industries should jump, according to Frank.

In June, NATO allies committed to increasing defence spending from 2% to 5% of GDP by 2035 — a dramatic shift that’s reflective of mounting geopolitical tensions as tariffs threaten supply chains and strain alliances. Germany, in particular, has taken the lead. It previously disclosed aggressive fiscal stimulus focused primarily on defence and infrastructure.

NATO allies more than double defence spending commitments

A horizontal bar chart compares the defense spending of 12 NATO countries in 2019 with what is projected for 2024. The top axis shows percentages from 0% to 5%, with two key benchmarks. A dotted vertical line at 2% represents the previous NATO guideline, while another at 5% indicates a new commitment announced in June 2025. This new 5% goal is further divided into 3.5% for core defense and 1.5% for critical infrastructure defense. The countries are listed in descending order based on their projected defense spending as of 2024: Poland, United States, United Kingdom, Sweden, Norway, Denmark, France, Netherlands, Germany, Italy, Canada, and Spain. The chart indicates a general upward trend in defense investment across member nations, as nine out of the 12 countries have increased their defense spending to reach or exceed the 2% threshold over the last five years, with additional growth implied by the new 5% commitment level.

Rising defence budgets represent a long-term tailwind for many U.S. companies, since the majority of advanced defence systems are made in America. U.S. contractor RTX, known for its sophisticated radar and missile systems, has seen demand climb as European and Middle Eastern nations pursue modernization. The growing adoption of drone technology is also expected to benefit companies like U.S.-based Northrop Grumman as well as U.K.-based BAE Systems.

In Germany, defence backlogs are mounting. Rheinmetall, a leading manufacturer of advanced systems, reported a backlog increase of 29.9% to €63.2 billion as of June 30, 2025.

5. AI investments continue to climb

Spurred by the arrival of ChatGPT, the AI economy has become a powerful engine of U.S. growth. As of June 30, 2025, technology spending — which includes research and development and data centres — accounted for roughly 7.5% of U.S. GDP, surpassing the dot-com era peak and poised to rise further.

“AI systems have made remarkable progress, but we’re still very early innings of the AI deployment over the next decade,” says portfolio manager Mark Casey. He expects widespread adoption of AI across industries, which could drive productivity gains and innovation.

However, the economic impact will be uneven, with some companies benefiting greatly while others face disruption or decline. Over the next decade, Casey anticipates the AI ecosystem will grow but also exhibit cyclicality, with periods of optimism followed by occasional setbacks when expectations outpace reality.

An economy on the move

The U.S. economy is vulnerable. Typical forces that propel growth — job creation, consumer confidence and business investments — have stalled. New potential tailwinds are untested, with long-term ramifications to the nation’s fiscal health and geopolitical alliances. Inflation remains elevated, with the full impact of tariffs yet to come. Meanwhile, AI’s influence on stock markets and GDP complicates the picture.

Still, there are reasons for optimism as the U.S. economy and stock market have proven naysayers wrong time and again. Over the long run, investors who remained fully invested during periods of heightened uncertainty and market volatility have often emerged stronger. “I believe in staying invested,” Frank explains. “Even when markets get a little too excited or fearful, discipline and a focus on fundamentals help me navigate the volatility.”

Cheryl Frank is an equity portfolio manager with 27 years of investment industry experience (as of 12/31/2024). She holds an MBA from Stanford and a bachelor’s degree from Harvard.

Damien McCann is a fixed income portfolio manager with 25 years of investment industry experience (as of 12/31/2024). He holds a bachelor’s degree in business administration with an emphasis on finance from California State University, Northridge. He also holds the Chartered Financial Analyst® designation.

Brittain Ezzes is an equity portfolio manager with 27 years of investment industry experience (as of 12/31/2024). She holds a bachelor's degree in international relations and Russian studies from Brown University.

Mark Casey is an equity portfolio manager with 24 years of investment industry experience (as of 12/31/2024). He holds an MBA from Harvard and a bachelor’s degree from Yale.

Copyright © Capital Group