by Bobby Chada, Samir Parekh & Christopher Thomsen, Equity Portfolio Managers, Capital Group

International stocks have long played second fiddle to the U.S. and the staggering rise of its technology sector. But for the first time in many years, the picture is brightening for non-U.S. stocks, fueled by new growth tailwinds.

International stocks have been out of favour due to concerns about tepid economic growth, lack of innovation and regulatory overreach. Here are five charts that shed light on the recovery and factors that could help sustain a long-term rebound.

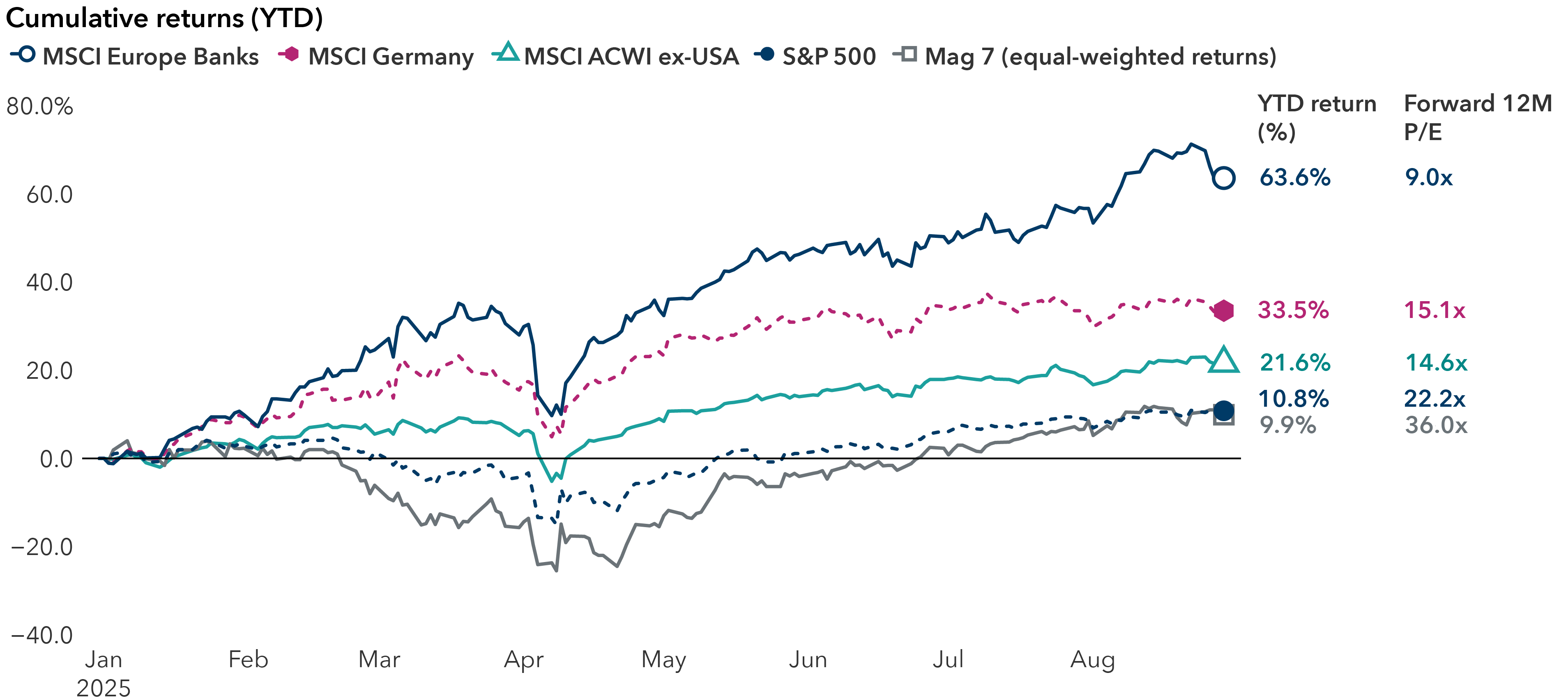

1. International stocks take the lead

Non-U.S. stocks have had a bright start to the year, pacing global markets through the first nine months of 2025.

Sentiment has shifted, fueled by new catalysts such as large-scale German stimulus, a recognition among governments for greater self-sufficiency, a weakening dollar and a decline in energy costs following a surge when Russia invaded Ukraine in 2022.

Non-U.S. markets pull away from Mag 7 and U.S.

Sources: Capital Group, FactSet, RIMES. P/E = price-to-earnings. Mag 7 = Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla. Return figures are based on total returns in USD. Data from January 1, 2025, to August 29, 2025. The forward price-to-earnings (P/E) ratio is computed by dividing the stock price by the consensus forward 12-month earnings estimates. Forward P/E ratio for the Mag 7 is the market-cap weighted average as of August 29, 2025. Past results are not predictive of results in future periods. The indices are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

2. Tailwinds from a weaker U.S. dollar

Sustained dollar weakness has often aided international stocks, helping returns for U.S.-based investors when local currencies are converted back to dollars. Currency effects have helped drive close to half of the returns for the MSCI EAFE and MSCI Europe indices in 2025. For the year to date through September, the dollar has fallen 12% against the euro, 7% against the British pound and 6% against the Japanese yen.

International stocks tend to benefit from weaker U.S. dollar

Sources: Capital Group, MSCI, S&P Dow Jones Indices, LLC. U.S. = S&P 500 Index. International = MSCI EAFE Index. U.S. Dollar Index is a measure of value relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. Relative returns are measured on an annualized rolling 5-year total return basis in USD. Data from January 1, 1976, to August 31, 2025. Past results are not predictive of results in future periods.

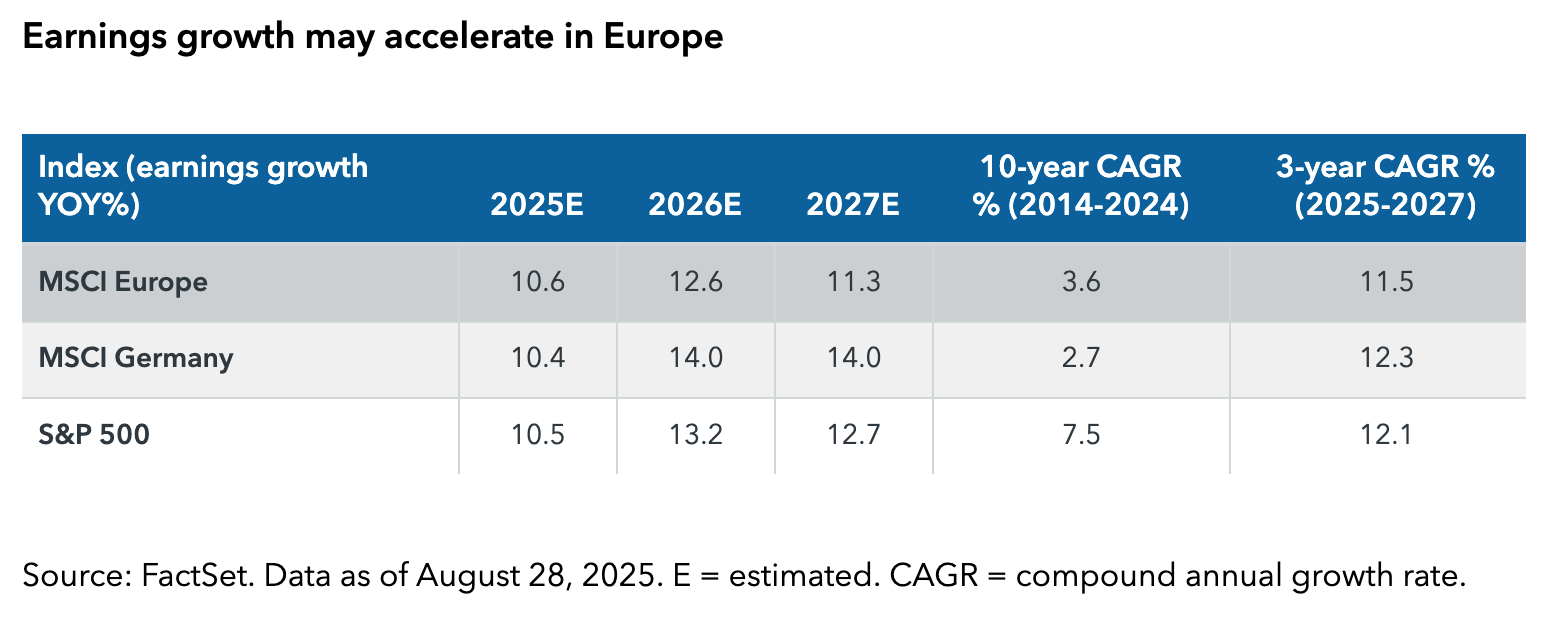

3. An earnings recovery is underway

Earnings growth has trailed the U.S. and its vibrant technology sector over the past decade. The trajectory appears to be changing, with earnings growth for European companies more comparable with those in the U.S. If there is a rebound across international markets, price-to-earnings ratios could re-rate higher.

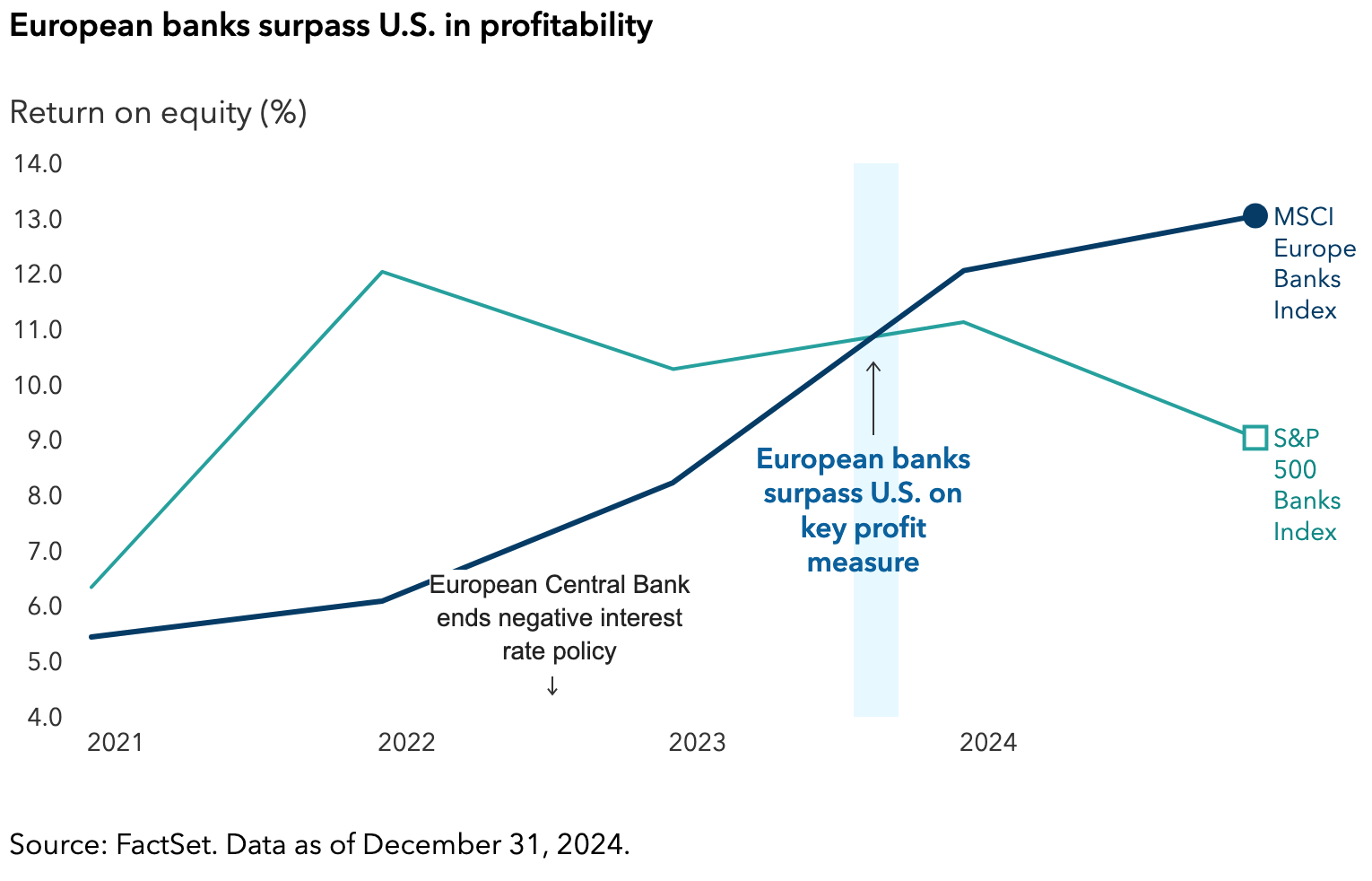

4. New tailwinds boost banks, aerospace, defence

European banks have had a stellar run, outpacing the Mag-7 group of U.S. technology leaders and the S&P 500 Index since August 2024. Interest rates have normalized following a period of negative rates from 2014 to 2022. Banks have amassed significant capital, loan losses are not anticipated and dividend payments have increased as regulatory requirements have been relaxed.

Commercial aerospace firms are riding multiple tailwinds that could help boost earnings, margin power and cash flows. There’s strong demand, tight supply, great pricing power and growth visibility over a long cycle.

On another front, European and Asian countries plan to spend more on defence. NATO allies pledged in June to ramp up their defence spending from a targeted 2% of gross domestic product (GDP) to 5% by 2035, a monumental change that reflects an ongoing transformation of the geopolitical landscape. Spending may be limited by national budgets, but more funding should still help defence firms.

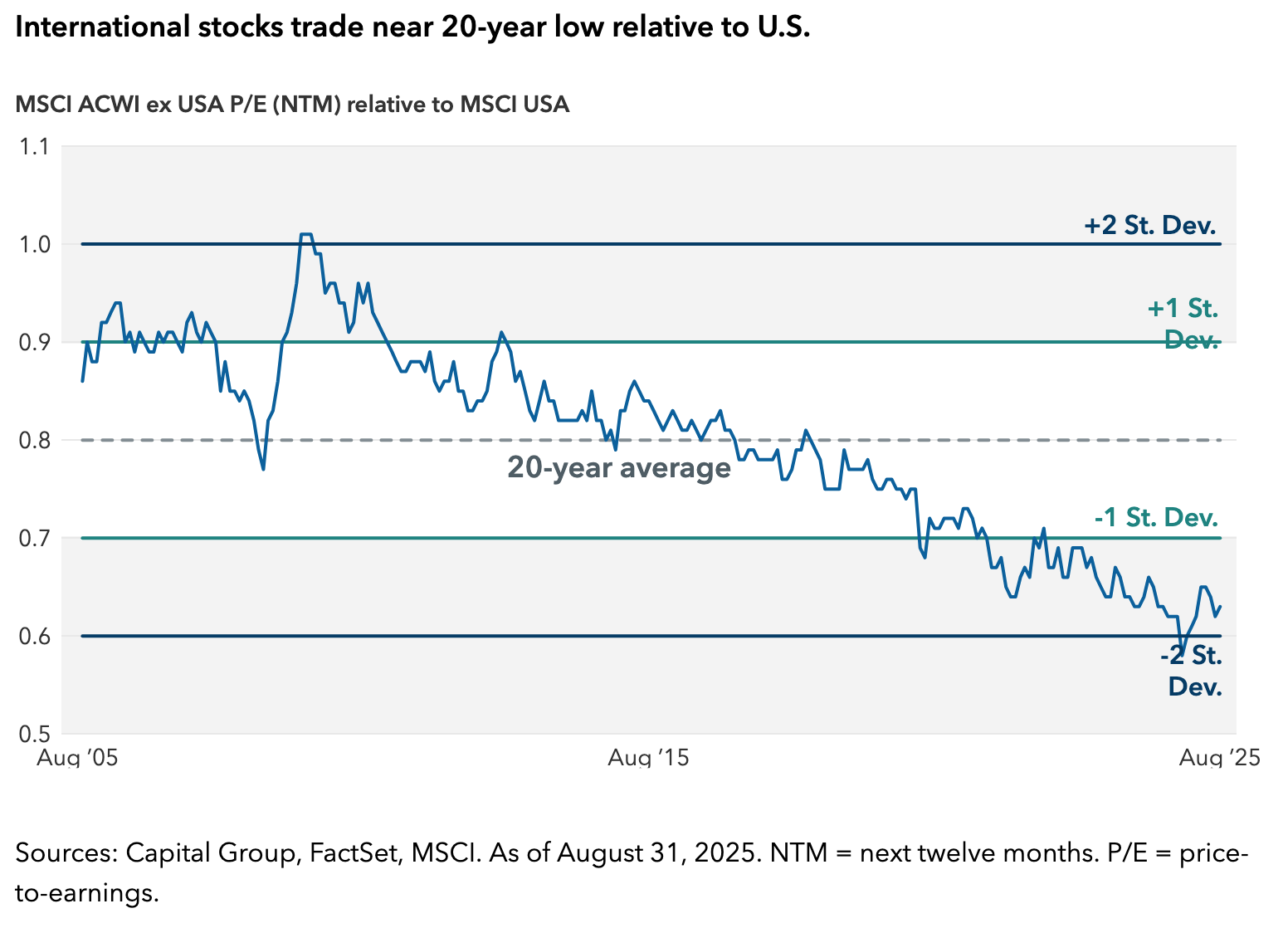

5. Valuations are still reasonable

For many years, an argument for owning international equities has been cheaper valuations compared with similar U.S. businesses. Even after strong gains in non-U.S. equity markets, valuations remain attractive thanks to new growth drivers.

The MSCI ACWI ex USA Index trades at 14.6 earnings on a 12-month forward basis, while the MSCI EAFE (developed international) trades at 15.1 times — both below their 10-year averages and at a substantial discount to the S&P 500 Index, which trades at 22.8 times earnings.

In an environment where infrastructure spending rises, non-U.S. markets are more diverse and weighted higher in heavy industry, energy, materials and chemicals than the S&P 500 Index. They are also less concentrated. The top 10 companies make up 11.2% of the overall weight in MSCI ACWI ex USA Index vs. 37.9% in the S&P 500 Index (as of August 29).

A turning point for international stocks?

Inflection points in markets tend to prompt investors to take a fresh look at asset allocation. Germany’s unprecedented stimulus, greater national security in several countries, a weaker dollar and undemanding valuations are among them. Year-to-date portfolio flows can be read as a signal that investors are looking to broaden their equity exposure and risk beyond the dominant U.S. technology companies.

It won’t be an overnight shift. But for investors with a longer term horizon, history shows global equity markets tend to move in cycles. Perhaps this is the next turn.

Bobby Chada is an equity portfolio manager at Capital Group. He has 29 years of investment industry experience (as of 12/31/2024). He holds a bachelor's degree in finance and accounting from the University of Edinburgh.

Samir Parekh is an equity portfolio manager and a global research coordinator with 23 years of investment industry experience (as of 12/31/2024). He holds a post-graduate diploma in business administration (equivalent to an MBA) from the Indian Institute of Management, Ahmedabad, and a bachelor’s degree from Sydenham College, Bombay University. He also holds the Chartered Financial Analyst® designation.

Christopher Thomsen is an equity portfolio manager with 31 years of investment industry experience (as of 12/31/2024). He holds an MBA from Columbia and a bachelor’s degree in international economics from Georgetown University.

Copyright © Capital Group