by Daniel Prince, CFA, BlackRock

KEY TAKEAWAYS

- Investors may make the mistake of focusing on return in its most basic form, without considering the risks they’re exposed to achieve those returns.

- It is important to understand how risk-adjusted return is calculated and how it could help investors manage market volatility and improve long-term performance.

Risk-adjusted return is a critical element to successful long-term investing, and one often overlooked — or misunderstood — by newer investors. I view risk-adjusted returns as perhaps the most important, least understood part of investing; after all, the return potential of any investment should be viewed in the context of the risks it takes to achieve that return.

So, what is “risk-adjusted return”?

Risk-adjusted return is a calculation of the return (or potential return) on an investment such as a stock or corporate bond when compared to cash or equivalents. Risk-adjusted returns are often presented as a ratio, with higher readings typically considered desirable and healthy.

HOW TO CALCULATE RISK-ADJUSTED RETURN

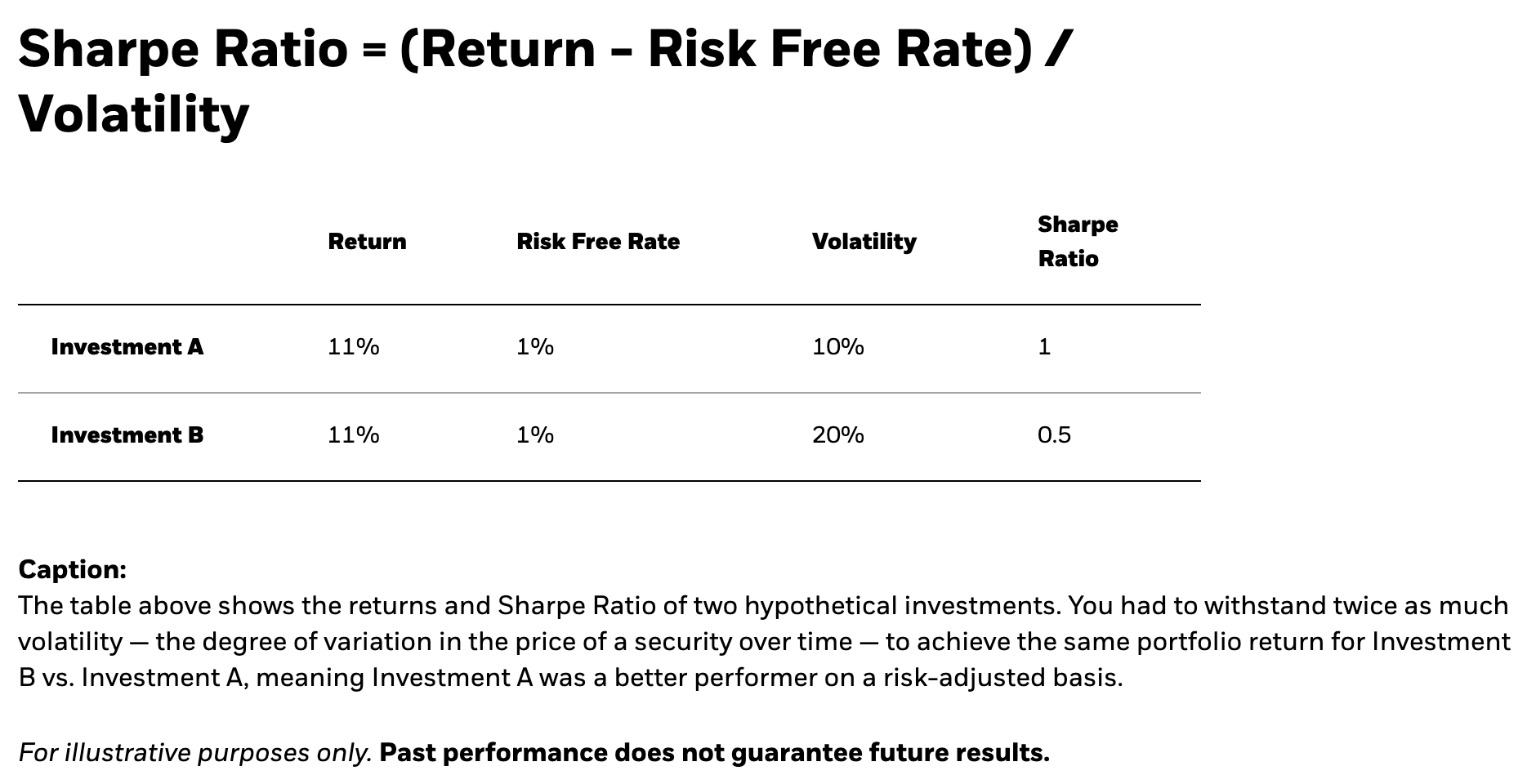

The Sharpe ratio formula is one of the most-commonly cited measures of risk-adjusted return. Developed by Nobel laureate William Sharpe, the Sharpe ratio calculates the return (or expected return) of an investment in excess of a “risk-free” security. While no investment is 100% risk-free, short-term government bond yields are often used as the proxy for risk-adjusted comparisons. You can find Sharpe’s formula and a hypothetical comparison of two investments here:

MANAGE MARKET VOLATILITY, AND YOUR OWN EMOTIONS WITH RISK-ADJUSTED RETURNS

One way to think of risk-adjusted return is that it’s like the speed limit for your car. If your destination is 60 miles away, you can get there in just over one hour if you stick to the 55 MPH limit. Or you can get there faster if you’re willing to drive above the speed limit. The faster you go, the quicker you could arrive. However, going above the speed limit increases your risk of getting a ticket, having to swerve wildly to avoid accidents, or something worse. And the faster you go the higher the odds of a bad outcome.

The same is true of your investing. Building a diversified portfolio based on one’s risk tolerance and investment goals may feel like a slow (even boring) approach that means it could take longer to reach your destination (investing goals). But you most likely increase the odds of getting there. Focusing on hot trends may seem like a faster route to your goals and it may even be so for a time, but you also increase the risk of a financial ‘accident’.

Considering the risks — and the risk-adjusted return — of your portfolio will go a long way to helping you stay on track, and on schedule while pursuing success in your investing journey.

Copyright © BlackRock