by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

Key takeaways

- Investors are embracing lower quality companies, choosing names with less impressive operating margins and free-cash flow figures vs. more profitable names – but can it continue?

- Given this type of ‘junk rally’ typically requires rapid market acceleration to sustain itself, Russ advises fading exposure to the trade, as prolonged market strength is not guaranteed heading into the end of the year.

The ‘junk rally’ needs a stronger economy to continue

Seasonal weakness is arriving late this year. What is typically a rough stretch for stocks has morphed into a full-on stretch for risk. Not only have markets been grinding higher, but riskier companies have been leading.

Can this continue or is this yet another one of the multiple narrative shifts that have so far defined 2025? My view is to fade the junk rally as the current expansion does not favor these trades lasting for very long.

Not playing to the seasonal script

Most investors know September is normally marked by poor markets and a general aversion to risk. Not this year. Not only have the first two weeks been positive, but more volatile companies, rather than defensive low beta, have been leading. Another manifestation of this trade: Small caps continue to outperform. Since the start of August small caps (represented by Russell 2000 index) have outperformed large caps (represented by the S&P 500 index) by roughly 4.5%. This same thirst for risk can be seen in the performance of several of the lower quality retail names. Another way to view this trade is to look at the fundamentals of recent winners. Companies with lower operating margins and free-cash flow are in many cases outperforming their more profitable peers.

In some ways, the shift in leadership is a continuation of the ‘anti-momentum’ trade that began in July. While these trades are not uncommon, they generally follow a recession or financial crisis when investors are looking to ‘re-risk’ their portfolios. While not unprecedented, in the context of the current market these rotations tend to be short-lived.

Looking for Bargains?

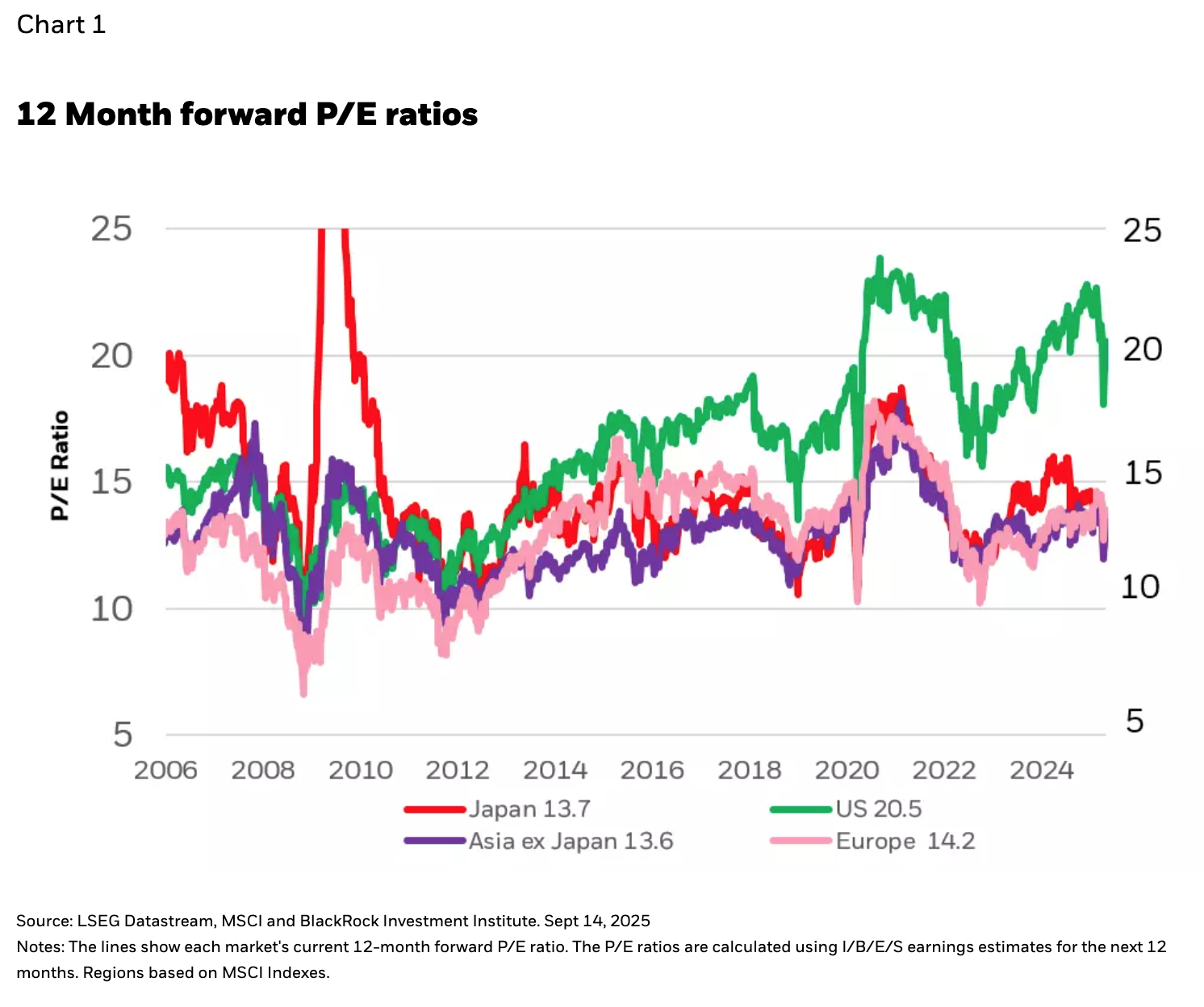

There are two potential explanations for the willingness to embrace lower quality companies. The most obvious one: U.S. stocks are expensive, with much of the premium being driven by a small number of growth stocks. At roughly 22x earnings, investors can be forgiven for bargain hunting into the cheaper, albeit lower quality names (see Chart 1).

The second explanation is more speculative and may decide if the rally can continue. As lower quality companies often benefit the most at economic inflection points, investors could be setting up for a re-acceleration in the economy after a sluggish first half of the year. This is not inconsistent with the recent upturn in economic estimates. Since May, the Bloomberg economic consensus for real 2026 GDP has risen from less than 1.5% to 1.7%.

The question is: Will the economy accelerate enough to justify the trade down in quality? These trades generally work best when the economy is rapidly accelerating, not merely stabilizing. While I’m constructive on growth, and Fed cuts will help, it’s not clear that a simple return to trend growth will be enough to justify a prolonged rally in small and lower quality companies. In the absence of which, I would not chase this trade.