by Matt Miller, Tom Hollenberg, and Mark Casey, Capital Group

In a year full of uncertainty over tariffs and trade, financial markets took another curveball on Wednesday as the U.S. government shut down amid an ongoing dispute between Republicans and Democrats over spending priorities.

There is no indication how long the impasse might last, but a long history of past government shutdowns suggests that, regardless of length, it will have little impact on the financial markets and the U.S. economy. Even during extended shutdowns of two weeks or longer, stocks and bonds have generally weathered the storm with only small ripple effects, followed by a strong rebound.

“My message for investors is to stay calm and carry on,” says Capital Group political economist Matt Miller, a former senior advisor in the White House Office of Management and Budget. “If history is any guide, the negotiations will be tense, there will be a great deal of political drama, and eventually a compromise will be reached.”

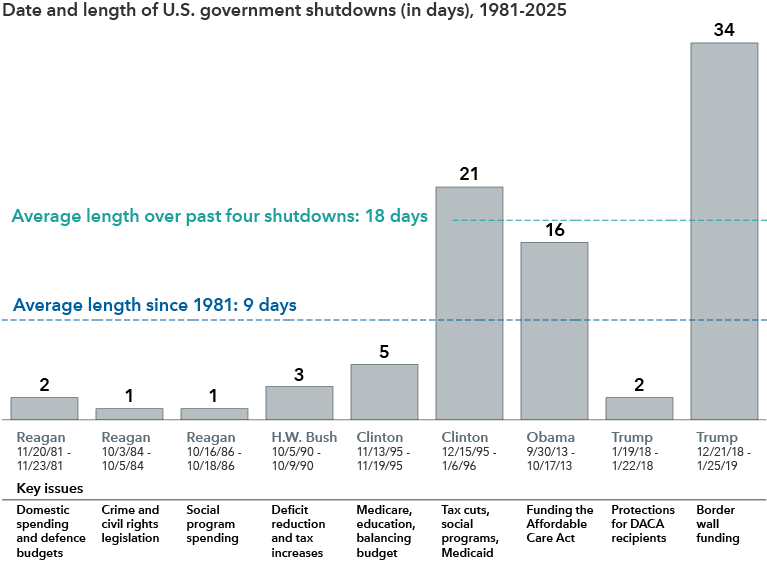

U.S. government shutdowns can get ugly but tend to be brief

Sources: Capital Group, U.S. Congressional Research Service: "Federal Funding Gaps: A Brief Overview." Length of government shutdowns are defined as the number of days during which no budget authority was available, starting from the first day without budget authority and ending the day before new budget authority was enacted. DACA is the Deferred Action for Childhood Arrivals policy. As of September 30, 2025.

Over the past four decades, U.S. government shutdowns have lasted an average of nine days, with some ending in as little as one or two days. However, more recently, an increasingly confrontational political environment has produced much longer conflicts, including a 34-day shutdown during President Trump’s first term in office.

Health care spending in the spotlight

The current dispute revolves around a Republican-crafted bill to continue funding the federal government for the next seven weeks while a full-year spending bill is hammered out. Senate Democrats have so far refused to advance the so-called “continuing resolution” unless Republicans agree to extend certain health care subsidies under the Affordable Care Act (ACA) that are due to expire soon and to reverse Medicaid cuts made earlier this year.

“An agreement to maintain the ACA subsidies is likely to be reached in the weeks ahead,” Miller says. "Democrats are pushing hard for it, and many Republicans leaders also want it to happen to help minimize the issue ahead of the 2026 midterm elections.”

Another issue that sets this shutdown apart are statements from Trump Administration officials that some non-essential workers could be permanently let go, rather than just temporarily furloughed. If this approach is followed, it could have more lasting effects on the U.S. labour market. Permanent job losses are likely to push up the unemployment rate and could dampen consumer confidence.

For financial markets, the direct reaction to a shutdown is usually muted. Historically, risk assets dip slightly during a shutdown’s immediate aftermath, but these moves are often small and tend to reverse once the government resumes normal operations.

This time, the bigger concern is the interruption of key economic data releases, which can complicate decision-making for the U.S. Federal Reserve and other policymakers if the shutdown drags on.

Bond investors still anticipating a Fed rate cut

The shutdown arrives at a crucial time for the U.S. economy and for the Fed, which relies on a steady stream of data to set monetary policy. Investors are anticipating a rate cut at the next Fed meeting in late October, unless a surprisingly strong jobs report shifts the outlook. This shutdown could cause delays to the release of key data from the U.S. Bureau of Labor Statistics, which would force the Fed to act without that information.

“The obstacle to a rate cut would be a blowout monthly jobs report,” says Capital Group fixed income portfolio manager Tom Hollenberg. “If that data doesn’t come in time, I think the Fed moves forward with a rate cut.”

Hollenberg otherwise views a government shutdown as a “non-event for bond markets.” Nonetheless, the dispute comes amid ongoing worries about the Fed’s independence and the federal government’s ability to gather and report crucial economic data.

Stock investors taking it in stride

With U.S. stocks hitting record highs in recent weeks, a relatively short government shutdown also isn’t likely to cause much disruption in equity markets, says portfolio manager Mark Casey.

“We may need to weather some short-term volatility, but the stock market usually takes these events with a grain of salt,” Casey says. “Investors have seen enough shutdowns to know that it probably won’t be long until the government is back in action.”

Matt Miller is a political economist with 34 years of experience and has been with Capital for 10 years (as of 12/31/2024). He holds a law degree from Columbia and a bachelor's degree in economics from Brown University.

Tom Hollenberg is a fixed income portfolio manager with 20 years of industry experience (as of 12/31/2024). As a fixed income investment analyst, he covers interest rates and options. He holds an MBA in finance from MIT and a bachelor's degree from Boston College.

Mark Casey is an equity portfolio manager with 24 years of investment industry experience (as of 12/31/2024). He holds an MBA from Harvard and a bachelor’s degree from Yale.

Copyright © Capital Group