by James T. Tierney, Jr., Chief Investment Officer—Concentrated US Growth & Michael Walker, Co-CIO—Concentrated Growth, AllianceBernstein

Companies with dependable growth profiles might be just what equity portfolios need in turbulent times.

In this year’s jittery financial markets, it’s worth revisiting an enduring investing insight: business models that can stand the test of time are powerful sources of long-term growth. Companies that can deliver reliable growth tend to outperform over time and can help portfolios deliver results through market storms.

When high-flying growth companies dominate markets, it’s easy to forget the virtues of a stable business. Companies with consistent, predictable revenue streams and earnings growth might not top the news headlines or rank among the fastest-growing businesses in a given year. Yet stable growers can be counted on to steadily increase sales and profits, year after year, with relatively low variance.

Defining Durable Business Models

Companies like these deliver growth regardless of whether GDP is booming or sputtering. Their durable business models are underpinned by broad and loyal customer bases, resilient demand for products or services, and management teams that prioritize long-term execution over chasing short-term fads.

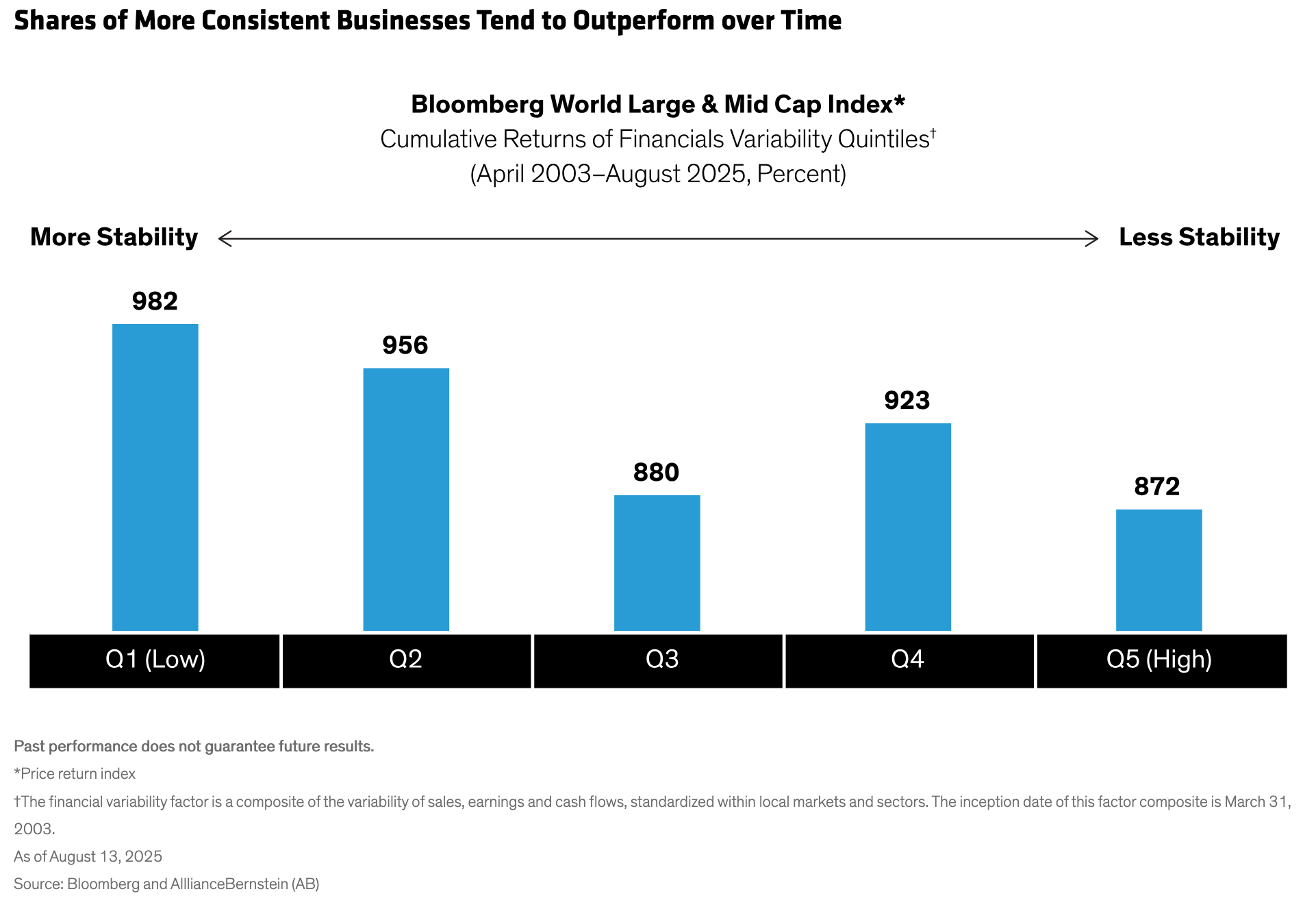

Consistent growth bolsters equity return potential. Shares of companies with more stable sales, earnings and cash flows have outperformed those with more variability over the long term (Display).

What type of business models can stand the test of time? We look for companies that reinvest their earnings with discipline, fueling future growth, and benefit from brand loyalties or economies of scale. Dividends, share buybacks or investment in expansion are enabled by consistent profitability. And each year of stable growth builds on last year’s profits, which can help fund a wider distribution network, a more entrenched market position or incremental innovation, making next year’s growth a bit easier.

A Tale of Two Growth Profiles

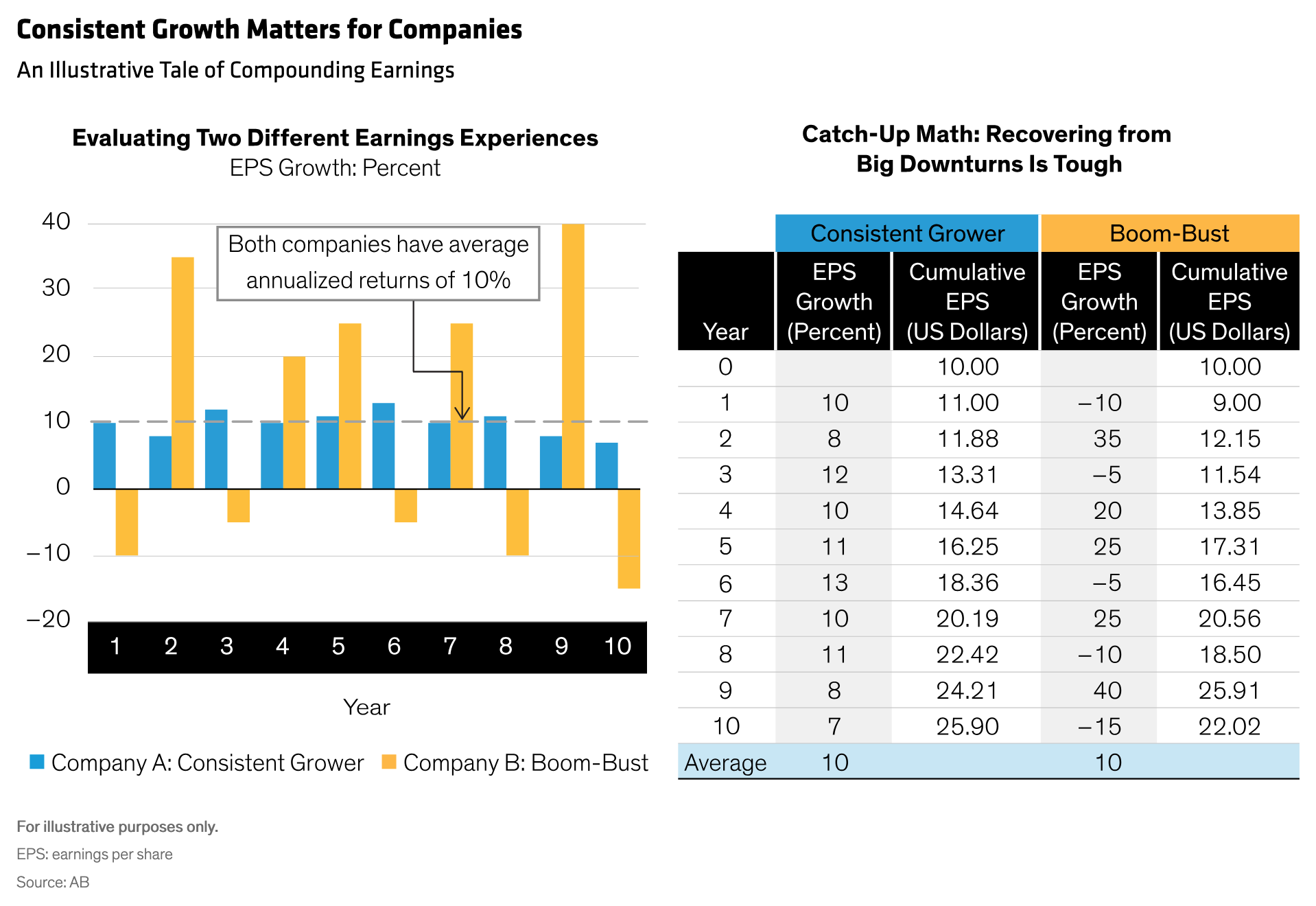

The benefits of stable businesses are rooted in simple mathematics, illustrated in this example:

- Company A: The Consistent Grower increases its revenue and earnings by about 10% annually. It has steady margins, repeat customers and responsible management. Even during recessions, growth remains positive, resulting in a steadily upward earnings chart with minor fluctuations

- Company B: The Boom-Bust Play operates in a cyclical or hype-driven industry, with annual earnings per share swinging from +40% to –15%. Its revenue is highly dependent on economic cycles, leading to significant sales fluctuations. Over a decade, Company B’s average growth rate resembles company A’s, but its earnings trajectory is very volatile (Display).

For companies that suffer big swings in earnings growth, the road to recovery from a bad year is very challenging. Here’s why: after company B’s earnings growth falls by 10% to $9.0 in year one, earnings must surge by 35% to catch up with company A. If earnings decelerated by just 5% the next year, the company would need to post a 20% gain to get back on par with the stable grower.

The Compounding Power of Steady Growth

This simple math explains why “smooth and steady” often wins the investment race in absolute terms, not just risk-adjusted terms. Avoiding deep losses builds gains on a higher base. It’s like climbing a mountain at a moderate, steady pace, which will help you reach the summit faster than someone who sprints and slides back repeatedly.

Given these advantages, why doesn’t every investor gravitate toward these types of growth strategies? We offer three explanations.

1. Allure of the “Next Big Thing”: It’s human nature to be captivated by exciting stories and rapid rewards. Promises of breakthrough technology or meteoric growth grab investor dollars—even if a company’s path to profitability is uncertain. Glamor stocks make stable businesses look boring.

2. Recency Bias and Overreaction: Recent performance is often extrapolated too far into the future. So investors might expect a company that had a stellar growth year to keep accelerating. Conversely, if a solid company has a rare soft quarter, short-term holders might flee, assuming the worst. Overreactions like these can punish stable stocks that stumble briefly, while rewarding volatile stocks coming off a winning streak.

3. Closet Indexing: Many active managers who aim to keep pace with their benchmarks hold the same popular names, especially during bull markets dominated by hot sectors. As a result of “closet indexing,” consistent, lower-profile businesses are overlooked and only gain recognition after their steady compounding becomes impossible to ignore. By then, it’s too late; much of the value creation has already happened and many portfolios have missed out on the rewards of reliable growth.

Business Models That Can Withstand Recurring Stress

Heightened volatility isn’t going away. Tariffs, geopolitical tensions and macroeconomic trends remain huge uncertainties. In these tricky conditions, which type of stock would you rather own in your equity portfolio?

We believe that companies with enduring, consistent growth offer an anchor for uncertain times and can help investors build wealth more effectively than volatile businesses with higher, but irregular return patterns. And when investors find companies like these at attractive share-price valuations, it adds another layer of resilience, especially in down markets when expensive stocks may get hit harder. Equity portfolios that maintain a disciplined focus on durable growth at the right price may experience lower annual returns in a given year or two—yet by the power of compounding on consistent returns, they might actually end up ahead of the pack over time.

**

About the Authors

James Tierney Jr. is a Senior Vice President and the Chief Investment Officer of Concentrated US Growth at AB. Prior to joining the firm in 2013, he was CIO at W.P. Stewart & Co. Tierney began his career in 1988 in equity research at J.P. Morgan Investment Management, where he assisted in the analysis of companies in the entertainment, healthcare and finance industries. He left J.P. Morgan in 1990 to pursue an MBA and returned in 1992 as a senior analyst covering a variety of industries, including energy, transportation, media and entertainment. Tierney joined W.P. Stewart in 2000. While there he analyzed companies in the media, consumer staples and financial sectors and managed client portfolios. Tierney holds a BS in finance from Providence College and an MBA from Columbia Business School at Columbia University. Location: New York

Michael Walker is a Senior Vice President and Co-CIO for Concentrated Growth and is responsible for the technology and business services sectors. Before joining AB in 2013, he was a portfolio manager/analyst on the US equity research and portfolio-management team at WPS Advisors. Prior to that, Walker was the technology sector analyst for the large-cap growth fund at Ark Asset Management. He had previously spent nine years as a senior research analyst covering the IT hardware and electronics supply chain sectors, first at Donaldson, Lufkin & Jenrette and then at Credit Suisse First Boston. In 2006, Walker was ranked the top analyst in his sector in the Institutional Investor All-America Research Team survey after having ranked third in 2004 and 2005. He began his career as an IT consultant with Deloitte Consulting. Walker holds a BS (magna cum laude) in Economics from the Wharton School at the University of Pennsylvania. Location: New York