by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

We are proudly Canadian; this is an awesome country with great people. With about a quarter-century of asset allocation work, we would also say holding more Canada than peers has been a frequent theme for us. Not all the time, and there have been times when holding more Canada was a detriment. Some may say we suffer a bit from home country bias.

While familiarity with your home market is often pleasant, we believe our Canadian view is a bit more thoughtful. Most of our clients are Canadian, with largely Canadian future liabilities, so less currency risk is a plus for owning a bit more Canada. A dividend tax credit is another big one. Not enough work in the asset allocation world incorporates tax.

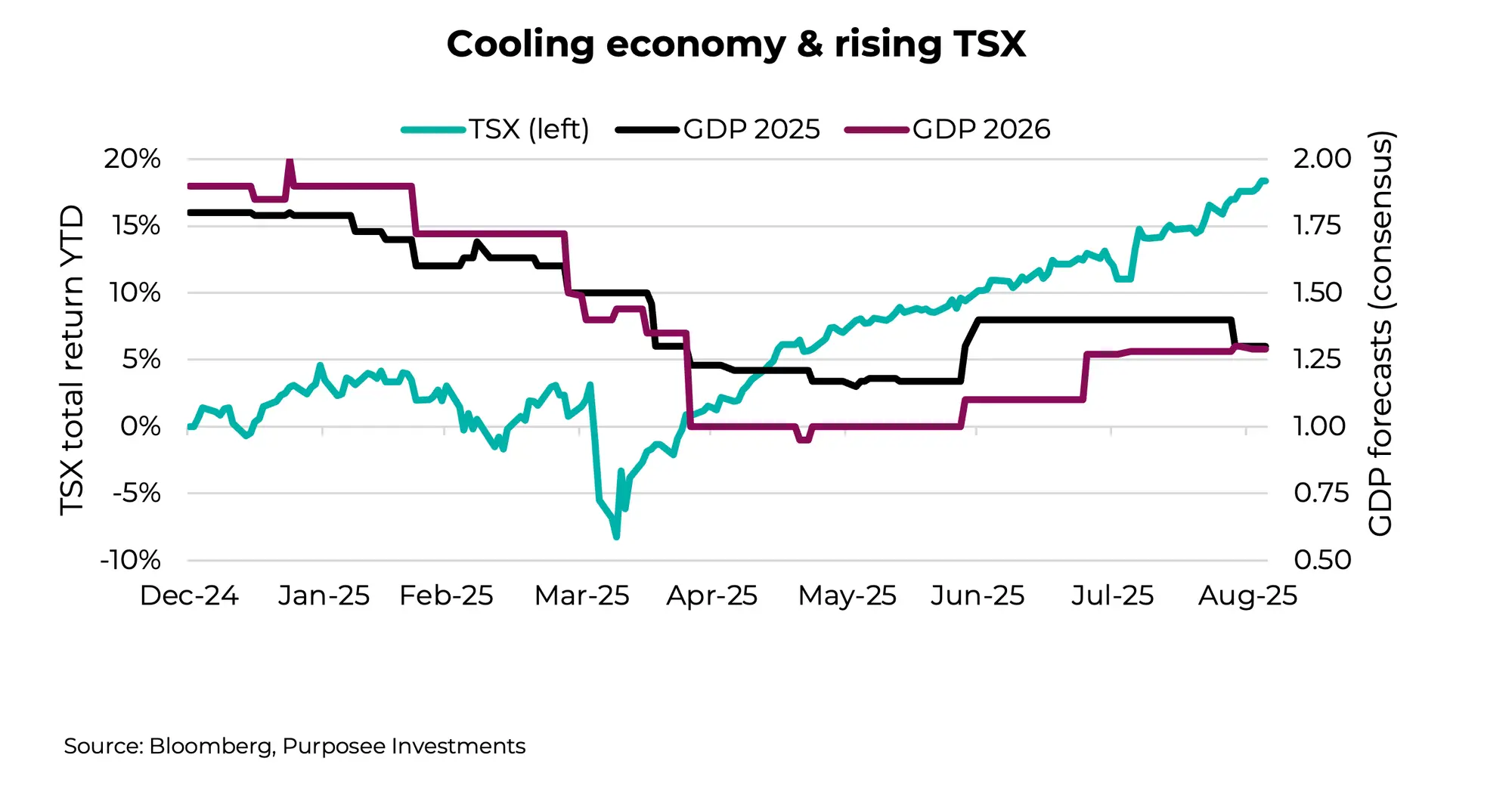

So far this year, Canada has been great, even with all the headlines over tariffs and a recent negative Q2 GDP print. The TSX is up an impressive 18% so far this year, making Canada one of the better-performing markets, roughly double the return of global equities. We all know the TSX isn’t the Canadian economy, and this year certainly highlights this fact. Economic forecasts for 2025 have fallen from 1.7% down to 1.3% with 2026 consensus declining from 2.0% to 1.3%. Tariffs are taking a bite out of economic growth, as is a tepid housing market. The stock market can move somewhat independently from the economy, but they are still somewhat tethered. So why is there such a big divergence?

Most of the TSX’s gains this year have come from two sectors: Financials, which are dominated by the banks and Materials, which are dominated by the golds. Materials have contributed 6.4% of the TSX’s 18.3% advance, and Financials another 5.8%. So two-thirds of the market gains have come from these two sectors. Golds have nothing to do with Canadian economic growth, and those companies are printing a lot of earnings given record gold prices. Gold miners contributed a paltry 2.3% of TSX earnings in 2022; over the next four quarters, that percentage has risen to 9%. In dollar terms, we’re talking $5 billion to $21 billion over a few years, which is a lot of bling.

In our opinion, we do love our gold exposure. There are many reasons behind this admiration, beyond simple price appreciation. But we do have some hesitancy, as those earnings can disappear as quickly as they appeared. Materials and Energy are called cyclicals for a very good reason. That is why the golds, even after such strong gains, are not trading at a high multiple. In fact, they’re trading at a lower one. The market usually doesn’t pay a high multiple on cyclical earnings.

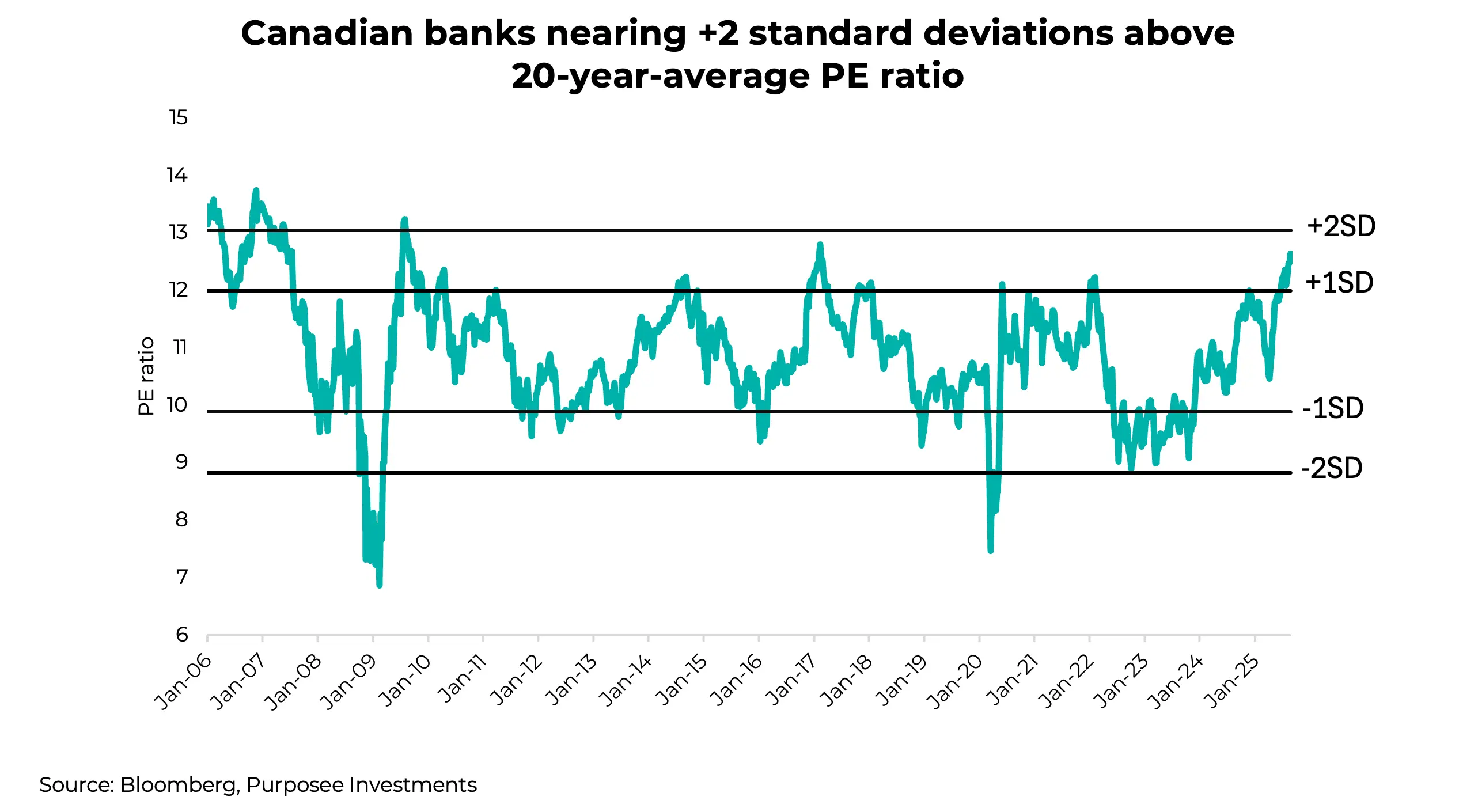

While gold may have nothing to do with the Canadian economy, Financials, dominated by banks, are a clear proxy for it. This is where things get a bit more challenging. The banks enjoyed a good quarter of earnings results, but are now bumping up against a valuation ceiling. The chart below shows the price-to-earnings ratios for the banks based on consensus estimates for the next 12 months. We added lines representing one or two standard deviations above or below the long-term average. With an economy slowing, that is at odds with paying historical premium valuations for bank shares. Given that this part of the TSX is so important and large, it’s certainly a risk.

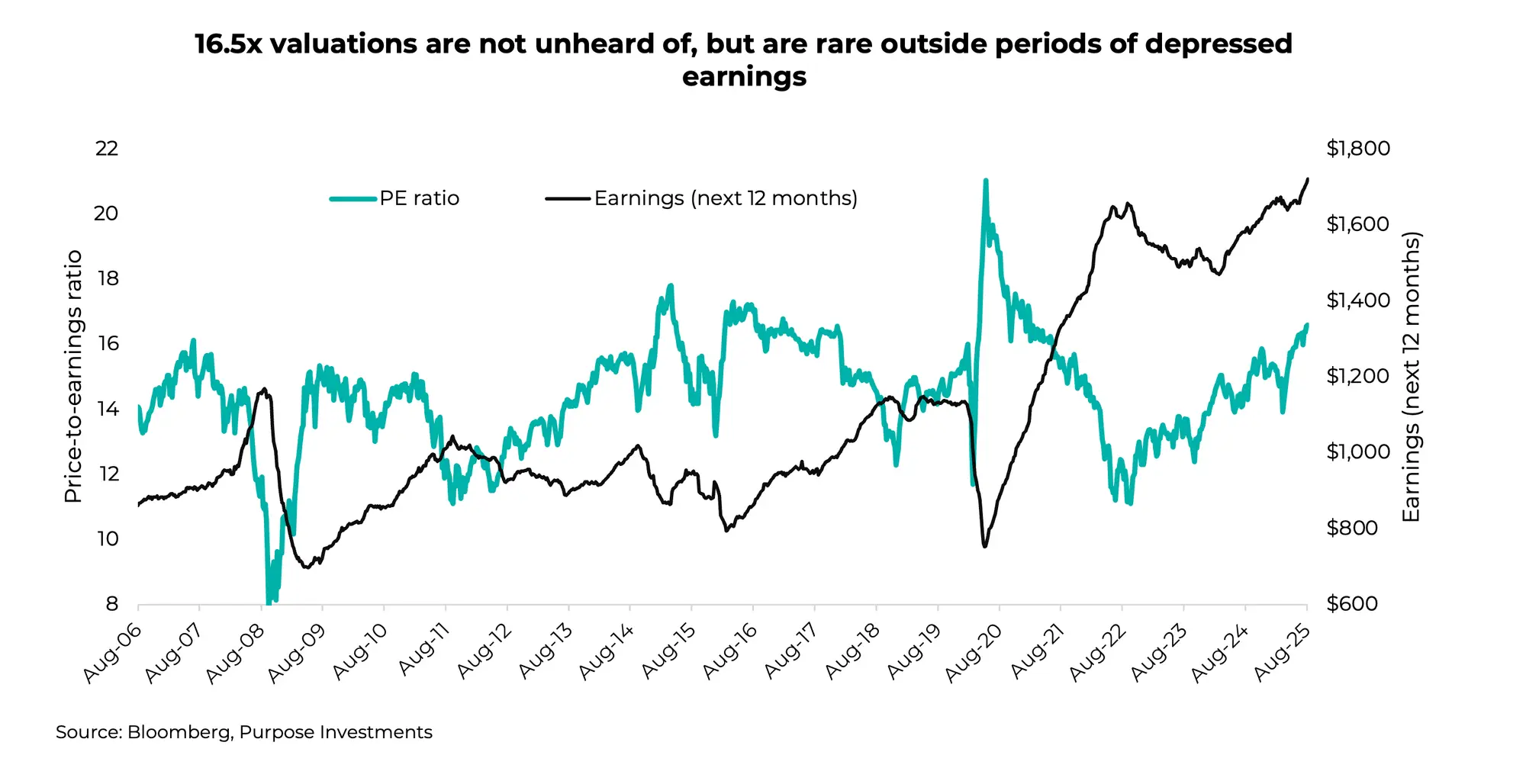

In aggregate, the TSX is certainly not as cheap as it has been over the past few years, and it may be getting close to the expensive zone. Because of a rather sizeable weight of cyclicals in the TSX, aggregate valuations are not a big deal. At times when cyclical earnings are depressed, those sectors can trade at high multiples given the longer-term value of the companies. Energy could be in this bucket at the moment. Still, 16.5x is expensive for the TSX, even with decent earnings growth. Usually, the TSX trades at these or higher valuations because earnings are really depressed.

Of course, the TSX could move higher from here. Maybe banks see already-stretched valuations pushing higher, or the golds see some multiple expansion if the market believes these booster profits have longevity. Energy could see a rise, which would likely lift the TSX, or maybe Shopify could have another huge quarter. But we believe another move higher for the TSX is becoming harder to fathom.

This may sound a bit too sanguine. There is another factor we didn’t mention, and that is flows. There’s a trend afoot with investors becoming a little less enamoured with U.S. equities and incrementally allocating more to international markets. Some of that is landing in Canada. And it doesn’t take much to move the Canadian market. $100 billion can come out of U.S. equities without much impact; $10 billion landing in Canada can move prices. This factor, if it continues or accelerates, easily dwarfs concerns over valuations.

Final Thoughts

We aren’t negative Canada, but we’re not nearly as enamoured as we were a few quarters ago. There are scenarios where we could see lifting the Canadian market higher; the challenge is that they are becoming fewer and farther between. Maybe more international inflows, maybe some more multiple expansion, maybe improving earnings growth, maybe energy comes back into vogue.

It does feel like we’re stretching a bit. And given that we’ve enjoyed over +18% this year with four months still to go, it’s already been a helluva year.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.

Copyright © Purpose Investments