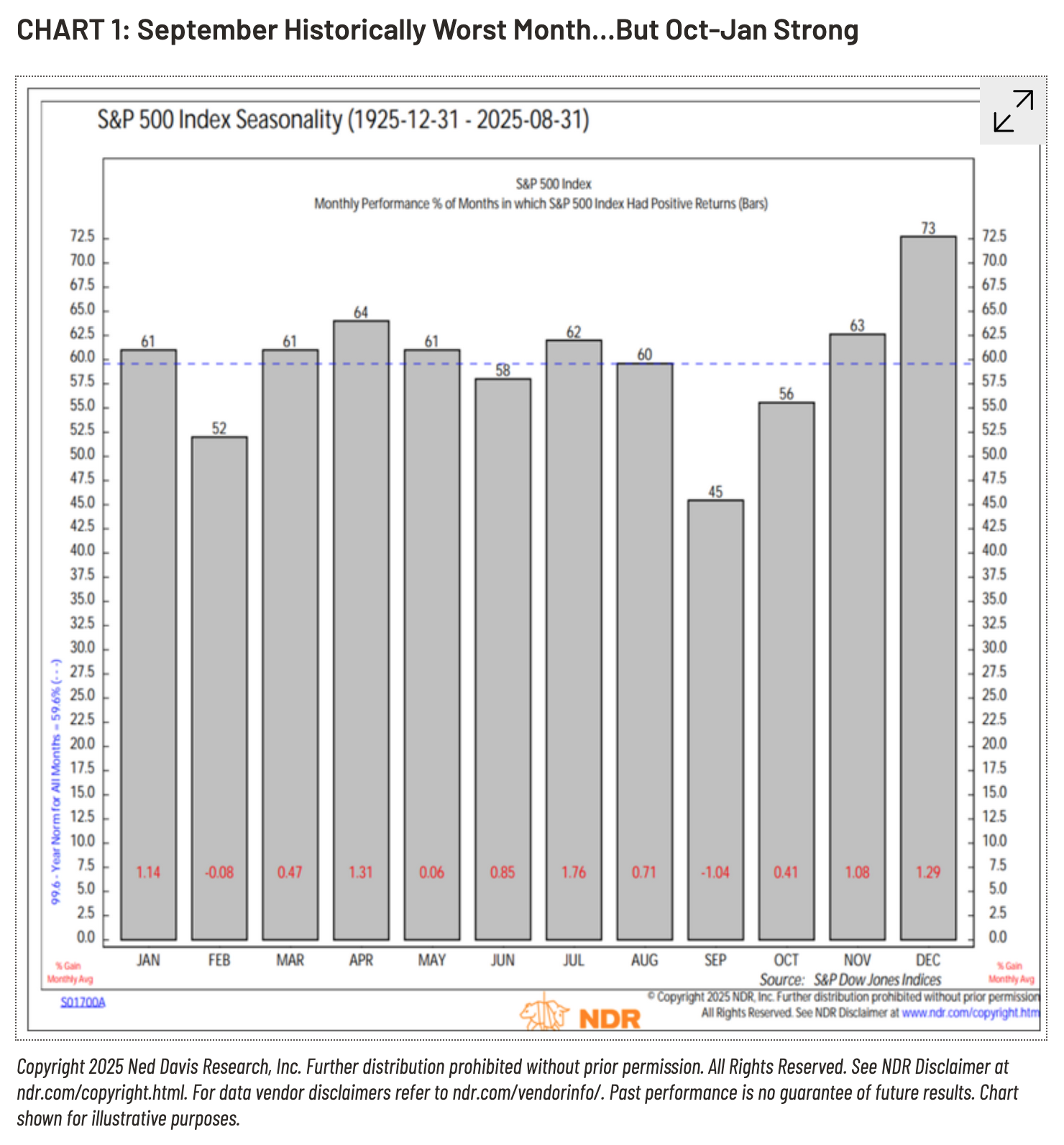

Every year when September rolls around, investors dust off the same old warning: it’s the worst month for stocks. History backs it up—returns in September have consistently trailed the rest of the calendar. Cue the chatter about the “September Effect.”

But Chris Konstantinos, CFA®, Managing Partner and Chief Investment Strategist at RiverFront Investment Group, doesn’t buy into the scare tactics1. His take is straightforward: “We do not believe investors should sell indiscriminately just because of this heuristic.”

The Myth vs. Reality

Yes, the data looks ugly. Over nearly a century, September has earned its reputation as the weakest month for U.S. equities. Why? A few theories make the rounds every year. Institutional managers, fresh off vacation, may “begin ‘window dressing,’ or selling underperforming stocks before year-end reporting.” Add in the “information vacuum” that follows second-quarter earnings, and the market often fills the gap with “FUD (fear, uncertainty, and doubt).” This year, tariffs and Fed policy are supplying plenty of it.

Still, Konstantinos points out a key detail: “In September, stocks were still up almost half the time since 1925, rendering the ‘September Effect’ practically a coin flip.” Hardly a slam dunk.

Why Staying Put Beats Jumping Ship

Trying to dance around seasonal volatility is risky business. “October often marks significant market bottoms and returns from November through January tend to be stronger than average,” Konstantinos reminds us.

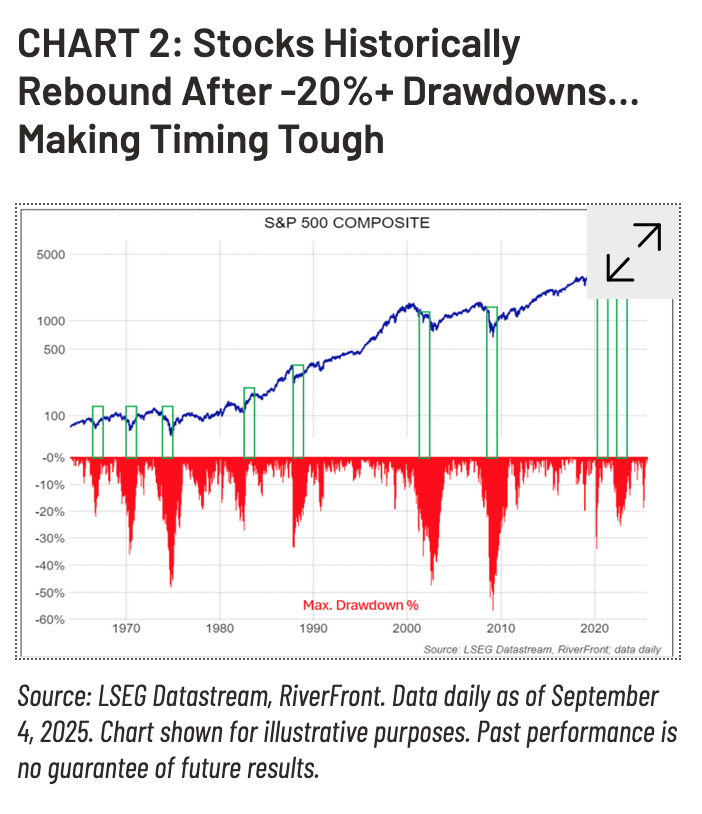

That’s why RiverFront hammers home an old saying: “Investment success isn’t in timing the market… but rather time IN the market.” History shows that after market drops of 20% or more, stocks tend to bounce back by double digits within a year. The real danger isn’t sitting through a downturn—it’s missing the rebound.

Fundamentals Look Better Than the Headlines

Step away from the seasonality charts, and the picture brightens. “We view the US economy as remaining on track, Fed independence should be maintained, and we expect some rate cuts between now and the end of the year. All of this creates a backdrop generally conducive to further stock gains through year end, in our view,” Konstantinos writes.

Corporate America is also pulling its weight. “We also believe that US ‘Economic Exceptionalism’ is not dead, as corporate America has adjusted well to the headwinds that have appeared this year, posting strong earnings growth year-over-year in the second quarter.”

Momentum Is on the Market’s Side

The technical setup supports the case for staying invested. RiverFront’s “3 Rules” strategy leans on the 200-day moving average as a key trend line. “The trend on the S&P 500, which we define as the 200-day moving average (DMA), has perked up as the technology sector has led the index to set a series of new all-time highs,” Konstantinos explains. Right now, “the trend is rising at a 14% annualized rate; if history is any guide, we believe this condition should bode well for stock returns over the next 3 to 6 months.”

The technical setup supports the case for staying invested. RiverFront’s “3 Rules” strategy leans on the 200-day moving average as a key trend line. “The trend on the S&P 500, which we define as the 200-day moving average (DMA), has perked up as the technology sector has led the index to set a series of new all-time highs,” Konstantinos explains. Right now, “the trend is rising at a 14% annualized rate; if history is any guide, we believe this condition should bode well for stock returns over the next 3 to 6 months.”

RiverFront has leaned into this by overweighting U.S. equities. At the same time, Konstantinos strikes a note of humility: “We will approach such decisions with the appropriate level of humility about our (or anyone’s) ability to perfectly time these tactical moves…and as always, we will also formulate a reinvestment plan concurrent to any risk reduction plan implemented.”

Bottom Line: Don’t Let September Spook You

Not every September is doomed. And this one, Konstantinos argues, looks more supportive than not. “For these reasons, we believe using simple heuristics like the ‘September Effect’ are fraught with peril and should be approached with trepidation.”

For investors, the message is clear: accept volatility, resist the urge to overreact, and remember that time in the market—not market timing—is what pays.

Footnote:

1 Konstantinos, Chris, CFA. "Don’t Be Scared of the ‘September Effect’: Buckling Up for a Volatile Autumn…but not Backing Down." RiverFront Investment Group, 9 Sept. 2025.