For years, the S&P 500 has looked like a rocket ride—powered mostly by a handful of mega-cap tech giants. Brendan Ryan, CFA at Algorithmic Investment Models (AIM), puts it plainly1: “Over the past several years we’ve watched the S&P 500’s performance become increasingly tethered to a handful of Mega-cap technology companies.”

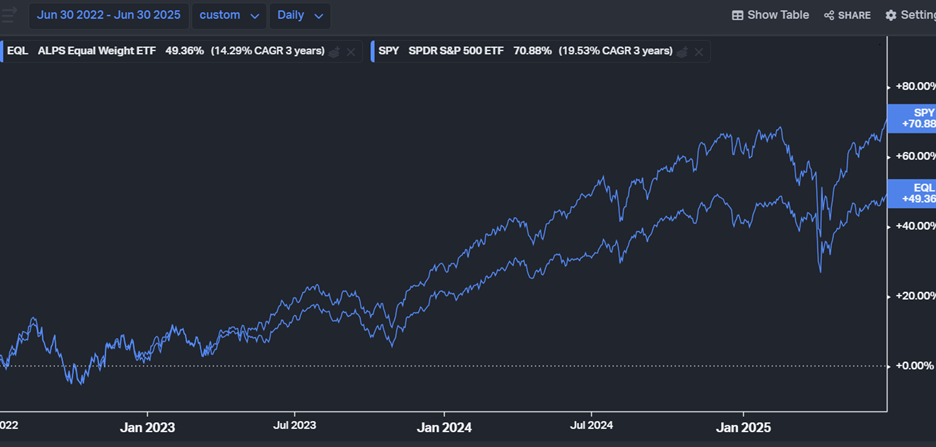

That tether has only tightened with the AI boom. Because the index is market-cap weighted, the biggest winners move the needle for everyone. And they’ve been moving it a lot. Ryan notes: “Over the past three years the market cap weighted S&P 500 (SPY) has returned roughly 70.9%, while the equal-weight S&P 500 (EQL) returned 49.4%. This sprawling gap underscores how much investors have been rewarded for crowding into the largest names.”

It’s been a dazzling run, but also a fragile one. History reminds us that the companies that lead the way up are usually the same ones that lead the way down.

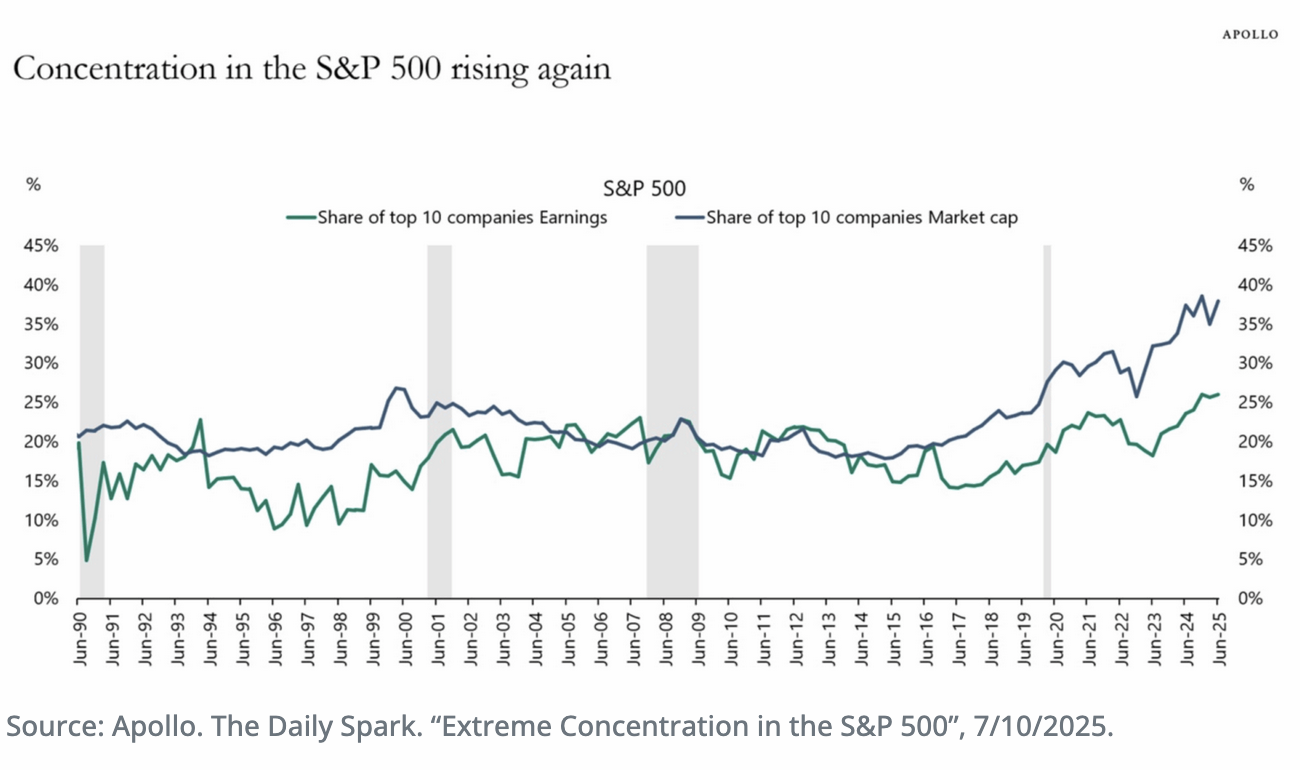

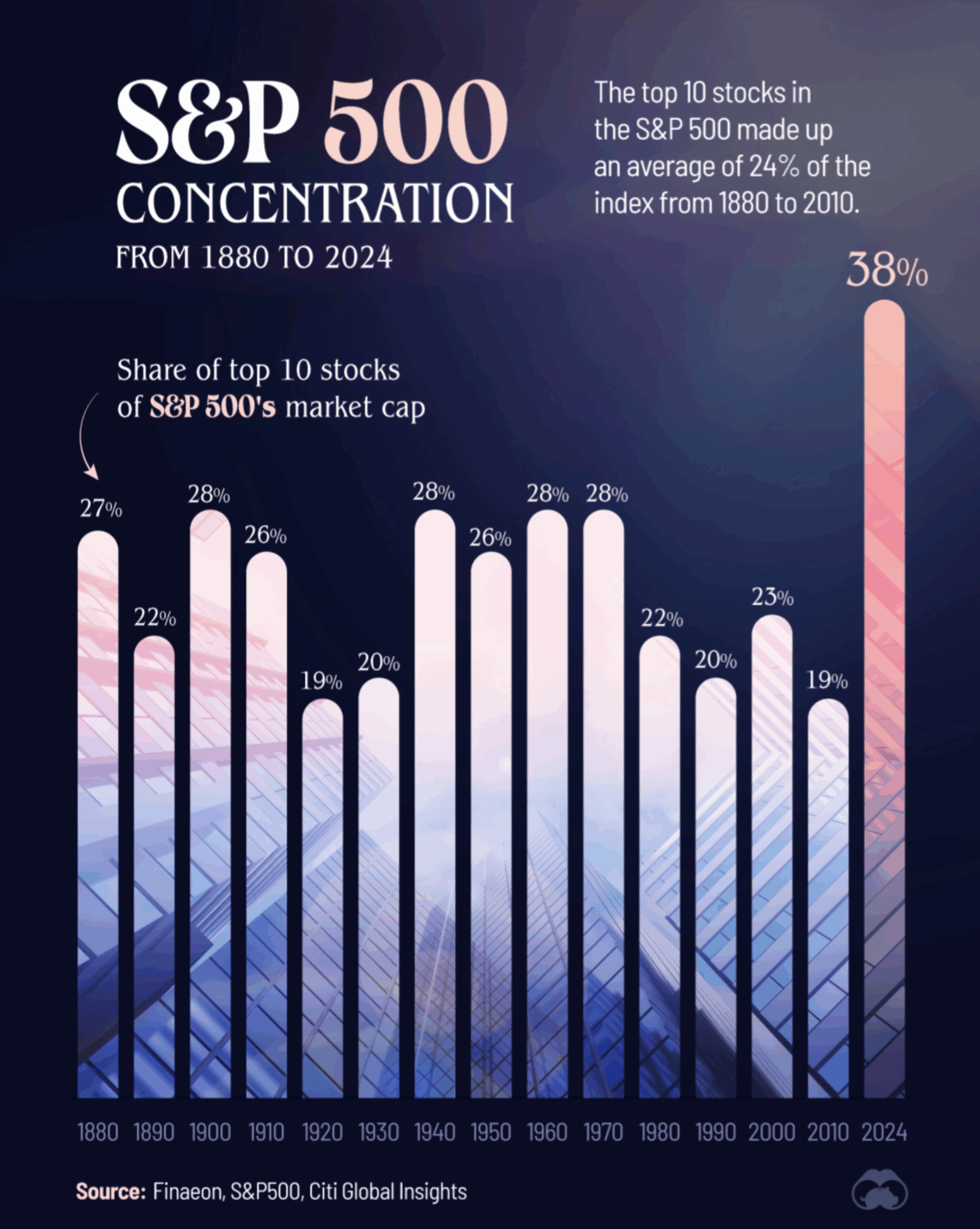

The Market Has Never Been This Concentrated

Right now, the S&P 500 is more top-heavy than ever. As Ryan explains, investors are “effectively betting on a subset of eight (ish) businesses.” The problem? They’re no longer operating in their own lanes. “This subset of companies, once relatively independent, are now all competing in AI, concentrating risk.”

We’ve seen this movie before. “History shows that the companies that lead the market up tend to lead the market down. In the most recent three periods of concentration, it was: Tech bubble in 2000 with Software and Internet Infrastructure; In 2008, it was Financials and Energy; and now we again have Tech and AI related companies making up a significant part of the index.”

When leadership is this narrow, reversals tend to be harsh.

Pullbacks Tell the Story

Markets have already given us a preview. During the 2022 correction, “the equal-weight S&P 500 fell a tolerable 10.6% while the traditional, market-cap weighted index slumped 18.2%. In other words, spreading exposure evenly across sectors cut the drawdown almost in half.”

The pattern repeated in early 2025. “The S&P 500 fell 15% from the beginning of the year while an equal-weight sector basket fell just 10%. Both foreign stocks and bonds had positive returns in the first quarter. Foreign stocks and bonds, long beleaguered diversifiers, also significantly outperformed.”

The lesson? The same leaders that fuel the highs also deepen the lows. As Ryan puts it: “These sell offs are proof that diversification can work when markets are stressed.”

Getting Ready for What’s Next

Markets don’t move in straight lines. When bull markets stretch on for years, they breed concentration. But when leadership shifts, those same weights become anchors. Ryan argues: “When the largest stocks falter, they tend to drag market cap indices with them, while the average stock, sector or foreign market can still deliver positive or relatively stronger returns, helping to smooth the ride for investors.”

His conclusion: “The defensive value of a rules-based, diversified approach is higher than ever.”

A Systematic Way to Spread Risk

AIM’s Sector Rotation strategies are designed to give investors participation without overexposure. Ryan breaks it down into two levers:

- “Trend following: Incorporating moving average-based portfolio management rules allows us to reduce risk when markets break down and reenter when they stabilize. This systematic component is designed to avoid the worst of prolonged bear markets.”

- “Equal weighting: Weighting each sector equally rather than by market cap redistributes exposure away from the largest names meaning more diversification and less concentration and whipsaw risk.”

The point isn’t to avoid equities—it’s to avoid making a single bet on tech titans. Or as Ryan says: “We are seeking to capture upside when the market’s offering it and reduce exposure when markets weaken.”

The Bottom Line

The message is hard to ignore. “Markets driven by a small group of stocks can deliver impressive returns – until they don’t. With valuations elevated and macro risks rising, a defensive, diversified approach isn’t just prudent; it may be essential.”

Ryan’s closing challenge to investors is as timely as it is pointed: “Now is the time to reconsider whether your portfolio is diversified enough to withstand a shift in market leadership.”

Concentration has rewarded investors handsomely. But sooner or later, the baton passes. The question is whether portfolios are prepared for the handoff.

Footnote:

1 Brendan Ryan, CFA. Algorithmic Investment Models. AIM. “When Eight Stocks Drive the Market, What Happens When They Fall?." 10 Sept. 2025.