by Denise Chisholm, Director of Quantitative Market Strategy, Fidelity Investments

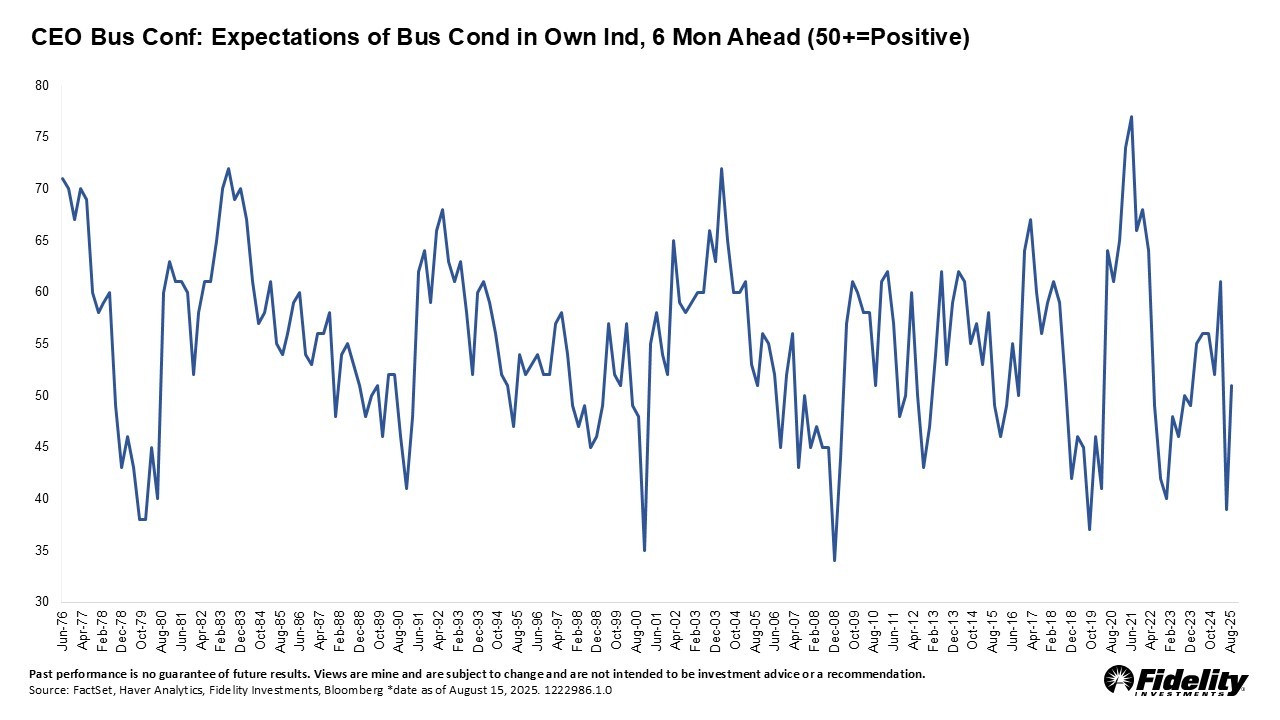

Last month, we learned that CEO confidence jumped 30% from the prior quarter. That’s a big move – but it’s worth remembering that The Conference Board Measure of CEO Confidence was sitting at recessionary levels back in Q1. Even after the big Q2 rebound, CEO confidence is sitting below its historical average.

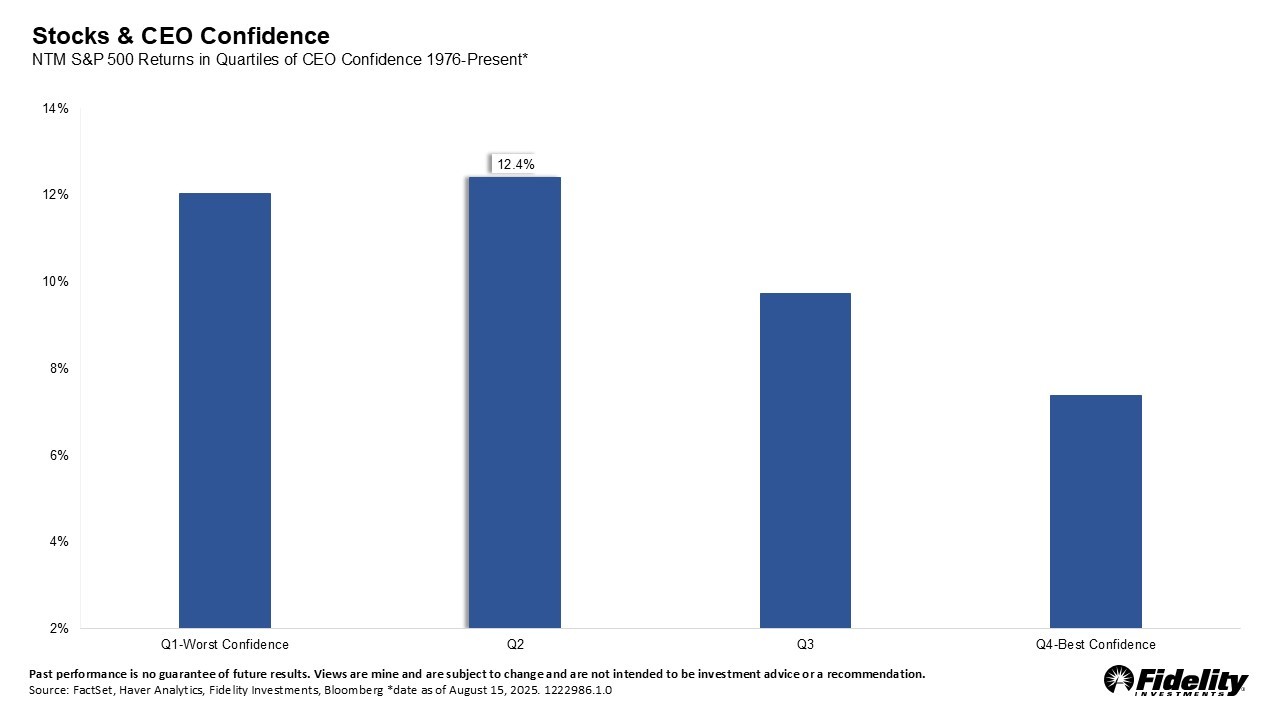

But is that a bad thing for stocks? History says no. Much like other sentiment indicators we track, “bad” survey results often coincide with “good” returns for equity markets – presumably because they tend to occur after the “worst” has passed. When comparing CEO confidence levels, average forward 12-month returns topped 10% when CEO confidence was below normal, compared with less than 10% when confidence was above average. Assuming we avoid a recession – which the data we track suggests is the more likely path – the historical averages don’t tell the full story. Starting from conditions like today, the markets typical gain is closer to 20%.

But is that a bad thing for stocks? History says no. Much like other sentiment indicators we track, “bad” survey results often coincide with “good” returns for equity markets – presumably because they tend to occur after the “worst” has passed. When comparing CEO confidence levels, average forward 12-month returns topped 10% when CEO confidence was below normal, compared with less than 10% when confidence was above average. Assuming we avoid a recession – which the data we track suggests is the more likely path – the historical averages don’t tell the full story. Starting from conditions like today, the markets typical gain is closer to 20%.

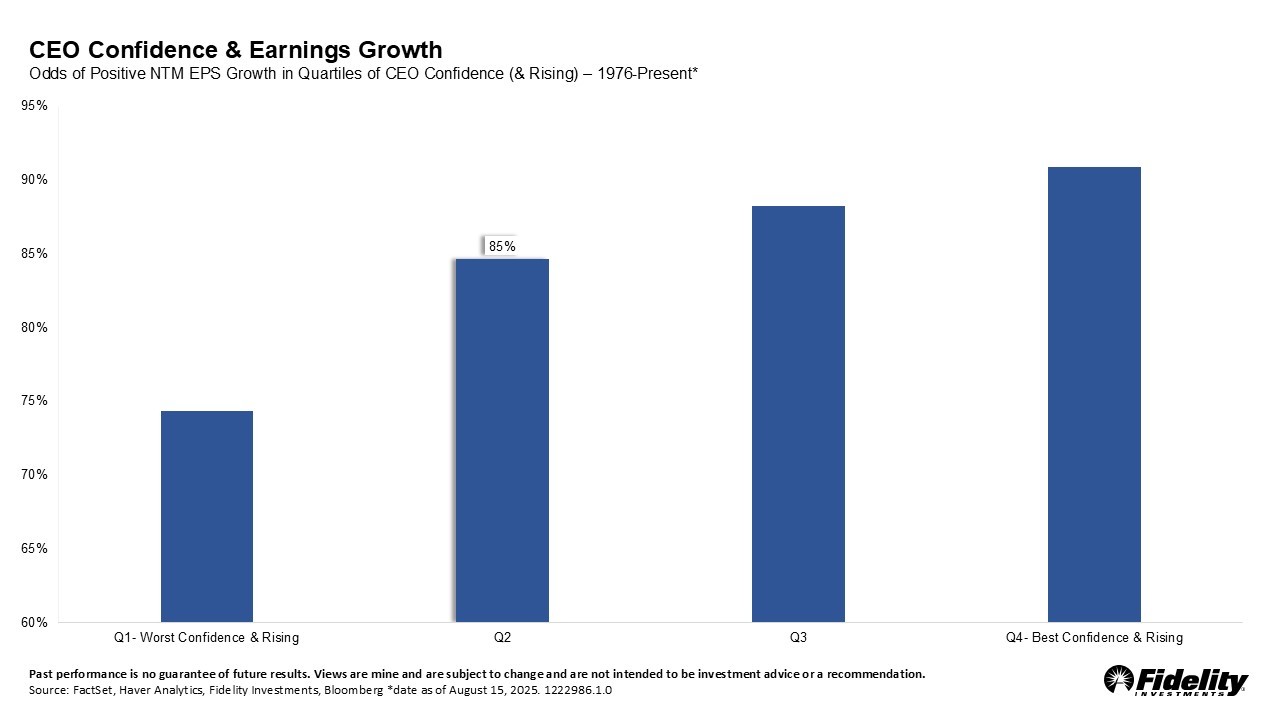

Why? History suggests that when CEO confidence is rising from depressed levels, it usually signals that earnings growth is becoming increasingly likely. The lower the starting point, the stronger that signal. So, big rebounds in confidence should have investors thinking about what could go right. But it’s not just earnings expectations that matter – valuation dynamics play an even bigger role.

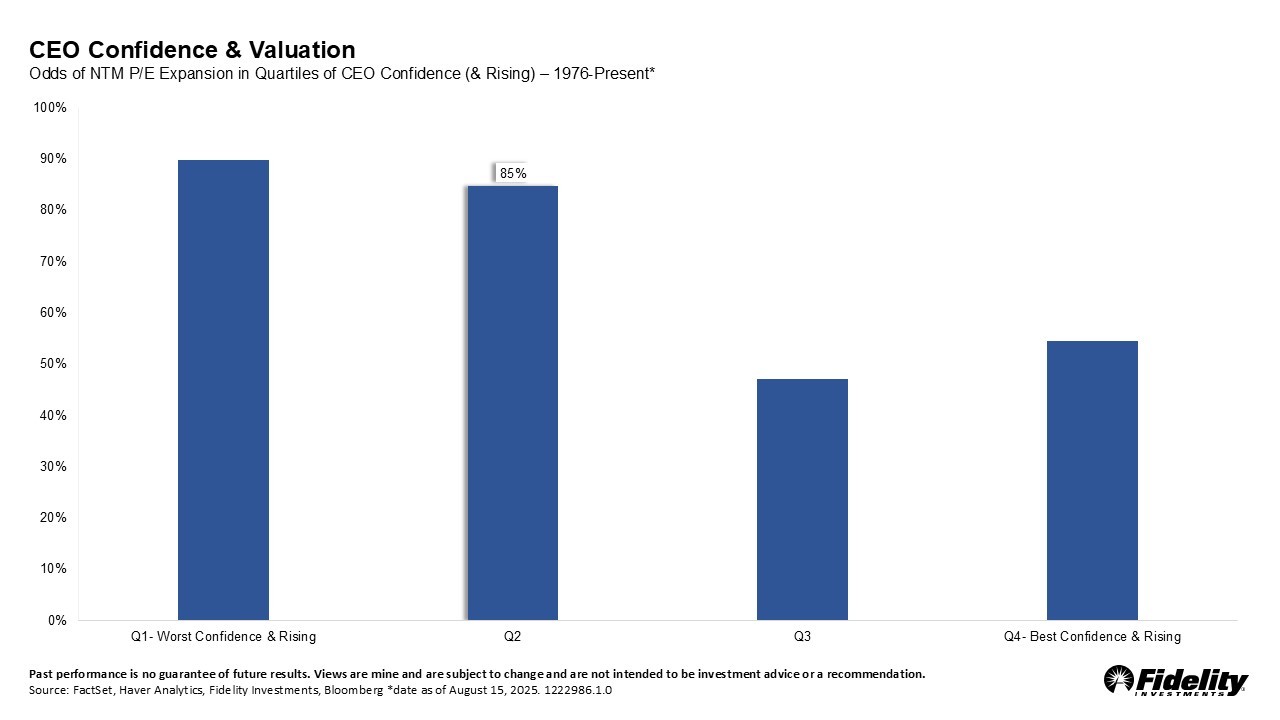

Historically, when CEO confidence was low but rising, we saw a nearly 90% chance of expanding valuations – even when valuations were already high. That’s because confidence gains from low levels tends to be durable. CEOs aren’t turning optimistic on a whim. They’re reacting to tangible improvements and increasing demand visibility. If those improvements end up being sustainable, the market will quickly price in that durability – bidding up valuations well before earnings fully materialize. This fits nicely with the broader theme we’ve been writing about: valuations may remain elevated for longer than many expect. In that context, the latest rebound in CEO confidence isn’t just a headline – it’s another piece of evidence supporting the case.

This information is provided for educational purposes only and is not a recommendation or an offer or solicitation to buy or sell any security or for any investment advisory service. The views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Opinions discussed are those of the individual contributor, are subject to change, and do not necessarily represent the views of Fidelity. Fidelity does not assume any duty to update any of the information.

Copyright © Fidelity Investments