by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses the merits of increasing one’s allocation to gold ahead of the potential for some seasonal volatility in the fall.

Key Takeaways

- Russ argues that a 2-4% strategic allocation to gold is still warranted and notes that historically, gold tends to outperform stocks when volatility rises - which often occurs in the fall.

- While volatility is currently trading at its lowest level since February, upping one’s exposure to gold in the short-term can provide both insurance and lock in potential gains as we head into the latter half of the year.

After a difficult start, stocks are back to their winning ways. The S&P 500 continues to advance and is now up a respectable 10% year-to-date. While alternative strategies worked in the first quarter, since May investors have done best rotating back into U.S. equities. While I still believe stocks will end the year higher, we are entering a time of year when volatility tends to rise. Given this short-term dynamic, I would advocate adding a bit more gold to portfolios.

I last spoke about gold in May. At the time, I was less focused on gold’s short-term value as a hedge, which is mixed, and more motivated by gold’s role as a long-term store-of-value against runaway deficits and legitimate questions about the dollar. Both factors still argue for a strategic allocation, which I’d define as around 2-4%. That said, in the short-term there may be an argument for taking the allocation towards the upper end of the range. If volatility rises, as it typically does in the fall, gold tends to post strong relative performance versus stocks.

Calmer Waters

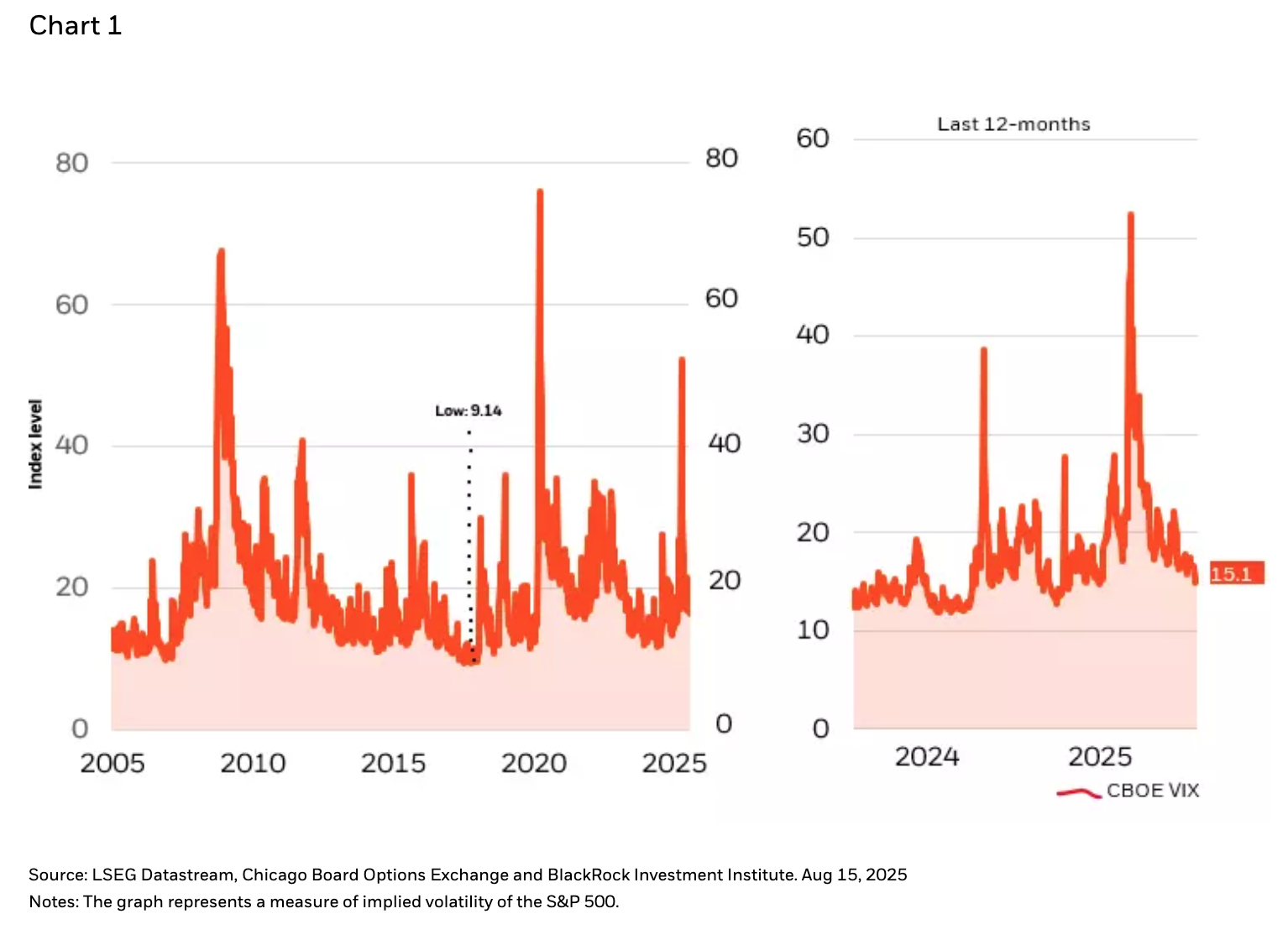

Consistent with a year of rapidly changing themes, equity market volatility, as measured by the VIX Index, has traded in a particularly wide range. March witnessed a violent spike, taking volatility to multi-year highs, only for the surge to reverse at a record pace. Recently, volatility has collapsed, with the VIX Index trading below 15, the lowest level since February (see Chart 1).

The key point in the relationship between gold, stocks and volatility: Even a modest uptick in equity market volatility can favor gold. Looking back at the past fifteen years, there has been a very consistent relationship between how gold performs relative to stocks and weekly or monthly changes in implied volatility.

Take the most recent period, in which gold has lagged as volatility fell. The reverse holds true as well. Based on weekly data from Bloomberg, in weeks when the VIX rises, gold outperforms the S&P 500 by an average of roughly 1%. The greater the spike in volatility, the greater the outperformance. A 20% spike in volatility has historically been associated with an average weekly outperformance of 3%; in the rare instances when the VIX spiked 50% or more, the average outperformance for gold is more than 5%.

Temporary Insurance

In addition to the turn of the season, investors might want to tuck in a bit of insurance given the unusually calm pall that has descended over markets. Regardless of the asset class – stocks, Treasuries, currencies – volatility is bouncing around the lows for the year, suggesting investors are not particularly focused on hedging their accumulated gains. A short-term trade in gold may help preserve those gains in what is turning out to be a decent year.

Copyright © BlackRock