by Kent Hargis, Chief Investment Officer—Strategic Core Equities, AllianceBernstein

QSPQuality, stability and price: three features of stocks that underpin an effective defensive equity strategy. |

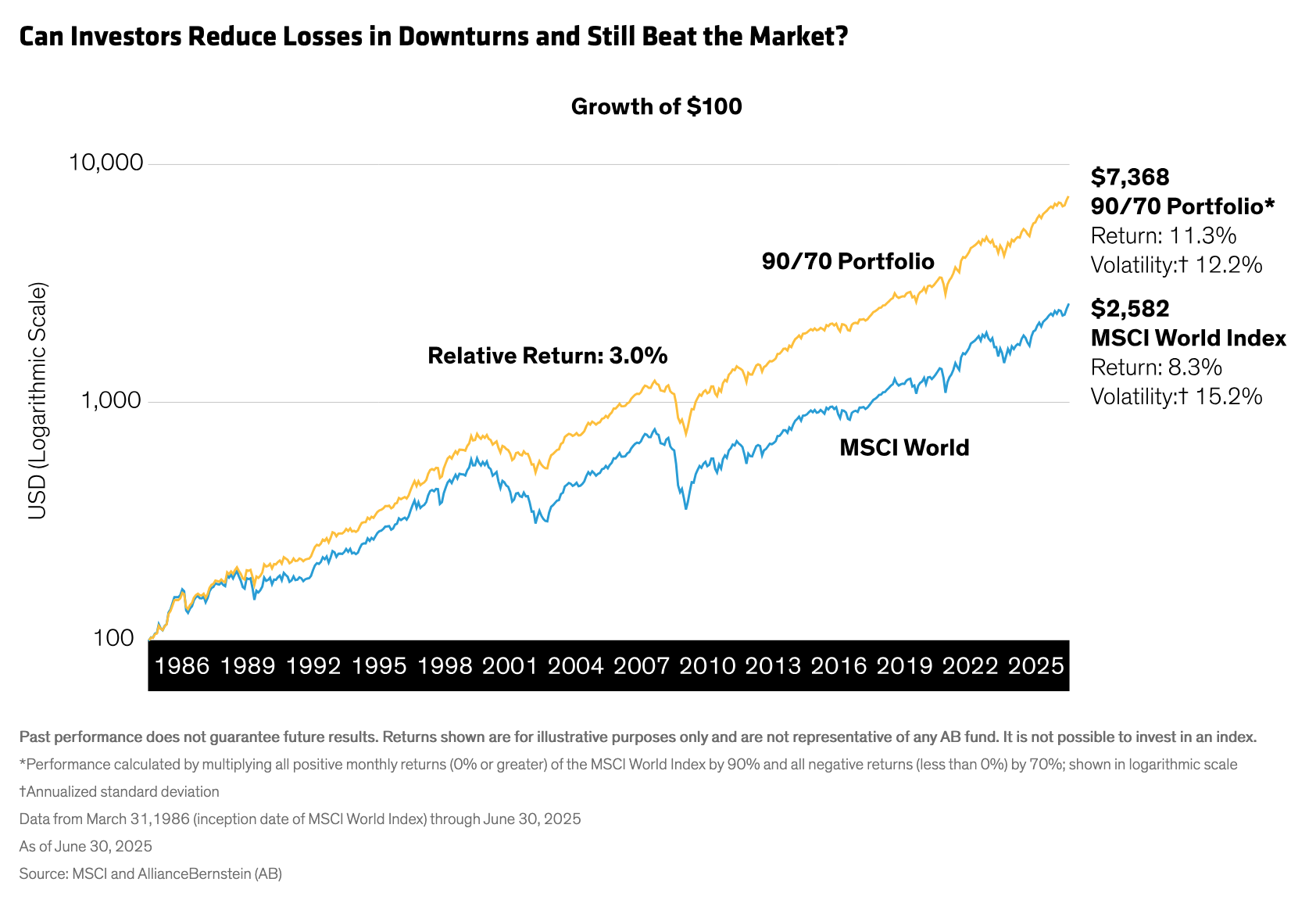

11.3%Average annualized returns of a global equity portfolio that captured 90% of the upside and 70% of the downside of the MSCI World from 1986 to 2025 vs. 8.3% for the broad benchmark.

|

2.0%Average annualized returns of global stocks with attractive QSP features when the MSCI World declined over rolling 12-month periods during the last decade.¹ |

Past performance, historical and current analyses, and expectations do not guarantee future results.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.