by Nick Zylkowski, CFA & Christina Shockley, Russell Investments

Key Takeaways

- Partnering with a full-scale implementation partner can free up time and resources for investment teams

- An implementation partner handles behind-the-scenes tasks like overlays, liquidity management and manager transitions

- Working with a single partner can help reduce costs and improve risk management

You don’t have to go it alone.

This can’t be said enough in today’s demanding environment, where the choices and decisions confronting investment teams seem never-ending.

Take asset allocation. Or manager selection. Or portfolio oversight. Each one takes up ample time and resources. And then there’s portfolio implementation—a highly complex undertaking where even one mistake can have lasting effects on performance.

But there’s help out there. All of these competing responsibilities don’t have to be handled in-house. Specialists can help with some or all of the day-to-day activity of your portfolio, allowing your team to focus on core investment tasks. Think of these specialists as an extension of your team. Their expertise and robust implementation capabilities can support your investment program however you’d like—often helping reduce total costs and risk as well.

Who, what, where, when, why and how? Enter a full-scale implementation partner.

Invest in Implementation

An implementation partner often provides multiple solutions to a total portfolio. This can range from daily needs like overlays and liquidity management to major projects like executing manager transitions. However, their overall purpose is straightforward. They are charged with taking your team’s investment decisions—on asset allocation, manager selection, tactical decisions, you name it—and integrating them into your portfolio.

A full-scale implementation partner does the behind-the-scenes—but critically necessary—work of managing portfolios according to the investment objectives, risk tolerance and preferences set by an investment team. In doing so, they free up time and energy for the investment staff to focus on decision-making.

Lighten the Load

Today’s investment staffs also face several other challenges. Increased pressure from stakeholders to reduce fees and keep costs low is a major one. Others include the need for more customized portfolios and additional due diligence monitoring for sub-advisors. Add to this the increasingly powerful data and analytics required to measure and manage an investment program spanning multiple managers and asset classes, and it’s no wonder today’s investment staffs are feeling the squeeze.

Amid all these pressures, it’s important to remember these teams are ultimately responsible for the results of the total portfolio. Their decisions on asset allocation and strategy drive a majority of the portfolio’s outcome. But without robust management of fees, costs, risks and other return enhancers, those outcomes can easily be eroded over time.

This is another area where a fully integrated implementation partner can make a meaningful difference. Here’s how.

Rein in Risk

An implementation partner can bring risks under better control by managing the interaction of all portfolio strategies—including those managed by sub-advisors. Examples could be:

- Keeping the total portfolio aligned with your strategic asset allocation while investing cash

- Reducing opportunity costs during manager transitions

- Identifying and trimming unintended risks introduced from combining specialist managers

- Decreasing trading costs by netting FX trades and lowering portfolio turnover via model implementation

- Enhancing yields and preserving liquidity within fixed income while providing capital efficiency elsewhere in the portfolio

Effective risk control allows asset owners to be more targeted and nimble in their strategies. Better yet, it also saves on costs—both explicit and implicit.

Tailor and Trim

Partnering with an implementation provider can also expand customization options for your portfolio while lowering costs.

Let’s say, for example, that you want to exclude tobacco companies from your portfolio. Or you have a tax-management or factor investing strategy. Any of these mandates can be carried out more effectively by working with a single implementation partner, rather than contracting with a separate manager for each. Why? Because a single, fully integrated partner will have access to your total portfolioview. This allows you to reap the benefits of your chosen managers’ best ideas, while reducing manager fees. This is done through model implementation which preserves alpha through lower turnover and centralized trade execution. How’s that for cutting costs?

Visualize Value

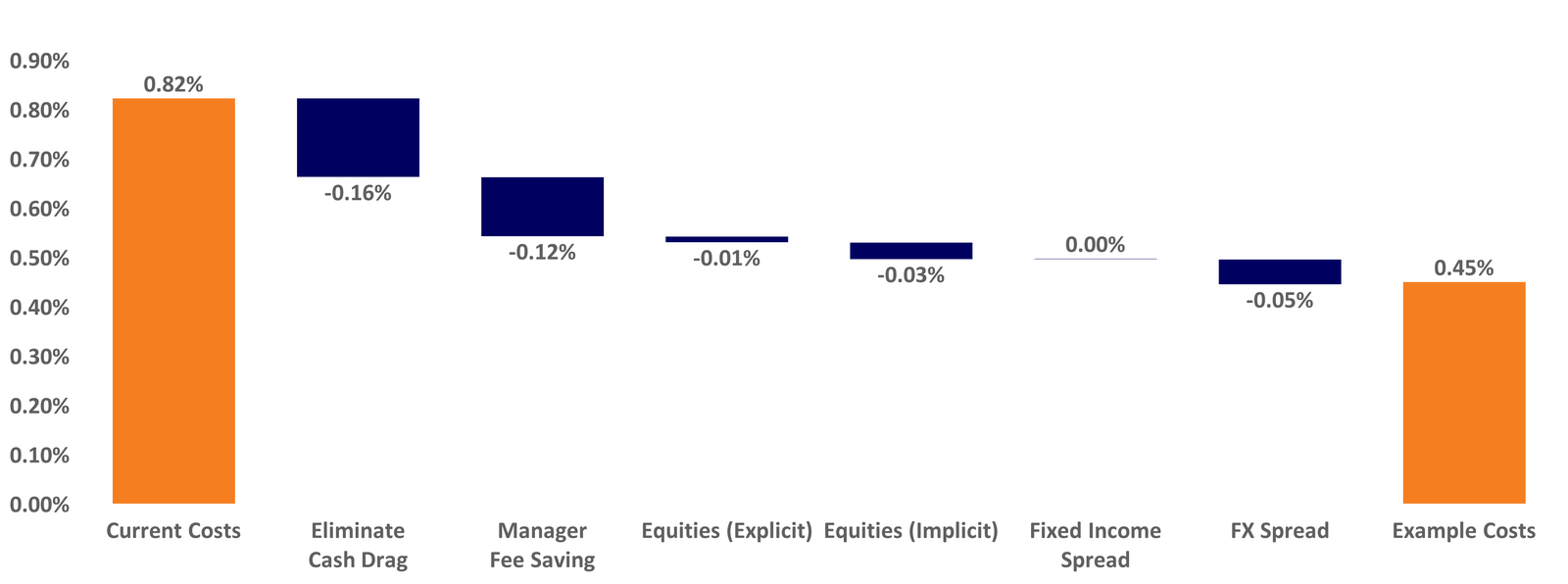

The illustration below shows a hypothetical example of the magnitude of savings (in basis points) that a full-scale implementation provider can provide in a total portfolio. While results will vary depending on portfolio structure, we estimate that approximately 0.37% (or 37 basis points) can be saved in a standard implementation portfolio per year. Here’s the breakdown:

- 0.16% from eliminating cash drag

- 0.12% from manager fee savings

- 0.01% from equities (explicit)

- 0.03% from equities (implicit)

- 0.05% from foreign exchange

0.37% total

Savings Unlocked

A full-scale implementation partner can help reduce portfolio expenses

Hypothetical costs saved in a total portfolio (in %)

For illustrative purposes only. Past performance does not predict future returns. Source: Russell Investments. Please see disclosure section for assumptions and methodology for calculation

Put another way, the value of an implementation partner in this instance is 37 basis points per year. What could it be for you?

The Bottom Line

In the world of portfolio implementation, the whole truly is greater than the sum of its parts. Consider reaching out to a full-service implementation partner to see the value they can add to your portfolio.

Copyright ©