by Craig Basinger, Derek Benedet, & Brett Gustafson, Purpose Investments

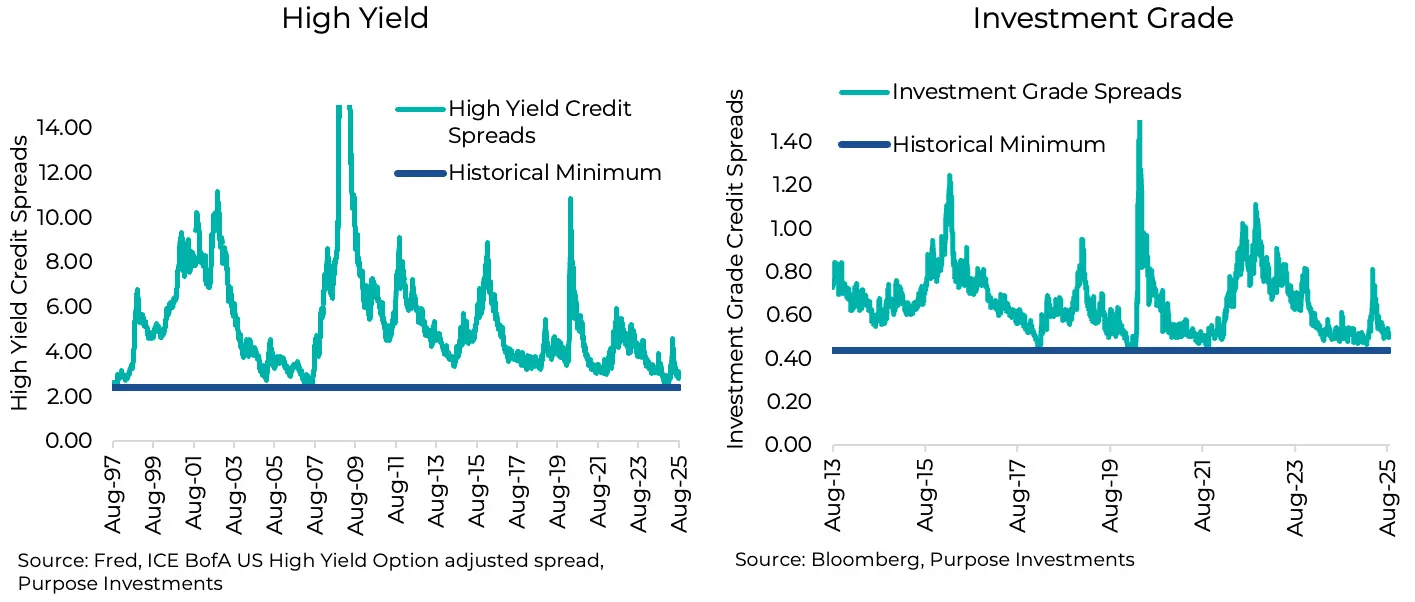

The risk-free rate, aptly named, is the nominal return you can achieve without assuming any risk. Generally, government bonds or bills are used as a proxy for the risk-free rate to put a number on it across different time periods. What got us thinking about the risk-free rate was credit spreads, the added yield above the risk-free rate provided by corporate bonds to compensate for such things as defaults. And these credit spreads are very low right now.

How Low Can You Go?

There are a few supporting factors that support such low credit spreads. Corporate debt, while high relative to assets, does enjoy coverage ratios (debt to EBITDA) that are very healthy. Perhaps the quality of issuers has improved over time. Or with such healthy credit markets, companies just don’t go bankrupt like they used to. Just like equity investors tend to buy the dip on any sign of weakness, so do credit managers when spreads tick higher. Clearly, there is no shortage of buyers. That all being said, do you think the world is so perfect to justify such euphorically low spreads?

Then again, corporate spreads may be wider than they appear. As we highlighted, corporate spreads are measured off this ‘risk-free rate,’ which is government bond yields. What if government bond yields aren’t risk-free anymore and now contain a bit of a risk premium? If so, that would suppress the stated corporate spread.

This risk premium in government debt isn’t about inflation or where yields are going next; it is more about default risk. This concern isn’t anything new with Ross Perot in the early 1990s warning that the government was on an unsustainable fiscal path when the total debt was a mere $4 trillion. It is now three decades later, and the debt is over $37 trillion. His warnings were premature in the 1990s, but today there are increased rumblings on the sustainability or path forward.

Without going down the rabbit hole of how government debt works, we will jump to the current state of the U.S. Its debt is very large, interest costs are rising, demographics are a challenge, as is the current deficit level and expected increases based on current programs and policies. Being the global reserve currency is a huge plus, as is the depth of their financial system, with many levers to pull. Today, there is no shortage of buyers of U.S. debt, despite some of the headlines. So, this isn’t today’s problem.

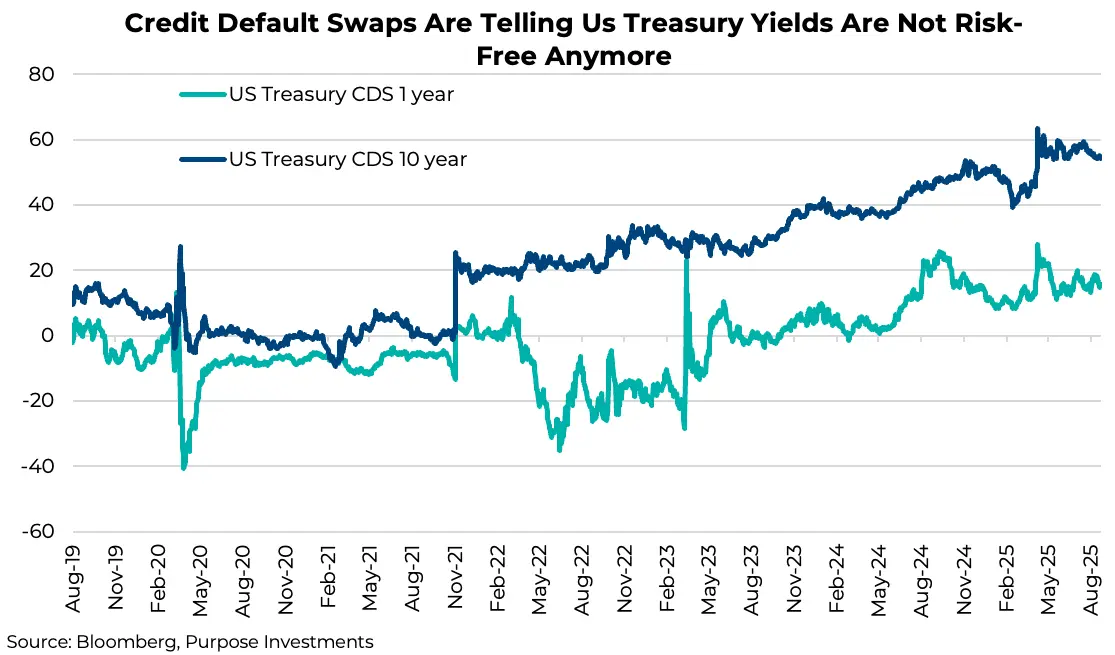

But it is a rising future risk without question. As a proxy for this risk, we will listen to the markets. Credit default swaps (CDS) are available on U.S. Treasuries, providing further evidence that government yields are not risk-free, because if they were, you wouldn’t need insurance now, would ya? CDS pricing is influenced by a number of factors that can push pricing around.

There are two key takeaways:

- Treasury yields are now incorporating some degree of risk, and

- That degree of risk rises the farther out you look.

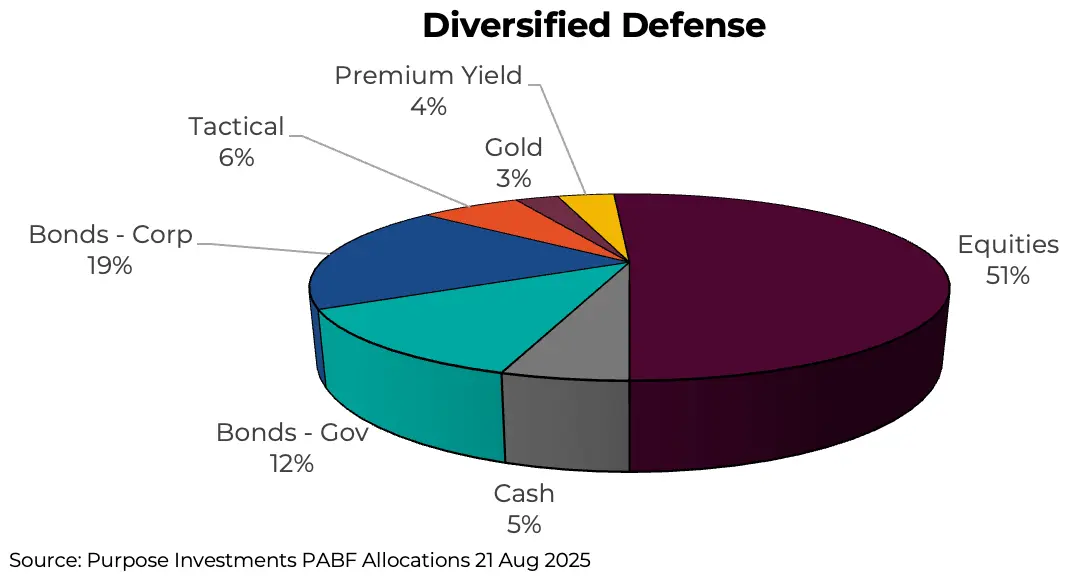

We are not alarmists on government debt or sustainability at this time, but do believe this subject is on the rise. There are vast implications for how and/or when policy evolves in an attempt to address this rising risk, with potential knock-on effects. Today, we are not losing any sleep, but we do believe portfolios should increasingly diversify their defensive positioning to include bonds, credit, hard assets, options strategies, momentum and alternatives. As an example, below are our defensive bucket allocations.

Final Thoughts

The crux is that a Microsoft 10-year bond trading with a credit spread of 10bps to the 10-year Treasury yield is actually closer to 70bps above the true risk-free rate. Maybe credit spreads are not as tight as they appear, given that the benchmark they are measured against has moved. For those with exposure to credit, including ourselves, this may provide some solace that the posted historically low credit spreads to Treasury yields are not a reason to get overly nervous.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.