by Lance Roberts, RIA

There is little doubt that excess bullishness has invaded the general market psyche. Just a couple of months following the market decline in March and April, where sentiment turned exceedingly bearish, the S&P 500 hovers near its highs. Furthermore, analysts are rushing to raise price targets to 7,000 or more. Nicholas Colas of DataTrek notes that sector correlations, a reliable signal of investor confidence peaks, are moving toward levels seen before tops in 2023, 2024, and February 2025.

Furthermore, growth stocks continue to outperform value by a wide margin. As noted in the Daily Market Commentary, dominance is driven by Big Tech, which accounts for nearly half of the S&P 500’s recent gains.

“Like an iceberg where we only witness the 10% rising above the water, the passive index concentration hides underlying weakness. Equal-weight versions of the S&P 500, which give each stock the same importance, are underperforming. That shows that the broader market is struggling outside of the top names. When gains are so concentrated, the market’s foundation is narrower than it appears.”

To better understand that performance gap, it is currently the largest since the “Financial Crisis.”

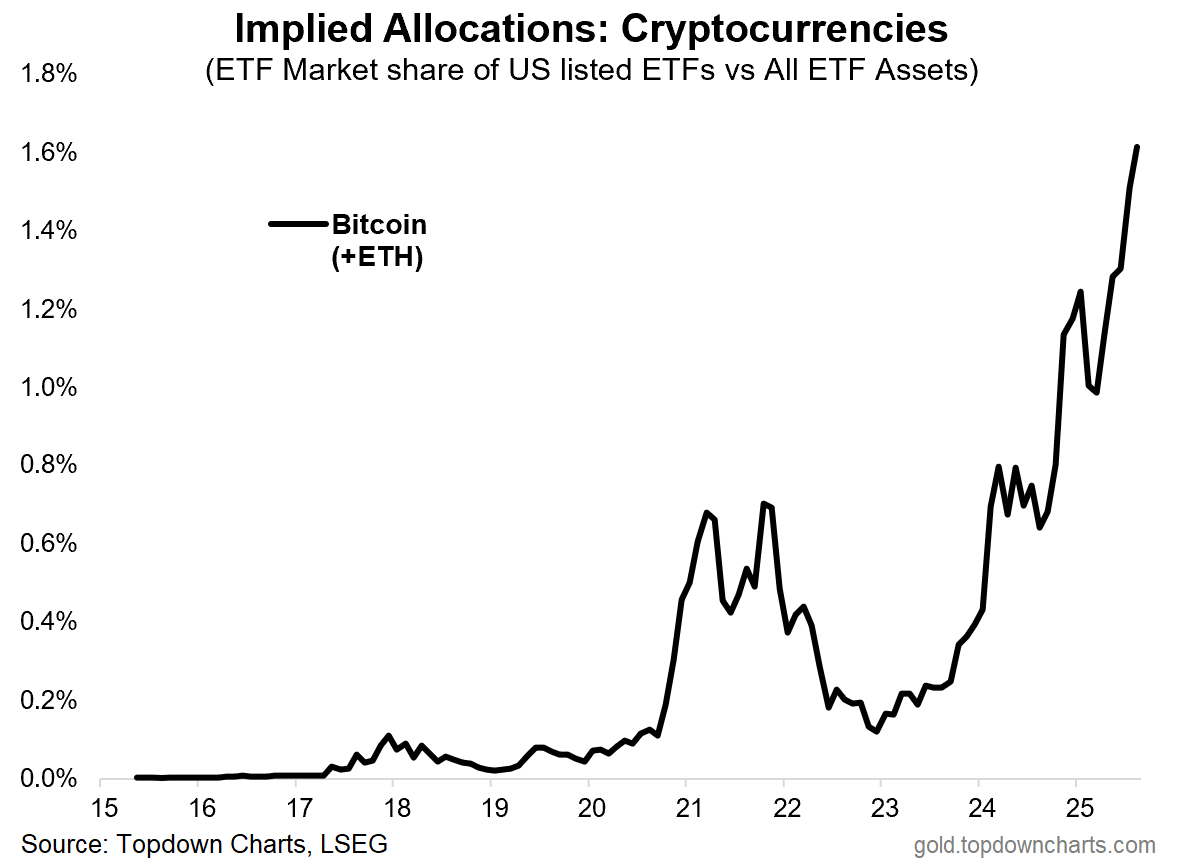

Excess bullishness is not confined to equities. Crypto markets exhibit very similar traits. Bitcoin and Ethereum sit at or near all-time highs, with altcoins following. As TopDown Charts noted this week:

“And here’s the thing, even if you don’t follow Bitcoin/crypto, and have no intention to ever touch it, the fact is by this point it’s probably going to touch you either way — in other words, as a barometer of risk appetite and speculation, as a risk asset itself, and being closely correlated with tech stocks: if Bitcoin goes, tech probably goes too (and the rest of the stockmarket for that matter!).”

So it’s an interesting chart with interesting implications for investors…

As he notes, and shows below, the correlation between Bitcoin and Nasdaq is more than just casual.

We have also witnessed excess bullishness with the uptake in Wall Street IPOs, which have been met with strong demand. Of course, the rationalization for the optimism is that a forthcoming Federal Reserve rate cut will lower the discount rate on future earnings, increasing the current valuations investors can pay for equity risk. While I am relatively certain that most of the benefit of rates has been largely priced into the current market valuations, investors seem to disagree and have pushed margin debt above $1 trillion for the first time.

While margin debt supports excess bullishness, it is also evidence of the return of “animal spirits.”

Animal Spirits Surge: The Limits of Rationality

The term Animal Spirits” comes from the Latin term “spiritus animals,” meaning “the breath that awakens the human mind.” The usage can be traced back to 300 BC in human anatomy and physiology. It refers to the fluid, or spirit, responsible for sensory activities and nerves in the brain. Besides the technical meaning in medicine, animal spirits were also used in literary culture. In that form, they referred to states of physical courage, delight, and exuberance.

Its modern usage came about in John Maynard Keynes’ 1936 publication, “The General Theory of Employment, Interest, and Money.” He used the term to describe the human emotions driving consumer confidence. Ultimately, the financial markets adopted the “animal spirits” to describe the psychological factors that drive investors to take action.

As noted, the market backdrop shows the hallmarks of excess bullishness with retail investors now outpacing institutions in equity flows. Over $50 billion has been deployed in recent weeks, boosting retail share of S&P inflows to its highest since February. Surveys also find that 62% of retail investors are bullish, and 66% expect further gains.

Another warning from Goldman Sachs showed that its equity asymmetry model warns that drawdown risk is nearing 30%, a level associated with previous peaks. Put-call ratios skewed by retail option buying reinforce the imbalance. Sentiment extremes complement them as contrarian indicators.

The crucial point is that when optimism peaks, reversals tend to follow. This excess bullishness, which comes amid aggressive AI valuations and leveraged positioning, underscores the fragility of the rally. As we noted in a recent #BullBearReport, the bet on higher asset prices, particularly in areas like Small and Mid-cap stocks, which are very sensitive to economic changes, shows the detachment of investor sentiment from underlying fundamentals.

“This was evident already in the Q2 earnings reporting period. Without Megacap Technology and major Wall Street banks, there would have been no earnings growth.”

Furthermore, the bet on future earnings growth from Technology companies to support the entire financial market complex is getting extreme. While current earnings growth has undoubtedly been robust, we saw the same heading into 2022, just before earnings turned lower.

What will cause the subsequent disappointment in earnings forecasts? No one knows.

However, we know it will eventually happen, and excess bullishness will be reversed.

Given that markets carry excess bullishness, leverage, and sentiment extremes, how should an investor navigate such an obvious risk while still participating in the overall market?

It’s a great question, but a more challenging process to incorporate. Our psychological bias of “greed” takes over in excessively bullish markets, making risk management protocols more difficult to enact. The “fear of missing out” or F.O.M.O. is the most apparent manifestation. You will likely recognize that bias if you have hesitated to take profits in a winning position under the premise that “this stock can only go higher.”

You might want to take a look at a recent chart of CoreWeave (CRWV) to understand why taking profits (rule #1) is the most important rule of all.

That said, here are the rules. If you have read our work for a while, you will be familiar with them, but a gentle reminder never hurts.

- Trim the most extended positions: Reduce holdings in names with the highest speculative premiums, particularly concentrated AI and meme‑stock themes. A high skew in options signals elevated tail risk.

- Rebalance toward quality and defensive sectors: Shift allocation to less speculative sectors with earnings stability. Defensive stocks historically outperform during corrections.

- Maintain or increase cash cushions: Cash provides optionality. In a correction, buying power grows when sentiment resets. Avoid full deployment in euphoric markets.

- Add hedges or volatility strategies: Consider defensive hedges, such as inverse ETFs, put spreads, and volatility exposure. Even modest positions can protect against sharp drawdowns.

- Monitor positioning and sentiment metrics: Track margin debt, retail flow data, sentiment surveys (e.g., AAII, Investors’ Intelligence). Elevated bullish readings above historical norms flag overextension³. Option skew, put‑call ratios, and channels like Goldman’s asymmetry gauge directional and tail risk pressures².

- Use alternative assets for diversification: Risk‑managed strategies in tangible assets, Treasury ladders, and low‑correlation hedge funds may cushion corrections while preserving growth potential.

- Stress‑test portfolios using worst‑case scenarios: Model drawdowns akin to the dot‑com collapse or the CoreWeave plunge. If the portfolio hits 20‑30 percent loss, ensure the structure withstands liquidity squeezes.

- Scale exposure in phases: If bullish, build exposure gradually. Enter over a more extended period. Avoid back‑loaded positions that spike exposure with momentum.

- 9. Stay nimble, avoid all‑in allocation: Lighten positions when sentiment soars. Use scale‑in and scale‑out tactics. Corrections punish static positioning.

- 10. Employ conviction limit frameworks: Set maximum exposure thresholds by theme (e.g., AI speculative basket). When performance exceeds the conviction limit, trim profits systematically.

These actions stem from technical discipline and pragmatic risk control. Excess bullishness isn’t inevitable. It can persist. But leaning against it preserves capital and behavioral conviction.

Copyright © RIA