by Teresa Keane, Managing Director—Equities, Walt Czaicki, CFA, Senior Investment Strategist—Equities, AllianceBernstein

Volatility often evokes emotional responses from investors. Two big sell-offs in early 2025 reminded us why it’s important to fight those responses and stay invested through downturns.

It’s perfectly human to feel fearful when the value of your investments is falling fast. However, trying to time the market can be counterproductive, as investors may forfeit strong gains that are common after volatility peaks.

Calculating the Cost of Market Timing

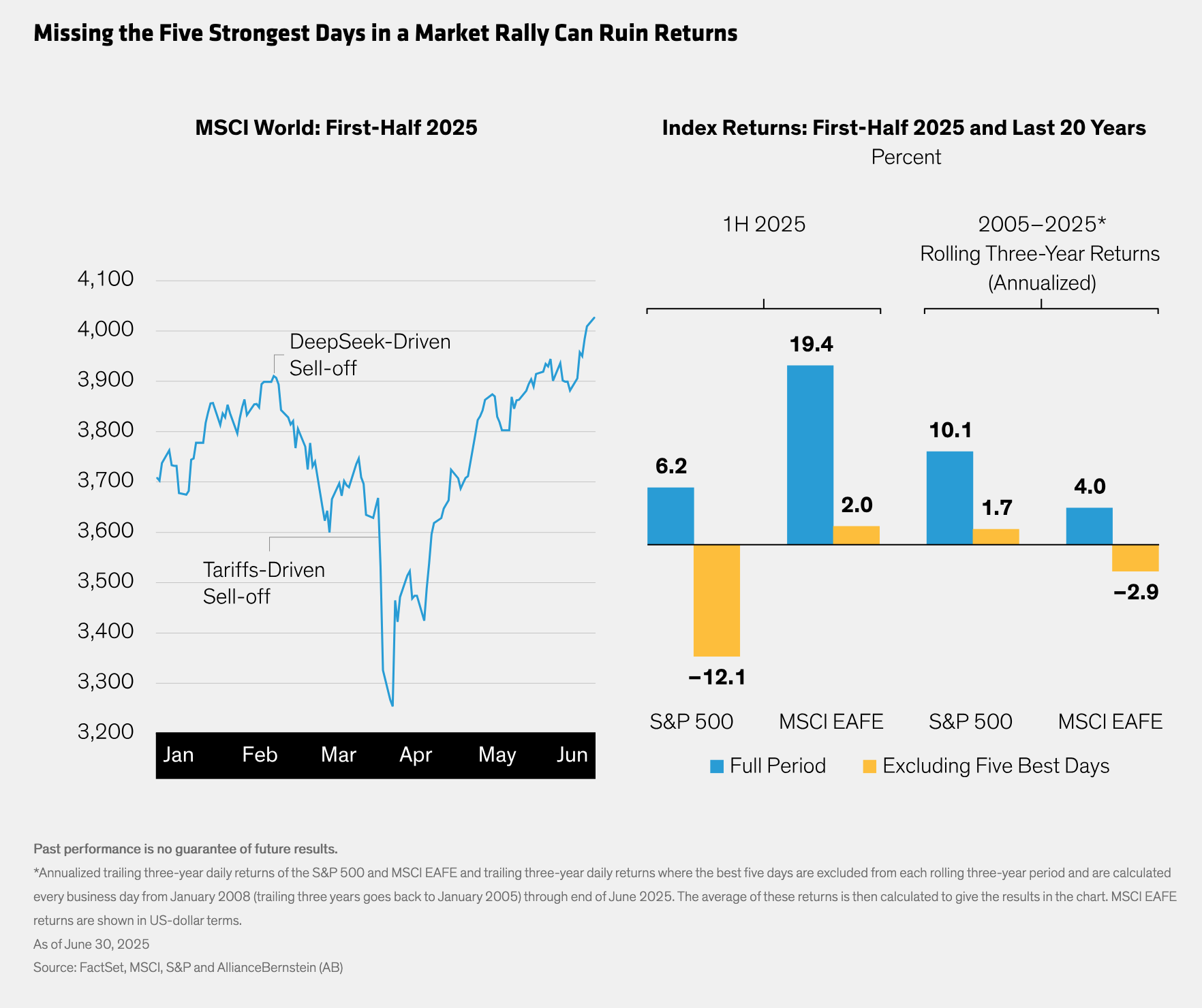

That timeless lesson was reinforced this year (Display). First, global stocks fell in the first quarter after DeepSeek’s artificial intelligence breakthrough raised concern about the technology mega-caps. Then, in early April, equities tumbled in response to President Trump’s sweeping tariff plans, followed by a rapid recovery after a 90-day pause was announced a week later.

By quarter-end, equities touched record highs. However, when excluding the five best days of the recovery, returns were dramatically impaired. For the S&P 500, missing the five best days in the first half of 2025 translated to a 12.1% loss compared with a 6.2% gain for the full period. For non-US stocks, the MSCI EAFE Index returned 2.0% in US-dollar terms, excluding the five best days, versus a 19.4% gain for those who stayed invested. These trends echo long-term patterns observed over the last 20 years in equity markets, when missing the five best days over each rolling three-year period significantly weakened returns.

How to Resist the Fear Factor

Despite the rebound, headline risks remain. Trade wars, macroeconomic challenges and geopolitical risks could provoke more market volatility.

So how can investors combat the natural impulse to sell in turbulent markets? Defensive equities can help. In particular, we believe an active strategy that aims to curb losses in down markets and capture most (but not all) gains in up markets can deliver a smoother pattern of returns over time. Targeting select stocks that offer quality, stability and attractive prices (what we call “QSP”) can help a defensive allocation get a better balance of returns through market cycles. And for investors, understanding a portfolio’s philosophy and approach—and the pattern of returns that it aims to deliver—is especially important in a world of slower growth and market turmoil.

In our view, a defensive portfolio that eases the pain of losses in falling markets can help investors pass the biggest test when market conditions get rough. By resisting the temptation to sell at the wrong time, investors will dramatically improve the chances of achieving their long-term goals.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Copyright © AllianceBernstein