Let’s face it—these days, investors are drowning in headlines, macro fears, and non-stop data streams. But BMO Capital Markets' Brian Belski isn’t rattled. He’s sticking to what’s worked for him for 35 years: a disciplined, fundamentals-first approach that filters out the noise.

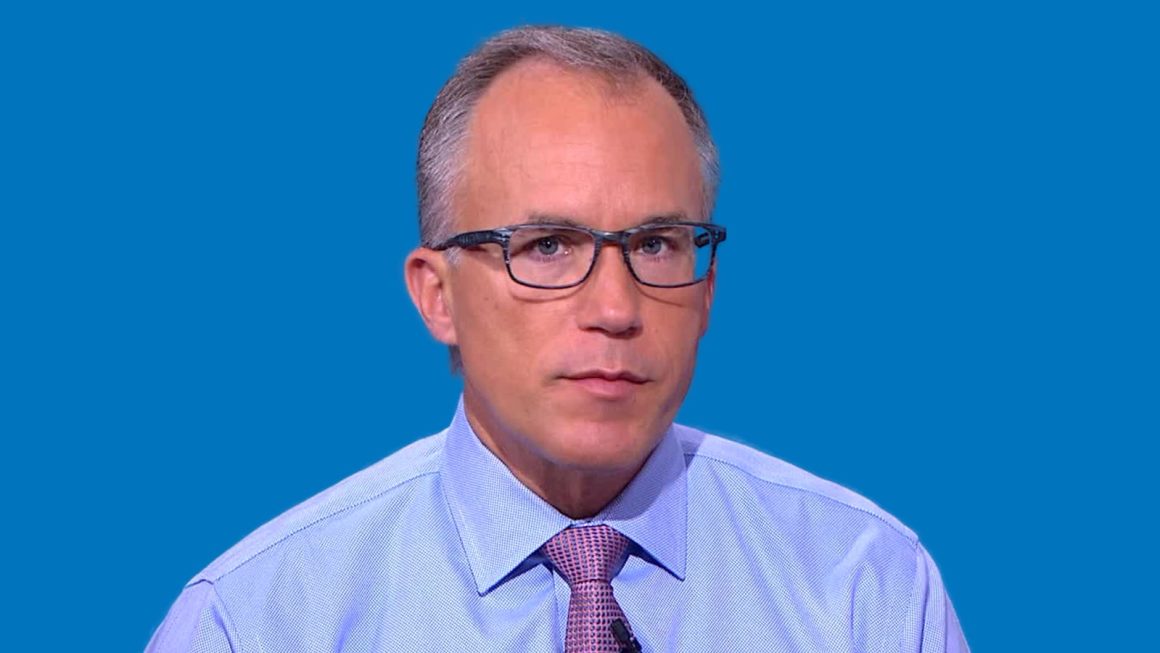

And now, for the first time, Canadian investors can access that strategy directly—thanks to five new ETFs built around Belski’s most successful managed accounts. In a special episode of Views from the Desk1, Erika Toth, Director and Team Lead at BMO ETFs, sat down with Belski to unpack where the market’s heading, which sectors he’s leaning into, and what makes these new ETFs more than just another shelf offering.

From Bay Street to Your Portfolio

Since 2012, Belski has been managing over $10 billion through separately managed accounts (SMAs) at BMO. These new ETFs give investors easier access to that same research-backed strategy. Here's the lineup:

- ZBEC: Canadian Equity Plus

- ZBCB: Canadian Core Plus Balanced

- ZBDU: U.S. Dividend Growth

- ZBEU: U.S. Focused Equity

- ZBVU: U.S. Large Cap Disciplined Value

Toth sums it up perfectly: “Z is for BMO, B is for Belski, and the last two letters are for the product name.”

The Outlook: Ignore the Noise, Stay the Course

Despite the macro drama—trade wars, deficits, rate anxiety—Belski’s view hasn’t changed:

“Stocks lead earnings which lead the economy.”

He’s not interested in fear-driven headlines. He calls those “exogenous”—events that might move markets temporarily but aren’t investable. And while many strategists chase the news cycle, Belski keeps his focus on fundamentals.

“We’re believers in fundamentals. We’re not believers in noise and negativity.”

His call? Both Canadian and U.S. stocks are headed higher through year-end and into 2026.

His Favorites? The Core and the Contrarian

Of the five ETFs, two stand out to Belski:

ZBEC, his “first child,” is a mix of the best Canadian and U.S. stocks—a “widows and orphans”-style core portfolio:

“We really whittled it down… the best names in Canada and the best names in the US.”

And then there’s ZBVU, which reflects his deep belief in value investing:

“Value investing’s been out of favor for decades… I believe that the essence of fundamental investing is defined by value investing.”

ZBVU isn’t just another value fund—it’s built for today’s markets, with sector research, low-debt companies, and a willingness to go contrarian when the time is right.

Why Belski Prefers 50 Stocks Over 500

Yes, index ETFs serve a purpose. But for Belski, concentrated portfolios are the real alpha generators—especially in markets where correlations are breaking down.

“You really want to be in the right stocks.”

And that means around 50 carefully chosen names, not 500.

A Model for Consistency

Two of the ETFs—ZBEC and ZBEU—use what Belski calls the “Constant Growth Model.” It’s about finding companies with reliable earnings over time, not those with flashy numbers one quarter and a faceplant the next.

“We like to look at consistent earnings growth versus more volatile earnings growth.”

A Contrarian’s Take on Value

ZBVU isn’t afraid to go against the grain. Belski has made bold bets that paid off—like picking up Costco when it was struggling (up 120%), buying Netflix after it got cut in half (up 200%), and hanging onto Boeing when everyone else had written it off.

“If you're consistent with your approach and… look to be a little bit different… that's how you can differentiate yourself.”

Dividend Growth Done Right

High yields might look attractive, but Belski warns they’re often the worst performers.

“You want free cash flow yields above the dividend yield.”

His preferred mix in ZBDU:

- 60% Dividend “Aristocrats”

- 30% Dividend growers

- 10% High yielders

That formula has helped the strategy outperform the broader dividend benchmarks—even in volatile markets.

Sector Likes and Dislikes

Belski is bullish on U.S. financials and Canadian energy, but cautious elsewhere:

- U.S. Energy: Overhyped. Political noise isn’t a thesis.

- Utilities: “Excessively expensive”—except for the old-school electrics powering AI.

- Consumer Staples: Pricey, and “earning into” those valuations won’t be easy.

Canada vs. U.S.: The Gap May Narrow

Belski made a bold call in 2024: Canadian equities would outperform the U.S. in 2025. So far, he’s been right. But he sees that edge softening as U.S. markets regain their footing.

“It’s worked… but that outperformance will likely begin to wane or decelerate.”

No need to swap out your entire portfolio, but it’s a cue to rebalance thoughtfully.

Final Word: Discipline Wins

More than anything, Belski wants investors to know one thing: don’t overthink it.

“Don’t waffle, just be consistent and find what works for you.”

Each of the five ETFs reflects that mindset—built for different investor goals, but all anchored in a disciplined, repeatable process.

“We’re just very, very humbled… and appreciate our great partners at BMO GAM for entrusting us with putting out these ETFs.”

The Takeaway:

This isn’t just another ETF launch. It’s a way to invest alongside one of Canada’s most respected strategists—who’s betting that fundamentals, consistency, and a bit of contrarian courage still win in the long run.

Footnotes:

1 "Podcast: Going Beyond the Index with Brian Belski." BMO ETF Dashboard, 26 June 2025.