“Nearly half of the opportunities available in fixed income aren’t represented in the Agg.”

That’s not just a bold claim from David Vick, CFA, Head of Fixed Income Portfolio Specialists at TCW—it’s a wake-up call1. For decades, the Bloomberg U.S. Aggregate Bond Index (aka "the Agg") has been the yardstick for fixed income portfolios. But in today’s fast-evolving market, clinging to that old benchmark might be holding investors back more than helping them.

Act One: The Agg Isn't Keeping Up

When the Agg was born nearly 40 years ago, it made sense. Simpler times. A smaller market. Fewer options. But here we are in 2025, and the bond market has exploded in size, complexity, and opportunity—and the Agg hasn’t kept pace.

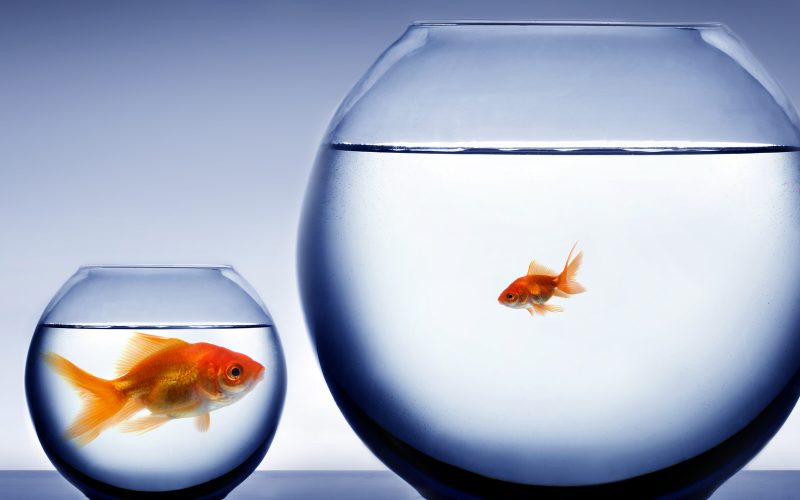

“Traditional fixed income portfolios are tethered to the Agg… But those traditional strategies miss out on opportunities available in the roughly 47% of the U.S. fixed income markets that aren’t included in the Agg,” says Vick.

That’s nearly half the market off the table.

Why? Because the Agg only includes a very specific slice of bonds: investment grade, U.S. dollar denominated, fixed rate, over a year to maturity, and publicly registered. That rules out a wide array of sectors—CLOs, bank loans, TIPS, high yield, short-term credit, and anything outside USD.

“In total, these excluded sectors in the U.S. alone account for an estimated $26 trillion, and more than $110 trillion globally.”

So, if you're only investing within the Agg? You're skipping an enormous part of the opportunity set.

Act Two: Treasury Bloat and Index Drift

Even the part the Agg does cover is drifting—fast. Thanks to ballooning deficits, U.S. Treasuries now dominate nearly half the index.

“U.S. Treasury bonds make up almost 45% of the index… We expect that to continue as the U.S. budget deficit grows.”

That’s a huge concentration in low-yield, low-volatility government debt. Add in other government-related bonds, and suddenly, your “diversified” index starts looking a lot like a Treasury fund.

“In essence, that means investors may be leaving money on the table.”

With corporate bonds and securitized debt becoming a smaller slice, the index’s return potential shrinks just when inflation, tariffs, and geopolitical uncertainty demand more from fixed income strategies—not less.

Act Three: Enter Active ETFs

So, what now?

According to Vick, there’s a smarter way forward: actively managed fixed income ETFs. Once the domain of institutional giants, these strategies are now accessible to everyday investors—and they’re built for flexibility.

“Actively managed ETFs provide an effective and efficient means by which any investor can benefit from the expertise of professional managers, tapping into the abundant opportunities potentially available in sectors outside of the Agg.”

These aren’t your grandfather’s bond funds. You can now choose from:

- CLO ETFs – high-quality yield with low correlation to traditional bonds

- Bank loan ETFs – floating-rate exposure for risk-tolerant investors

- Multi-sector active ETFs – go-anywhere strategies with the freedom to chase yield wherever it hides

And the best part? They don’t have to play by the Agg’s outdated rules.

Final Act: Don’t Wait for the Benchmark to Catch Up

Vick offers a great parallel:

“This isn’t the first time that a market outgrew an index. The Nasdaq Composite, for example, became more influential when the traditional companies contained in the Dow Jones Industrial Average didn’t reflect the growing investor focus on technology.”

The Agg might evolve someday—but waiting around for it to happen doesn’t sound like a great investment strategy.

“Investors want more choices and more flexibility… sentiment is shifting seemingly daily.”

And that’s the reality. Markets are volatile. Risks are different. Opportunities are everywhere—just not all inside the Agg.

“There’s just no time to wait.”

So, What Should Advisors Do?

- Break Free from the Benchmark:

Stop letting the Agg define your strategy. It’s a lagging indicator, not a forward-looking tool.

- Use Tools That Can Pivot:

Flexible ETFs aren’t a luxury anymore—they’re a necessity in modern fixed income.

- Help Clients See the Bigger Picture:

Most don’t realize they’re missing out on nearly half the market. That’s a powerful conversation.

- Match Strategy to Need:

Whether it’s income, inflation protection, or risk mitigation—active ETFs can be laser-targeted.

Bottom Line

If you're still using the Agg as your GPS, you're probably taking the long way—and missing some key turns. David Vick’s message is loud and clear: the bond market has moved on. Now it’s your move.

Footnotes:

TCW. David Vick, CFA. "When the Market Outgrows the Index." March 2025