Louis-Vincent Gave breaks it down—simply, sharply, and with implications you can’t ignore.

“When the facts change, I change my mind. What do you do, sir?”

That iconic quip from Keynes isn’t just a clever retort—it’s the jumping-off point for Louis-Vincent Gave’s latest macro rundown, KISS: The New Trends of 2025 Reshaping Financial Markets1. But Gave’s not here to preach flexibility for the sake of it. The real challenge? Figuring out which facts actually matter. And this year, Gave argues, there’s a whole new batch of them coming fast and furious, shifting the tectonic plates under global markets.

So—keep it simple, stupid. That’s his mantra. Here are the eight megatrends Gave says will reshape how capital flows, where risk shows up, and where investors might want to be looking next.

8 Trends That Are Changing the Game

- The US is stepping back from global policing. From JD Vance's blunt Munich speech to talk of defense budget cuts, the message is loud and clear: Uncle Sam doesn’t want to be the world's security guard anymore.

- Say hello to ‘Fortress America.’ The US is tightening its borders—physically, politically, and economically. Trump loves reminding everyone the country has “two beautiful oceans” to protect it.

- The US consumer isn’t picking up the global tab anymore. The trade war wasn’t just about tariffs. It signaled that the US won’t be the demand engine for the rest of the world.

- China is sprinting ahead in tech and industry. Whether it’s EVs, industrial robotics, or DeepSeek’s AI release, China is closing the innovation gap—and fast.

- AI won’t be a winner-takes-all game. Gave puts it bluntly: “When China enters a room, profits walk out.” With both superpowers racing in, expect competition, not monopolies.

- China’s government is gassing up the stimulus engine. Beijing isn’t playing defense—it’s pumping both fiscal and monetary fuel into the economy to counter trade and tech friction.

- Europe is joining the stimulus party. With the US stepping back from its security role, Europe is responding with its own economic muscle.

- The dollar is losing its magnetism. The days of excess global cash flowing into Treasuries and Big Tech are winding down. That money is now looking for a new home.

Where Does That Leave Your Assets?

Let’s walk through Gave’s asset-by-asset breakdown—what’s rising, what’s faltering, and what deserves a fresh look.

US Dollar: The Shine’s Wearing Off

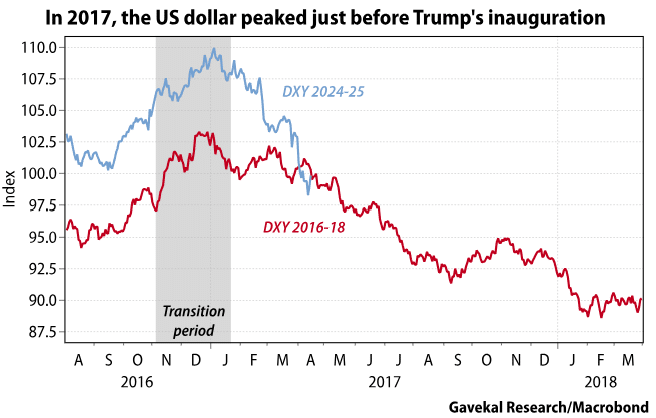

Yes, the dollar index (DXY) is echoing Trump’s first term, but this second round? It’s far less friendly to foreigners. Translation: continued downward pressure looks likely.

US Treasuries: Losing Their Safety Halo

Despite equity selloffs and economic softness, Treasuries aren’t rallying. That’s not normal. Gave wonders if it’s the glut of new issuance, foreign outflows, or just too much supply all at once. Either way, “a mild US recession and massive equity losses are no longer enough” to lure buyers.

US Corporate Debt: The Hidden Risk

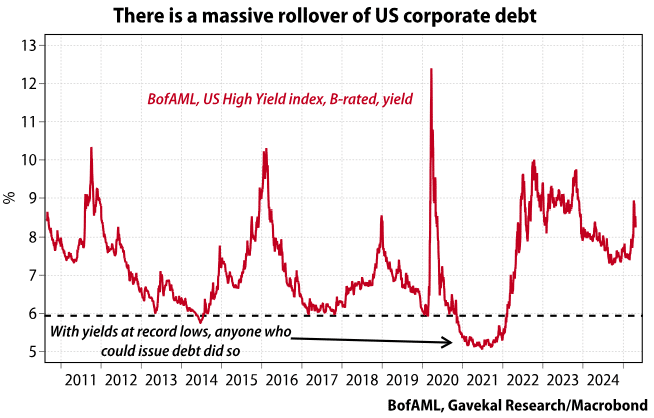

A wave of rollovers is coming, thanks to the 2020 debt binge. Back then, companies borrowed cheap to buy back stock. Now they’re refinancing into higher rates—and widening spreads could expose real fragilities. As Gave puts it, this could be “the Achilles’ heel” of the whole system.

US Equities: The Capital Vacuum

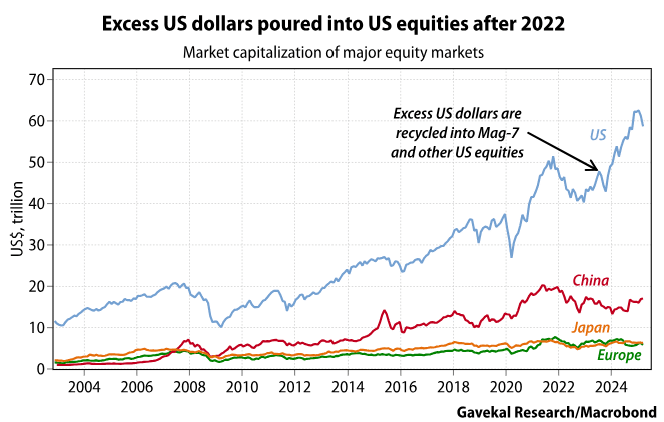

From 2022 to early 2025, US stocks gained $20 trillion in value. But now, foreign inflows are drying up. After Russia’s reserves were frozen, global investors got spooked—and the Trump administration’s rhetoric isn’t helping. “US equities are no longer the default destination,” Gave warns.

Gold: Bullish Tailwinds, Pricey Entry

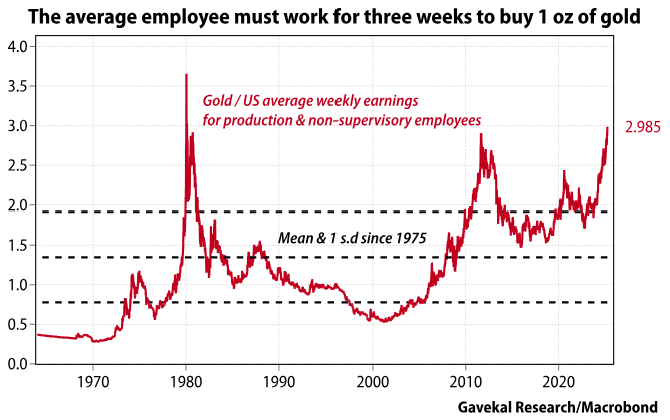

With trust in the dollar and Treasuries falling, central banks are pivoting toward gold. China and Europe’s stimulus only add support. But the metal’s not cheap. Gave flags price as the one catch: “The only issue with gold is that it is getting expensive.”

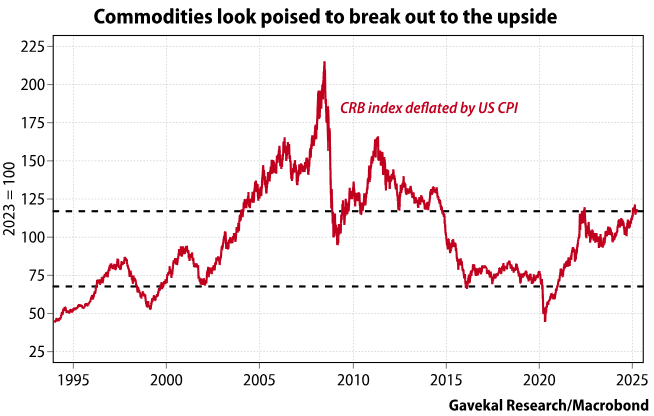

Commodities: Starting to Percolate

From a weaker dollar to mounting geopolitical risks, this is a favorable setup. Gave thinks companies and countries alike will start stockpiling key resources.

“In a more uncertain world, most countries and businesses should feel compelled to build up inventories of strategic commodities.”

European Equities: Flows Are Coming Home

Pension funds and private banks are bringing money back from the US. You’re already seeing the effects in currency strength (euro, franc, krona, pound). The next leg? Likely equity markets—especially with fiscal stimulus rolling in.

European Bonds: Caught Between Two Forces

Stronger currencies help fixed income, but stimulus pushes yields up. Gave thinks a steeper yield curve is probably the direction we’re headed in.

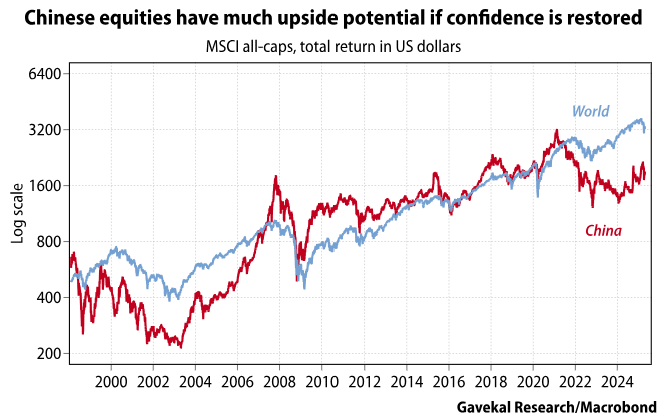

China: Opportunity... Eventually

China’s firms are as globally competitive as ever, but confidence is still low. If sentiment turns, “the past year’s outperformance of Chinese equities will become turbocharged.”

As for distressed debt, it’s risky—but potentially rewarding.

“Most issuers are priced to fail. Most will; some will not... Investors should ponder how to best position for the ‘brrrrr’ sound the Chinese printer is set to make.”

Latin America: Benefiting from the Shift

With the US reshoring policy and regional pension money coming home, LatAm is well-positioned for a structural re-rating.

Financials: Quiet Winners

Banks and insurers are quietly outperforming. Why? Steeper curves, better margins, and potential efficiency gains from AI. It’s not flashy, but it’s working.

Tech Stocks: Don’t Just Buy the Dip

Tech investors raised on the idea that “every dip is a buy” might need to rewire. Gave questions whether that old instinct still holds:

“What if it is not the case this time around?”

Final Thought: The Year It All Turns

For Gave, 2025 isn’t just another volatile year. It’s a turning point. Geopolitics, trade dynamics, capital flows, even tech dominance—they’re all shifting at once. And with that comes opportunity—but only for those paying attention.

“Money managers are not paid to forecast, but to adapt.”

KISS—Keep It Simple, Stupid—isn’t about dumbing things down. It’s about clarity. And right now, that clarity could make all the difference in navigating one of the most dramatic portfolio reshuffles in decades.

TL;DR for Allocators: Watch where the money’s leaving. Look at where it’s starting to go. And remember—rebalancing isn’t optional. It’s survival.

Footnote:

1 "KISS: The New Trends of 2025 Reshaping Financial Markets." Evergreen Gavekal, 9 June 2025,

Copyright © AdvisorAnalyst