by Ben Rizzuto, Wealth Strategist, Janus Henderson

Wealth Strategist Ben Rizzuto shares timeless teachings from Greek Stoic philosopher Epictetus that may help investors navigate market volatility and uncertainty.

While we’re all eager to get the latest news and guidance on tariffs and market volatility, a philosopher who lived between c. 55 – 135 A.D. may be just the person to turn to right now. The Greek Stoic philosopher, Epictetus, shared ideas on how to live one’s life, and these timeless teachings ideas may help investors navigate these volatile times.

Overall, it’s important to stay invested. And while this emotional rollercoaster may be hard to stomach at times, below are three ideas that may make it a bit easier and help provide some perspective.

What do you control?

The chief task in life is simply this: to identify and separate matters so that I can say clearly to myself which are externals not under my control, and which have to do with the choices I actually control.

– Epictetus, Discourses, 2.5.4-5

You don’t control the markets. None of us do. They go up AND down and have done so for decades. Your experience over the past few days is an experience many have had over the years.

So, if you can’t control the markets, what can you control? Our reactions to these external forces are key in markets like this. Over the past several days, you may have felt despair, anger, and frustration, and those emotions can lead to untimely errors like selling investments at the wrong time. Remember, a longstanding investing rule is to buy low and sell high. If you give in to these emotions and sell now, you’ll being doing the exact opposite.

The wisdom of long-term perspective

First off, don’t let the force of the impression carry you away. Say to it, ‘Hold up a bit and let me see who you are and where you are from. Let me put you to the test.’

– Epictetus, Discourses, 2.18.24

Unfortunately, for many investors, the emotions that are stirred during significant market shifts lead them to make drastic changes in their asset allocation. Loss aversion looms large during volatile markets; it demonstrates that we feel the pain of losses twice as much as the satisfaction we feel from gains. This pain may lead some people to move completely to cash, not only to limit losses, but also to gain a sense of control and security. But this is only a short-term fix: Once the markets return to normal, investors frequently fail to reallocate themselves appropriately and continue to be more conservative than they should be.

As illustrated in the chart below, this leads many investors to miss out on gains when the market rebounds.

Source: FactSet Research Systems, Inc. from 1/1/99 – 12/31/24. The example provided is hypothetical and used for illustration purposes only. It does not represent the returns of any particular investment.

The lesson is this: Your asset allocation will change over time. As you get closer to retirement, it will get more conservative, but this is a change that happens gradually over your lifetime and should not be based on short-term swings.

The educated investor

Only the educated are free.

-Epictetus, Discourses, 2.1.21-23a

While you don’t need to become a professional investor, it is important to be educated on the markets from a historical perspective.

There have been several corrections and recessions over the years. A correction is defined as a decline of 10% or more from the recent peak. A recession often defined as when the gross domestic product (GDP) growth rate is negative for two consecutive quarters. And we’ve seen corrections and recessions in 1990, 2000, 2008, and 2020, as well as several other periods. But if you look at history, you can see that staying in the market over the long term has paid off.

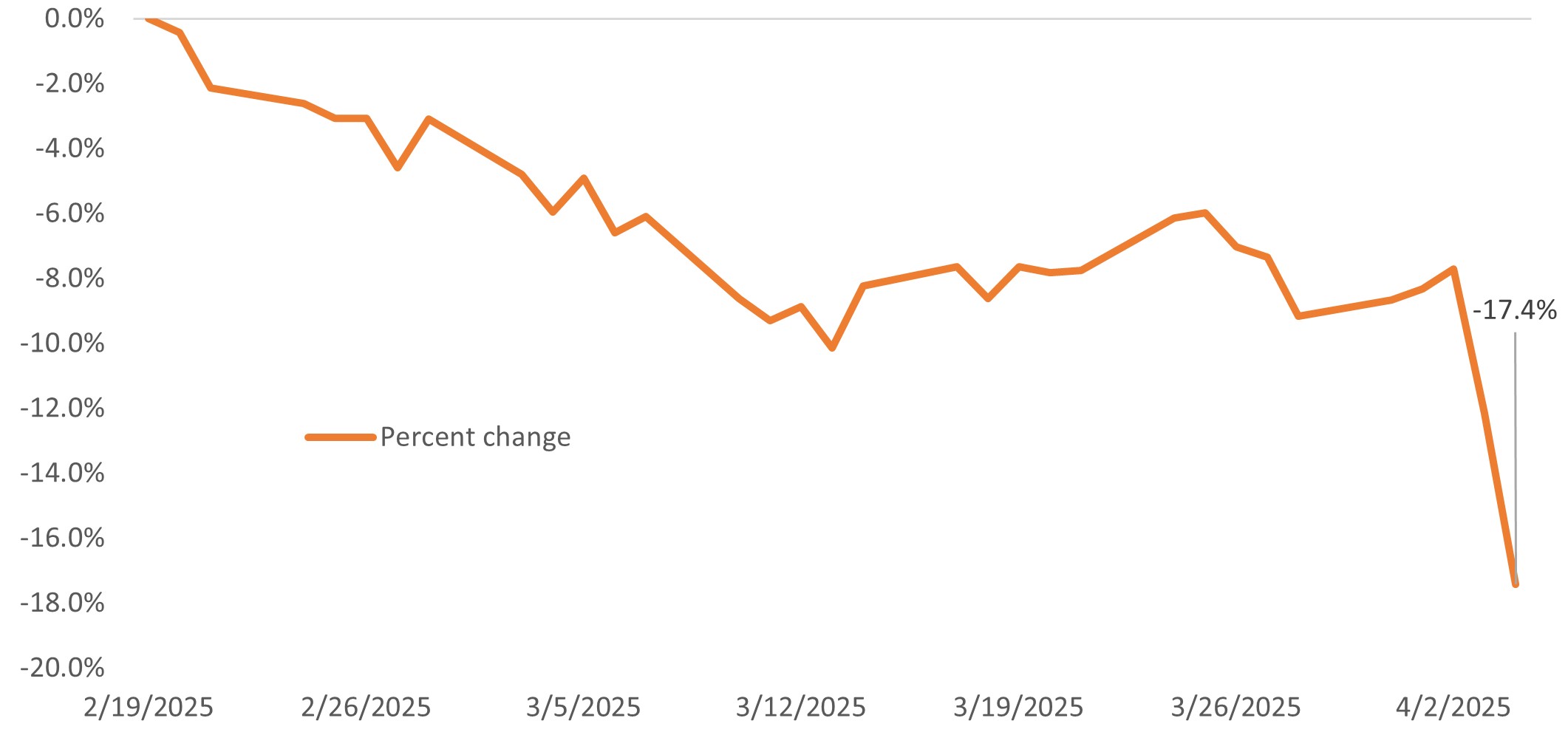

Viewing the performance of the market over a short period of time can look like this:

S&P 500® Index, February 19, 2025 – April 4, 2025

Source: Federal Reserve Economic Data, fred.stlouisfed.org. As of April 4, 2025.

The trend illustrated above looks like a losing proposition. But if we zoom out, we can see that this only a small piece of a larger – much more favorable – picture.

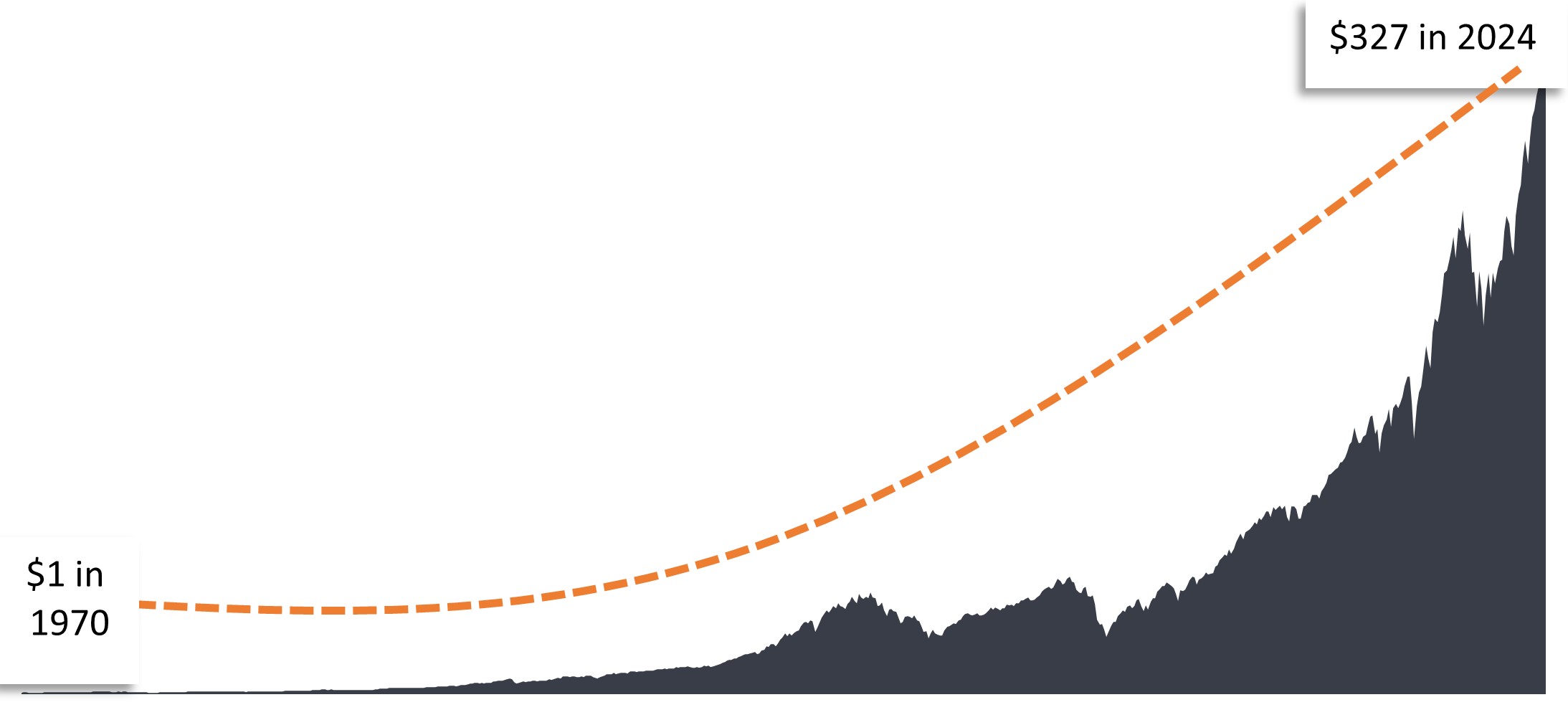

$1 invested in S&P 500 Index since 1970

Source: Lipper, 12/31/69 – 12/31/24. U.S. Equity Market represented by the S&P 500 Index. Past performance is no guarantee of future results. Data reflects S&P 500 Total Return Index, which assumes dividend reinvestment. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

History has shown that many investors who have taken the long view and stayed invested have been rewarded in the end. If you look at several past recessions, they look like bumps in the road along the path of long-term growth.

That’s why it’s so important not to let short-term emotions distract us from our long-term goals. In fact, during these times, it might be a good idea to turn off the TV, stop looking at the markets, and contemplate some philosophy.

Copyright © Janus Henderson