by Nelson Yu Head—Equities, AllianceBernstein

Political uncertainty and volatility create fertile ground for active investors to find companies that can successfully navigate a new era.

Equity markets enter the new year primed for change. The policy plans of US President-elect Donald Trump’s incoming administration will affect regions, sectors and firms in complex ways. Since the road from campaign promises to policy action is never straight, investors should stay focused on company fundamentals to position portfolios for the twists and turns ahead.

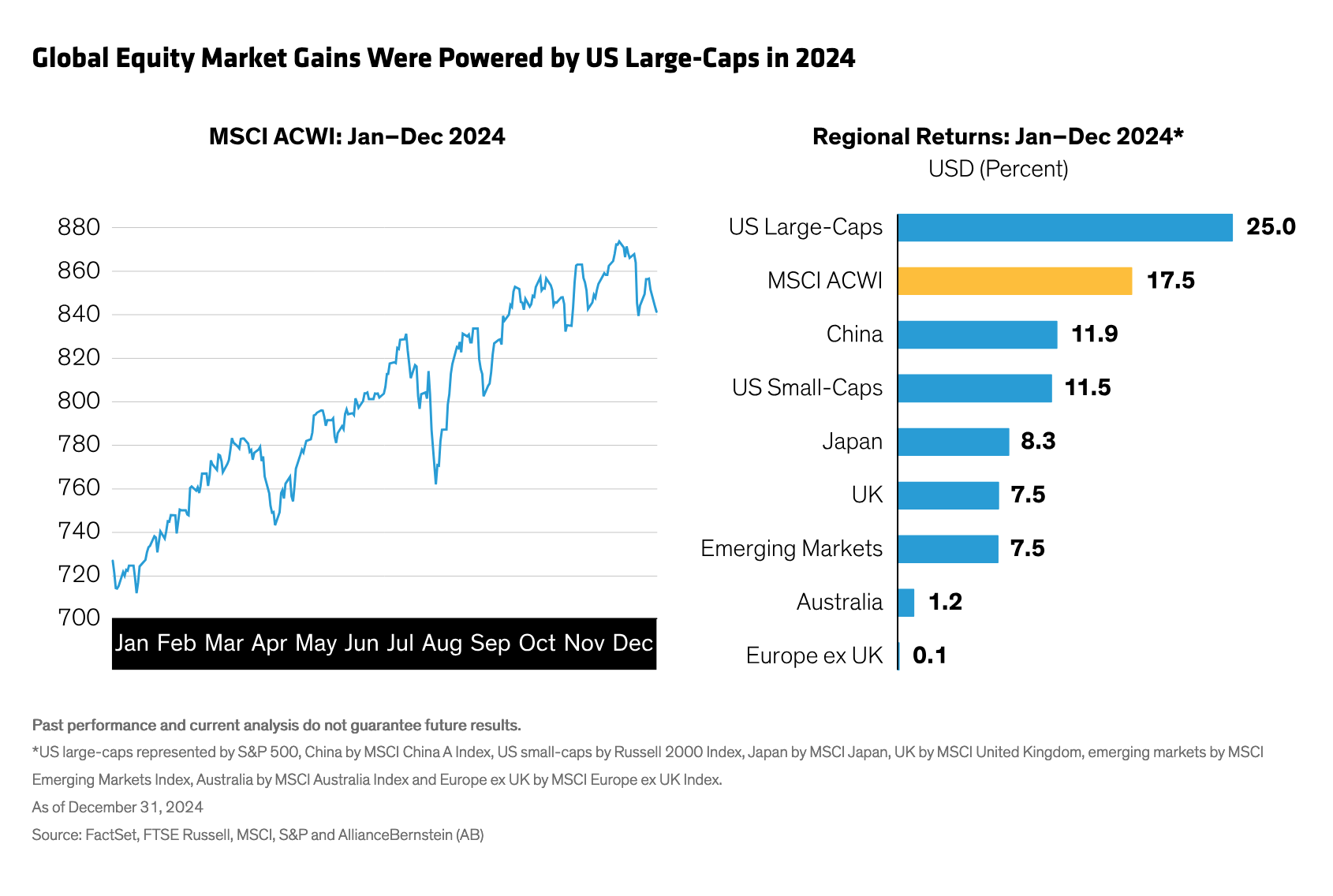

Global stocks rallied in 2024, though regional performance was diverse. The MSCI All Country World Index (ACWI) gained 17.5% in US-dollar terms during the year (Display), driven by US equities, which eclipsed returns in Europe, Japan and emerging markets (EM). Chinese stocks recovered in the second half of the year after first-half declines.

Sectors and Style: A Tale of Two Halves

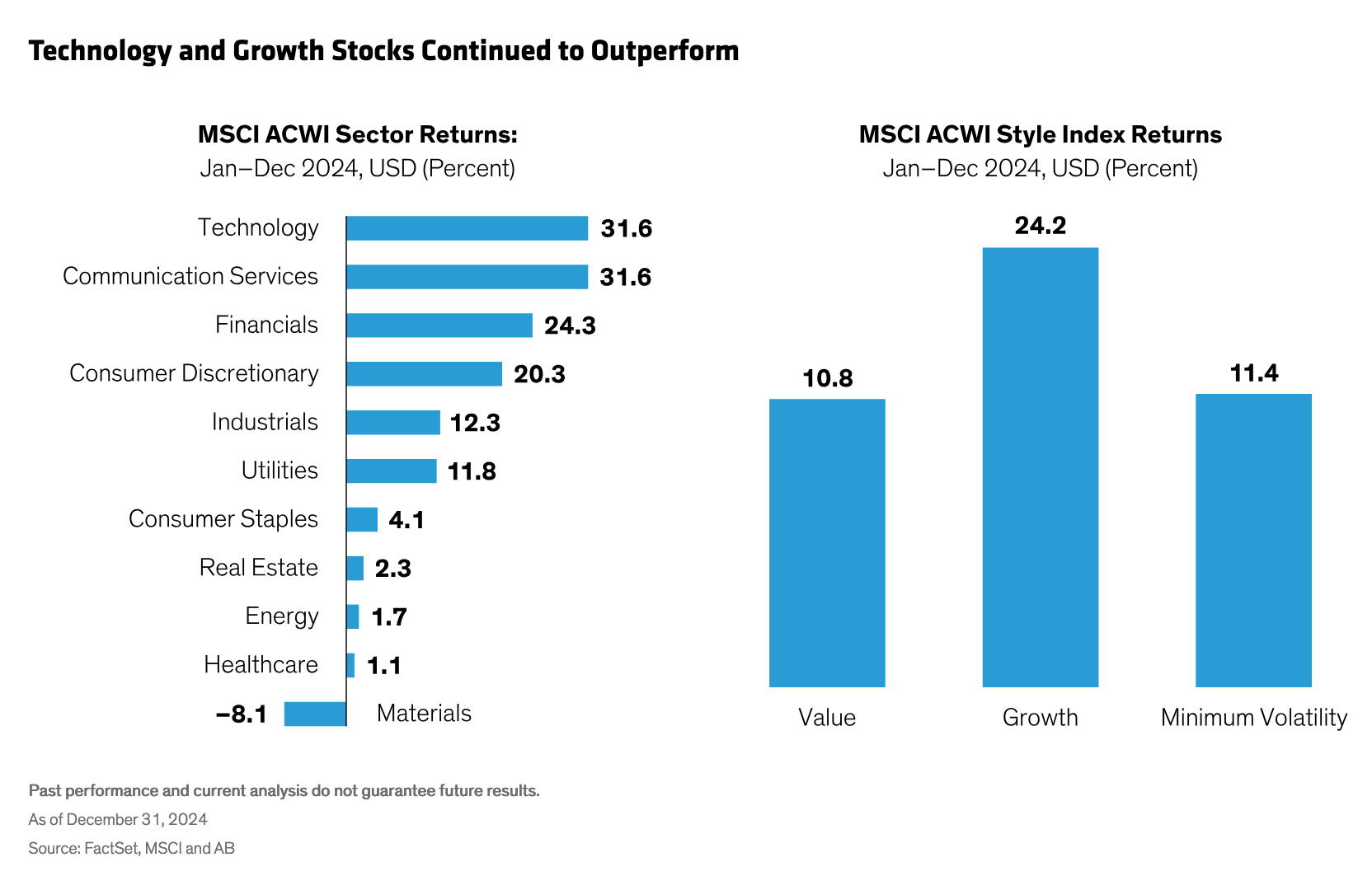

Sector returns shifted dramatically. While information technology was the year’s best-performing sector (Display), returns weakened in the second half. Consumer discretionary and financial stocks lagged in the first half but were the two best-performing sectors in the second half. Healthcare underperformed throughout 2024.

Style performance also changed direction. Across the board, global market–style returns shifted repeatedly during the year, though growth stocks outperformed for the full-year period, largely driven by the US market. Excluding the US, value and minimum-volatility stocks led style gains in 2024, based on MSCI EAFE indices.

Preparing for a New US Policy Era

Shifting return patterns reflect a world in flux. Geopolitical stress remains high with ongoing wars in Ukraine and the Middle East and the collapse of Syria’s regime in December. In 2024, more than 70 countries held elections. Trump’s victory in November marked a historic turning point in US politics, with huge implications for countries, companies and investors around the world.

The direction of policy change has been clearly telegraphed by the president elect. Higher tariffs, lower taxes, less regulation and subsidy reductions are among Trump’s keynote economic policies. On day one, he’s expected to make some changes through executive orders. However, even in a unified government where Trump is backed by a supportive Republican Congress, it will take time to formulate and legislate many policy details.

More Inflation Means Investors Need Stocks

While the agenda is still on the drawing board, one outcome seems clear: the proposed policy mix is likely to lead to a widening federal deficit and hotter-than-desired inflation in the US. This expectation is reflected in financial markets by rising US bond yields and a steepening Treasury yield curve.

We think a potentially more stubborn inflationary environment reinforces the need to maintain meaningful exposure to equities. Our research shows that stocks have done a good job outpacing the rate of inflation—or delivering positive real returns—over more than a century. So investors who prepared for a decelerating economy may want to consider positioning for a possible acceleration of US economic growth and the risk that the US Federal Reserve may not succeed at getting inflation down to the 2.0% target level over the next year; the US consumer price index has fallen from a 9.1% peak in June 2022 to 2.6% in October 2024.

The inflation outlook adds uncertainty to the US monetary policy outlook. On December 18, US stocks fell sharply in volatile trading after the Fed signaled that it may cut interest rates more slowly than expected in 2025.

Trump’s policies may also prompt greater economic divergence globally. Higher tariffs could curb growth, especially in China and Europe. If the US reduces support for NATO and presses members to spend more, we expect a drag on debt and fiscal deficits across Europe.

How to Evaluate Equities as Policy Changes

Investors face several challenges. First, details of policy change are hard to forecast. Second, the macroeconomic forces that could be unleashed may play out differently across regions. Third, the effects of policy change on business outcomes and earnings will take time to discern.

So how can portfolio managers prepare? We think the key is to concentrate on individual company fundamentals. Even when change originates from the top down (i.e., via policy), conducting bottom-up research to assess how companies might be affected can help distinguish between vulnerable businesses and those poised to gain from new developments.

Case Study: Preparing for Tariffs

Tariffs are a good case study. In November, Trump announced plans to levy a 25% tariff on all imports from Canada and Mexico after taking office. He’s also threatened to increase tariffs on Chinese goods from current levels. Since tariffs can be imposed via executive order, details will probably be unveiled quickly after Trump takes office. Since Trump’s first term, tariffs have risen, albeit from a historically low base.

At first glance, tariffs might seem to give a boost to US companies and handicap overseas rivals. The reality will be far more complex.

New tariffs would incentivize US companies to bring production home. But businesses that rely on overseas suppliers could face immediate cost increases until they reshore critical operations. Chinese companies might seem obvious victims of tariffs. Yet our research shows that even though US imports from China have declined since the first wave of tariffs in 2018, Chinese exports to the rest of the world have risen. That’s because many Chinese firms reconfigured supply chains by relocating to Mexico and Vietnam.

Meanwhile, global companies with US facilities could benefit from tariffs. Examples include European and Japanese automakers, electronics manufacturers and consumer goods companies with a large US manufacturing presence.

The moral of this story? It’s risky to make sweeping assumptions about how a new policy will affect companies. US and global businesses that have skillfully navigated previous tariffs and the pandemic by reconfiguring supply chains will be better positioned to cope with new tariffs. And to really identify tariff risks and opportunities, a research analyst needs a solid grasp of a company’s competitive positioning, business structure and management skill. This allows an investment team to assess in real time how tariffs could shape long-term earnings and return outlooks, and to adjust discount rates and portfolio positions accordingly.

“America First” Won’t Transform Weak US Businesses

Given that Trump’s agenda aims to put America first in policy considerations, it’s not surprising that US equities are expected to thrive.

But don’t look at the entire US market with rose-tinted glasses. Consider tax policy. Yes, cutting corporate taxes—as Trump has promised—enhances the bottom line for any company. But tax cuts don’t transform a weak business into a quality company. If anything, tax cuts enable stronger businesses to bolster their positions, particularly in highly competitive industries.

Similarly, potential cuts to subsidies might not play out as expected. Even if the administration allows more drilling for fossil fuels, subsidies for renewable energy projects might not disappear overnight; some projects led to job creation in Republican states. Trump’s support for infrastructure development might also mean that certain Biden-era subsidies survive.

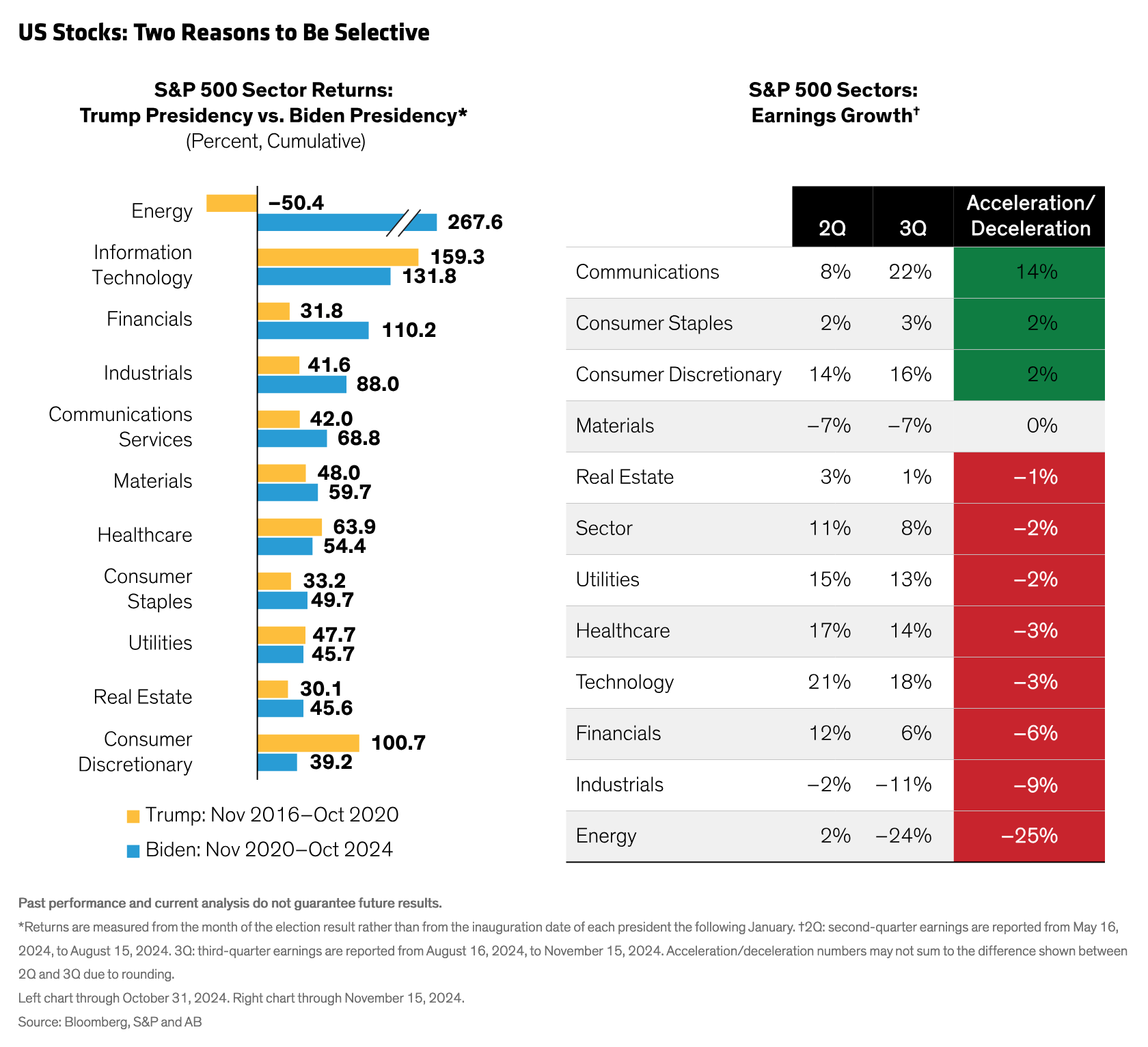

How policy filters through to equity returns can be surprising. In fact, US energy stocks, financials and industrials underperformed during Trump’s first presidency—and were the top performers during Biden’s (Display). Healthcare stocks performed marginally better during Trump’s first administration than during Biden’s.

In most S&P 500 sectors, earnings growth has decelerated in recent months—even in the vaunted technology sector (Display, above). This means equity investors must be especially selective to find companies that are defying weakening industry trends and are well-positioned to benefit from imminent policy change.

Why Diversify Globally?

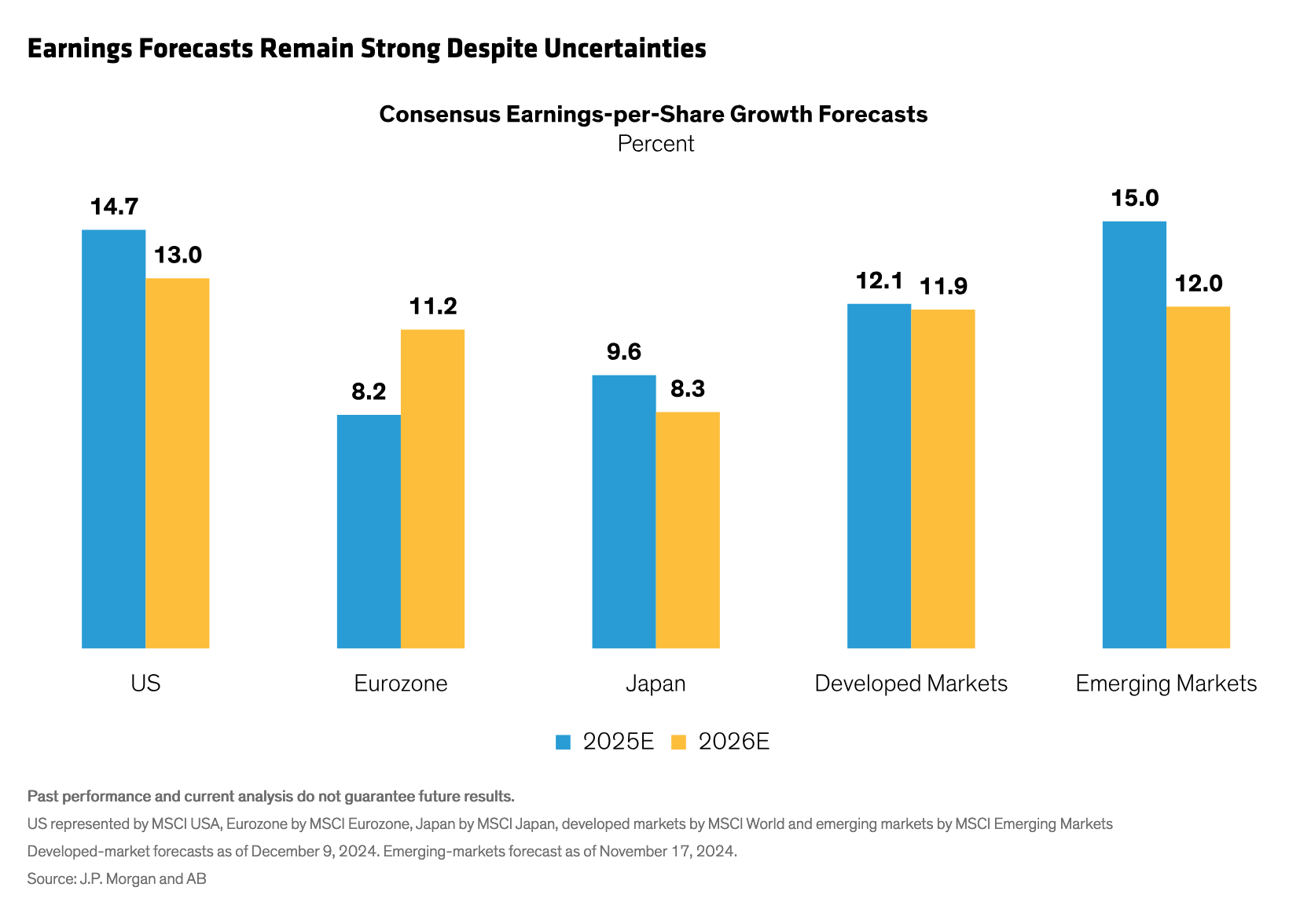

Despite softening sector growth, in aggregate, the US earnings outlook is relatively strong. Still, consensus earnings growth estimates for Europe and Japan—while lower than the US—also look healthy. EM earnings growth is forecast to exceed the US in 2025 (Display).

Equity markets don’t always reflect the macroeconomic backdrop. So even in Europe’s weaker economy, investors can find global businesses with dominant industry positions and attractive growth prospects that aren’t tethered to regional growth.

EM may face higher hurdles from Trump’s policies. Yet during Trump’s first term, the MSCI Emerging Markets Index returned an annualized 14.1% in US-dollar terms, outpacing the MSCI World’s 13.3%. Even if EM returns trail those of developed markets, we think active EM portfolios will find attractive opportunities to generate alpha, or market-beating returns. Look for portfolios that target underappreciated companies, which benefit from favorable regional and industry trends and are relatively resilient to US policy fallout.

Valuations in Focus

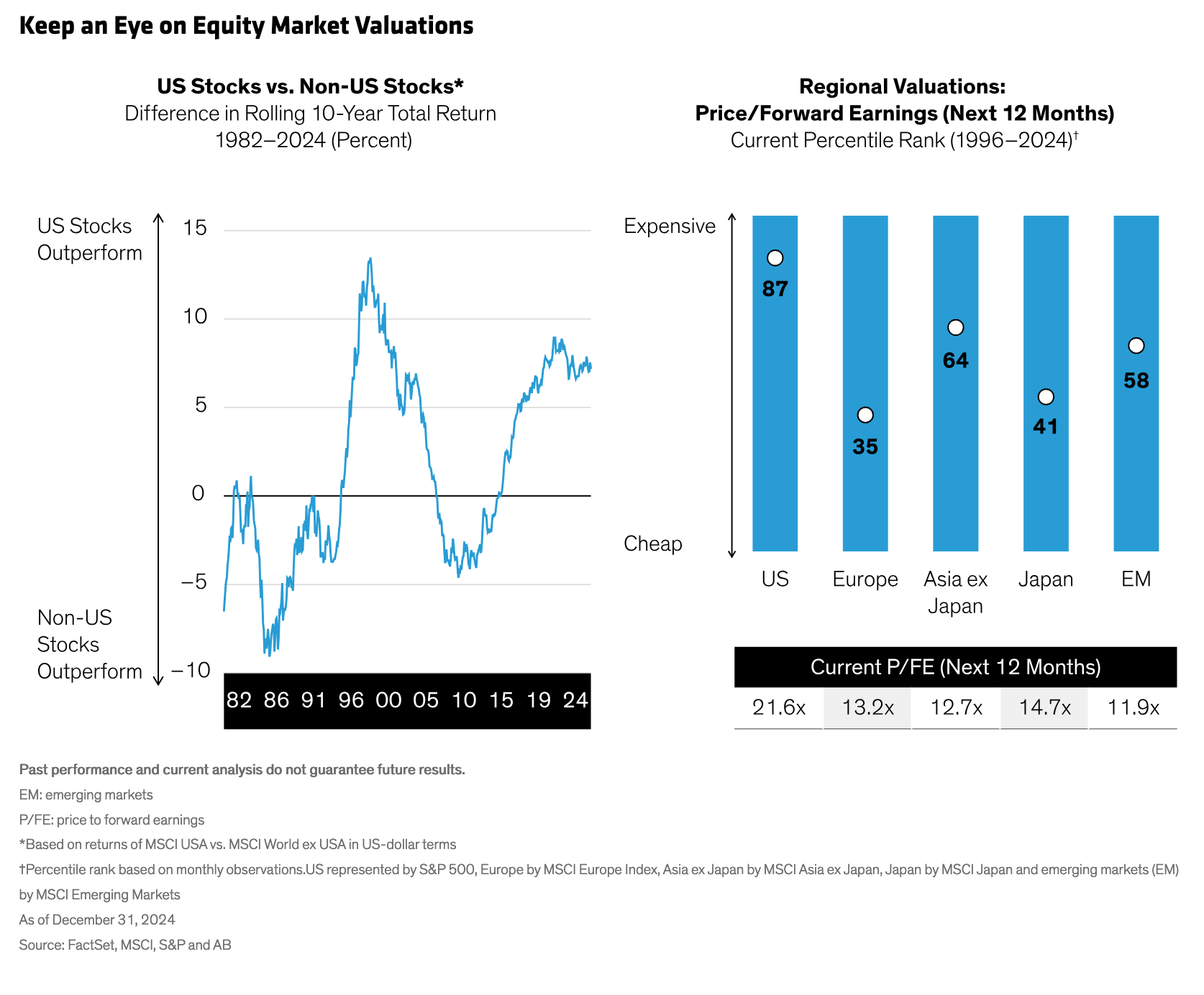

Regional equity market valuations deserve attention. US stocks have outperformed non-US stocks for more than a decade, pushing US valuations close to their highest level since 1996 (Display). European and Japanese markets are relatively cheap.

US valuations have been fueled by the mega-caps. The Magnificent Seven companies continued to ride a wave of enthusiasm for artificial intelligence during 2024. Changes to regulation—and possible deregulation—are seen as a boon to the mega-caps. Yet we believe the outcomes won’t be one dimensional and could support a wide range of companies across sectors. As we see it, diversified equity exposures to a broader set of US companies could capture earnings and return potential that may be unlocked in the coming years.

A Wide Range of Outcomes Spells Opportunity

Political transformation can be daunting. It typically triggers market volatility and can lead to a wider range of outcomes for companies and stocks than in more tranquil markets.

Yet these conditions are favorable for active investors. Market confusion can lead to a mispricing of stocks, which enables research-driven portfolio managers to identify opportunities in resilient businesses. Positioning equity portfolios with a carefully curated collection of quality companies can help investors ensure that the path toward their long-term financial goals isn’t derailed by political uncertainty.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

Nelson Yu is a Senior Vice President, Head of Equities and a member of the firm’s Operating Committee. As Head of Equities, he is responsible for the management and strategic growth of AB’s equities business and investment decisions across the department. Since 1993, Yu has experience generating investment success in global equity markets by joining fundamental research with rigorous quantitative methods. He joined AB in 1997 as a programmer and analyst, and served as head of Quantitative Equity Research from 2014–2021. Since 2017, Yu also served as head of Multi-Style Core Equity strategies, with over $10 billion in assets. Most recently, he was CIO of Equities Investment Sciences and Insights, which brings together resources across Data Science, Quantitative Research, Advisory Services, Risk and Global Execution to deliver differentiated capabilities and insights to AB’s equities investment platform. Prior to joining AB, Yu was a supervising consultant at Grant Thornton. He holds a BSE in systems engineering from the University of Pennsylvania and a BS in Economics from the Wharton School at the University of Pennsylvania. Yu is a CFA charterholder. Location: New York