by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Thematic investing is a different beast. It’s not about earnings, dividends, debt or cash flow. At its core, it’s about identifying structural trends and innovations that are expected to drive future growth. It doesn’t focus on traditional asset classes or sectors. Thematic investing can offer the potential for higher returns compared to traditional portfolios, but timing is paramount. Thematic investing is exciting, but it can also present significant challenges. Themes get popular, then fizzle out, and often test investor patience.

Behavioural biases impact all investment decisions, but they carry an outsized role in the thematic space given the inherent detachment from fundamentals and decisions often driven by ‘gut’ feelings. In the thematic space, herd mentality plays a large role. In 2024, thematic investing experienced a year marked by both promising opportunities and notable challenges, underscoring the need for a unique and discerning approach.

Performance

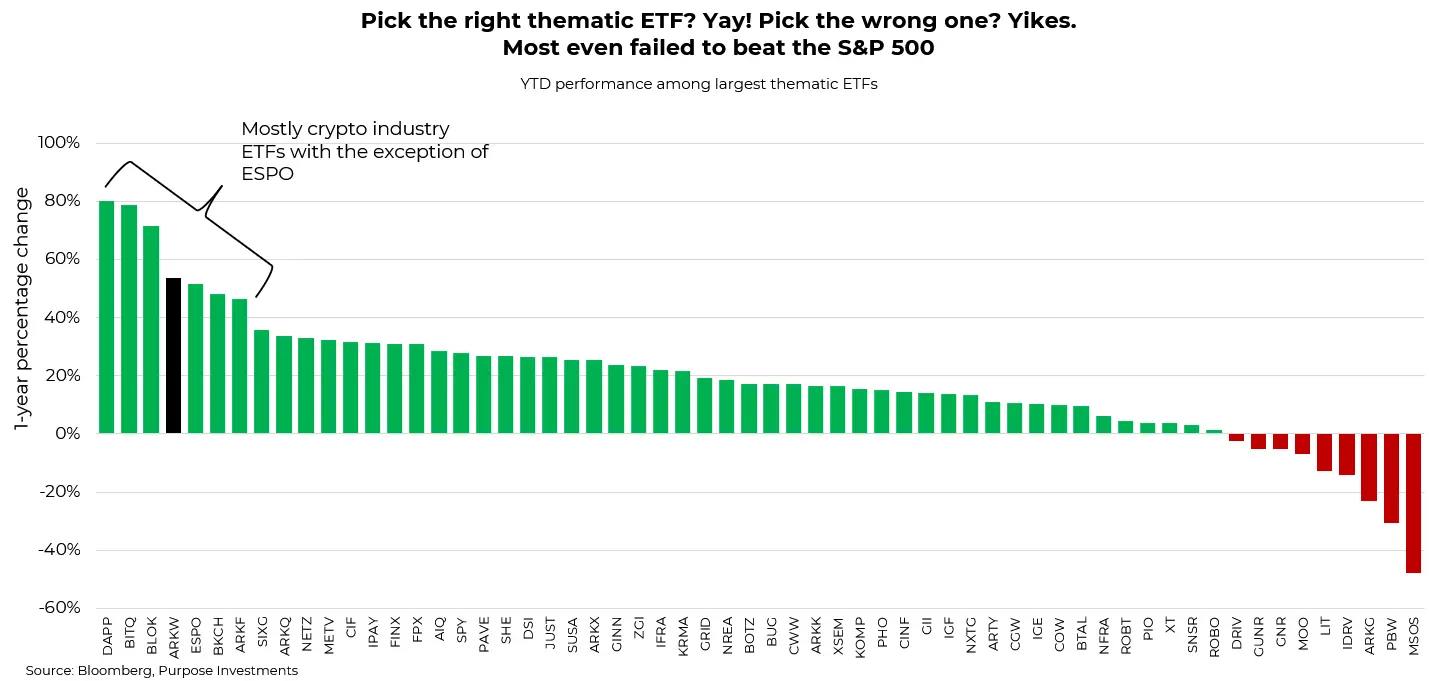

The performance disparity across thematic ETFs in 2024 was extreme. The chart below shows the year-to-date performance of some of the largest thematic ETFs. The large disparity reflects the dynamic and volatile nature of the space. Crypto-themed ETFs saw a massive resurgence this year. Performance surged following the election, with some up nearly 80% year-to-date. These funds all benefited from the post-election crypto surge. It’s worth noting that in this analysis, we excluded direct investment Bitcoin ETFs. Among the top performers was also an eSport and Gaming ETF, which rose 52% and benefited from Nvidia, but surprisingly, 1/3 of the year’s gain was attributed to just one company – AppLovin (no relationship to McLovin from Superbad), which gained nearly 1,000% this year. Other notable winning themes were anything to do with AI, infrastructure, and fintech.

Several themes faced immense headwinds throughout the year. Clean energy investments struggled due to reduced investor enthusiasm for renewable energy. Similarly, rare earth metals, lithium ETFs and anything related to electric vehicles were all in negative territory. Slower-than-expected adoption rates, competitive pressures and concerns about oversupply in the supply chain were key culprits. Other out-of-favoured themes in 2024 were agribusiness-focused ETFs and the genomic revolution.

For comparison’s sake, we added the S&P 500 to the chart. With the S&P 500 having one of the best years on record, up 28% as we write, it’s been difficult for even thematic ETFs to keep up. The average return across the entire thematic universe is just 16.2%. Over 70% of the largest thematic ETFs failed to beat the S&P 500, and when we expanded the analysis to the entire thematic universe of nearly 300 ETFs, 77% failed to beat the S&P 500. No wonder investor interest has waned.

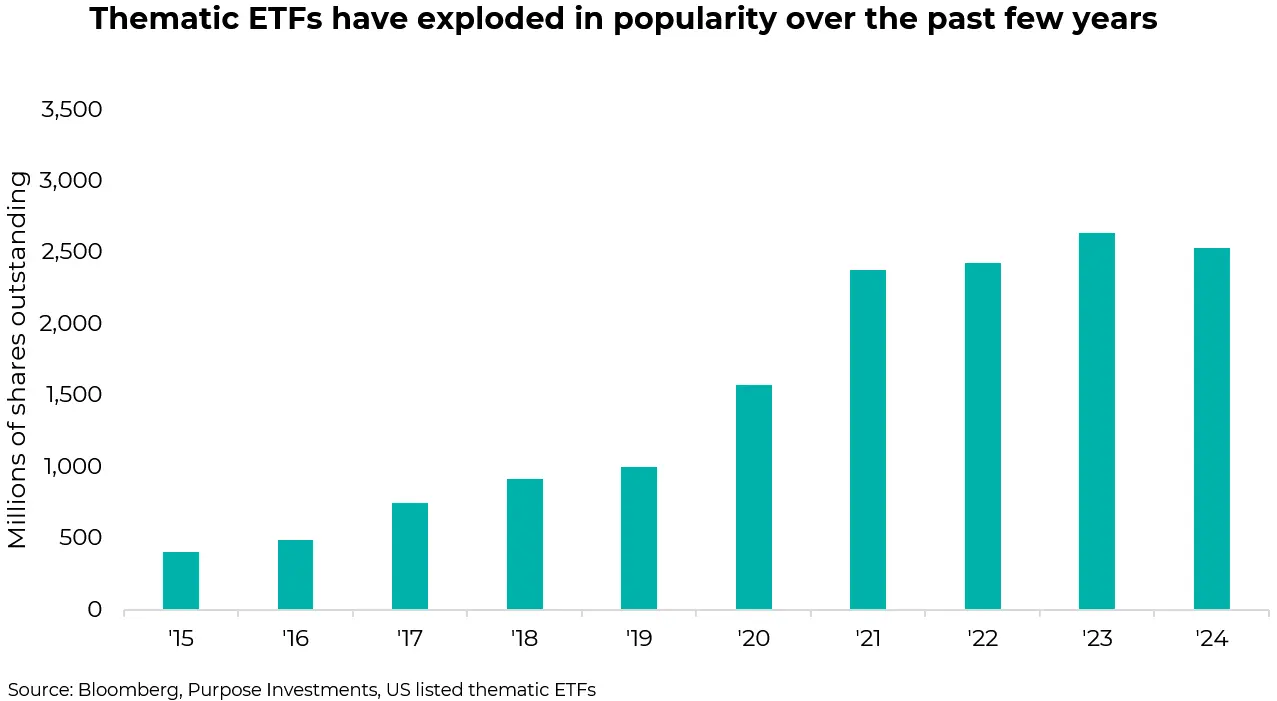

Overall, the thematic universe experienced net redemptions in 2024 of close to $7 billion USD. As seen in the chart below, the impressive inflows seen in 2021 have levelled off, and 2024 was the first net-negative year for thematic ETF flows. Inflows went towards AI and infrastructure ETFs; however, these were not enough to stem the bleeding from the rest of the space. Infrastructure ETFs claimed 4 of the top 6 spots in terms of year-to-date flows, collectively raising over $4 billion USD. Sounds impressive, but it doesn’t even offset the combined $4.8 billion USD in outflows from all the Ark-managed ETFs. On the surface, this cooling in thematic ETFs might suggest a more cautious approach among investors, but the reality tells a different story.

While investors are pulling away from traditional thematic funds due to lacklustre performance, they’re not shying away from risk. For instance, there’s the massive growth in U.S.-listed bitcoin ETFs and the plethora of specialized ETFs that use options and leverage to define specific outcomes. The growth in this segment of the ETF market is remarkable. The top three specialty ETFs this year are the 2x Long Nvidia ETF, the 3x U.S. Long Bond ETF, and the 3x Bull Semiconductor ETF, which have collectively attracted $7.2 billion in inflows in 2024. Call us skeptics, but this type of leverage is akin to financial dynamite when markets turn.

The decline in flows to thematic ETFs should not be mistaken for reduced risk appetite among investors. Instead, the popularity of leveraged ETFs indicates that risk appetite has escalated to new heights. Investors are increasingly drawn to leveraged products – perhaps some of the riskiest financial instruments ever seen in the market. Another big factor impacting flows is simply performance or lack thereof. Performance chasing is real. The lack of widespread strong-performing themes has cooled investor interest.

AI vs Internet

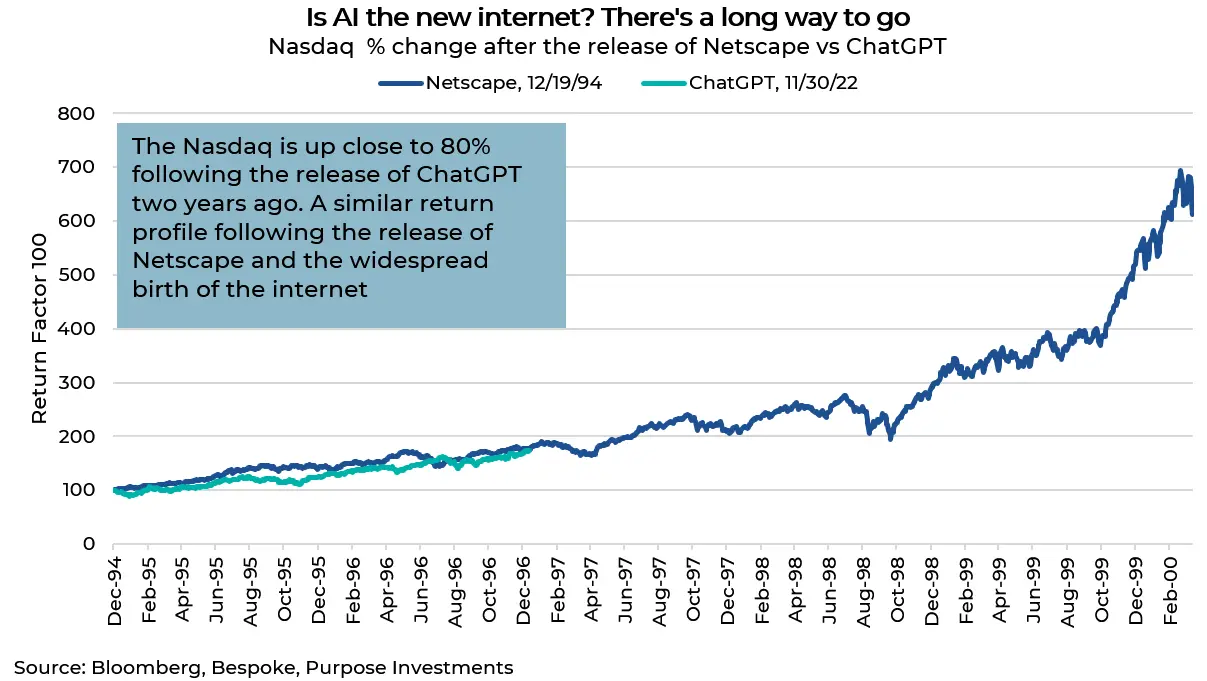

To approach thematic investing effectively, investors have to realize that many themes require years to fully materialize. Thirty years ago, Netscape was released, and the internet was gaining popularity. At the time, many could not fathom the massive changes it would usher in. The chart below (thanks, Bespoke) compares the percentage change of the Nasdaq following the release of Netscape and ChatGPT. In each case, it’s up nearly 80%. While it’s easy to rationalize that the AI theme is overextended, it’s important to remember that popular themes or narratives can take on a life of their own. One person’s irrational advance is another person’s foresight into the distant future. Maybe this isn’t a bubble just yet. There will always be a pop, but timing it is still just speculation. This underscores a major challenge in thematic investing – timing the buys and sells.

Final Thoughts

Thematic investing in 2024 faced significant challenges. While themes like infrastructure, AI and crypto showed strength, many faced challenges and struggled to keep up with the broad market. Some previously popular themes, like clean tech and electric vehicles, struggled to capitalize on structural trends due to declining investor interest. Diversification is important to manage risks, especially since many thematics have very high correlations. Beyond that, having a robust, disciplined process is essential for success in thematic investing.

Rather than just relying on gut feelings, it’s important to monitor trends and momentum across the universe to improve the chances of catching the big wave. Trend-following systems are designed to do just that. By carefully selecting themes, managing correlations, and staying adaptable, investors can harness the power of foresight and use thematic ETFs to enhance the portfolio’s long-term return potential. Thematic investing in 2024 was characterized by a few big winners, a number of failures and rapid rotations and bouts of volatility.

— Derek Benedet is a Portfolio Manager at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L. P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.