"The laws of supply and demand don’t care about concerts, couches, or concerts on couches."

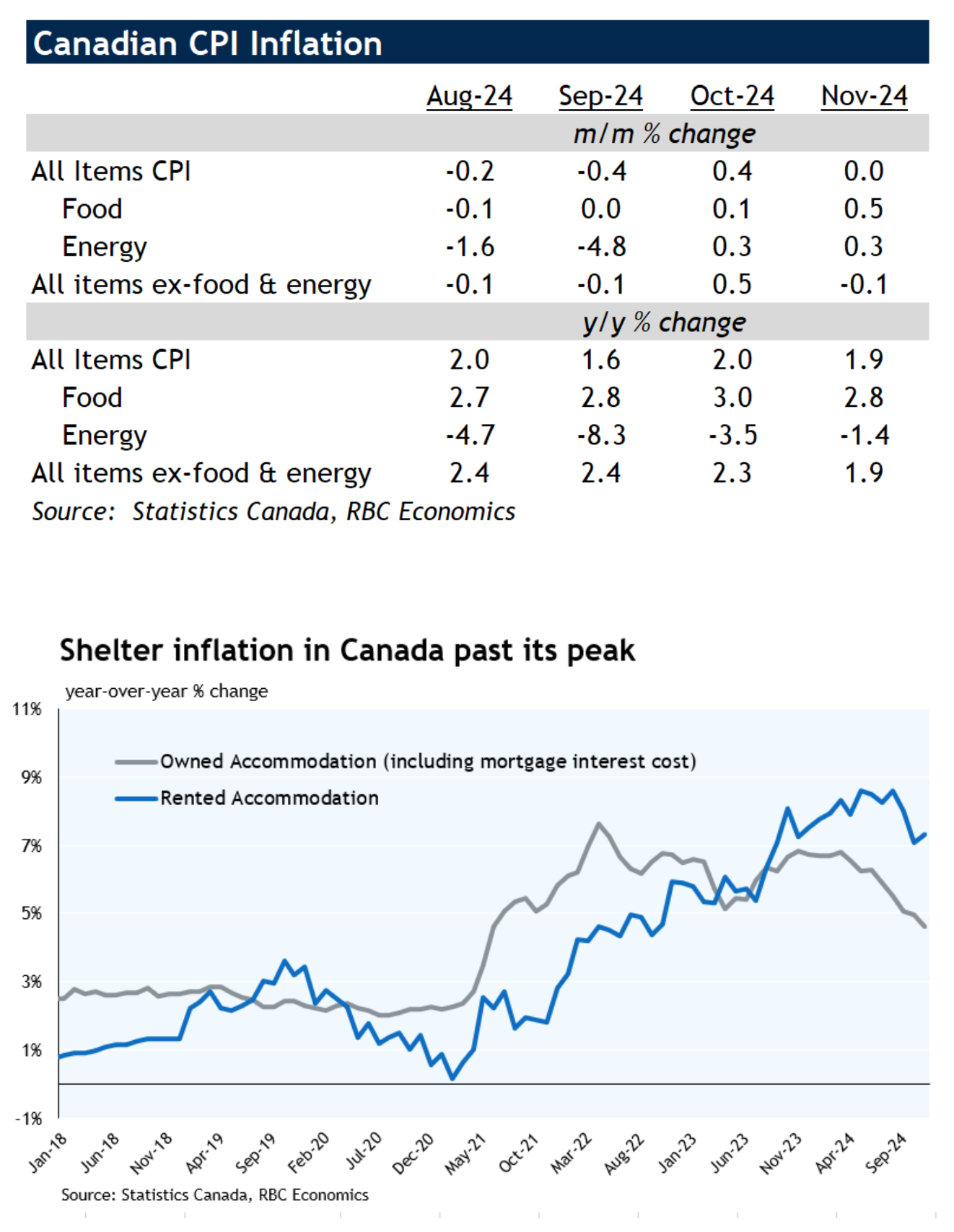

Inflation in Canada edged ever so gently toward the Bank of Canada’s (BoC) coveted 2% target in November, ticking down to 1.9% after a brief October blip. Yet behind this benign headline figure lies a curious mix of economic softening, consumer behavior quirks, and the unexpected influence of global pop icons. As Claire Fan of RBC Economics notes, “There were some unusual events in November that slightly distorted price growth in specific categories. Underlying inflation pressures, however, continued to broadly narrow and ease.”

Let’s unpack the numbers, dissect the noise, and peek behind the curtain of Canada’s inflationary performance, one category at a time.

Black Friday Blues and Swifty Surprises

The shopping season did its part to help cool inflation. Black Friday promotions left a mark on the inflation data, driving prices for some retail staples into noticeable deflationary territory. Statistics Canada flagged phone plans, furniture, and clothing/footwear, where prices dropped by 8.7%, 2.2%, and 3.8%, respectively, compared to a year ago. Claire Fan pointedly describes this as temporary noise rather than an economic trend.

However, not all consumer activity leaned deflationary. Taylor Swift’s Toronto concerts—yes, you read that correctly—provided an unusual inflationary spike in traveller accommodation. Rates surged from -8.5% in October to +8.7% in November as Swifties descended upon the city. “That didn’t end up contributing much to headline inflation,” Fan clarifies, “as the acceleration was offset by a slowing in travel tours (to -12%) in the same month.”

The lesson? Inflation analysis in 2024 involves everything from furniture sales to superstar-driven hotel bookings.

Shelter Costs: A Painful Lag

While Black Friday and concerts make for headlines, shelter costs remain the largest thorn in the BoC’s side. Claire Fan highlights the persistent bite of mortgage interest costs, which grew 13.2% year-over-year in November. It remains a paradoxical driver of inflation—higher interest rates, imposed to cool price pressures, are ironically keeping inflation higher through housing expenses. Excluding mortgage interest, BoC’s core measures (CPI trim and median) would have averaged 2.2%, far closer to the central bank’s comfort zone.

Rent inflation ticked up to 7.7%, another painful figure for Canadians, though Fan anticipates this won’t persist. “We don’t expect that trend will continue as market asking rents continue to decline but flow through to lower average rents with a lag,” she observes.

For those waiting on housing relief, the rate cuts will be slow-moving medicine for a stubborn ailment.

Food and Energy: Modest Relief

On the food front, Canadians finally saw minor reprieve. Food inflation ticked down from 3.0% to 2.8%, with groceries holding steady but dining out costs easing. “A small uptrend in grocery inflation has been balanced off by lower inflation for dining out,” Fan notes.

Energy also provided some relief, with gasoline prices staying flat month-over-month but falling 1.4% year-over-year. While energy inflation has cooled for now, Canadians know all too well that this category is one geopolitical surprise away from another surge.

Core Metrics and the Narrowing Scope of Inflation

The Bank of Canada’s core measures—CPI trim and median—grew at a 2.6% annual pace in November, slightly above target but trending lower when adjusted for mortgage costs. Meanwhile, the “supercore” inflation measure (trim services CPI ex-shelter prices) rose 3.0% on a three-month annualized basis, up marginally from October’s 2.9%.

Perhaps most encouragingly, Claire Fan points to a narrowing scope of inflation pressures. Only 45% of the CPI basket grew at an annualized rate above 3% in November—a far cry from the ~80% peak in summer 2022. Fan highlights this as an important sign of progress: inflation, once widespread, is now far more contained.

The Big Picture: BoC to Cut Gradually

Canada’s economy is cooling, and inflation is (mostly) cooperating. Yet the road to sustained disinflation remains littered with obstacles. Falling per capita GDP and a rising unemployment rate—already at 6.8%—will continue to suppress demand. RBC Economics expects this economic weakness to push the BoC further into rate-cutting mode.

The BoC’s recent 50-bps cut to 3.25% was a bold move, but the pace will slow from here. As Claire Fan puts it, “We expect consecutive smaller 25 basis point cuts to the overnight rate down to 2% by July 2025.” That target would bring rates below the BoC’s estimated neutral range of 2.25%-3.25%, making monetary policy officially stimulative once again.

Key Takeaways

- Headline inflation ticked lower to 1.9% in November, aided by Black Friday sales and specific distortions.

- Mortgage interest costs remain a major driver of inflation, artificially elevating core metrics. Without them, inflation would sit closer to the BoC’s target.

- Shelter inflation remains high, though relief is expected as rents decline and interest rates ease.

- Food inflation and energy prices are stabilizing, offering some relief to Canadian households.

- The BoC will cut more gradually. Expect smaller 25-bps cuts throughout 2025, with the overnight rate reaching 2% by mid-year.

Conclusion: A Gradual Path Down

Canada’s inflationary picture is improving, albeit with bumps and quirks along the way. The BoC’s challenge is balancing a softening economy with persistent price pressures in shelter and services. Claire Fan’s outlook captures it best: progress is happening, but it will be “a more gradual approach” from here.

For Canadians, the message is clear: inflation may no longer be the monster under the bed, but the cost of a good night’s sleep remains higher than anyone would like.

Every time you ♡ Like this piece, mortgage costs tick down just a little faster.

Source: "RBC Royal Bank." 17 Dec. 2024, https://view.website.rbc.com/?

qs=b11dcf6eb0a998a7303506dbd4f518bf7165e39c8a7171bc4b09a

49c66b546ece3109b3793073137e79091d26eec736386af0409938

5668c848eea7bbacc93b11b076d589e8dff3021fbe0c45746b006.