by The Editor's Desk, AGF Investments

This year’s presidential race has been framed as an existential battle between two starkly different visions of the United States—one that claims saving democracy as its goal, the other claiming to want to save America. Amid the high-octane, high-volume discourse that has come to define modern U.S.

presidential races, discussions of actual policy alternatives often seem to get lost in the noise. But for investors, the direction that a Democratic President Kamala Harris or a Republican President Donald Trump would take the world’s largest economy will matter, and we believe it will matter to

some sectors more than others.

To help make sense of it all, the following series of short takes from AGF Investments Inc. analysts take a deep dive into seven market sectors that could be dramatically impacted by the outcome on Nov. 5: consumer staples, U.S. banks, industrials, energy, technology, healthcare and semiconductors. It also includes an outlook for currency markets under a Trump or Harris administration. In a race that is still too close to call, the details matter—and investors need to be prepared.

S&P 500 Index Returns in the First Year After Past U.S. Presidential Elections

Source: Bank of America Merrill Lynch U.S. Equity and U.S. Quant Strategy. As of October 18, 2024. One cannot invest directly in an index. Past performance is not indicative of future results.

Consumer Staples: What Would Trump Tariffs Do?

Abhishek Ashok, Analyst, AGF Investments Inc.

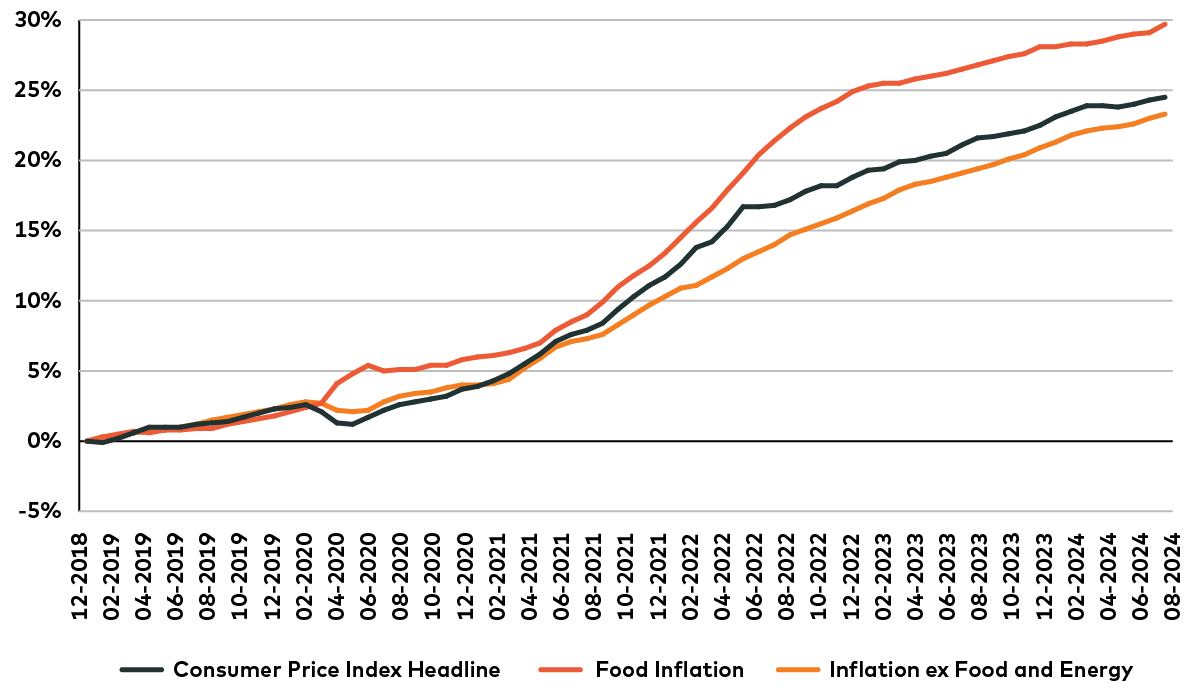

A key issue for American consumers has been the rapid rise in prices since the pandemic, and one of the key points of debate during this U.S. election cycle has been the potential implementation of more tariffs. These two themes are, of course, related. Tariffs, which are basically taxes on imports, can be inflationary because they raise the cost to import goods, and some, if not all, of those cost increases can often be passed along to the consumer.

Cumulative U.S. Inflation Since 2019

Source: U.S. Bureau of Labor Statistics. As of October 25, 2024.

Like her predecessor, U.S. President Joe Biden, Democratic candidate Kamala Harris is hardly anti-tariff, but her approach is highly targeted. She has been largely in favour of continuing and perhaps heightening trade protections against China, in particular (though not exclusively) in the semiconductor sector. As a result, we would expect the impact of a Harris presidency on tariffs and consumer staples prices to be minimal.

Republican candidate Donald Trump is far more committed to tariffs as a trade policy. He has proposed a blanket tariff, which would affect all imports equally. It would effectively raise prices for anything crossing the border, from fresh produce and apparel to home furnishings and cars. Given the historic levels of inflation in the last few years, such a tariff policy could significantly dampen the consumer’s ability to spend. As well, consumer staples companies that rely heavily on imported goods could also be adversely affected, while those with largely domestic supply chains, significant global exposure and strong supplier relationships could be better insulated against the introduction of additional tariffs.

On the topic of prices, recent headlines suggest a stronger push (Democrat-led, but recently gaining bipartisan traction) towards combating “shrinkflation”—the practice of reducing product sizes while charging the same or higher prices. As companies continue to face pressure to grow revenues and profitability while having limited scope to increase prices directly, companies with strong brands and the ability to be disciplined on costs may be better positioned, while highly commoditized industries could continue to feel pressure. Additionally, we could see a push for retailers to provide more disclosure on companies engaging in this practice, which could lead to higher penetration of their private label or “own brand” products.

Banks: Potential Upside in a Republican Victory

Marko Kais, Analyst, AGF Investments Inc.

We believe a Trump win may be a positive for many U.S. banking stocks, while a Harris win could at best be neutral and at worst a negative for the sector.

In our view, a Trump win is more likely to unleash what economist John Maynard Keynes famously dubbed ‘animal spirits,’ which should bode well for capital markets activity such as loan growth and mergers and acquisitions (M&A), which, in particular, is currently muted.

On the subject of M&A, the U.S. regional banks are on a secular consolidation trend, but under the (Democratic) Biden administration, recent regulatory comments suggest more scrutiny in approving deals. In our view, Trump administration appointees are likely to be more constructive on consolidation, and current hindrances to getting deals approved might be reversed in case of a Republican win.

A Republican administration also appears more likely to prolong tax cuts, whereas Democrats could go the other way on the tax file. Also, the current Democratic administration is driving the proposed Basel III Endgame rules, which could see higher capital rules imposed on the banks. This effort could be delayed indefinitely or substantially watered down should Trump retake the White House.

Industrials: Will “Green” Win or Lose?

Wai Tong, Senior Analyst, AGF Investments Inc.

We believe the U.S. election could significantly impact the industrials sector. If Kamala Harris wins, it would likely mean the current industrial environment, established under President Joe Biden, will largely continue. The Democratic candidate has indicated her administration would continue supporting the green energy transition, reshoring and the Biden-era Inflation Reduction Act, which included significant incentives for green industry. Her campaign also proposes raising the U.S. corporate tax rate to 28% from 21% to fund social programs (among the proposals: a US$25,000 subsidy for first-time homebuyers). Higher corporate taxes may adversely impact all corporations, including industrials, of course.

On the other hand, a Donald Trump victory would likely shift priorities away from the Biden administration’s focus on the energy transition. Trump’s policies seem to favour traditional energy production, particularly oil and gas, that may lean towards lighter regulatory burdens, promoting domestic fossil fuel production. In turn, this could lead to increased drilling, higher production volumes, lower energy prices, reduced inflation and lower input costs for many industrial segments, especially transportation, potentially boosting profitability for these companies.

Trump has also pledged infrastructure spending, which may see renewed focus if he is re-elected. Companies in construction, engineering and building materials may experience increased demand. Additionally, a Trump presidency is likely to increase defense spending, potentially benefitting defense contractors.

On the less rosy side of a Trump victory scenario, the Republican candidate’s trade policies, including potential import tax increases of 60% to 100% on Chinese goods and at least 10% on all other imports, could negatively impact industrial companies reliant on global supply chains, although they could benefit local manufacturers and accelerate reshoring.

Trump’s administration aims to reduce regulation, having previously eliminated over three old regulations for each new one introduced and resulted in saving of nearly US$200 billion in regulatory costs for U.S. companies across all sectors. The rollback of environmental protections would focus on oil drilling and reducing support for electric vehicles and other green energy initiatives, adversely impacting industrial companies benefiting from current government support.

Currency: Will the Fed Stay Independent?

Sherry Xu, Foreign Exchange Analyst, AGF Investments Inc

There are a few key policy areas to watch in this U.S. election, such as taxes, immigration and fiscal spending. However, we believe the main policies that may impact currency markets concern trade and tariffs, the U.S. Federal Reserve (the Fed) independence, and the strength (or weakness) of the U.S. dollar (USD). Expansionary fiscal policy is likely no matter which party wins the presidential race, but Republicans could be worse from a currency perspective.

The polls continue to suggest a close race, both for the presidency and for control of Congress. The president can execute tariff policy via executive orders, which has implications for international trade dynamics and exchange rates. A 2023 study from Olivier Jeanne and Jeongwon Son of Johns Hopkins University suggests that tariffs tend to appreciate the currency of the country imposing the tariffs and weaken the currency impacted by tariffs.

In this regard, a Democratic win is seen as status quo, while a Republican win is seen as putting a greater focus on protectionist trade policies, with minimum 60% import tariffs on China and a 10%-20% universal import tariff on the rest of the world. A Trump win would be USD-positive, whereas a Harris win is relatively USD-negative. For foreign exchange markets, this is largely a binary process. Foreign exchange (FX) volatility has risen in recent weeks, and this is more pronounced in USD against commodity currencies (e.g., the Canadian, Australian and New Zealand dollars, as well as the Mexican peso) or the emerging market currencies that are more correlated to Chinese yuan.

Unlike 2016, when both Trump’s win and trade war with China were a shock, the market has been pricing in some of the tariff risk this time around, so we probably would see a more elastic reaction should he be elected.

Meanwhile, both candidates’ policies take a generally expansionary fiscal approach to boost growth. Harris plans to fund spending via corporate tax hikes without loosening the existing tariffs policy on China. This is likely to be relatively neutral to slightly negative for the USD, as some corporates may be incentivized to divest from the U.S. In contrast, Trump wants to fund spending via aggressive trade policies and looser monetary policies from the Fed, which could undermine the Fed’s independence.

In the past, both Trump and vice-presidential running mate J.D. Vance have called for weakening the USD to boost American exports. If they win on November 5, they will certainly have the means to pursue this policy. But we believe this is a dangerous game, because doing so may ultimately threaten the U.S. dollar’s status as a reserve currency.

Technology: How Big a Target is Big Tech?

Wyeth Wright, Senior Analyst, AGF Investments Inc.

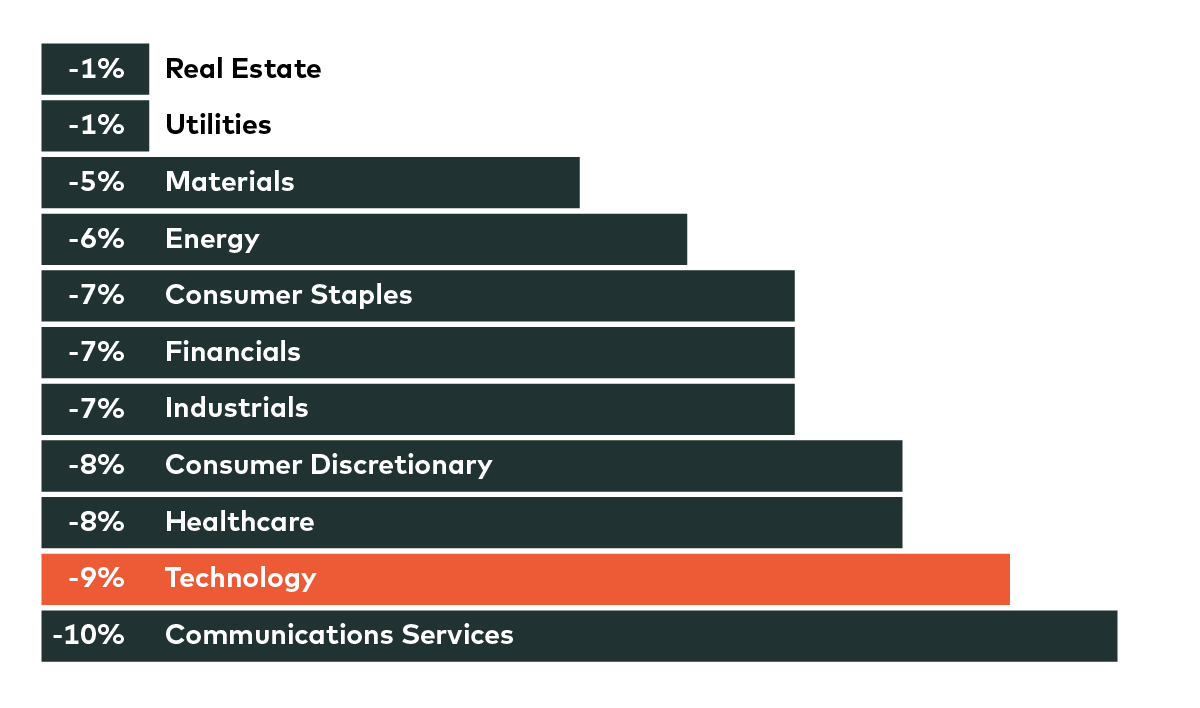

When we think about the potential impact of a Democratic or Republican election victory on the tech sector, one area of the election to consider is each candidate’s plans for the corporate tax rate.

A Democratic win, with Kamala Harris successfully implementing a corporate tax rate of 28% and a 21% tax on foreign earnings, would likely lead to a reduction in S&P 500 Index earnings. This policy change would particularly impact the tech sector, with semiconductor companies facing a larger hit of around 10% and software companies experiencing a 9% decrease in earnings. The increased tax burden on foreign earnings would disproportionately affect these sectors due to their significant global operations and reliance on international revenue streams. Consequently, investors could potentially see a more pronounced impact on tech stocks compared to other industries.

Potential Impact to S&P 500 Index Earnings Per Share of Democratic Party’s Proposed Corporate and Foreign Earnings Tax Increase(s)

Source: Wolfe Research Portfolio Strategy and Accounting and Tax Policy. As of October 21, 2024. One cannot invest directly in an index. Past performance is not indicative of future results.

On top of that, a Democratic win would likely lead to a subdued environment for mergers and acquisitions (M&A), adversely affecting technology stocks. Public companies might shy away from pursuing larger deals due to increased regulatory scrutiny.

Of course, both Democrats and Republicans could impose more anti-competitive regulations, but Democrats have traditionally been more stringent in this area. That said, the Republican vice-presidential candidate, J.D. Vance, has taken a strong stance against big tech, suggesting that regulatory pressures could come from both sides. This bipartisan skepticism towards large tech companies may further dampen M&A activity, impacting the growth and innovation typically driven by these strategic deals.

Energy: Lots of Rhetoric, but What’s the Impact?

Pulkit Sabharwal, Analyst, AGF Investments Inc.

While the upcoming U.S. election poses a potential headline risk for the energy sector due to differing policies between parties, the reality is that the sector has been largely party agnostic. In fact, U.S. production has climbed significantly under both Democratic and Republican regimes over the past decade.

There are, however, some differences that stand out in the energy policy proposals of Harris and Trump. A Republican administration under Trump may ease drilling regulations, which could initially benefit energy producers. Yet much of the Tier 1 U.S. acreage is not on federally controlled land anyway, and the key regions of the Gulf of Mexico and Alaska, which theoretically could be impacted, require long-term projects. As a result, any notable production increase is unlikely during Trump’s four-year term, should he win. On the other hand, Trump’s previous term saw him re-enact sanctions against Iran, resulting in a significant drop in Iranian production. In sum, we believe this likely means that despite the friendlier tone, a Trump presidency may be neutral to overall production growth, with an ever-present upside risk of Iranian production being sanctioned and taken off the market.

Conversely, a potential Harris administration is expected to maintain stringent environmental regulations, similar to those of the Biden administration. Although this may appear limiting, the energy sector has performed well over the past four years, and a Harris administration will likely continue initiatives like the Inflation Reduction Act and promote the transition to electric vehicles (EVs) and biofuels. Short-term crude oil demand is unlikely to see significant impact. However, should a Democratic administration renew the push to halt further liquefied natural gas (LNG) development, it could restrict U.S. natural gas exports, ultimately diminishing long-term prospects for U.S. natural gas companies.

Healthcare: What’s Ahead for Obamacare?

Ling Han, Analyst, AGF Investments Inc.

Amid the 24/7 coverage of the U.S. election cycle, healthcare—even though vitally important to hundreds of millions of Americans—has been getting relatively short shrift as other issues, such as inflation and immigration, seem to be capturing voters’ attention. But if we look within healthcare as a sector, there is one space that is getting the most focus: Managed Care, which comprises healthcare insurance operators in the U.S.

Among the most binary outcomes from this election could be the fate of the Healthcare Insurance Marketplace and Medicaid as they exist under the Affordable Care Act (ACA), aka Obamacare. The Biden administration meaningfully expanded subsidies to enrollees who buy coverage on the exchanges. As a result, enrolment under the Democratic president has increased by more than eight million, and today the program covers 22 million Americans. The Biden-enhanced subsidies are due to expire as of 2026, and Harris has already said that extending them would be one of her priorities as president.

Under a Republican administration, however, the path forward for ACA Managed Care would likely be far different. Trump has been very outspoken about wanting to dial back Obamacare, so a Republican victory could result in the removal of the Biden subsidies and, potentially, the loss of enrollees. Clearly, this outcome would negatively affect Medicaid-focused Managed Care companies. It would also affect hospitals and ambulatory surgery centres (ASCs), since insurance exchanges under the expanded Medicaid program pay a higher rate than Medicare and the ACA has brought more people into the healthcare system.

We believe a subset of Managed Care could, however, benefit (relatively speaking) from a Trump victory. Over the past two years, the Democratic administration has been cutting rates in Medicare Advantage, another U.S. government coverage program that is an enhancement of Medicare insurance for elderly people. The cuts have created pressure and uncertainty on Medicare Advantage insurance providers, and we would expect this to continue under a Harris presidency. On the other hand, Trump retaking the White House may benefit these providers.

Semiconductors: Would a President Trump build on Democratic Successes?

Grace Huang, Senior Analyst, AGF Investments Inc

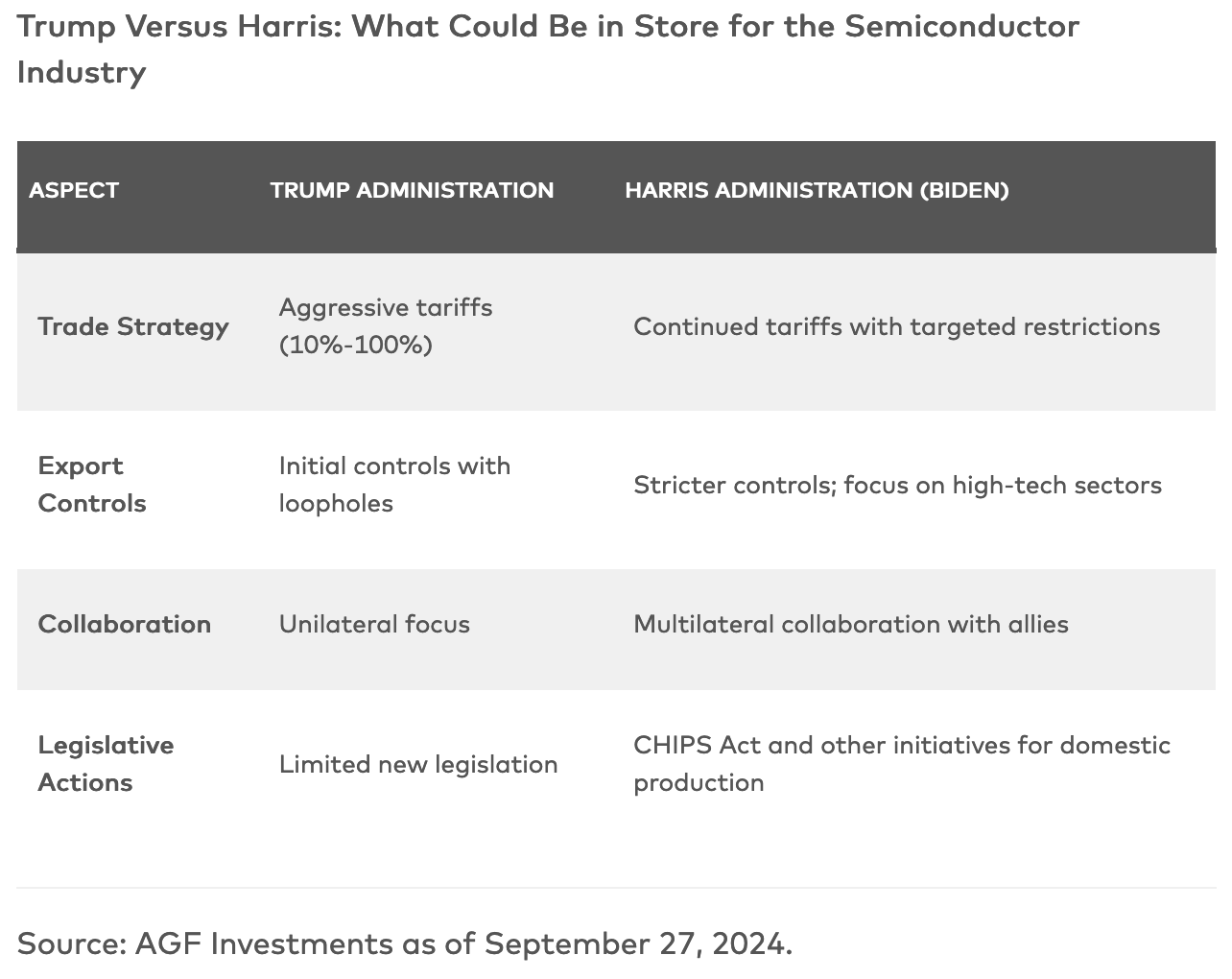

Few sectors have received as much focus from U.S. policymakers as the strategically and economically important semiconductor industry. It is also one of the few areas where the Republican and Democratic candidates seem to agree, at least in the broad strokes. Both say they have a common goal of restricting exports of advanced semiconductor equipment and chips to China, in an effort to hinder China’s ability to build anything in advanced tech.

These kinds of restrictions actually started under the 2017-2020 Trump administration, but the Republican efforts were unilateral, lacked significant legislative backing, and came with multiple loopholes. The Biden administration’s anti-China semiconductor policy has been much more effective, in large part because it has been much more targeted. On the one hand, Biden has taken a multilateral approach, emphasizing collaboration with international allies to enhance U.S. restrictions on exports to China. On the other, the Democrats have enacted significant legislation, such as the CHIPS and Science Act, which allocates substantial funding to boost domestic semiconductor manufacturing capabilities.

Passed in 2022, the CHIPS and Science Act represented a strategic pivot towards reducing reliance on Chinese supply chains and enhancing U.S. competitiveness in technology sectors. Additionally, the Biden administration has implemented stricter export controls on sensitive technologies since 2022, reflecting an ongoing commitment to national security.

If she wins the election, Harris as president would likely to follow the Biden administration’s targeted approach to semiconductor policy. As for Trump, might he have learned the “lessons” from his administration and follow the Democratic strategy in a second term, too?

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

This communication is for informational purposes only and does not constitute an endorsement or opposition to any political candidate or party. This material is not intended to influence the outcome of any election or to sway the reader to vote or act in a particular manner.

Commentary and data sourced from Bloomberg, Reuters and other news sources unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of October 25, 2024. It is not intended to address the needs, circumstances, and objectives of any specific investor. The content of this commentary is not to be used or construed as investment advice, as an offer to buy or sell any securities, and is not intended to suggest taking or refraining from any course of action. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments Inc. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

For Canadian investors: Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

Investment advisory services for U.S. persons are provided by AGFA and AGFUS. In connection with providing services to certain U.S. clients, AGF Investments LLC uses the resources of AGF Investments Inc. acting in its capacity as AGF Investments LLC’s “participating affiliate”, in accordance with applicable guidance of the staff of the SEC. AGFA engages one or more affiliates and their personnel in the provision of services under written agreements (including dual employee) among AGFA and its affiliates and under which AGFA supervises the activities of affiliate personnel on behalf of its clients (“Affiliate Resource Arrangements”).

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.

RO: 20241101-3977232

Copyright © AGF Investments