by Raffaele Sevi and Jeff Shen, Systematic Investing, BlackRock

The US Federal Reserve (“Fed”) began its rate-cutting cycle in September with a 50-basis point reduction, underscoring greater focus on the growth aspect of their mandate amid strong, yet deteriorating labor markets and falling inflation.

But is it too soon for equity markets to declare victory on a soft-landing? In this quarter’s outlook, we bring together historical and real-time analysis for insight into the economy, markets, and potential alpha opportunities and risks we’re watching.

What do past cutting cycles tell us about what’s ahead for equities?

The start of the Fed’s cutting cycle has somewhat narrowed the scope of potential economic outcomes, causing many investors to focus in on a key question: will there be a recession or not?

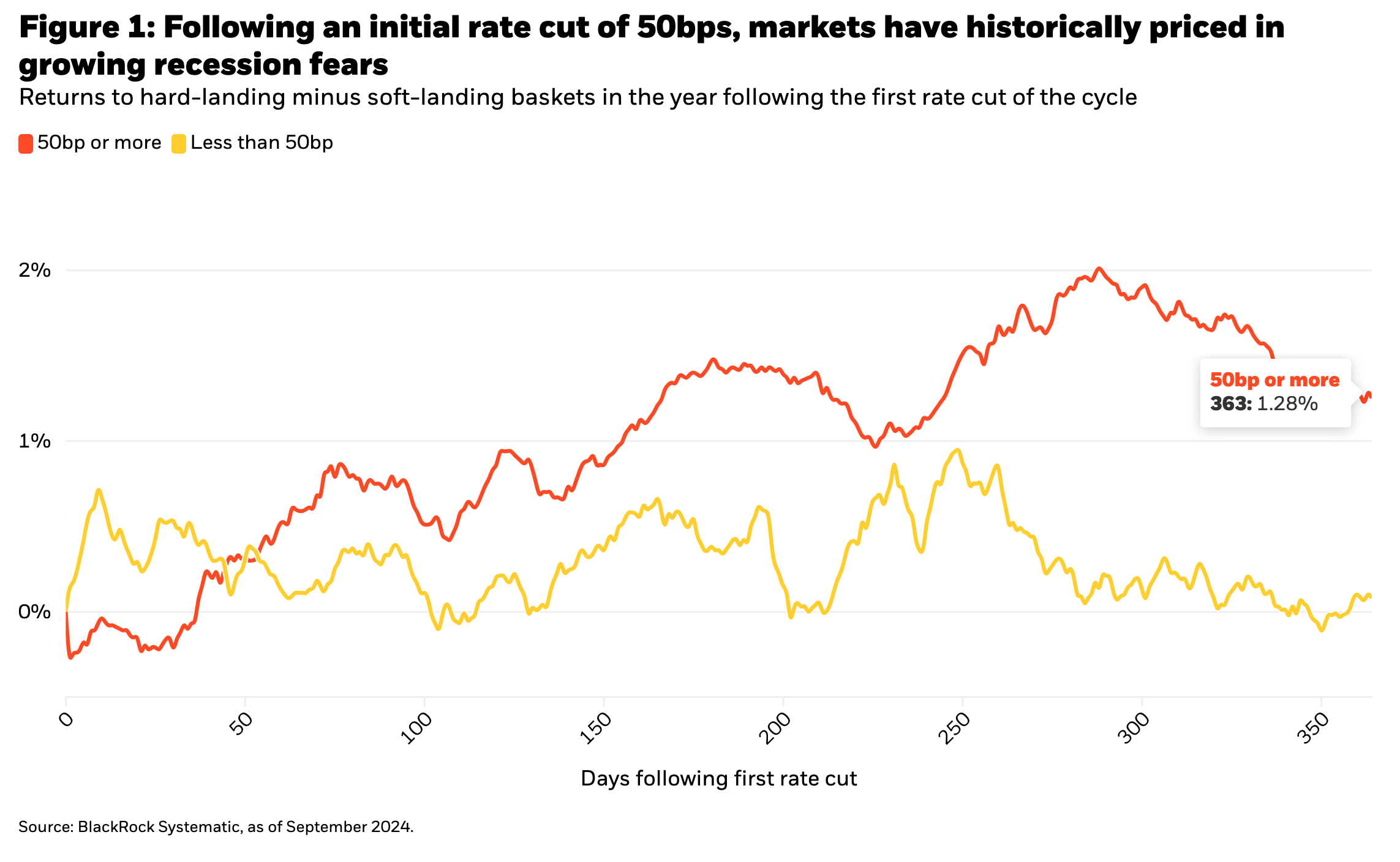

Our analysis of cutting periods over the last ~40 years reveals that cycles beginning with a 50bp cut were twice as likely to end in a recession within a year as those starting with a smaller 25bp cut. Figure 1 shows the evolution of markets in both scenarios using the performance spread between our equity baskets representing hard-landing and soft-landing macro regimes. While cycles starting with a cut of 50bp or more saw slight leadership of the soft-landing basket over the first ~35 days, recession fears eventually took hold as shown by the relative strength of the hard landing basket. An uninformed law of averages would imply that recession risk is higher following an initial 50bp cut versus 25bp, and markets could be more likely to embrace that narrative with further weakening in the data.

However, in the minutes immediately following the decision, our high frequency returns analysis showed strong US beta performance and negative returns to the size factor, with momentum and short interest exposures also slightly negative. In the context of the regime baskets referenced above, the soft-landing basket outperformed in what appeared an immediate right tail “FOMO” reaction. Some of this sentiment reversed into the close following Chair Powell’s commentary suggesting that upcoming rate cuts may be smaller.

Overall, the Fed has so far been successful in mitigating recession fears by emphasizing economic strength and the intention to slow the pace of weakening in the labor market. Compared to past cycles starting with a 50bp cut, labor data including payrolls, unemployment, and jobless claims are stronger on average, but the trend of deterioration has been worse—indicating the data is fragile enough to justify the 50bp move despite relatively strong absolute levels.

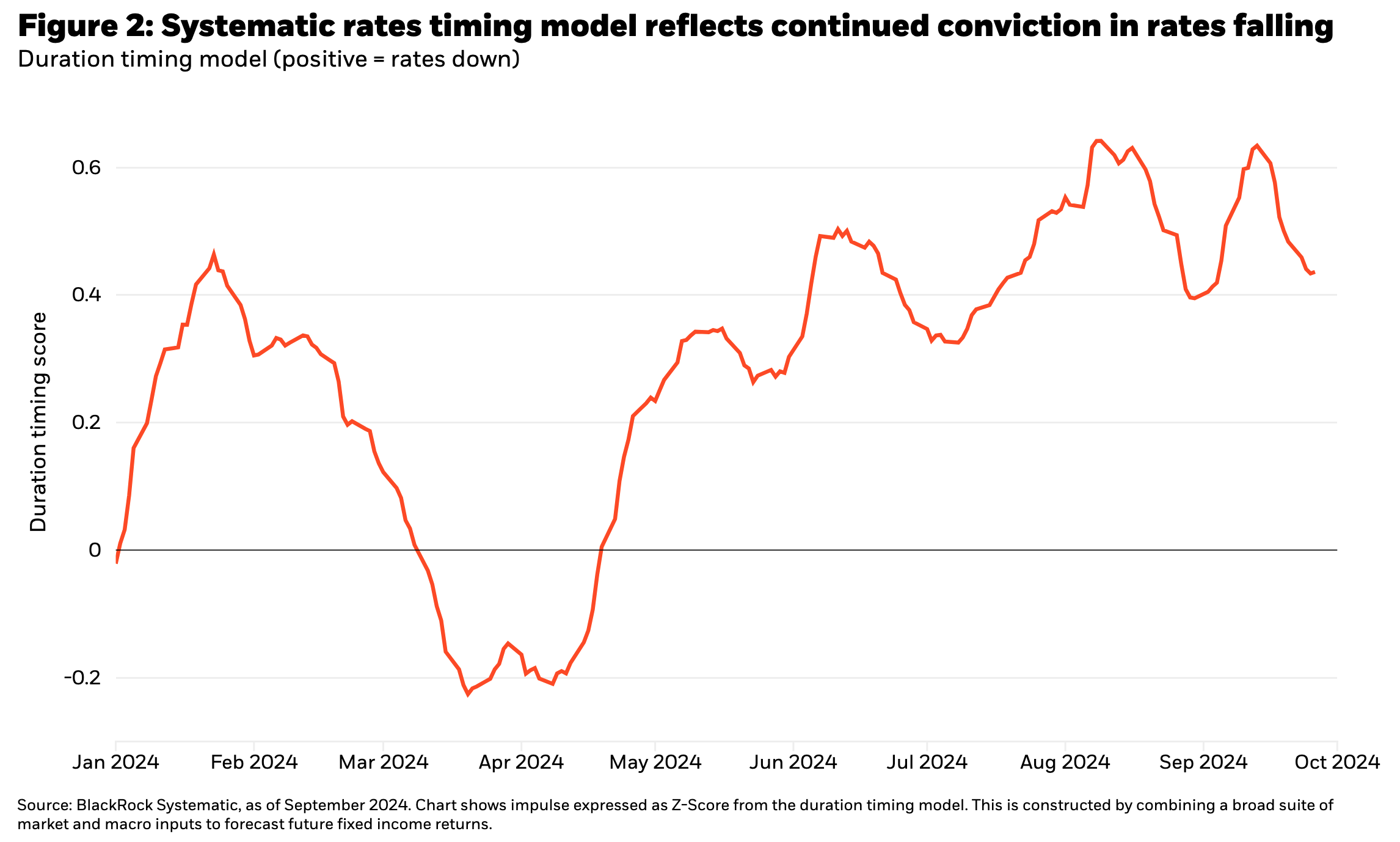

Our systematic indicators also support this view. Figure 2 shows our rates timing model which uses a range of alternative data insights to forecast the direction of interest rates. The model value remains positive, signaling conviction in interest rates falling based on measures like web-scraped product prices showing continued disinflation in the US. This supports the Fed’s ability to focus on the growth/employment portion of their mandate without sacrificing inflation progress.

Notably, the more recent slight reduction in the long duration position is driven by policy sentiment in broker reports which suggests that the Fed’s 50bp cut to start the easing cycle will ultimately allay downside growth fears and reduce the need for more aggressive cuts down the road.

Will this cycle continue to be different?

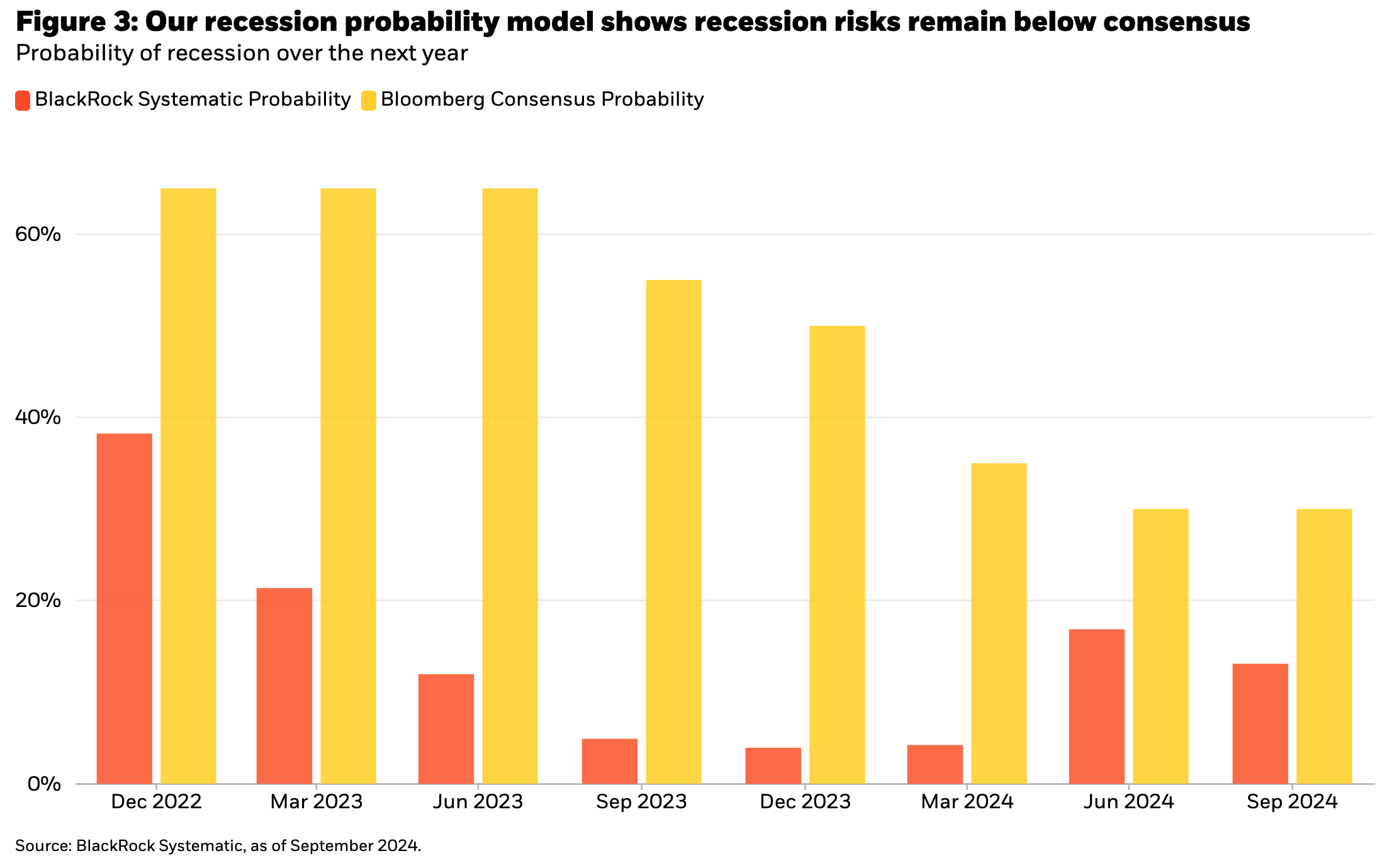

We discussed the higher probability of recession following an initial 50bp cut versus 25bp. But in an era that Fed Chair Powell has referred to as one of ‘flouted rules’, this could be yet another exception.

Figure 3 shows our estimated probability of recession over the next year based on several long-dated macro indicators. The likelihood of recession implied by the model is currently 12%, which is higher than at the beginning of the year but still well below Bloomberg consensus expectations of around 30% - suggesting that the economy remains on relatively strong footing.

Our broader library of alternative growth data also struggles to validate the recession story. Layoff mentions in conference calls haven’t significantly increased and business-to-business activity has continued to accelerate year-over-year across both goods and services. We have seen some signs of weakening in measures like credit card spending and hotel bookings recently, indicating a potential pullback in discretionary spending across income cohorts. However, the overall strength of consumer trends in activity and sentiment continues to exceed recessionary levels.

Uncovering alpha and systematically managing risks in equities

Putting it all together, we see inflation continuing to ease and recession risk remaining subdued despite having increased over the summer months. This is expressed in portfolios through a preference for higher duration, more cyclical exposures poised to benefit as positive macroeconomic developments continue to be priced in. We’ve also made efforts to marginally trim risks relative to earlier in the year as volatility and uncertainty are likely to remain more elevated in the coming months.

With our core thesis largely aligned to market consensus expectations for a soft-landing, this section highlights two of the areas where we’re seeking an edge in (1) alpha generation, and (2) risk mitigation as we look ahead.

Disinflation not yet priced in the cross-section

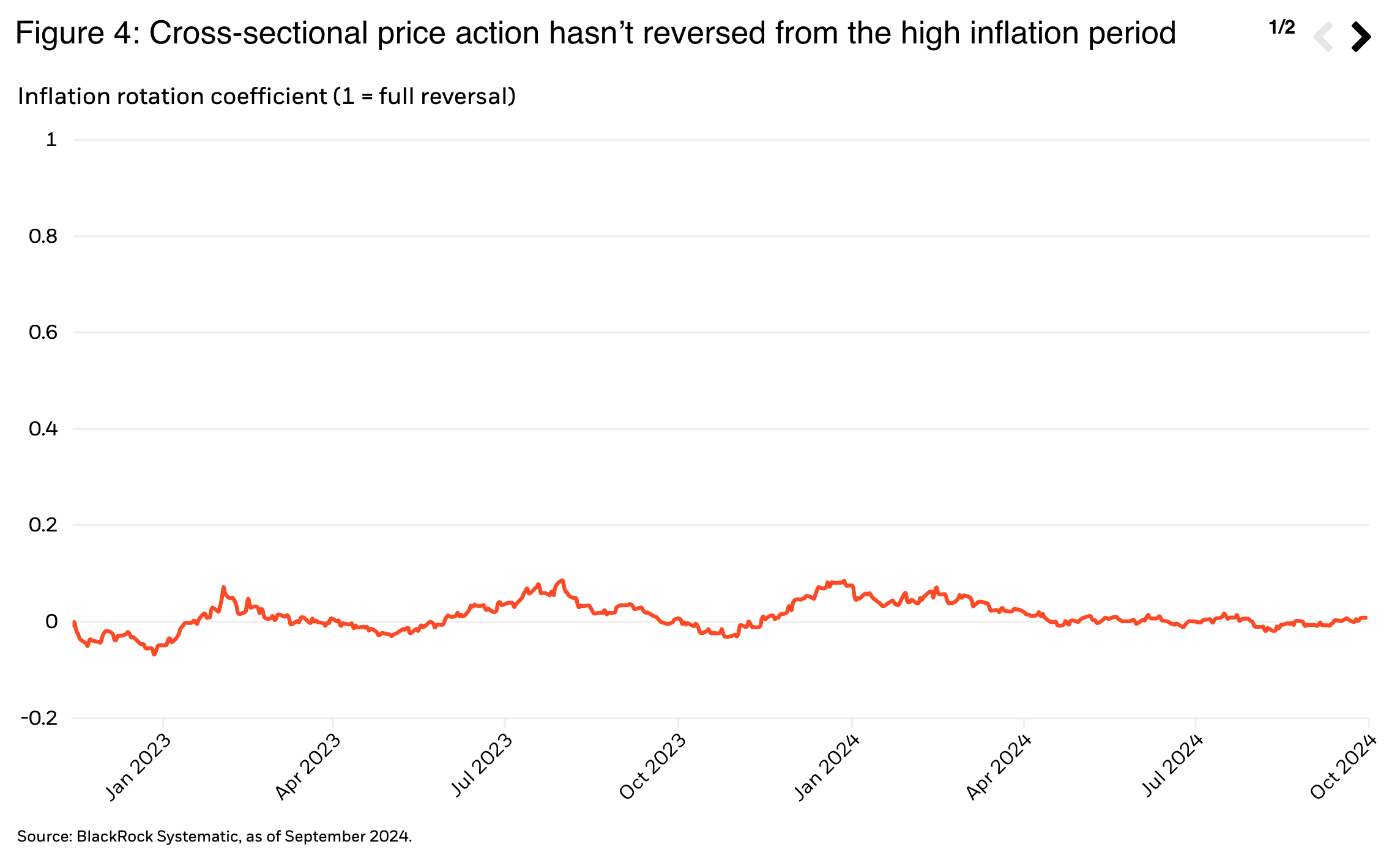

The shift to a world of high inflation and interest rates drove significant cross-sectional price action in equities. Now with inflation fears largely fading and significant expectations of rate cuts into year-end 2025, to what degree have those moves reversed?

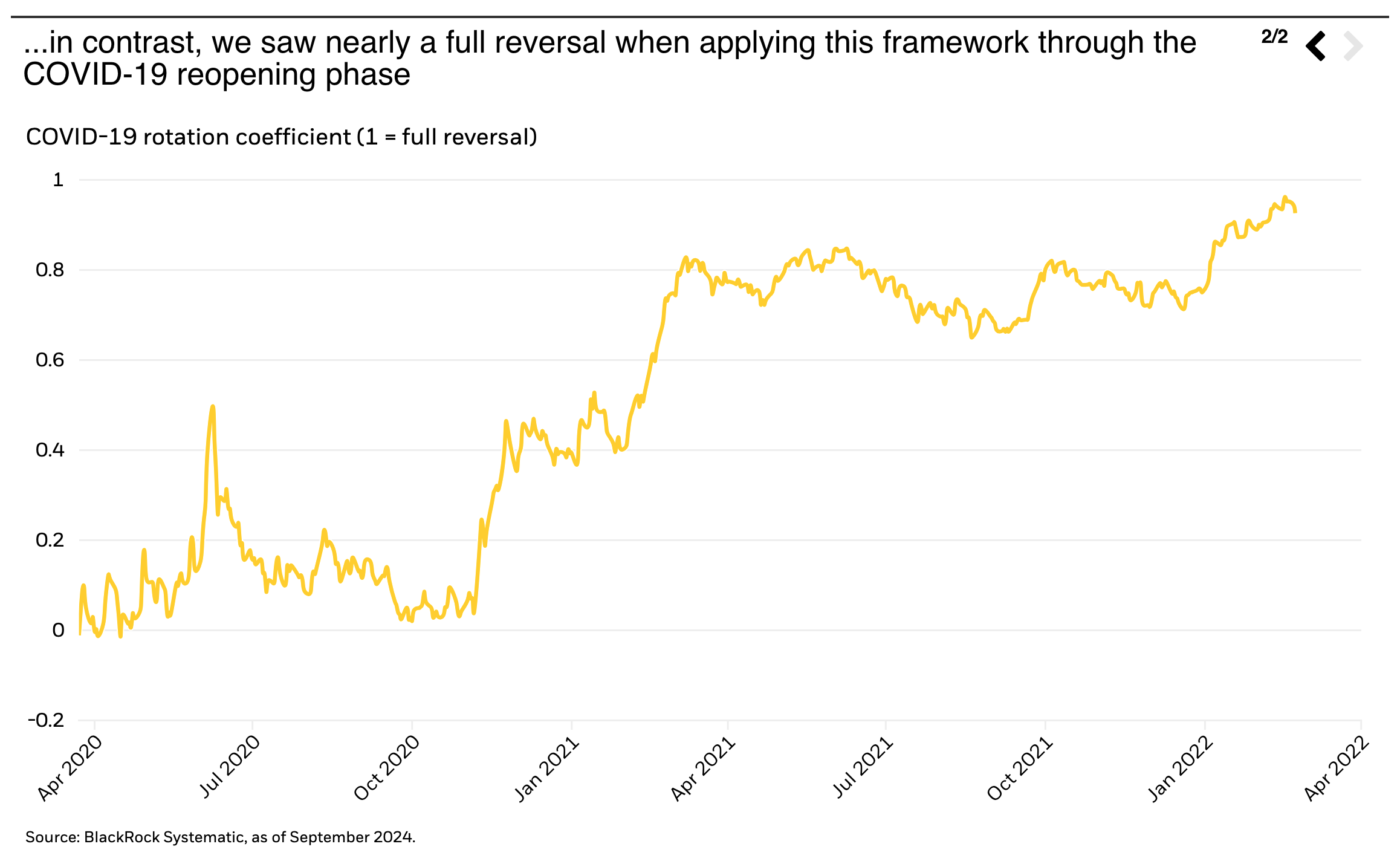

We analyzed the strength of the cross-sectional equity rotation observed up to the point that attention to “high inflation” versus “low inflation” peaked in news articles in late 2022, comparing those moves with what would be required to return pricing to the last point at which inflation appeared normal.

The first chart in Figure 4 shows the strength of the rotation since attention to higher inflation peaked, measured by the coefficient (a value of 1 would imply that a reversal has fully taken place). The coefficient reveals practically no evidence of reversal in the equity cross-section—even as inflation has moved substantially lower. By comparison, the second chart highlights our use of this same conceptual framework during the COVID-19 reopening phase where we eventually saw nearly a full reversal in the price movements observed over the prior period. Looking ahead, we view the start of the cutting cycle is a potential catalyst for price action from the higher inflation period to reverse as interest rates continue moving lower in the absence of inflation reaccelerating.

Systematically hedging the tails

While the soft-landing outcome is our base case, increased fragility in the data and broader uncertainty across several dimensions makes the case for building portfolio resiliency.

Our framework for systematic hedging seeks to do this with a portfolio of liquid macro assets constructed to outperform in stress periods. Currently, the hedge is broadly positioned for potential falling US yields, implied curve steepening, Yen appreciation, tightening emerging market (EM) credit spreads, and outperformance of EM over developed markets (DM). While positioning is not explicitly classified based on risk scenarios, the 3-month correlation of the hedge to our macro regime baskets has shown a shift towards addressing slightly higher left tail, hard-landing risks over recent months.

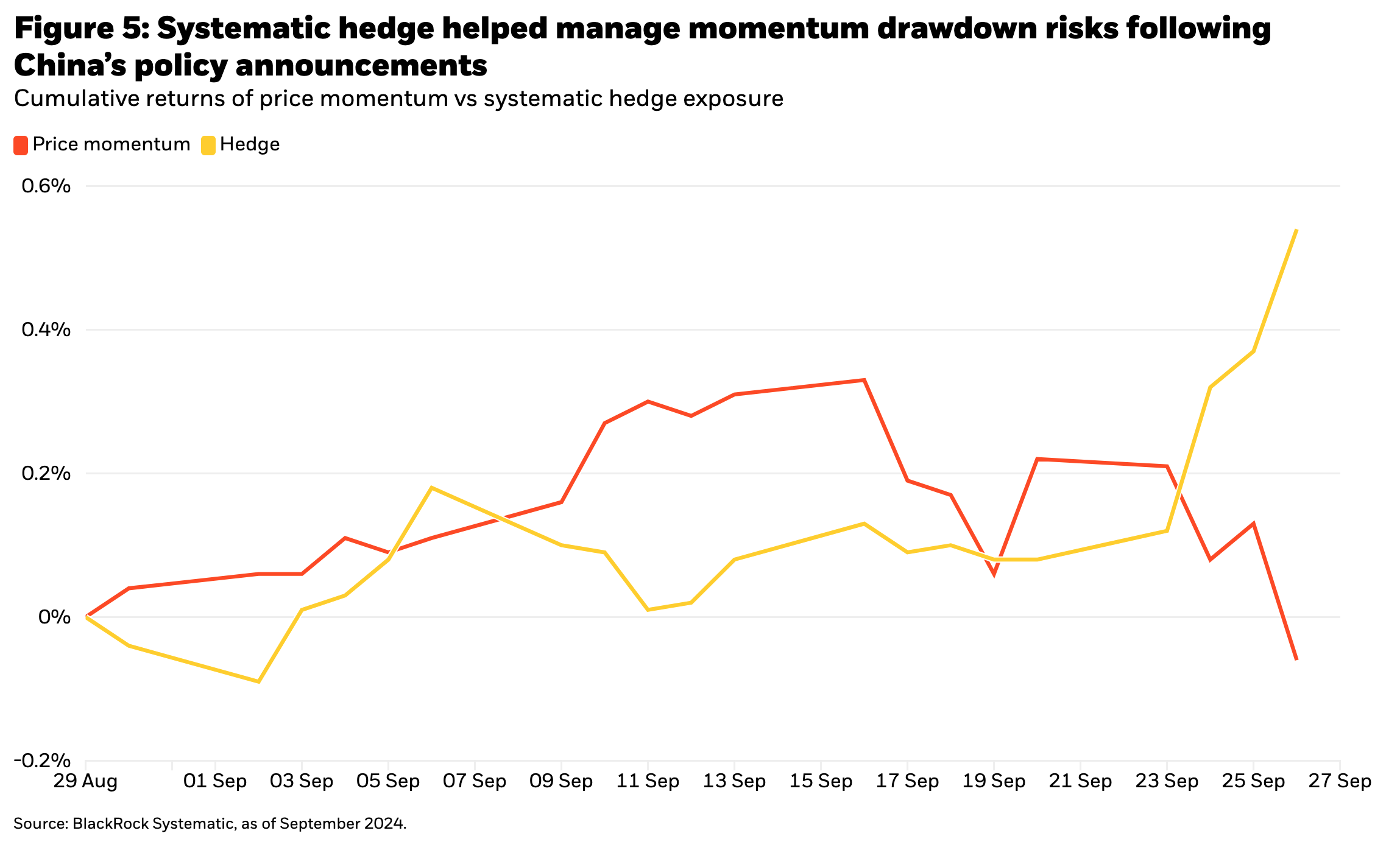

Figure 5 highlights a recent example of the hedge helping to offset sharp moves in price momentum following the announcement of significant stimulus measures in China. Contrarian positions in China, EM, Yen, commodities, and small caps all contributed to performance of the model, which realized a -0.5 correlation to momentum factor returns over the week following the news.

While this is just one example, it highlights the role of this framework in helping us to adapt and remain nimble in the current environment. Over just the few final weeks of Q3, market risk drivers have ranged from macroeconomic releases, monetary and fiscal policy decisions, the escalation of conflict in the Middle East, and potential supply chain disruptions and labor strikes—underscoring today’s fast-changing market conditions that call for more dynamic investment capabilities.

Conclusion

The long-anticipated cutting cycle is underway in the US, with the Fed’s first 50bp cut initially fueling enthusiasm across equity markets. While historical odds suggest that the size of the move implies higher recession risk versus a smaller 25bp initial reduction, our alternative data indicators point to continued economic resilience and muted inflation risks, supporting the view that a soft-landing remains the most likely outcome from here.

Portfolio positioning reflects a preference for cyclical parts of the market positioned to benefit as these dynamics continue to play out, and we see opportunities to capitalize on the reversal of cross-sectional price action from the prior high inflation period. At the same time, heightened volatility and uncertainty into year-end magnify the importance of hedging potential risks to our outlook.

Copyright © BlackRock