by Robert M. Almeida, Global Investment Strategist, MFS Investment Management

Capital cycles are imperfect, showing a tendency for booms and busts. Over the past year, investors have focused on the economy and interest rates when assessing risk. That emphasis may be misplaced because that wasn’t where the boom was.

In brief

- Capital cycles are imperfect, showing a tendency for booms and busts.

- Over the past year, investors have focused on the economy and interest rates when assessing risk.

- That emphasis may be misplaced because that wasn’t where the boom was.

The capital cycle drives booms and busts

Capitalistic economies allocate resources in accordance with utility. The private sector pulls capital from industries with falling societal value and return on capital and allocates it to industries with rising returns and greater utility.

While the capital cycle drives innovation, progress and change, cycles are imperfect as evidenced by the repetition of industry and economic booms and busts. History has shown a tendency to flood high-return projects with capital, creating a boom. At first, supply meets demand, but eventually supply exceeds demand. Upon the broad realization that the industry or project has indeed reached a state of excess, returns on capital collapse and the bust is underway. Market forces often overshoot in the opposite direction until, ultimately, water finds its right level, equilibrium is achieved and returns normalize.

Many forecasts for a US recession in the last year have come up short, giving investors a renewed appetite for risk assets. But whether we’re in for a hard or soft landing, investor emphasis may be misplaced. I would offer that overallocation to industries with excess supply is a far greater risk to investors. Conversely, investments in industries in which supply is structurally constrained and returns on capital are sustainable may offer better outcomes versus trying to time markets based on highly uncertain economic and interest rate predictions.

In that spirit, I focus this edition of Strategist Corner on where the boom was and where the bust may be.

Where was the boom and why?

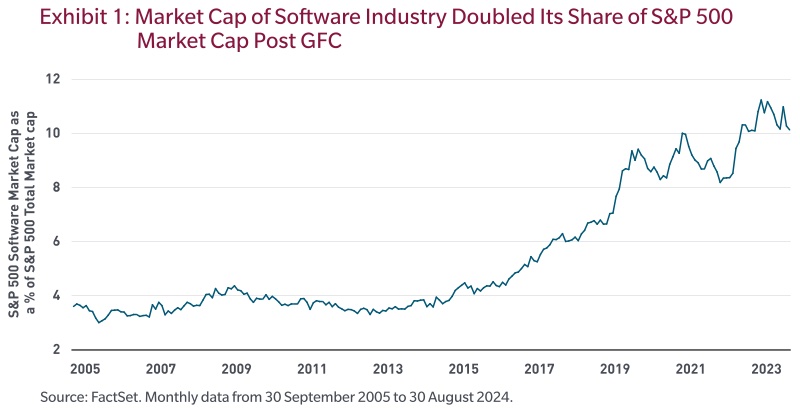

The business cycle following the 2008 global financial crisis (GFC) was long but weak due to the unwillingness of banks to lend and unwillingness of consumers and businesses to spend. When western enterprises weren’t repurchasing their stock or shifting manufacturing to China, they were allocating resources to software. This manifested in the software industry doubling its share of the S&P 500 market capitalization.

The spend was particularly acute across larger companies where the efficiency gains were the highest. Today for example, companies with more than 10,000 employees have on average 650 software applications. Although it’s hard to observe in aggregate stock prices, software spend has been in decline for the last couple of years. Why?

While companies provide numerous reasons, from economic concerns to budget constraints, in general, they are in a software digestion phase from years of spending. The more acute and potentially chronic factor, however, is wallet share take by artificial intelligence.

Technology is deflationary over time because it removes frictions from society. Replacing an old technology with a new technology allows not only for cost savings but greater and more efficient output, driving its value to society. When most people think of AI, they think of the benefits and positive impact to productivity. That’s true. But what about the revenue streams tethered to the technology AI is replacing? Many of those companies are driving the exhibit above and are facing collapsing returns.

Look in the right places

Investors are following cues from economists and policy makers, whose rear-view oriented models seek to assess future economic activity and interest rate levels. I think they may be looking in the wrong places. Much like generals tend to fight the last war, the next bust won’t come from where the last bust was. It will come from where the boom was.

The boom wasn’t in GDP, the labor market, household spending, etc. The boom was in software. And while that boom was justified by attractive return on capital and efficiencies for enterprises, AI can potentially do more at a fraction of the costs. We expect to see IT budgets shift from software to AI and for the number of software applications to fall. The question isn’t the direction of travel, but only the speed.

While software is saturated with too much competition, AI may not be able to duplicate mission-critical applications. Software and AI will work together, but the excess of sub-scale providers in undifferentiated categories needs to “recess.” Avoiding terminally value challenged companies while owning mission-critical software providers may prove a powerful recipe for outsized performance. That’s why I believe active management will be important after years of dormancy.

*****

“Standard & Poor’s®” and S&P “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS’ Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affi liates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affi liates make any representation regarding the advisability of investing in such products.

The S&P 500 Index measures the broad US stock market. It is not possible to invest directly in an index.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. Past performance is no guarantee of future results.

Copyright © MFS Investment Management