by Carl R. Tannenbaum, Chief Economist, Vaibhav Tandon, & Ryan Boyle, Northern Trust

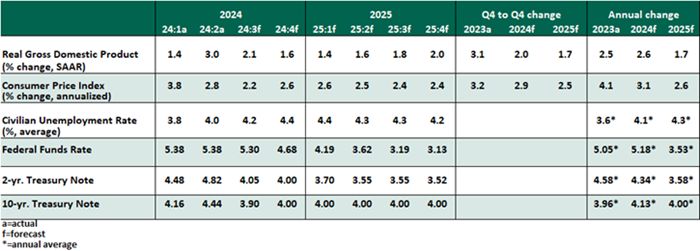

The Northern Trust Economics team reacts to the Fed's decision and shares its outlook for U.S. growth, employment and inflation.

September 2024 will be remembered as a significant juncture for monetary policy. After holding for 14 months, the Federal Open Market Committee (FOMC) began a rate cutting cycle.

As we laid out last week, arguments were made for a faster or slower pace of easing, but there was no question the time had come to offer some accommodation. Moderate inflation and softer labor markets paved the way toward lower rates. Less restrictive monetary policy should allow the economy to settle into a sustainable pace of activity.

We are attuned to the risk that the shift toward slower activity can be the first step in a tumble toward recession, but we view the current data as consistent with the long-anticipated soft landing. Symptoms of greater distress are limited, and we expect resilience to prevail as it has throughout this cycle.

Following are our thoughts on recent data and developments.

KEY ECONOMIC INDICATORS

Influences on the Forecast

- The FOMC made a decisive opening play in the rate cutting cycle, reducing the Fed Funds Rate target range by 50 basis points. The accompanying statement continued the Fed’s recent emphasis on risks to both inflation and employment. In his press conference, Chair Powell assured that this is not a distress signal, but a “commitment to not fall behind the curve.”

The quarterly Summary of Economic Projections reflected an outlook of more tame inflation paired with higher unemployment. Both adjustments helped to justify a large initial move. The “dot plot” of rate expectations shows a median expectation of 50 basis points of further cuts by year end, and 100 basis points in 2025, with wide differences of opinion.

We expect a steady pace of 25 basis point cuts at each meeting hereafter until the Fed Funds Rate range reaches 3.0%. At that pace, the target would be achieved in summer of next year. Powell emphasized that no decisions were preordained and the committee is not in a rush, though he did hint that more 50 basis point moves are unlikely.

- FOMC members have emphasized the realignment of their focus toward both sides of their dual mandate, reflecting greater attentiveness to the labor market. The employment report for August added to the cause for concern. Like the prior month, the headline numbers were rather ordinary, with 142,000 jobs created and the unemployment rate improving one-tenth to 4.2%. However, revisions to prior two months pushed job gains down further.

Job openings fell to a post-pandemic low of 7.7 million in July, and the ratio of vacancies to unemployed workers continued its descent, down to 1.07:1 from a peak of 2:1. Falling vacancies with only a modest rise in unemployment is thus far a best-case outcome for the labor market, as long as the series does not deteriorate further.

- The FOMC’s decision was supported by inflation’s gradual improvement. In August, the consumer price index (CPI) reached a three and a half year low of 2.5% year over year. Core CPI (excluding food and energy) showed less improvement, again held higher by prices of shelter and core services. The Fed’s preferred measure, the price index on personal consumption expenditures, showed a similar trend of flat core inflation of 2.6% in both June and July. Though above target, readings of this magnitude are soft enough to support a sustained cycle of rate cuts.

- The runoff of the Fed’s balance sheet continues, with no change of pace in the September FOMC statement. The balance sheet stands at $7 trillion, down by nearly $2 trillion from its 2022 peak, but still $3 trillion above its level before pandemic interventions spurred a massive cash infusion. Placements in the Fed’s overnight reverse repurchase facility reached a new post-crisis low of $239 billion mid-month, reflecting depleting market liquidity. The balance sheet normalization is not a current focus of monetary policy, but we expect a steady state to be reached next year.

- The upcoming election is top of mind but low on our list of forecast considerations. We are addressing specific economic matters at stake in the election in our Weekly Economic Commentaries. Our forecast does not assume a winner, as we do not take the most extreme campaign ideas as likely to manifest in our baseline.

Copyright © Northern Trust