The Northern Trust Economics team adds coverage of Canada and Australia to its outlook for major market economies.

by Carl Tannenbaum, Vaibhav Tandon, Ryan Boyle, Northern Trust

Editor’s Note: With this month’s edition of our Global Economic Outlook, we are expanding coverage to include Canada and Australia. We hope our views will be helpful to clients interested in details on these two markets.

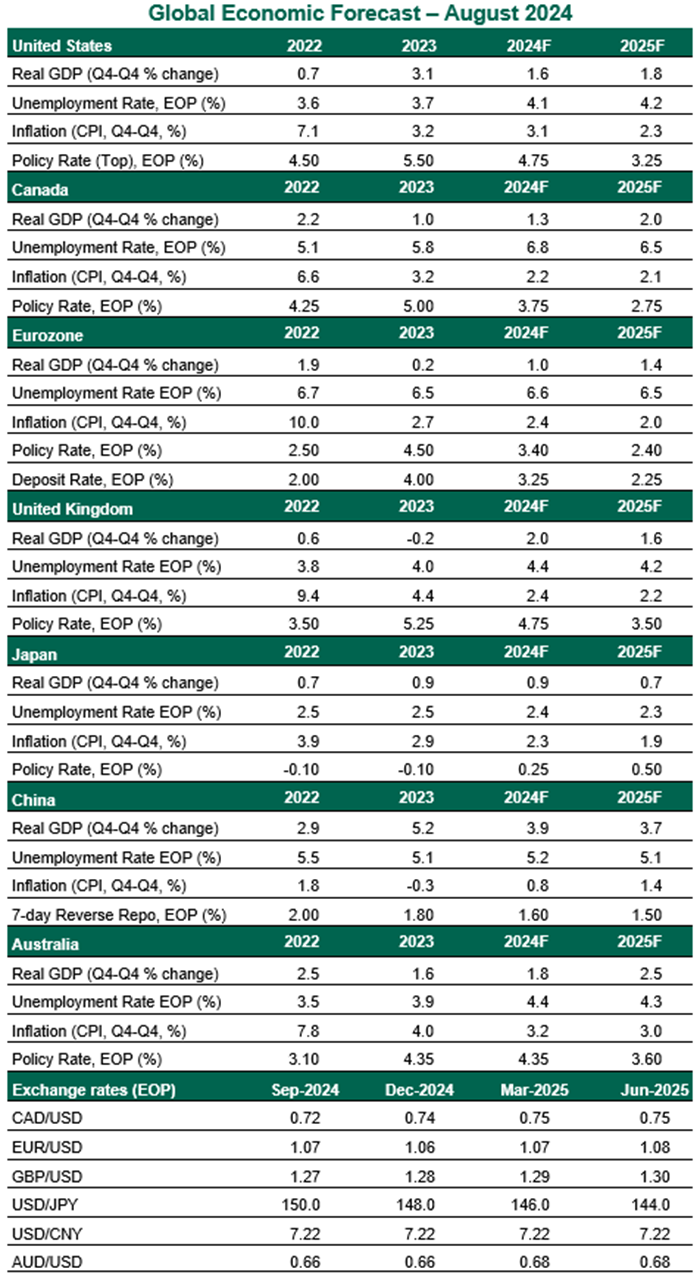

Major world economies are entering a sweet spot, with growth slowing down just enough to let inflation cool further. To date, this moderation has not triggered a sharp rise in unemployment or sustained market volatility. The market turmoil earlier this month passed without materially altering the course of financial conditions.

A soft landing scenario is still a realistic base case. Central banks are seeing a more balanced set of risks. With easier policy on its way in most places, the focus is squarely on the size and pace of rate cuts.

We must not lose sight of the geopolitical risks raised by events in the Middle East and Russia. Uncertainty around the outcome of the U.S. elections will rise in the months ahead.

Following are our thoughts on how major economies are faring.

United States

- Markets took an extreme risk-off turn in the wake of the July jobs report, amid fear of a recession taking hold and the Federal Reserve waiting too long to ease. While some of the previously reliable recession indicators are flashing warning signals, they have not worked recently owing to the anomalies of the pandemic cycle. In fact, U.S. gross domestic product (GDP) exceeded expectations again in the second quarter as consumers and businesses continued to spend and invest.

- Inflation is cooling, while the labor market is rebalancing. Fed Chair Powell strongly suggested cuts are in sight: “A reduction in the policy rate could be on the table as soon as the next meeting in September.” We expect quarter-point reductions at each of the Fed’s three remaining 2024 meetings.

Canada

- The Canadian economy is moderating. Activity has weakened, despite a tailwind from higher immigration. Consumers have been pulling back on spending and businesses on investments, amid high borrowing costs. Headline inflation is approaching the target, underpinned by disinflation in its core components. Employment has stalled for two months in a row, reflecting the challenge of generating enough jobs for a growing population. Swelling mortgage payments at higher rates will crowd out consumption, generating below-potential growth for the year to come.

- The Bank of Canada was the first major central bank to pivot and has already cut twice since its June meeting. With the Bank of Canada clearly focused on the downside risks to growth, rate cuts will continue until the policy rate settles at a neutral level of 2.75% sometime in 2025.

- The housing sector remains a thorn for Canadian policymakers and households alike, with affordability reaching its worst levels in a generation. Despite higher financing costs, demand for housing is outpacing supply. The Canada Mortgage and Housing Corporation unveiled plans to build 3.5 million houses by 2030, nearly tripling the current pace of construction; but this measure is unlikely to provide any relief in the near term. Restoring housing affordability could take up to a decade.

Eurozone

- Incoming surveys have raised concerns about the health of the eurozone economy. The Purchasing Manager’s Index declined in July. Industry continues to struggle with weak demand. Forward-looking sentiment data are pointing to a loss of momentum in the third quarter, with the ZEW index dropping to its lowest level since the start of the year. While the surveys have surprised to the downside, we don’t think the recovery is in imminent danger. Softer but still positive GDP growth remains our base case for the second half of the year. GDP growth was steady in the second quarter; employment and real incomes are still growing, with monetary conditions set to become less restrictive.

- The European Central Bank (ECB) remains non-committal about the pace and magnitude of cuts. But given generally slow economic conditions, we expect the next easing at the September meeting. The central bank will prefer to maintain its data-dependent approach, with a focus on the dynamics of underlying inflation. But threats to the recovery could pressure the ECB to commit to a clearer easing path.

United Kingdom

- The British economy has turned the corner. Following a technical recession in the second half of last year, real GDP grew 0.6% quarter over quarter in the three months ending in June. This was only minimally less than the pace recorded in the first quarter. Consumer and government consumption were the key drivers of this result. The economy has firmly exited the stagnation phase; real income gains and easing financial conditions will support ongoing growth.

- Headline inflation in Britain climbed two-tenths to 2.2% year over year in July. The rise was largely expected, due to fading energy base effects. Services inflation finally resumed its downward progress, decelerating to 5.2%. The U.K. unemployment rate surprised to the downside, falling two-tenths to 4.2% in June, but private sector pay growth cooled further. We continue to see a quarterly pace of reductions by the Bank of England for the next year. But the possibility of back-to-back cuts cannot be ruled out, given the mixed leanings of those who vote on monetary policy.

Japan

- The Japanese economy bounced back strongly in the second quarter, growing 3.1% at an annualized rate. This outcome reflected a sharp rebound in consumer spending, greater appetite for capital expenditures and the resumption of auto production after a temporary halt. The recovery in consumption is a sign of translation from higher wages to spending that should underpin growth. Prime Minister Fumio Kishida’s decision to not seek reelection as the Liberal Democratic Party president in September has raised the possibility of an early election, but is unlikely to introduce any immediate economic risks.

- At the July meeting, the Bank of Japan raised its policy rate by 15 basis points to 0.25%, the highest level since October 2008. In another step toward policy normalization, the central bank also revealed its plan to reduce its purchases of Japanese government bonds from the current level of around JPY6 trillion per month to JPY3 trillion per month in January-March 2026. But the hawkish tilt didn’t go down well with financial markets. While evidence of pass-through of higher wages to consumption is starting to appear, the risk of renewed market turmoil will force the central bank to tread cautiously. Another rate hike this year looks unlikely.

China

- July activity data from China pointed to a weak start to the third quarter amid a continued imbalance in supply and demand. Weak domestic consumption remains the primary driver of China's softening economic momentum. The property sector is still depressed. There are signs that momentum in major engines of growth, like infrastructure and manufacturing investments, is losing steam. Fixed asset investment growth and retail sales declined sequentially. Exports slowed in July, led by softer external demand. The gloomy clouds hanging over China’s economy are unlikely to pass anytime soon.

- Chinese inflation edged up to a five-month high of 0.5% year over year in July, but the improvement was largely driven by weather-related disruptions to food prices. Underlying price pressures remained soft. Deflation at the producer level persists, with sluggish discretionary spending forcing businesses to slash prices on everything from cars to appliances. Deflationary forces and the pledge to “unswervingly” achieve the full year growth target are amplifying calls for more meaningful stimulus. The People's Bank of China is likely to ease monetary policy again in the coming months, but the situation calls for direct demand stimulus.

Australia

- Growth in Australia came to a near-standstill in the first quarter with inflation and the associated tight monetary policy settings heaping pressure on household budgets. Consumer confidence is low, and spending has been concentrated in non-discretionary components. The labor market is slackening, with the unemployment rate starting to climb. The cost-of-living support measures announced in the 2024-25 budget, which includes a personal income tax cut, will underpin growth in the second half of the year.

- Inflation is still elevated, prompting the Reserve Bank of Australia (RBA) to take a hawkish tone over the past couple of months. According to the RBA, “it will be some time yet before inflation is sustainably in the target range,” which means monetary policy settings will remain tight this year. We expect inflation to cool, but not enough for the RBA to pivot as other central banks have done. A short easing cycle will begin, but not before early next year.

Copyright © Northern Trust