by Tony DeSpirito, CIO of U.S. Fundamental Equities, BlackRock

When it comes to assembling a well-rounded investment portfolio, the makeup and placement of U.S. equity allocations are key considerations. Tony DeSpirito, Global CIO of BlackRock Fundamental Equities, challenges conventional thinking to suggest that alpha-seeking strategies in U.S. large-cap stocks are deserving of a core position in portfolios.

Investors have more choices than ever for building their investment portfolio, both in asset types and the vehicles for holding them. While U.S. large-cap stocks often hold a place at the core of portfolios, many believe this exposure is best achieved via passive index-tracking products. The rationale: The U.S. equity market is so efficient and transparent that there is little alpha (or above-market return) to be captured via active stock selection.

We disagree.

Ample alpha potential

Many prefer to apply active strategies in more niche and less transparent markets, such as emerging markets or U.S. small caps. We see wisdom in this but believe the alpha opportunity is much broader.

The top stock by market cap in the S&P 500 is larger than the entire small-cap universe, suggesting to us that avoiding active in U.S. large caps means sacrificing tremendous alpha potential.

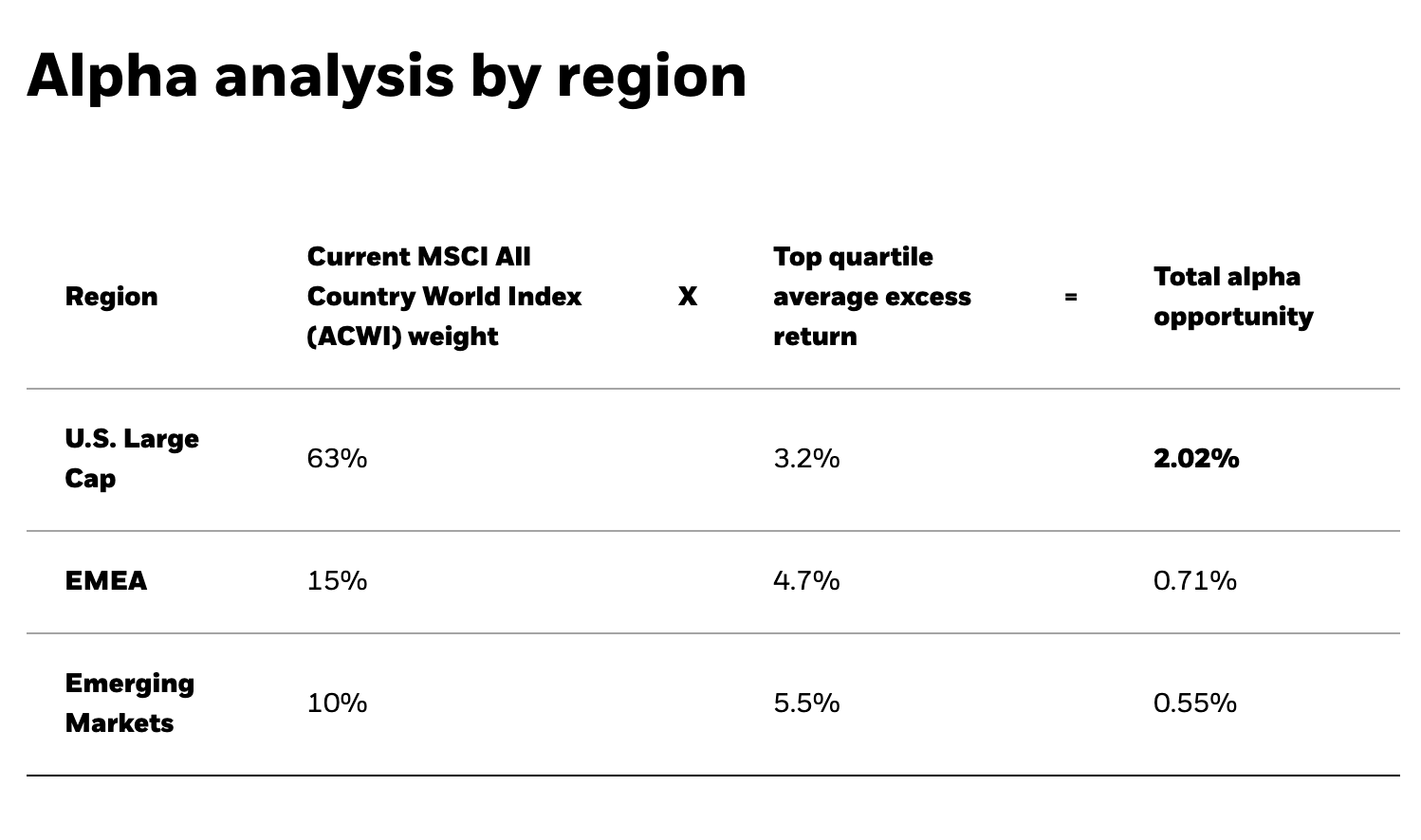

The analysis below shows that large-cap U.S. stocks historically have provided a meaningful alpha opportunity on the global stage. This is a function of the excess returns of the top quartile of managers alongside large U.S. representation in global markets. While top-quartile managers in less-efficient markets may generate a higher percentage of alpha (see EMEA and EM in the table below), their impact on a whole portfolio could be less than a top-quartile U.S. large-cap manager given their smaller global representation, as summed in the far-right column.

Source: BlackRock Fundamental Equities, with data from FactSet, MSCI and eVestment, April 2024. Regions represented by the following eVestment categories: U.S. Large Cap Equity, All Europe and All Emerging Markets. MSCI ACWI weights are as of March 31, 2024, and top quartile excess returns are averages over the 20-year period from 2004-2023. Total alpha opportunity represents the current weight times the top quartile excess return. Figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Source: BlackRock Fundamental Equities, with data from FactSet, MSCI and eVestment, April 2024. Regions represented by the following eVestment categories: U.S. Large Cap Equity, All Europe and All Emerging Markets. MSCI ACWI weights are as of March 31, 2024, and top quartile excess returns are averages over the 20-year period from 2004-2023. Total alpha opportunity represents the current weight times the top quartile excess return. Figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

The significance of the opportunity has swelled as the U.S. has grown to comprise a larger share of global indexes. U.S. representation in the MSCI ACWI is at 63% today, a steady climb from 37% in 1995.

This record U.S. share comes at a time when the potential for active stock selection to generate above-market return is the greatest we have seen since before the period of moderation (in valuation, volatility and dispersion) that followed the 2008 global financial crisis ― a thesis we expand on in Equity investing for a new era: The return of alpha.

As shown in the table above, top-quartile managers in the U.S. have been able to achieve average excess returns of 3.2% over the past 20 years.* This means U.S. large caps’ 543% cumulative return over the 20 years ended Dec. 31, 2023, could have amounted to more than 1,000% over that time period when applying the top-quartile manager alpha.†

An emphasis on skill

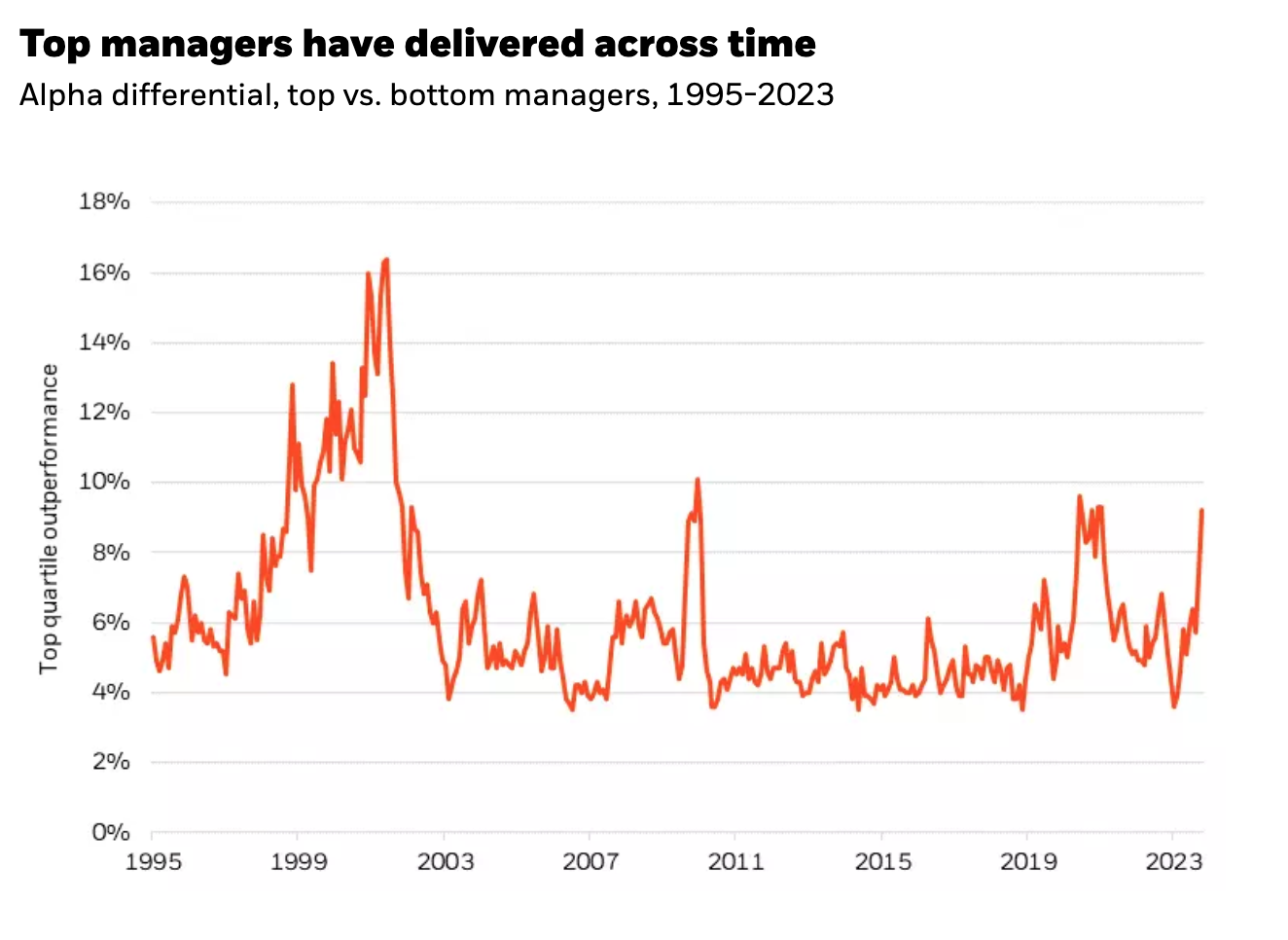

Skill does matter. The alpha generated by median managers has been negative in 67% of rolling one-year periods over the past 10 years. Yet the top quartile of alpha generators remained positive and posted returns as much as 16% higher than bottom-quartile managers since 1995, as shown in the chart below.

Source: BlackRock Fundamental Equities, with data from eVestment as of Dec. 31, 2023. Chart shows the percent of excess alpha offered by the top quartile of managers over the bottom quartile in the eVestment U.S. Large Cap Equity category. Alpha is calculated as one-year excess returns, gross of fees, compared to primary prospectus benchmark. Figures shown relate to past performance. Past performance is not a reliable indicator of current or future results. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Even as median managers may continue to underperform, we see growing opportunity for skilled managers to add alpha given our outlook for greater earnings and valuation dispersion ― a view we outline in our most recent Taking Stock quarterly market outlook and in our Q1 earnings recap .

Other research lends support:

- The BlackRock Investment Institute (BII) found that alpha from top-quartile large-cap U.S. equity managers increased in the post-COVID era (2020-2023) relative to the three years prior. Dispersion in alpha also edged higher, suggesting manager selection has become more important.

- Research from BlackRock Risk and Quantitative Analysis has found dispersion to be higher in the U.S. compared to Europe and the Asia-Pacific region, amplifying the opportunity to differentiate across U.S. equities.

- Bank of America’s Mutual Fund Performance Monitor reported in April that 64% of active managers had outperformed their benchmarks in Q1 2024, the best quarter since 2007.

We acknowledge that active investing is subject to periods of outperformance and periods of underperformance. We believe the goal should be a steadier experience across time that results in alpha gains over a 5- to 10- year horizon. This requires sourcing a manager with a sufficiently strong investment process and fundamental research capabilities to offer long-run consistency, alongside a track record of providing an investment experience aligned to its stated objective.

Bottom line

The impact of alpha in the U.S. on the whole portfolio is significant and potentially misunderstood. Even lower U.S. alpha is meaningful in a whole-portfolio context given the increasingly outsized U.S. representation in global indexes. For investors seeking to increase their portfolios’ alpha potential, we find large-cap U.S. equities to be an underappreciated place to target that exposure.

*****

About the author

Antonio (Tony) DeSpirito, Managing Director, is Global Chief Investment Officer of Fundamental Equities. He is also lead portfolio manager of the BlackRock Equity Dividend and value portfolios.

Copyright © BlackRock