by Adam Turnquist, Chief Technical Strategist, LPL Research

Additional content provided by John Lohse, CFA, Senior Analyst, Research.

The Russell 2000 Index, a key benchmark for small cap stocks, advanced an impressive 6% last week, outperforming the S&P 500 by the widest margin since November 2021. This surge brought the small cap index to its highest level since January 2022, signaling a potential breakout for a sector that has largely underperformed in recent years. So, what’s been propelling this asset class to its highest levels in over two and a half years, and is it sustainable?

Inflation Cooperating

It’s hard to start any conversation about small caps without first analyzing the inflation environment. The headline Consumer Price Index (CPI) reported last Thursday, declined 0.1% in June (the first monthly decline in over four years!) and rose 3.0% year over year. This print was largely cheered on by small cap investors. An hour after the report came out, upon the market's opening, the Russell 2000 immediately traded 1.5% higher than Wednesday’s close and finished the day up over 3.5%. That marked the largest one-day gain from the index since November of last year.

Watch the Fed and Interest Rates

June’s CPI report was welcome for small cap stock prices because smaller companies generally rely on borrowing to fund operations. As inflation cools, the expectation that the Federal Reserve (Fed) will cut rates increases, therefore, creating a lower cost of capital for debt-dependent companies. The Fed will meet four more times this year in July, September, November, and December. The probability for a rate cut in July remains low, however, markets are pricing in a greater than 90% chance for a 25 basis-point cut (0.25%) in September. For context, only a month ago, the market was pricing in just a 62% chance of a September rate cut. If the market is right, this would mark the first cut since the depths of COVID-19 in March 2020.

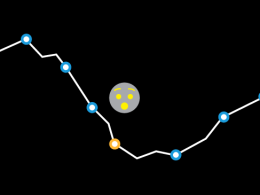

The chart below highlights the probability of the fed funds rate following the September 17–18 Fed meeting over time. Currently, the target rate sits between 5.25–5.50%. Shown below is the uptick in the probability for a rate of 5.00–5.25% after Thursday’s CPI report, indicating a greater than 90% probability of a 25-basis-point cut. The spike in probability coincided with a 3.5% Russell 2000 rally last Thursday.

Target Rate Probabilities for September 18, 2024, Fed Meeting

Source: LPL Research, CME Group, 07/15/24

Adding to more speculation of the start of Fed rate cuts, on Monday, Fed Chair Jerome Powell indicated an unwillingness to wait until inflation hits its long-run 2% rate, saying “The implication of that is that if you wait until inflation gets all the way down to 2%, you’ve probably waited too long.” Powell did curtail that comment a bit by stating that the Fed is searching for “greater confidence” inflation will return to the 2% level. Nonetheless, small caps continued their rally on the comments, with the Russell 2000 finishing up 1.8% on the day, beating the S&P 500 by over 1.5%.

Improving Technical Analysis Picture

The technical backdrop for small caps has improved following the recent rally. Below, we examine the price action on the S&P Small Cap 600 Index. After a rally late last year, the index consolidated and traded sideways for much of 2024, finding support at its August 2023 high of 1,254. The recent move higher last week pushed the index above its 50-day moving average, as highlighted in the top panel. Below, the bottom panel details the relative strength of the index versus the S&P 500 index, showing the near-term rebound is trying to thwart the year-long downtrend.

Early Signs of a Technical Shift

Source: LPL Research, Bloomberg 07/15/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

Economic Conditions May Bring Headwinds in the Second Half

Before we get too excited about small caps, we need to examine the economic backdrop. The jubilee of the recent small cap rally should be tempered as we expect to find signs of a weakening economy in the latter half of 2024. Strong consumer spending has staved off the hard-landing narrative, but we’ve seen a shift away from big-ticket purchases. Today’s retail sales report indicated a month-over-month decrease in auto sales, while sales at sporting goods and hobby stores declined for the third time in four months, and restaurant spending decelerated.

The labor market has also shown signs of cooling as initial jobless claims have been ticking higher since the start of this year. The unemployment rate remains historically low but is expected to pick up in the second half.

Despite attractive valuations, improving technicals, and potential rate cuts, a slowdown in economic growth and a softening labor market could make the bull case for small caps much more opaque.

Summary

There seem to be competing factors underpinning small cap performance. For now, more immediate data points like CPI and Fed projections are igniting small-market-cap names higher. However, at this point, it remains to be seen if a longer-term economic slowdown will balance out the recent step higher. In this case, we’d expect more difficulty for small cap growth in particular, as it has a higher sensitivity to economic health than small cap value. A portion of small cap stocks, mainly regional banks on the value side, could continue to benefit from elevated lending rates if the higher-for-longer policy takes hold. For these reasons, LPL Research maintains a neutral stance on small cap equities with a bias towards high quality. We don’t want to miss spikes in price appreciation as we’ve recently seen, but if economic weakness indeed persists, we want to be positioned in more profitable segments of the small caps and remain careful. The late-cycle characteristics of this economy and the increase in expected volatility require a watchful and targeted approach at this point.

Copyright © LPL Research