by Tony Davidow, CIMA®, Senior Alternatives Investment Strategist, Franklin Templeton Institute

Franklin Templeton Institute’s Tony Davidow sits down with Daniil Shapiro of Cerulli Associates to discuss the growing interest in alternative investments among advisors, the increased availability of private market funds, and the need for better alternatives education.

In the latest episode of our Alternative Allocations podcast series, I had the opportunity to sit down with Daniil Shapiro of Cerulli Associates. Daniil and I discussed Cerulli’s research on alternative investments, focusing on advisor adoption and product evolution, and how the industry is embracing the sector. We focused on the growth and adoption of private market funds. Today’s environment is unique in that asset managers are delivering products that advisors and investors are clamoring for, in structures that align everyone’s interests.

Daniil and I discussed some of the challenges for advisors, including alternatives education, illiquidity, and operational difficulties. We discussed how we can help advisors move from the current industry average of roughly a 6% allocation to alternatives, to a more impactful 15%-20% allocation, depending on each client’s goals, objectives, and time horizon. Daniil stated, “. . . it comes down to the enhanced liquidity products that are being increasingly made available to them. It’s using platforms like iCapital and CAIS in order to streamline the access to alternative investment exposures.”

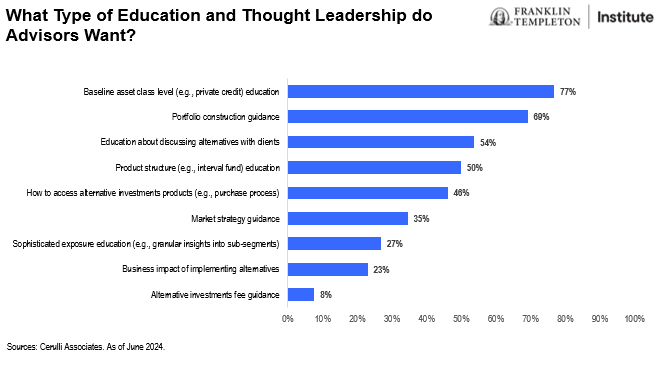

We discussed the importance of developing alternative education and thought leadership to help advisors and investors. Daniil also stressed the importance of having dedicated resources to help educate, sell and support alternative investment offerings. In several industry studies, including Cerulli’s research, advisors recognize the value of private markets, and have indicated a desire to increase their exposure.

Daniil shared the types of education and thought leadership that are most helpful for advisors. Advisors are seeking asset-class education, guidance on portfolio construction, help with communicating the merits of alternatives to clients, and education regarding the tradeoffs of the various structures.

Given Cerulli’s unique vantage point, I asked Daniil where he thought we would be as an industry in the next 10 years. He stated that “advisors are going to be allocating more to alternative investments. They’re going to be allocating more to these high-quality alternative investment products.” He said he anticipated trillions of dollars would be available across the US wealth channel.

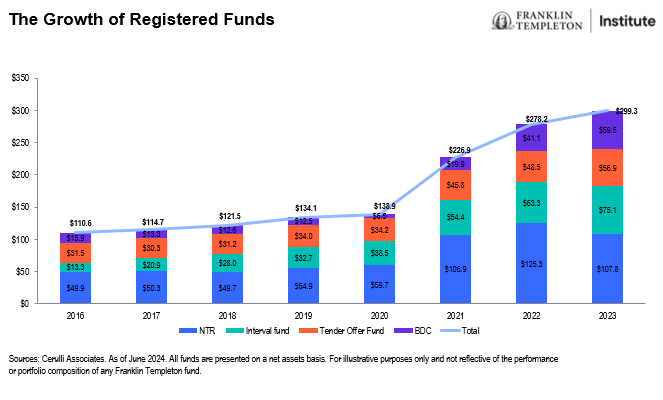

Daniil mentioned there would be winners and losers, and the assets would not be distributed evenly. He predicts that semi-liquid structures like interval and tender-offer funds will benefit from advisor adoption due to their flexible features and ease of access.

While there has been a lot of interest in the growth and adoption of alternatives in the wealth channel, the percentage allocated to alternatives has stubbornly remained about 6% over the last decade, despite advisors recognizing the need and advantages of increasing their allocations.

We believe this growth and adoption will be driven by a market environment that demands a more robust toolbox, product innovation that makes private markets more accessible to a broader group of investors, and access to institutional-quality managers.

Make sure you don’t miss an episode by subscribing to Alternative Allocations on Apple, Spotify or wherever you get your podcast.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. An investment strategy focused primarily on privately held companies presents certain challenges and involves incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity. Diversification does not guarantee a profit or protect against a loss.

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S. by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorized Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Trust Management Co., Ltd., 3rd fl., CCMM Building, 12 Youido-Dong, Youngdungpo-Gu, Seoul, Korea 150-968. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E and Legg Mason Asset Management Singapore Pte. Limited, Registration Number (UEN) 200007942R. Legg Mason Asset Management Singapore Pte. Limited is an indirect wholly owned subsidiary of Franklin Resources, Inc. 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.