by Jordan McCall, Russell Investments

Executive summary:

- U.S. small cap stocks have struggled significantly in the past decade compared to their large cap counterparts, with only three other periods in the past 100 years charting a worse performance. Notably, each of these instances was followed by a period of meaningful outperformance.

- The current underperformance of small cap stocks can largely be attributed to a decline in the number of publicly listed U.S. companies, brought about by an uptick in mergers and acquisitions. We think that shifting regulatory scrutiny toward large cap companies, coupled with new opportunities for smaller firms created by future innovations such as AI, could open the door to increased listings for small caps.

- We believe an allocation to small cap equities is still a good idea, and think that skilled active management strategies can exploit small cap areas of the market more effectively. In our view, the combination of scarce sell-side analyst coverage and low stock-level correlation provides strong opportunities for skilled active managers.

Introduction

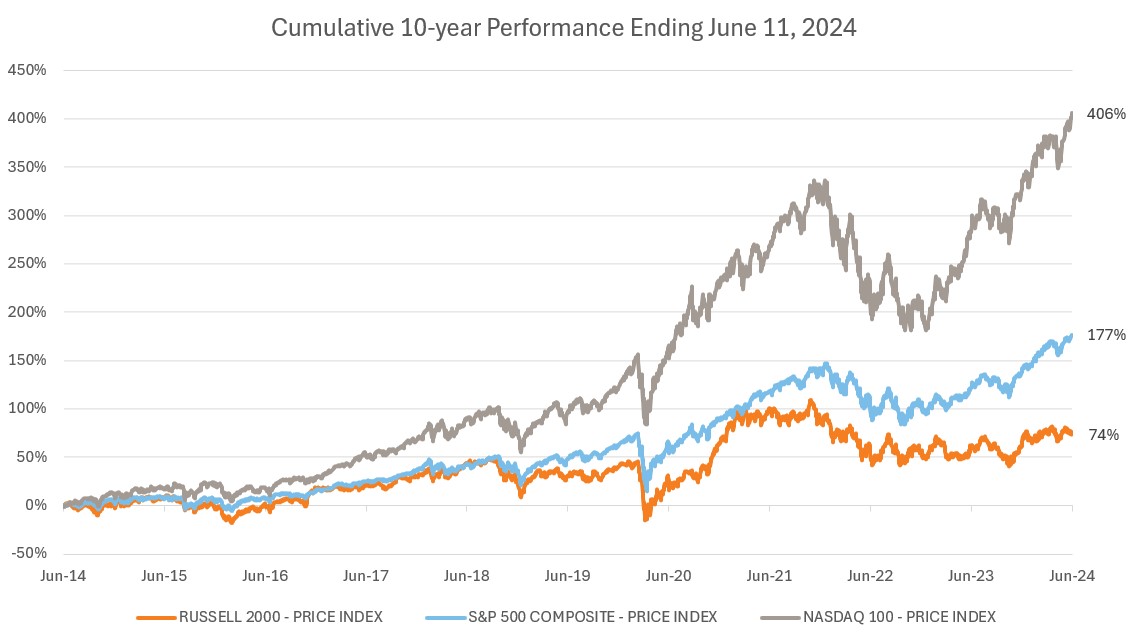

Small cap performance has been a hot topic lately, with many pundits declaring the small cap premium on life support or dead altogether. To wit, over the last ten years the Russell 2000® Index has cumulatively underperformed the S&P 500® Index by approximately 103% and the Nasdaq 100 Index by an astonishing 332%.

Source: LSEG Datastream, Russell Investments, June 11, 2024

Explanations and prognostications abound as to why this happened and what lies ahead. Is the rise of private equity (PE) to blame for keeping firms private so long that they only go public as large caps? What about the regulatory environment? Are mega-cap tech firms buying up all the best small cap firms before they go public? Can we expect current trends to continue and thus declare small caps permanently fallen from grace? Finally, what should a prudent, long-term, forward-looking equity investor do with their small cap allocations from here?

All good questions that deserve a deeper dive into the topic. In this article, we will:

- Review the empirical evidence around the small cap premium.

- Analyze the drivers behind small cap's struggles.

- Re-examine Russell Investments' views on small cap.

- Provide some thoughts on how to move forward when it comes to small cap.

The small cap premium review: Small minus big. Tell me what that is again?

In the early 1990s Eugene Fama and Kenneth French developed what is now known as the Fama/French Three Factor Model. The Fama/French model expanded the Capital Asset Pricing Model (CAPM), adding a Size factor (Small Minus Big, which represents the excess return of small cap stocks over large cap stocks, or SMB for short) and a Value factor (High minus Low or HML). They found that up until that time, over the long term, there was a return premium for owning smaller stocks relative to large stocks and cheaper stocks versus more expensive stocks (using book-to-price as the valuation model). While the same questions above could be asked about Value stocks, we'll just focus on smaller cap stocks in this article.

The beauty of the Fama/French model is that they maintain and publish all the model's historical data regularly on their website. Below you can see the 3-year excess returns of SMB in the U.S. going back to 1927, along with the 20-year moving average. There are several things we can glean from this data set:

- The evidence of a small cap premium is quite clear for close to 70 years up to the early 1990s.

- Conveniently, shortly after Fama/French started publishing this phenomenon, the premium degraded during the TMT bubble.

- However, small caps came roaring back in the 2000s, last peaking in 2010 before the prolonged struggle through zero interest rates, COVID and the rise of the mega-cap tech stocks.

- While the trend downwards is notable from 1995, the SMB premium 20-year moving average has settled at around +2%, but has degraded slightly in the most recent downturn.

- Speaking of recent downturns, we can see that, as of early 2024, SMB excess returns are reaching points of underperformance only seen at 3 other times in its 100-year history. In the prior three periods (1931, 1974, 1999) when SMB had underperformed by this much, average trough to peak 3-year outperformance of SMB was 34% in the ensuing periods of recovery.

Where to lay the blame for recent small cap struggles?

Migration and the lottery effect.

In 2006, Fama and French furthered their research on the Size factor, noting that a big source of the small cap premium came from a few stocks in the small cap universe experiencing outsized returns, ultimately becoming large cap stocks in the process. They called this phenomenon migration. Effectively, investors who buy a lot of small cap stocks are purchasing outsized amounts of lottery tickets and getting the outperformance via a few winners. The problem is that there seems to be a diminishing number of winning tickets these days. The search to understand why leads us to the listing gap.

The listing gap: What is it—and is it a problem?

From 1996 to 2019, the number of publicly traded companies in the U.S. declined by about 50%, from 8,090 in 1996 to 4,266 in 2019. This occurred despite the total number of publicly traded companies outside the U.S. increasing during the same period. This has been labeled the listing gap and has been the subject of several academic studies.

Source: "Dissecting the Listing Gap: Mergers, Private Equity, or Regulation?"; Lattanzio, Megginson, Sanati; 2023

One important thing to note about the listing gap is that outside the U.S. this issue is far less prevalent. While there has been some evidence in Germany, France and the UK, listings have expanded elsewhere. Essentially, the listing gap is primarily a U.S. phenomenon.

Research shows that the U.S. listing gap can be explained primarily by three factors: 1) the rise of private equity; 2) changes in regulatory requirements; and 3) market consolidation via mergers and acquisitions. The most recent study comes to a few important conclusions1:

1) Regulation definitely has had an impact, mainly from the Sarbanes-Oxley Act of 2002 (SOX). SOX was passed in response to several accounting scandals during that time and placed stricter audit standards and disclosure rules on publicly traded companies. However, this impact was primarily felt in the mid-2000s. The passage of the Jumpstart Our Business Startups (JOBS) Act of 2012 alleviated this factor.

2) While the dramatic growth of private equity has kept companies from public markets, this effect is only temporary as public listing remains the most rewarding exit strategy. As such, the findings show that PE's impact is merely private for longer, rather than permanently private.

- One argument that has been made with respect to private for longer is that firms are waiting so long that when they do finally IPO, they list as large cap stocks. Our research shows that while there are a few anecdotal examples of this, the vast majority of public listings still start as small caps. Of the 154 U.S. IPOs in 2023, just four are currently in the Russell 1000.

- And if you are looking for anecdotes, we will point you to super micro, a recent small cap success story that has outperformed NVIDIA by ~1400% over three years!2

3) The biggest driver of the listing gap is M&A (mergers and acquisitions) activity. In fact, since the late 1990s six large tech firms (Google, Microsoft, Apple, Meta, Amazon and NVIDIA) have acquired over 870 companies! The research further reveals that within M&A, the major driver is larger firms acquiring private firms, effectively keeping smaller companies from ever listing. Examples of private companies purchased in this group include YouTube, Ring, Skype and Instagram, to name a few. In short, these six behemoths swallowed many of the potential lottery tickets that public investors never had a chance to purchase.

So where does this leave the small cap premium?

If we don't have past regulation to blame, and if PE is not truly an obstacle in companies ultimately listing, the big question is should we expect the M&A activity of the world's largest tech firms to continue to limit listing opportunities for small caps? It's a great question and very difficult to predict, of course. That said, there are a couple of emerging factors that could make an impact.

Growing regulatory scrutiny

As noted above, the early 2000s saw increased regulatory scrutiny that impacted small caps. The regulation pendulum now appears to be swinging towards large caps. In the U.S., EU, Canada and Australia, we are seeing increased litigation and regulatory updates that are challenging big tech's heretofore unimpeded dominance. Governments across the globe have multiple active cases against Apple, Google, Amazon, Microsoft and Meta. While the outcome of this activity is unknown, what is clear is that regulators are going to be paying a lot more attention to M&A activity in this space, which could slow the pace of acquisitions by these firms in the future.3

Yesterday's realities aren't tomorrow's trends

Big Tech is currently dominated by what is known as Web 2.0. These are the winners of Web 1.0 that rose from the ashes of the dotcom bust. And unless you've been living under a rock for the last year, the AI (artificial intelligence) transformation is taking off. While AI press coverage is dominated by NVIDIA's rise (at one time a small cap stock!) and how the big tech Web 2.0 firms are racing against each other for AI dominance, what is often missed are the opportunities that AI is creating for smaller firms broadly across industries. This development has the potential to create an entirely new class of winners that will likely emerge from today's privately held startups and publicly traded small cap stocks. In fact, EY recently looked at privately held AI firms and uncovered more than 250 with IPO exit plans. To the international point previously mentioned, it is worth noting that 85 are outside the United States.

What is the role of public markets anyway?

A final point to consider when looking forward is to consider why we have public markets in the first place. Stock markets play a pivotal role in driving economic growth, efficient allocation of capital, price discovery and democratization of investment opportunities.4 In fact, a recent study found that "a dollar of equity allocated through public markets generates at least two times more revenue and patent applications than a dollar allocated to comparable firms in private markets."5 In short, the concept of public ownership of firms has been crucial to innovation and advancement over the last century. As long as public listing remains a primary exit strategy for privately held firms, we expect this symbiotic relationship to continue to drive healthy and thriving returns for investors in both public and private markets.

How does Russell Investments view small cap stocks?

To quote our statement of belief directly, "Russell Investments believes that there are long-term advantages to overweighting smaller-capitalization stocks that are best captured through active management and well-researched factor exposures."

In other words, we believe in the small cap premium but also believe that passive allocations are subject to high volatility and long periods of underperformance relative to large cap. In our view, skilled active management strategies can exploit small cap areas of the market more effectively. The combination of scarce sell-side analyst coverage and low stock-level correlation provides strong opportunities for skilled active managers.

That sounds good but I want proof!

An obvious area to highlight the risks to passive small cap is quality. If you buy the entire Russell 2000 Index, 35% of the companies you own are not profitable! In fact, research done by AQR and extended by Peter Kraus, a European small cap portfolio manager at Berenberg, finds that if you can focus on higher quality stocks within the index, the small cap premium in the U.S. is an order of magnitude higher.

Where do we go from here?

Allocating to small cap is still a good idea

What can we do with all this information? A lot actually. For starters, we believe investors with an allocation to small cap equities should maintain it, and those who don't should consider adding one. The SMB data show us that we appear to be approaching a cyclical low point for small cap that has only happened a few times in its 100-year history, and each time in the past it was followed by meaningful periods of outperformance. Public markets remain the ultimate arbiter of success, providing transparent price discovery and efficient capital allocation. The academic research and recent trends in regulation and AI point to myriad opportunities for today's startups and smaller companies to be among tomorrows biggest winners.

Go active

We believe there are many advantages to actively managing a small cap allocation. A key benefit is that you're able to pick and choose the companies you want to invest in. This contrasts with a passive approach where you automatically own a large percentage of unprofitable companies. In addition, small caps have lower cross-sectional correlation and higher cross-sectional volatility, which gives active stock pickers greater choice within their opportunity set to "buy low and sell high". Finally, they have lower—and decreasing—numbers of sell-side analyst coverage, resulting in more pricing inefficiencies that can be exploited.

Go global

It should be noted that most of the analysis we have done here focuses on the U.S. market. However, the research shows that 1) similar opportunities for long-term outperformance exist outside the U.S.; 2) the listing gap is far lower or non-existent in non-U.S. countries; and 3) going global broadens the universe extensively for skilled managers to find the winning lottery tickets over the next market cycle.

1 "Dissecting the Listing Gap: Mergers, Private Equity, or Regulation?" Lattanzio, Megginson, Sanati; 2023; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3329555

2 Source: Russell Investments research

3 Source: https://www.politico.com/news/2024/05/03/tech-companies-us-eu-battles-00156110

4 Lattanzio, et al; 2023; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3329555

5 "Comparing Capital Allocation Efficiency in Public and Private Equity Markets" Sanati, Spyridopoulos; 2024; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4403578

Copyright © Russell Investments