by AllianceBernstein Equity Research

The world’s central banks have made great strides in tamping down inflation over the past year. But as investors are discovering, fighting inflation is a long game. US economic growth slowed to an annualized 1.6% in the first quarter—even as core inflation ticked up close to 4%. Near-term activity indicators are showing some evidence of recovery, but we expect overall economic growth to trend lower.

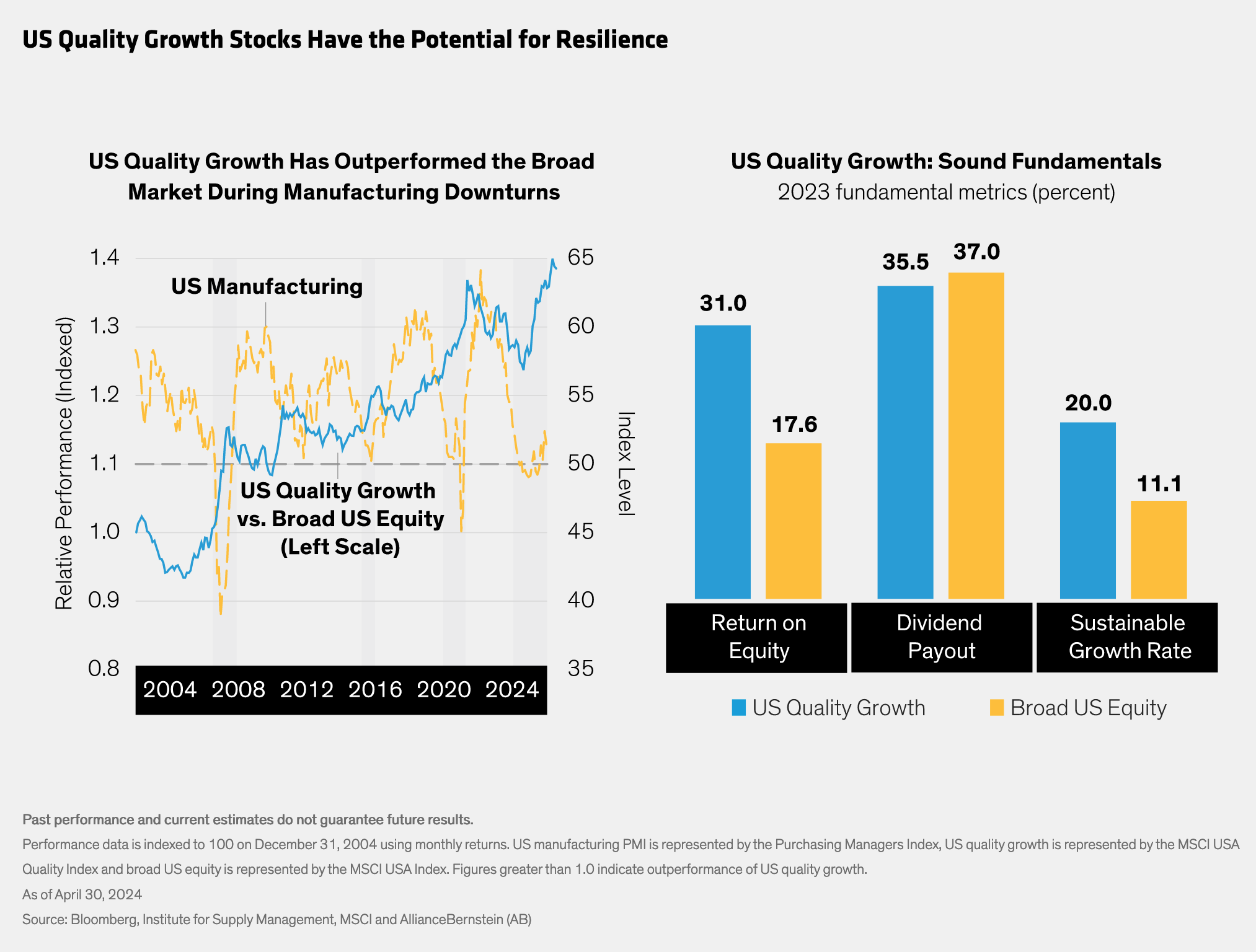

In our view, the playbook for a mixed economic backdrop calls for both offense and defense—that is to say, growth and quality equity exposure within multi-asset strategies. Historically, US quality growth stocks have outperformed the broad US equity market (Display) when manufacturing activity slows—as indicated by the Purchasing Managers’ Index (PMI) falling below 50. Even when manufacturing activity returns to the expansionary zone, these same stocks have held up well.

That behavior seems intuitive to us. After all, when the economy is picking up steam, growth stocks offer the potential to capture market gains. But hallmarks of quality—including sustained earnings growth and sound underlying fundamentals—may help weather economic headwinds. Quality companies also tend to prioritize reinvesting their profits over paying out dividends, which supports long-term earnings growth potential.

In all market conditions, we think an active, balanced approach to asset allocation makes sense. But with the US economy likely to slow and rates yet to fall, this might be an especially good time for multi-asset investors to consider US quality growth stocks.

Copyright © AllianceBernstein Equity Research