by Kristina Hooper, Chief Global Market Strategist, Invesco

Key takeaways

- Time for a rate cut? - Dovish remarks from the Federal Reserve and a cooler-than-expected US jobs report strengthened the case for a coming interest rate cut.

- Softening or slowdown? - Are we seeing the “economic softening” needed to get inflation completely under control, or are we seeing the start of a far more substantial slowdown?

- “Dr. Copper” - It’s important to note that copper prices have been on an upward climb since mid-February, despite a brief drop early last week, suggesting that the global economy is improving.

Fed meeting led to re-pricing of rate expectations

At its meeting on May 1, the Fed noted the lack of progress on the disinflation front in the last several months but indicated that it would be patient. It also pointed to the incredible progress made on the disinflationary front in the past year.

In addition, when asked about the possibility of a rate hike, Fed Chair Jay Powell dismissed it, describing it as unlikely. And when asked if the US is in a stagflationary environment, Powell was emphatic that it isn’t. Finally, the Fed also said it would be slowing the level of its balance sheet reduction.

Re-pricing of rate expectations for the year began immediately. The S&P 500 Index went up after the announcement and moved up even more after the start of the press conference. I think that speaks to the Fed's thoughtfulness and measured perspective — that it is not over-reacting to recent disappointing inflation data.

Weaker-than expected US jobs report bolsters case for a rate cut

The press conference was followed later in the week by a Job Openings and Labor Turnover Survey (JOLTS report) that showed job openings and quit rates had decreased — signs of an easing in the tight labour market.

That was followed by a US jobs report that offered an even stronger sign of a cooling labour market, strengthening the case for a rate cut. Non-farm payrolls were far below expectations at 175,000 jobs added in April.1 But the most important part of the report was average hourly earnings, which came in below expectations — up only 0.2% for the month and 3.9% year over year.1

Markets rejoiced. The moves in the 2-year US Treasury yield over the course of the week were significant, falling from an early peak above 5% to finish the week at 4.8%.2 The 10-year US Treasury yield followed a similar pattern, peaking early in the week at 4.68% only to drop to 4.5% by the end of the week.2 The S&P 500 fell early in the week, only to rally later in the week as yields eased.

Disinflation continues in the eurozone

We also got signs of disinflationary progress in the eurozone last week. The flash estimate of April inflation in the eurozone was 2.4%.3 Inflation ex-food and energy was 2.8%, down from 3.1% in March and 3.3% in February.3 Not surprisingly, we saw a similar pattern with the Stoxx Europe 600 Index last week as we saw with the S&P 500 Index.

Economic softening or substantial slowdown?

Last week seemed to support the idea that the narrative has changed, that we are still “on the disinflationary train” because Western developed economies are sufficiently cooling. As I’ve said before, I fully believe we’re still on “the D train.” However, I can’t help but worry about the long and variable effects of monetary tightening. Are we seeing the “economic softening” that we need to get inflation completely under control, or are we seeing the start of a far more substantial slowdown? I think of recent data points such as these Purchasing Managers’ Indexes (PMI):

- The Institute for Supply Management (ISM) services PMI for the US was 49.4 for April, far lower than expected and its first time in contraction territory since December 2022.4

- Chicago PMI for April was far lower than expected, clocking in at a relatively anemic 37.9.5

- The Conference Board’s April reading of US consumer confidence showed a deterioration for the third consecutive month, clocking in at 97 — which is down from 103.1 in March.6 Confidence is now at its lowest level since July 2022 with consumers less positive about the labour market and future business conditions.6

I will be vigilant given how aggressive the Fed’s tightening was and how long we have maintained rates at the peak for this tightening cycle. We would all like to think this turns out like the 1994-1995 Fed tightening cycle with the economy avoiding a recession. However, in that tightening cycle, only five months elapsed between the end of rate hikes and the start of rate cuts.7 In this tightening cycle, rate hikes ended in July 2023, and we are still waiting for our first rate cut; this allows for far more damage to potentially occur.

And, of course, the absolute level of tightening is much greater this time around, up 500 basis points versus 300 basis points in the 1994-1995 tightening cycle.7 That’s why I am very sensitive to any data and anecdotal information suggesting the economy is weakening quickly. Right now, I think it’s far more likely that we are getting the kind of economic softening the Fed wants but I am not naïve about the risks.

Copper prices suggest global growth may be improving

The good news is that the outlook for global growth seems to be improving. The Organization for Economic Cooperation and Development (OECD) updated its global outlook last week. It upwardly revised its 2024 global growth forecast to 3.1% (up from 2.9% in its previous forecast back in February) and its 2025 forecast to 3.2% (up from its last forecast of 3%).8 It’s worth noting the OECD upwardly revised its growth forecasts for both the US and China.

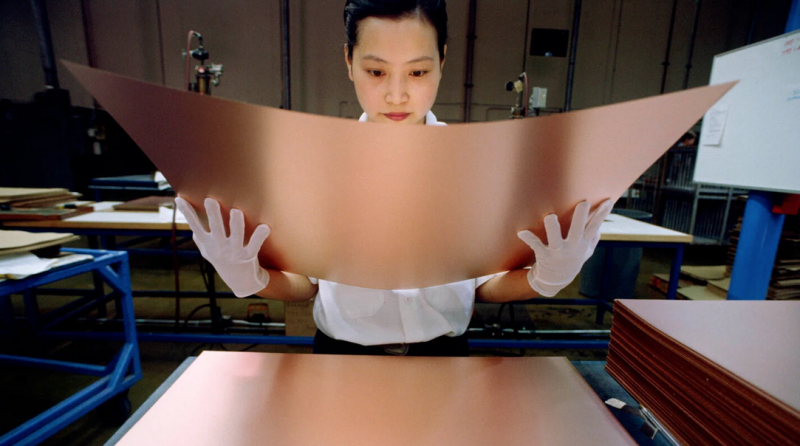

It's not just the OECD. “Dr. Copper” — i.e., copper prices — seems to be suggesting the same thing. Market watchers have long looked to the price of copper as an indicator of the health of the global economy, especially China. That’s because copper is a fundamental raw material utilized in many industries and products. When demand for copper increases, it suggests economic growth may be rising because things are being built and manufactured. Copper has been on an upward climb since mid-February, despite a brief but significant drop last week before rebounding late in the week, suggesting that the global economy is improving. I suspect global small-cap stocks could experience a sustainable rally if more signs appear of this economic resurgence.

Looking ahead

This week we will get two major central bank decisions — the Reserve Bank of Australia (RBA) and the Bank of England (BOE). Fears have risen that the RBA will actually hike at its meeting, but I think that is very unlikely; I do expect it to sound very hawkish as it uses words as a monetary policy tool.

I am particularly focused on the BOE. There has been an increase in dovish central bank speak coming from the BOE, and I think there is a possibility of a rate cut at this meeting, especially after the Fed’s dovish performance last week. If there is not a rate cut this week, I fully expect a dovish BOE that will signal rate cuts may start this summer, most likely in June like the European Central Bank is messaging.

I will also be interested in a number of data releases coming out this week, including the April jobs report for Canada to see if there is a similar easing in the labour market, especially wage growth. And, of course, the University of Michigan reading of inflation expectations is must-see data for me, just to ensure inflation expectations remain well anchored. UK gross domestic product, industrial production and business investment will also be important.

Copyright © Invesco