by Russ Koesterich, CFA, JD, Portfolio Manager, BlackRock

In this article, Russ Koesterich discusses why the current momentum trade, despite stretched valuations, could continue.

Key takeaways

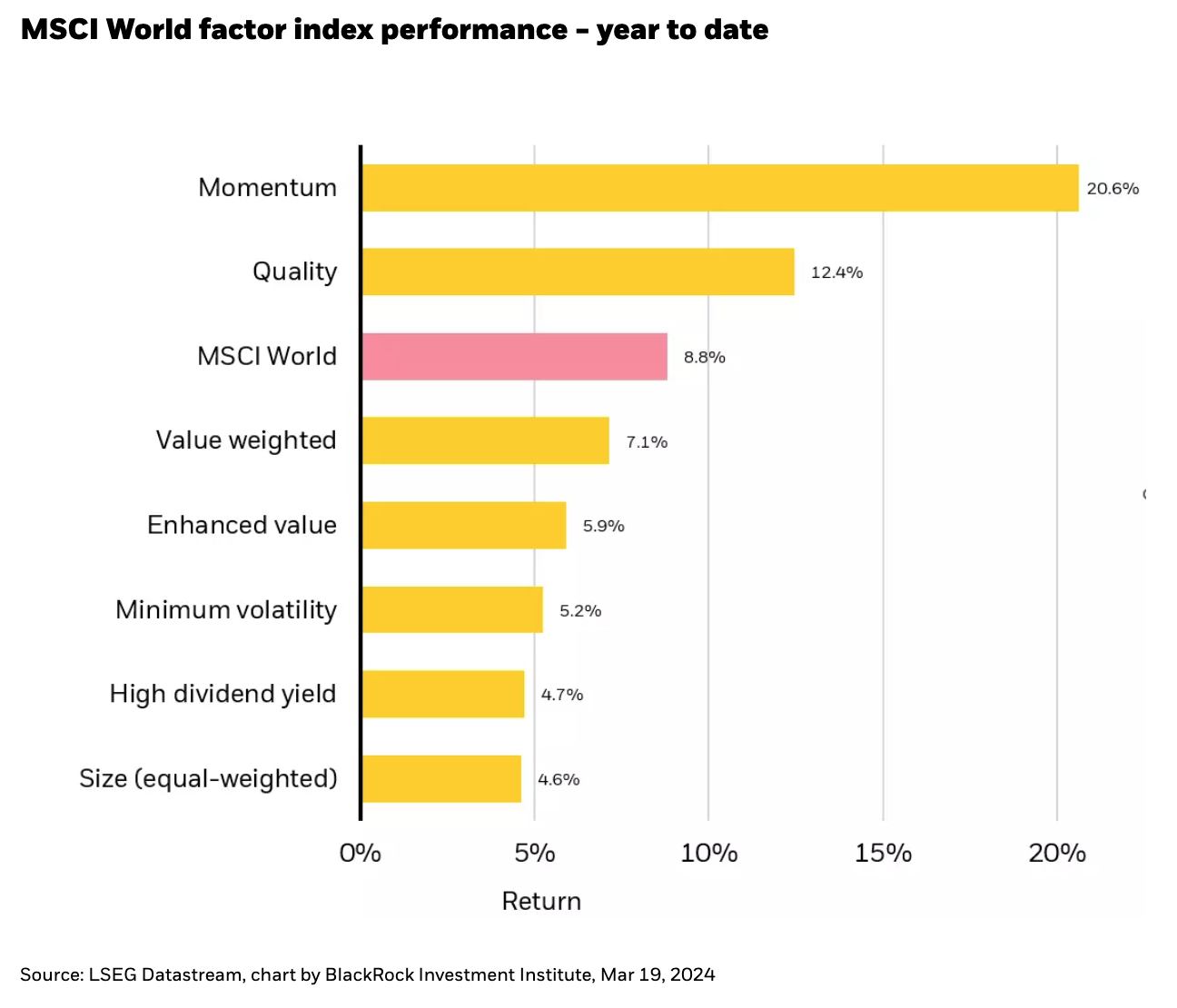

- Year to date, technology related companies have been the market leaders, with an increased focus on the ability to generate cash-flow. From a style factor lens, momentum has been the winner.

- Historically, this style has often been associated with more speculative, lower-quality parts of the market. Today, momentum names are increasingly high-quality businesses with consistent profitability – something investors are willing to pay a premium for.

Markets have been on a tear, driven by solid earnings and a benign economic backdrop. And while a chorus of commentators is increasingly pointing to a replay of the late 1990’s technology bubble, there is one important difference: cash flow generation. Today’s technology related market leaders are incredibly powerful businesses levered to long-term secular trends. While this does not guarantee perpetual dominance, and valuations do ultimately matter, we believe it can support the trend to continue in the near-term.

I last discussed the technology (tech) sector in November of last year. At the time the market was still trying to recover from last fall’s backup in U.S. long-term interest rates. My view at the time was that tech might provide a measure of safety in a volatile market.

While markets have rallied sharply since then, the same logic holds. Tech and tech-related names are still benefiting from the generation of high-quality cash-flow, something most investors prioritize in the current environment. Adding to this subset buying, year-to-date a new group of investors have been chasing this trend: momentum players (see Chart 1).

Momentum investors typically focus on stocks that are rising the fastest, often using a one-year time frame to measure. Last year the momentum factor struggled relative to other investment styles. Chasing trends was difficult when the economic and market narrative kept shifting every few months.

More recently, as recession fears fade and a soft-landing seems to be taking hold, momentum has enjoyed a resurgence. The investment style has also been supported by an increasing fixation on long-term structural themes, notably artificial intelligence. As a result, year-to-date, momentum has significantly outperformed other investment styles, such as value investing (see Chart 1).

What is interesting about the current rally is the composition of the companies included in the momentum trade. In the past, momentum has often been associated with more speculative, lower-quality parts of the market. Today, momentum names are increasingly high-quality companies, i.e., firms defined by high profitability, consistent earnings, and relatively low debt. This dynamic is evident in the increasing representation of highly profitable companies, as measured by return-on-equity, ROE, in momentum strategies measure of a company's net income divided by its shareholders' equity ).

We see a similar pattern using more granular systematic signals. Based on research by the Global Allocation systematic research team, the top performing signals in Q1’24 have mostly been tied to cash-flow momentum and earnings. Based on this research, some of the best performing systematic signals are cash-flow momentum, analyst revisions, margin consistency and stable revenue growth. Put differently, investors are investing in companies generating strong cash-flow and consistent earnings.

Momentum may have further to go.

The rally in mega-cap growth has been going on for some time. For many of these names, valuations appear stretched, if not outright expensive. That said, company fundamentals underpinning the rally are still very much in place. To the extent many of these businesses are levered to long-term trends such as artificial intelligence, semiconductors (a key component in AI enablement), internet commerce, and innovations in pharmaceuticals, the momentum trade may continue a bit longer.

Copyright © BlackRock