by John Lynch, CIO, & Team, Comerica Wealth Management

The U.S. equity markets managed to maintain their momentum from last year throughout the first quarter. Unlike the Magnificent 7 driven strength exhibited during 2023, the other 493 stocks gained traction over the past three months, supporting the potential to sustain the bull market.

Executive Summary

- A curious aspect of the first quarter equity gains, however, was that as the catalyst shifted, the momentum persisted. Lowered expectations for Fed rate cuts were supplanted by optimism over economic and profit growth.

- While the Magnificent 7 still experienced strong tailwinds from AI optimism and Nvidia, the remaining 493 stocks in the S&P 500® still managed to climb approximately 8.0% on average last quarter.

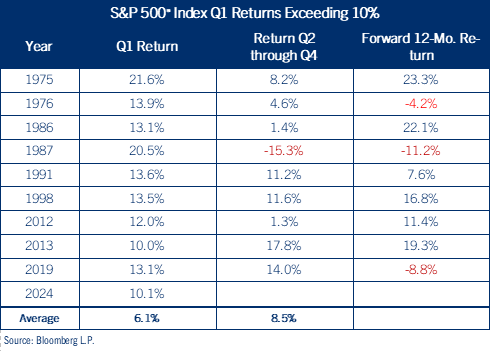

- Since 1970, when the S&P 500® has risen more than 10.0% in the first quarter, the Index climbs by an average of 6.1% for the remaining three quarters, with positive returns in eight of the nine occurrences.

Of course, a potential full year return of this magnitude would essentially double the average return expected during a presidential election year. Technical tailwinds are evident, though fundamentals remain dependent on other factors including demand, pricing, geopolitics and policy.

In next week’s report we’ll explore market fundamentals a little further, emphasizing corporate earnings and equity market valuation.

Strong 1st Quarter

The U.S. equity markets managed to maintain their momentum from last year throughout the first quarter. Indeed, after surging by ~24.0% in 2023, the S&P 500® Index climbed by ~10.0% during the first three months of this year.

A curious aspect of the first quarter equity gains, however, was that as the catalyst shifted, the momentum persisted. Since the October 2023 low, the primary driver for market sentiment was the anticipation of six interest rate cuts by the Federal Reserve this year. As time passed and inflationary pressures firmed, market expectations for monetary accommodation have essentially been cut in half. The Fed Funds futures markets now project three cuts this year, though recent economic data points suggest those hopes may prove elusive in the months and quarters ahead.

Nonetheless, the collective thinking transitioned to the combination of solid employment, a return to corporate profitability and the transformative expectations of artificial intelligence (AI) would offset any Fed disappointment to propel the economy, and the equity markets, sufficiently higher. See table: Equity Index Performance – 1st Quarter.

Improving Participation

Market leadership was broad-based during the first quarter. Large caps continued to outperform small caps and growth stocks maintained their advantage over value. 10 of the 11 sectors in the S&P 500® were positive to start the year, with Communications Services and Energy leading the way. Only the interest rate sensitive Real Estate sector pulled back (fractionally) over the past three months.

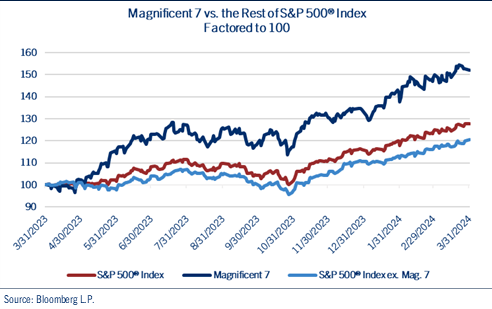

It is important to note that the “Magnificent 7” stocks, which powered the Index higher last year, lost some momentum last quarter as previous stalwarts Apple, Tesla and Alphabet (Google) all struggled. It was the remaining stocks in the S&P 500® – the “Pretty Good 493” - which enabled the equity markets to persist higher. See chart: Magnificent 7 vs. the Rest of S&P 500® Index.

While the Magnificent 7 still experienced strong tailwinds from AI optimism and Nvidia, the remaining 493 stocks in the S&P 500® still managed to climb approximately 8.0% on average last quarter. This trend was also evident in the Equal-Weighted S&P 500®, which climbed by a similar magnitude during the first three months of the year.

We view this rotational shift as an important development for the potential sustainability of this bull market.

Potential for Follow Through

A final point to note is that in the equity markets, history shows that early-year success often begets further gains as the calendar year progresses. Since 1970, when the S&P 500® has risen more than 10.0% in the first quarter, the Index climbs by an average of 6.1% for the remaining three quarters, with positive returns in eight of the nine occurrences. See table: S&P 500® Index Q1 Returns Exceeding 10%.

Of course, a potential full year return of this magnitude would essentially double the average return expected during a presidential election year. Many market dynamics can come into play, including both technicals and fundamentals. Technical tailwinds are evident, though fundamentals remain dependent on other factors including demand, pricing, geopolitics and policy.

In next week’s report we’ll explore market fundamentals a little further, emphasizing corporate earnings and equity market valuation.

Be well and stay safe!

*****

Contributors

John Lynch

Chief Investment Officer

Comerica Wealth Management

Deborah Koplik

Director Portfolio Management

Comerica Wealth Management

Matthew Anderson

Senior Analyst

Comerica Wealth Management

Copyright © Comerica Wealth Management