by Kristina Hooper, Chief Global Market Strategist, Invesco

Key takeaways

| Bank of Canada (BOC) The BOC is reluctant to be a first mover on rate cuts and remains anxious about inflation, despite a loosening labor market. |

European Central Bank (ECB) ECB President Christine Lagarde said the bank is making good progress toward its inflation target and is feeling more confident, but it will know a lot more in June. |

US Federal Reserve (Fed) The Fed will no doubt keep rates static this month, but change is in the air as Fed Chair Jay Powell recently suggested that rate cuts are coming soon. |

It’s March, and for many of us in the US (and for some around the world), this month is most notable for being college basketball championship season. We’re about to witness the culmination of hard work, sacrifice, and strategic vision that has been years in the making for these student-athletes. I can’t help but draw comparisons to central banks, and how investors are closely watching them this month for signs that central bankers believe they have seen enough success in achieving their goals and will soon be ready to change their policies.

The matchup: Central banks vs. inflation

Today’s monetary policy “season” began in 2022, when central bankers in Western developed economies started hiking rates to combat inflation; it’s taken them years to get where they are today. The next few months and beyond – rather than a few weeks of playoff games -- will likely tell us whether their efforts have been successful.

The good news is that, like many youth sports programs nowadays, everyone can be a winner. Central banks aren’t competing against each other. They need only meet their objectives — for most, that means merely vanquishing too-high inflation. They all seem on track to do that, although each has its own particular strategy for success given the individual characteristics and factors impacting each respective economy.

This is where we currently stand:

Bank of Canada: Not ready to cut rates yet

The Bank of Canada (BOC) met last week and registered its apprehension about cutting rates just yet. BOC Governor Tiff Macklem was rather emphatic that “It’s still too early to consider lowering the policy interest rate.”1 I think the Bank of Canada is reluctant to be a first mover and remains anxious about inflation, which seemed appropriate at first blush given the strong February jobs report released on Friday. It showed 41,000 jobs were created last month in Canada, about double what was expected.2 Canada is experiencing a significant increase in population, however, so the labour market is loosening. Wage growth remains elevated but has eased to 4.9% year-over-year.2

European Central Bank: Confidence is growing

The European Central Bank (ECB) met last week and decided to keep its key policy rate static, although it seems closer to the start of rate cutting. It’s seeing some signs of improvement in the services economy: The S&P Global/HCOB services Purchasing Managers’ Index (PMI) for February was 50.2, the first time it has been in expansion territory (over 50) in seven months.3

However, despite this positive development, the manufacturing sector remains disappointing. What’s more, in February the European Commission downwardly revised its forecast for economic growth for 2024 as well as its forecast for inflation. 4 The eurozone economy is clearly cooling.

As ECB President Christine Lagarde explained last week, "We are making good progress toward our inflation target, and we are more confident as a result – but we are not sufficiently confident. We will know a lot more in June."5

US Federal Reserve: Change is in the air

The Federal Reserve (Fed) will no doubt keep rates static as well when it meets this month, but change seems to be in the air. We got to hear a lot from Fed Chair Jay Powell last week during his two-day Humphrey-Hawkins testimony before Congress. There were many takeaways and a lot of quotes from this semi-annual event but key highlights for me were:

- He said rates are at their peak for this cycle (which was good to hear, as there have been some rumors about the potential for a rate hike rather than a cut in the near term).

- He sees no elevated risk of recession right now.

- Longer-term inflation expectations remain well anchored (an important consideration for the Fed in its decision-making process).

- Most importantly, Powell suggested that rate cuts are coming soon, “We want to see a little bit more data so that we can become confident and so that we can take that step of beginning to reduce policy rates.”6

Powell’s testimony helped change market expectations about when a first rate cut may happen, with markets becoming more comfortable with June. That expectation remained consistent after Friday’s release of the February jobs report, which showed that while the United States economy remains resilient, it has cooled a bit7:

- The jobs report showed 275,000 non-farm payrolls were created in February, which was solid but not over the top. And January non-farm payrolls were revised down from a hot 353,000 to a more subdued 229,000.

- The unemployment rate rose to 3.9% from 3.7% as more participants entered the workforce, which means the labour market is loosening.

- And the single most important metric in my view, average hourly earnings, remains elevated but improved slightly, falling to 4.3% year-over-year in February from 4.4% year-over-year in January.

The madness won’t end this month

And so you could say we are in the midst of Monetary Policy Madness, although it won’t be resolved in March. This will play out over the course of 2024, and we may not know who the winners are until much later.

What we do know is that many central bankers have exhibited “herding behavior” because of fears of a resurgence in inflation; no one wants to go down in history as the next Arthur Burns (the Fed chair who presided over a massive rise in inflation in the 1970s) — and that has made them overly hawkish in their rhetoric. I harken back to the comments of former St. Louis Fed President Jim Bullard who, no longer tethered by the need to tamp down financial conditions as a Fed official, proclaimed last month that the Fed should start cutting in March.

I don’t believe they’ll cut in March, but they know policy is very restrictive and they should be cutting soon, regardless of the state of the economy. Despite progress toward central bank goals, markets are likely to continue to worry about each data point and what it will mean for central bank decision-making.

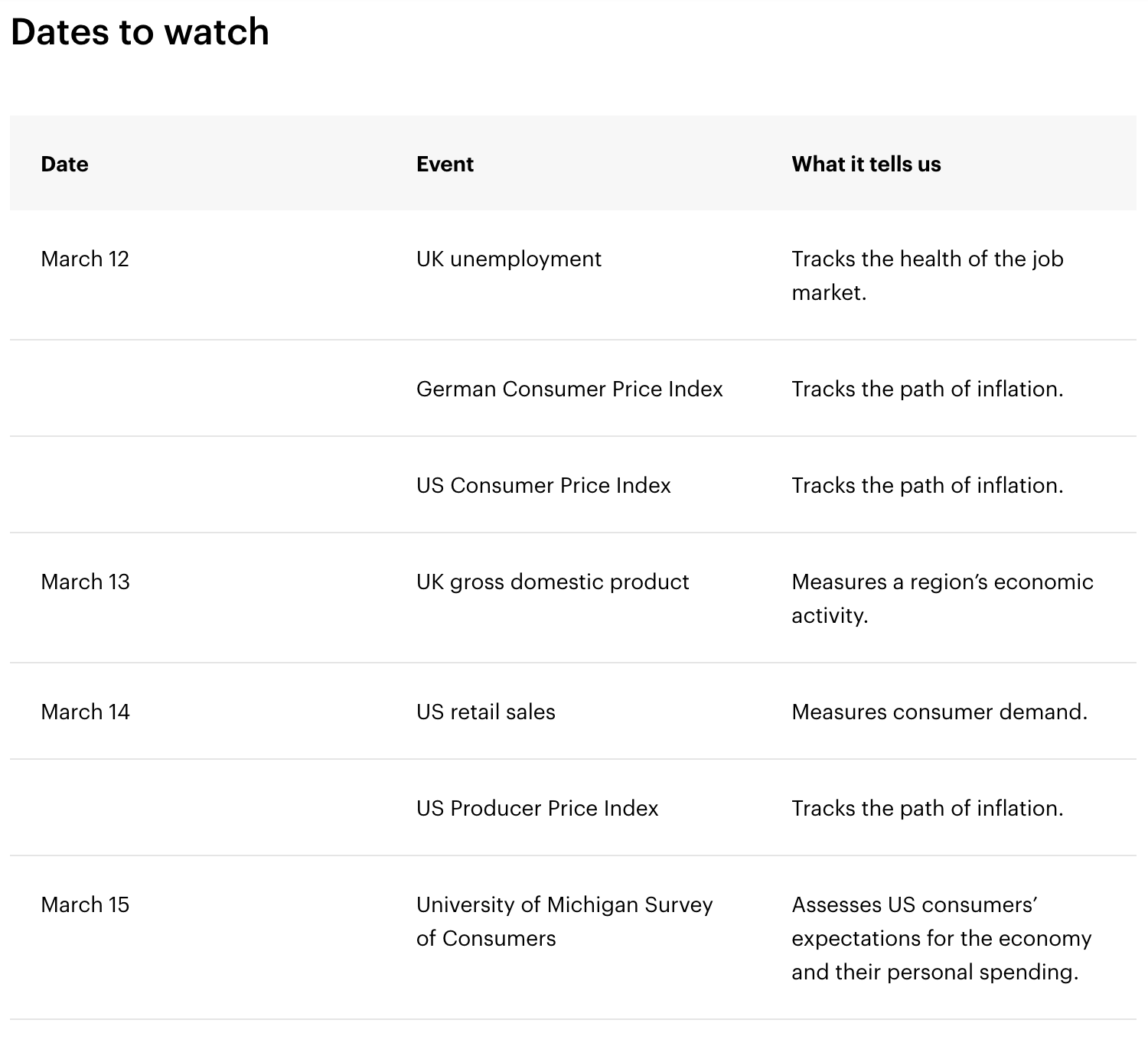

On March 12 the US Consumer Price Index print will be released. While not the Fed’s preferred gauge of inflation, it is closely watched — and has the potential to strike fear in the hearts of market participants if it’s higher than expected. There are growing concerns that this data point could be “hot,” which would likely send risk assets tumbling. I would caution investors not to be rattled if this happens. As I always say, the disinflationary journey is an imperfect one; not every data point will support the narrative, but the overall trend will. If markets tumble enough, this could actually represent a buying opportunity.

Markets have been broadening in anticipation

In the last week, the S&P 500 Index, Dow Jones Industrial Index, and NASDAQ Composite Index all posted losses.7 However, the Russell 2000 Index and the Russell 3000 Index posted gains, as did the MSCI Emerging Markets Index, the MSCI Europe Index, the MSCI Japan Index and the MSCI UK Index – to name a few major non-US indexes. 8

Markets have clearly started to broaden recently. In the last month, the S&P 500 Index has taken a back seat to other major non-US indices and smaller-cap stocks. Markets seem to be foreshadowing a re-acceleration in global economic growth and a weakening US dollar; the start of Fed rate cuts are likely to be a key driver of this, and markets seem to be moving in expectation of rate cuts starting soon.

March memories

March 9 marks the 15th anniversary of the bottom of the S&P 500 Index following the Global Financial Crisis. I remember it like it was yesterday. The stock market had been in a freefall for months, and there was an incredible lack of confidence in markets and institutions after the collapse of Lehman Brothers and the ensuing chaos in the fall of 2008. Negative sentiment only accelerated in early 2009, culminating in the S&P 500 falling below 700 – yes, 700 – in early March.

One moment in particular stands out from that crazy period. At the time, I sat on the board of an endowment and some very nervous hedge fund managers who also served on the board wanted to exit all long positions in equities in those very difficult days. Although usually a cordial group, we had a heated exchange over differing views on a conference call one night. Ultimately, common sense – and our investment policy statement – prevailed, and we remained in equities, so we were able to enjoy the ensuing strong multi-year rebound that was very much helped by accommodative monetary policy.

For some, this day is a miserable memory because it was when stocks hit rock bottom – the lowest they had been in 13 years. For me, it’s a positive memory because it marked the start of an incredibly strong market recovery. More importantly, it is a powerful reminder of the importance of staying invested and sticking with a prudent long-term allocation plan -- no matter what surprises and disappointments come our way. What an anniversary to never forget.

Explore what we expect from markets and the economy in 2024: Read our 2024 Investment Outlook and listen to our podcast.And follow me on LinkedIn and X for more insights.

Footnotes

- 1 Source: Barron’s, “Canada central bank holds key lending rate at 5%,” March 6, 2024

- 2 Source: Statistics Canada, March 8, 2024

- 3 Source: S&P Global/HCOB, March 6, 2024

- 4 Source: European Commission, Feb. 15, 2024

- 5 Source: European Central Bank, March 7, 2024

- 6 Source: The Wall Street Journal, “Jerome Powell says Fed on track to cut rates this year,” March 6, 2024

- 7 Source: US Bureau of Labor Statistics, March 8, 2024

- 8 Source: Bloomberg, L.P., as of March 8, 2024

Copyright © Invesco