by Chris Fasciano, Senior Portfolio Manager at Commonwealth Financial Network

Nobel Prize winners and “Modern Portfolio Theory” pioneers Harry Markowitz and William Sharpe developed what we know today as the 60-40 portfolio. This strategy consisted of a hypothetical 60 percent allocation to equities and a 40 percent allocation to fixed income. For years, it was the gold standard for portfolio construction.

The future of this investment strategy has been a hot topic for the last couple of years as bonds have come under pressure and equity markets have been volatile. And even with the relatively positive returns of the last several months, it generates questions and debate. Over the last couple of years, the role of fixed income in portfolios has been a subject of debate and whether there is a better answer to the question of “What is the best all-weather portfolio going forward?”

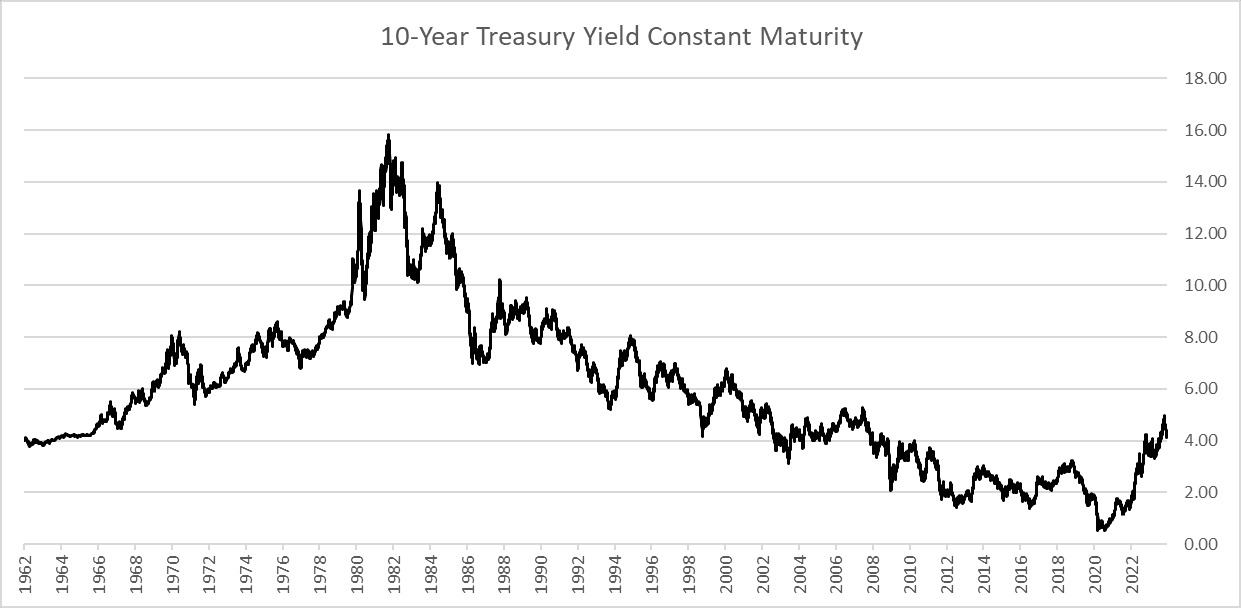

To decide whether the 60-40 portfolio is still viable, we must understand how we arrived at this point. The short answer is a 15-year period—defined by historically low interest rates followed by two years of a rapid rise in rates—has led to two years of challenging fixed income returns. No one would consider these moves in interest rates as the best-case scenario for the 40 percent allocation of the portfolio made up of various bonds or for a large swath of the equity markets.

A Look Back

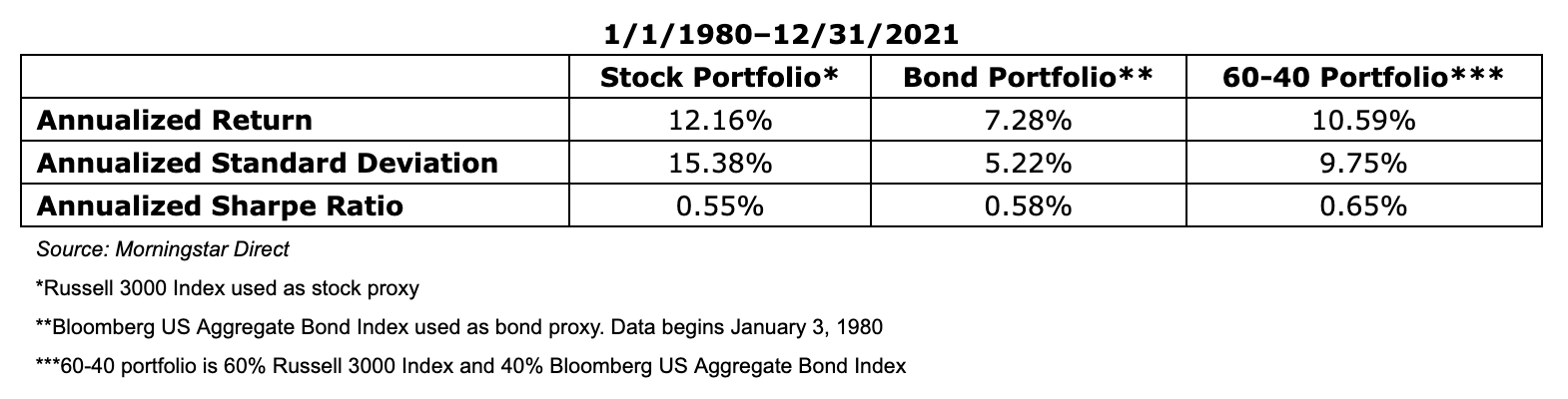

For 42 years, starting at the beginning of 1980 and ending on December 31, 2021, the 60-40 portfolio outperformed with lower volatility than its components.

A 60/40 allocation is a hypothetical allocation represented by a blended index of 60% stocks (Russell 3000 Index) and 40% bonds (Bloomberg U.S. Aggregate Bond Index), for illustrative purposes only. All indices are unmanaged, and investors cannot invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. No specific investments were used in this example. Actual results will vary. Past performance does not guarantee future results.

We’ve seen that stocks and bonds complement each other—when one is up, the other is down. Bonds consistently acted as an airbag or downside protection during years of down equity markets. From 1980 to 2021, the Russell 3000 declined during seven of those years. The Agg, on the other hand, rose during all seven of those years. The biggest performance disparity occurred during the two years it was needed most. In 2002, the Russell 3000 declined a21.5 percent, while the Agg increased over 10 percent. And during the global financial crisis of 2008, the Russell 3000 dropped 37.3 percent, and the Agg still managed a positive return of just over 5 percent! So, while 2022’s 13 percent decline in the Agg was noticeable during a year when the S&P 500 declined between 18 percent and 19 percent, a previous bad year in the bond market was down low-single digits and was accompanied by a gain in the equity markets.

At its essence, this is the appeal of the 60-40 portfolio. But in 2022, equity and fixed income markets both declined for the first time since 1969. It was a difficult year for most investors and there was increased concern about the future of the 60-40 portfolio. While last year was not unprecedented, it was certainly an anomaly.

Through the lens of history, 2008 to 2020 was a unique period for interest rates. The low interest rate environment we experienced during those years stands out when looking at a longer time frame. In reality, today’s longer-term rates are close to where they were in the early 60s (between 4 percent and 8 percent).

A Look Ahead

So, what can we take away from that brief history lesson? While two years of rising rates have shaken investors, in order to believe that losses will continue in bonds, one would need to trust that interest rates will continue to rise. It is more likely, however, that bonds will move with the economy. A strong economy will lead to higher corporate earnings, which, in turn, should lead to higher equity markets. Bonds should mark time. But when the economy falters, earnings and stocks are more likely to decline, and the Fed will adjust rates downwardly in response. In that scenario, bonds should provide the ballast to portfolios that investors have come to depend on.

What About Today?

The starting point for bonds is much different today than at the start of 2022, so the current investment decision to stay the course with a fixed income allocation is also different. One way to illustrate this is by looking at what would happen to an investor’s total return if bond prices fall depending on the yield of the bond.

For example, if yields are 1 percent and bond prices decline 5 percent, an investor would collect 1 percent in interest and lose 5 percent in price value for a net loss of 4 percent. But if yields are 5 percent and bonds decline 5 percent, the investor experience would be different. They would collect 5 percent in interest and lose 5 percent in price value for a net of 0 percent. Bonds would have done their job in the latter scenario.

It’s also worth noting that yields are a measure of future return expectations for fixed income investments. While other factors can influence the relative attractiveness of bonds versus stocks, generally, higher starting yields for bonds mean that they have higher total return expectations and may be relatively attractive. The 10-year Treasury yield finished 2023 at roughly 4 percent, which would marked the highest year-end yield for the 10-year Treasury since 2007 and highlight the currently attractive valuations for high-quality bonds on a historical basis. The silver lining of the rising interest rate environment over the past two years is that higher rates equate to higher expected total returns for bonds looking forward.

Another twist on why bonds can be a good complement to equities is that, unlike a stock that declines, a bond that declines in value in an interim period will still mature at par value if held to the maturity date. If a stock goes down, it may indeed rebound. But it may also have fundamental issues that preclude it from recovering its value. A high-quality bond held to maturity doesn’t have that risk.

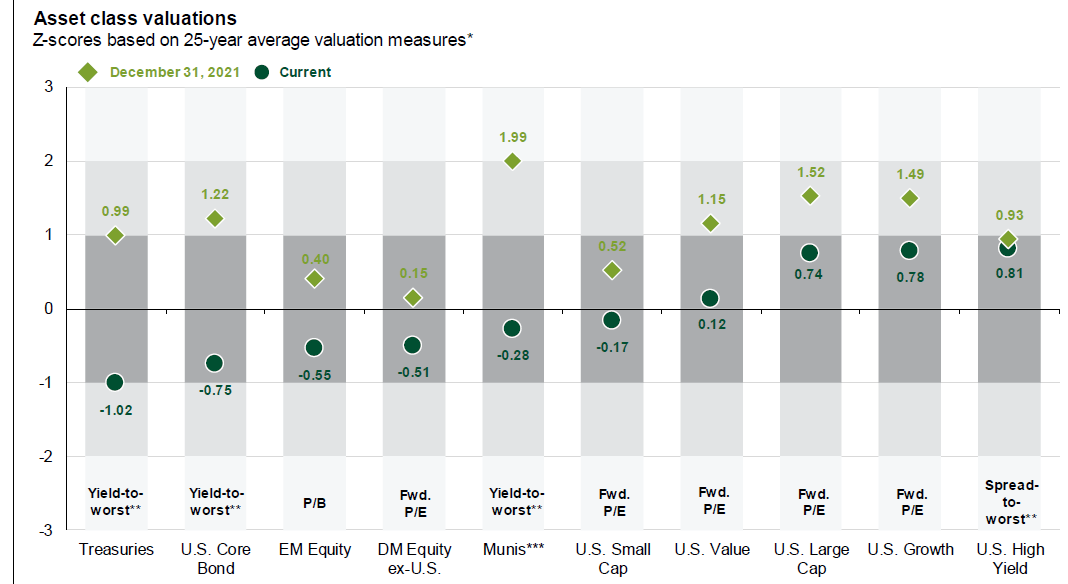

I believe that the equity side of a portfolio will rally over time, as history has often proven. But it’s always nice to start at a point where valuations look attractive. Despite the rally in equity markets since November 2022, the broadly defined market still offers reasonable value using Z-scores (a z-score describes the position of a raw score in terms of its distance from the mean when measured in standard deviation units) compared to where we were in 2021.

Source: Bloomberg, BLS, CME, FactSet, MSCI, Standard and Poor’s, and J.P. Morgan Asset Management. Data through December 8, 2023

The above chart from J.P. Morgan illustrates the attractive valuations of both bonds and equites relative to where they were just two years ago.. That brings us full circle and back to the question at hand: What about today? Given today’s starting point, bonds are back as an income producer and an attractive asset class. And equity markets have reasonable valuations through a long-term lens. Because of that, not only is the 60-40 portfolio relevant, but it’s also alive and well.

This communication should not be construed as investment advice, nor as a solicitation or recommendation to buy or sell any security or investment product. Investments are subject to risk, including the loss of principal. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Bonds are subject to availability and market conditions; some have call features that may affect income. Bond prices and yields are inversely related: when the price goes up, the yield goes down, and vice versa. Market risk is a consideration if sold or redeemed prior to maturity.

Copyright © Commonwealth Financial Network