by Anthony Wu, CFA, Portfolio Manager, SLGI Asset Management, Inc.

Diversification is one of the key foundations of investing. As major asset classes such as equities and bonds can react differently to the same set of economic conditions, when one falls, the other can provide a cushion. But over the past two years, benefits from a diversified portfolio of bonds and stocks has been dismal.

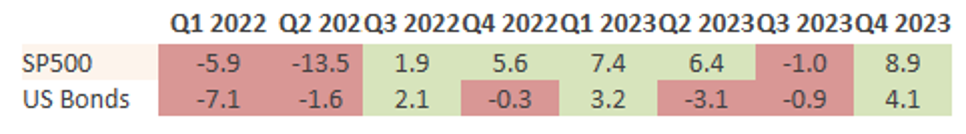

As the table below shows, for the past eight quarters ending 2023, bonds and equities behaved differently only in two quarters. In other words, bonds and equities fell together. And this has caused many to question the benefits of portfolio diversification.

Source: Bloomberg. S&P 500, Total Returns in CAD and iShares Core U.S. Aggregate Bond ETF, Total Return Index in CAD.

Source: Bloomberg. S&P 500, Total Returns in CAD and iShares Core U.S. Aggregate Bond ETF, Total Return Index in CAD.

Despite the recent setback, we still believe diversification matters in portfolios. In fact, as multi-asset portfolio managers, we are optimistic about the future of diversification.

Diversification’s disappointment is neither new nor permanent

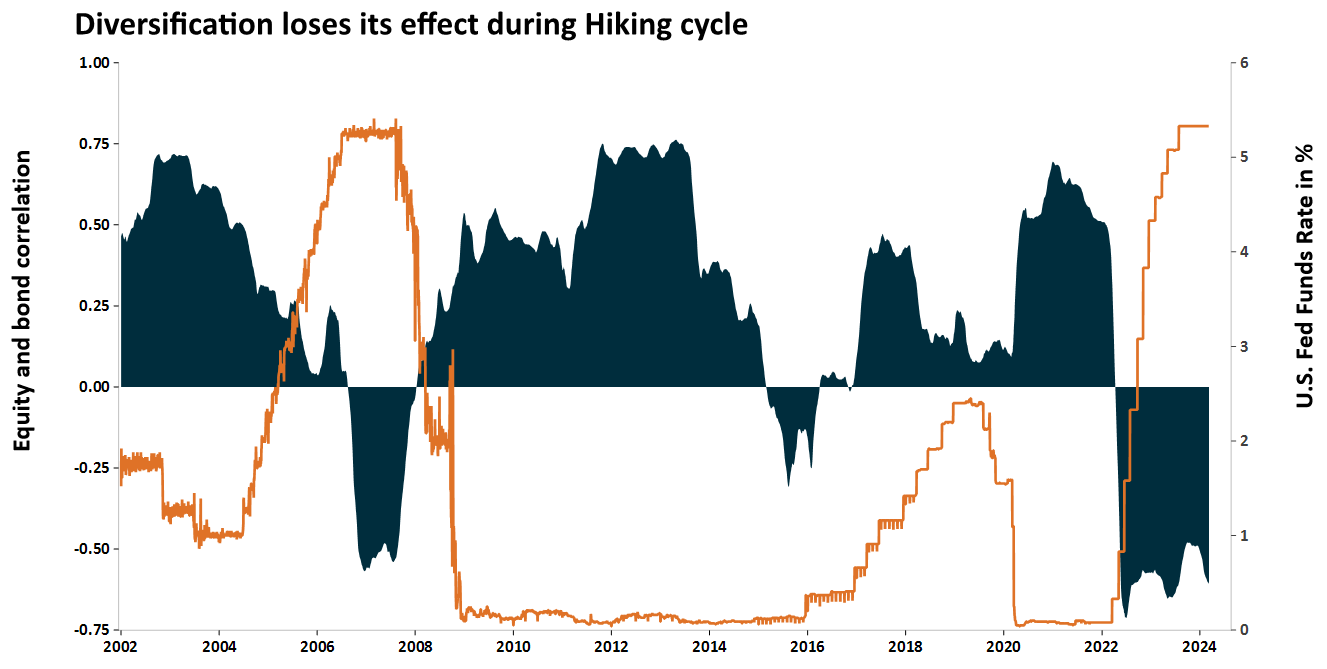

Our research shows that the current decline in the benefits of diversification is not only temporary but also not abnormal. Over the past two decades, we see this pattern repeating when the U.S. Federal Reserve (“the Fed”) started to hike rates to cool the economy. As a result of this restrictive policy action, both bonds and stocks fell in tandem defying diversification.

Consider the chart below: It plots the rolling two-year correlation of three-month changes between equities and yields* (blue area in graph) against the Fed’s effective interest rate (orange line in graph).

In an environment without policy intervention, higher interest rates coincide with higher equity prices as it indicates better economic growth ahead (note that high yields also mean lower bond prices).

But as the Fed’s hiking cycle begins, the correlation between interest rates and equities begins to weaken and even flips to become negative. That would mean that as the orange line (in the graph below) takes off, both equity and bonds move together. During this cycle, the correlation between interest rates and equities reached a two-year average of negative 0.7, the worst in recent memory. As both bond and equity prices suffered together, benefits from diversification was limited.

*Source: Bloomberg. Calculated as the rolling two-year correlation between three-month S&P 500 total return and the U.S. Generic Govt 10-year yield.

Better times for diversification is likely around the corner

In mid-2022, post-covid inflation hit highs last seen in the 1980’s. But after rapid rate hikes from the Fed since early 2022, inflation has now fallen to roughly 3% and is closer to the Fed’s target level of 2%. The Fed and other key central banks have largely communicated that we are currently at peak policy interest rates.

Without policy intervention, we expect the historical relationship between interest rates and equites prices that prevailed in the early 2000s and mid 2010s, to reassert itself.

In the past 10 years, equities represented by the S&P 500 outperformed most other major asset classes. It’s easy to extrapolate such performance into the future and assume that equities are the only asset to own for the long term at the expense of other asset classes. This, however, is classic hindsight bias. Remember a portfolio made of only equities in 1999, just before the dotcom crash, underperformed a balanced portfolio that also contained bonds for the next two decades with significantly more volatility. Diversification doesn’t matter, until it does.

We are likely to see the doubts dissipate soon over the benefits of diversification in multi-asset portfolios.

*****

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any mutual funds managed by SLGI Asset Management Inc. These views are subject to change at any time and are not to be considered as investment advice nor should they be considered a recommendation to buy or sell. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

SLGI Asset Management Inc. is the investment manager of the Sun Life family of mutual funds. Sun Life Global Investments is a trade name of SLGI Asset Management Inc., Sun Life Assurance Company of Canada, and Sun Life Financial Trust Inc., all of which are members of the Sun Life group of companies.

© SLGI Asset Management, Inc., Sun Life Assurance Company of Canada, and their licensors. All rights reserved.