by Rich Mathieson, Senior Global Portfolio Manager, Systematic Equities, & Christopher DiPrimio, CAIA, Head of Americas Strategy, Systematic Equities, BlackRock

Key points

- Dispersion on the rise: The shift from a regime of secular stagnation to one of reflation is contributing to both a broadening of global earnings growth and significantly higher dispersion in company results and performance.

- Alpha over beta: Along with driving heightened dispersion, the new regime is likely to suppress broad market performance relative to recent decades. This reflects a shifting opportunity set in favor of alpha return sources over beta.

- Investing for a new era: BlackRock’s Global Equity Market Neutral Fund (BDMIX) takes advantage of higher dispersion to generate uncorrelated alpha—seeking to provide investors with the dynamism and differentiation that’s needed to navigate a changing market environment.

The post-COVID era has marked a shift from decades of stagnant economic growth to a regime of reflation characterized by positive nominal growth and structurally higher inflation (and interest rates).

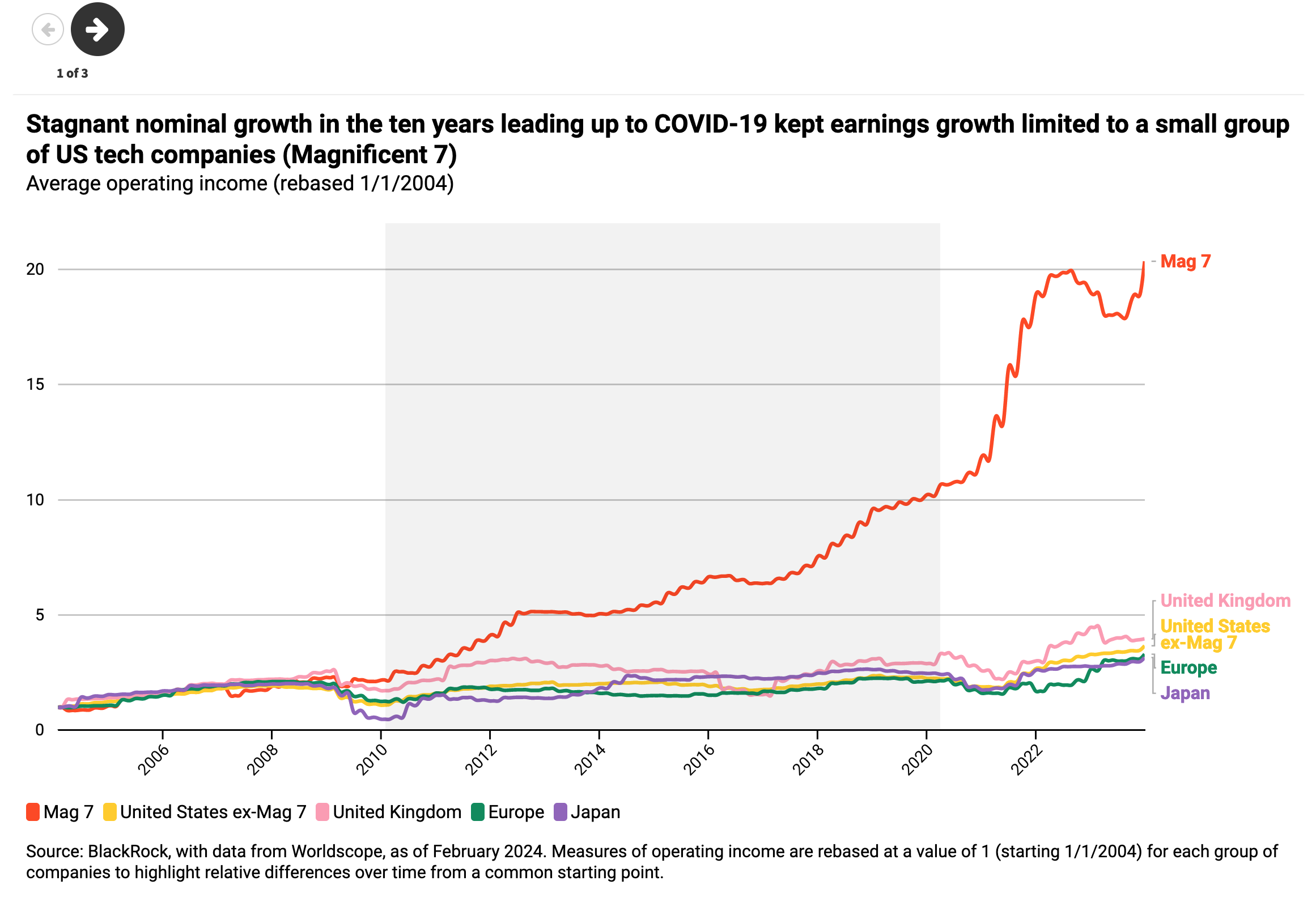

The below series of charts illustrates the impact of this shift through the lens of corporate earnings. The first chart shows that in the ten years following the Global Financial Crisis (GFC), prior to the pandemic, depressed levels of nominal growth meant that only a small number of tech companies (known as the “Magnificent 7”) were able to significantly grow their earnings.

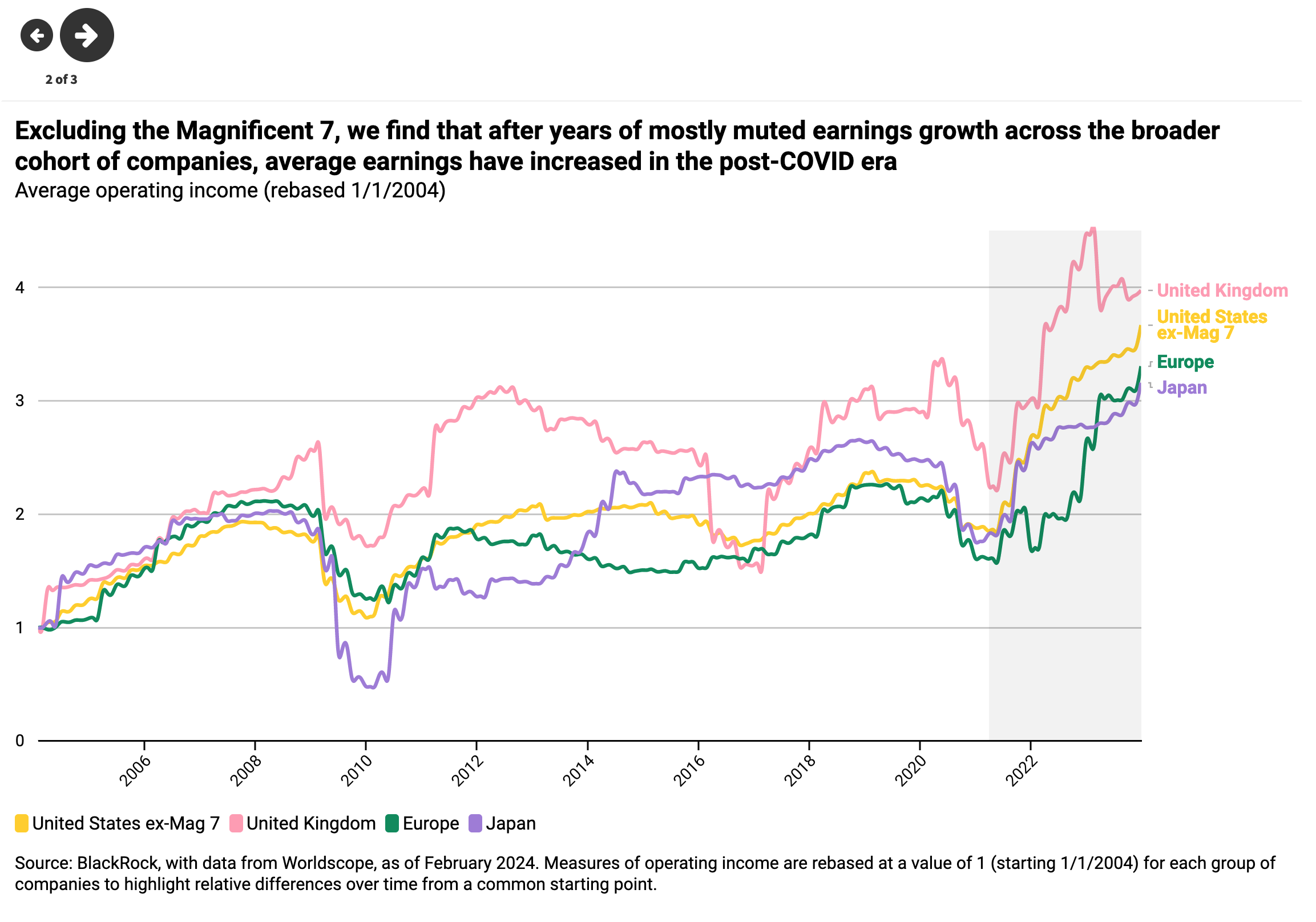

Excluding the Magnificent 7 in the second chart highlights that during that time, operating income for US companies—along with their peers in Europe and Japan—essentially flatlined. By the time COVID hit, earnings were no higher than they had been in 2007 immediately prior to the GFC. This has begun to change as inflationary pressures have re-emerged in the post-COVID world, with average company earnings now breaking to the upside.

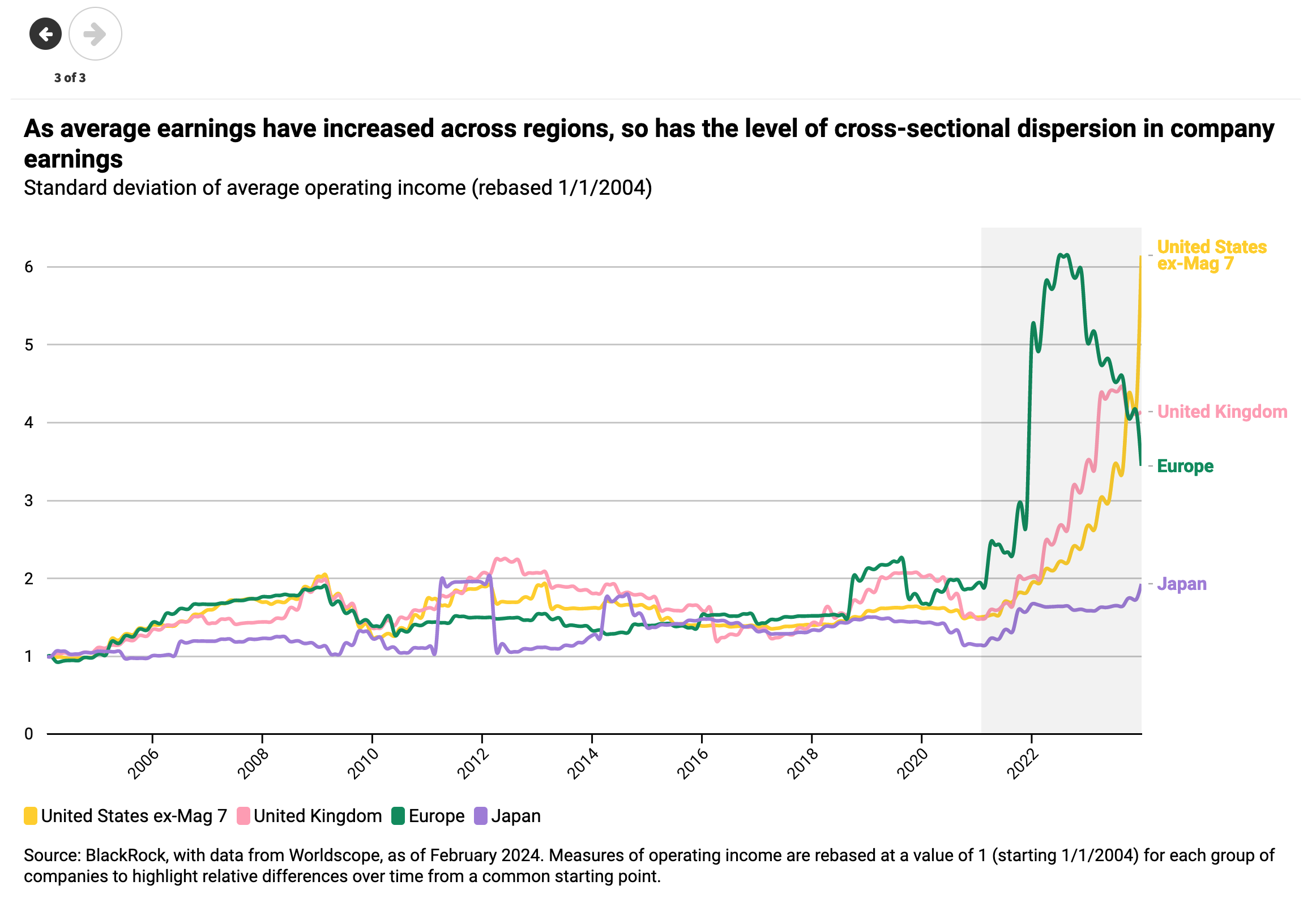

The final chart in the series reveals that a further important nuance of the new regime can be observed in notably higher cross-sectional dispersion in earnings.

Why might this be the case? Reflation and the return of positive nominal growth can provide more runway for earnings expansion in fundamentally strong companies. The ability to pass on higher prices to customers varies across companies. Additionally, some companies are better than others at capturing nominal revenue growth in bottom line earnings. At the same time, this enhanced opportunity set comes with challenges like a higher cost of capital and muted policy support relative to recent decades that can expose vulnerabilities in companies with fundamental weaknesses. The result is a wider range of potential outcomes, and a significantly enhanced investment opportunity set relative to the one that stock pickers faced for much of the previous cycle.

Fundamental dispersion translates to return dispersion across stocks

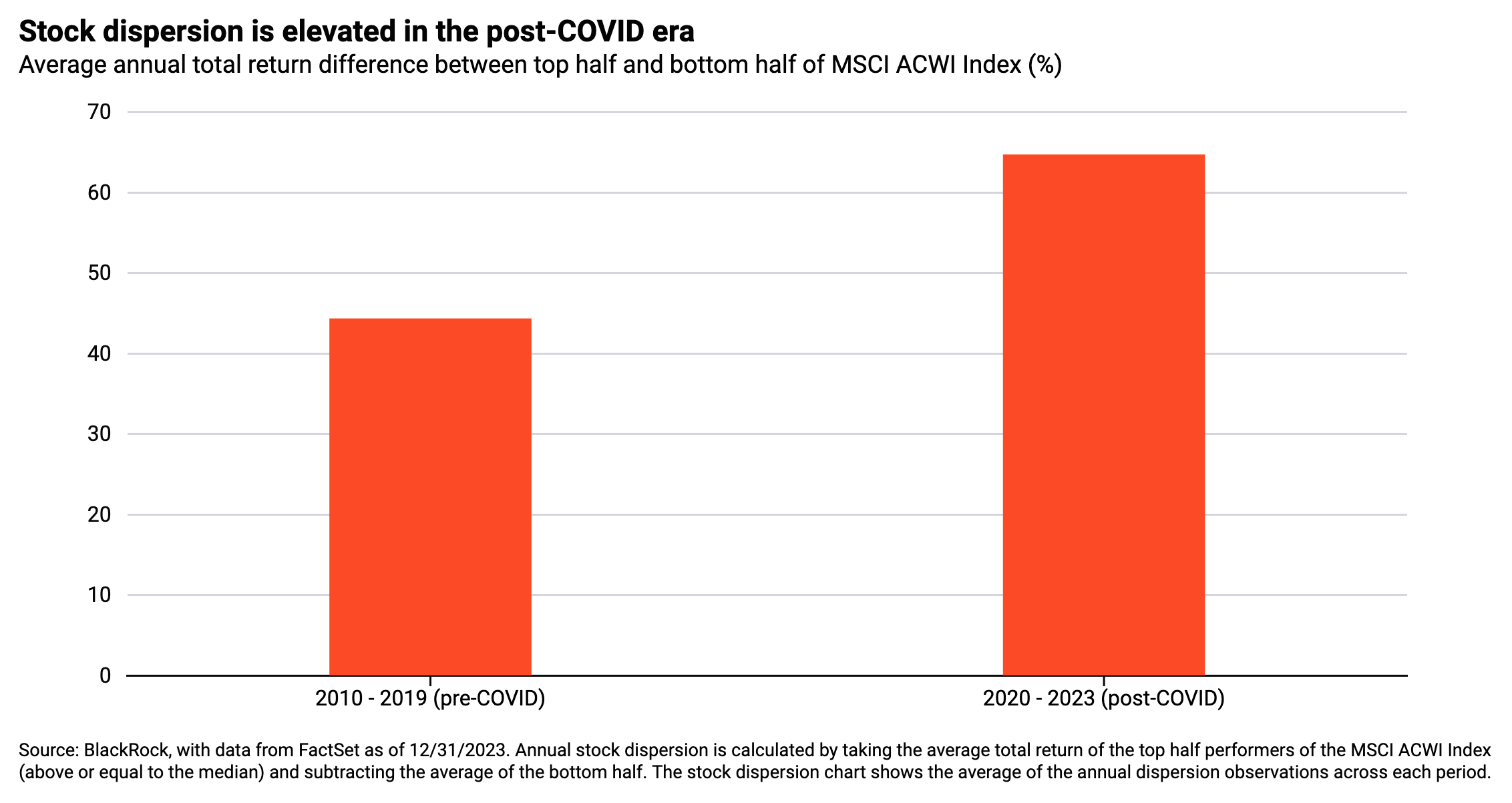

In the pre-COVID period, dynamics like zero interest rate policy and quantitative easing both suppressed return dispersion and lifted broad equity market performance. This meant that static market index exposures and strategies tilted towards beta generated strong absolute and risk-adjusted returns.

Now, a higher rate regime sets the stage for more moderate equity beta performance and higher security dispersion as returns are more closely tied to individual company characteristics like earnings growth and profitability rather than broadly benefitting from the previous ‘rising tide lifts all boats’ macro environment.

Dispersion creates an expansive opportunity set for long/short equity investors

But a more challenging backdrop for market beta doesn’t mean a lack of investment opportunity. In a world of higher dispersion, it means that the opportunity set is shifting towards a richer environment for generating alpha through security selection.

Beyond selecting the winners of the new regime, managers that invest both long and short can deploy security selection insights to harness dispersion as a return source. This can be done by positioning long/short portfolios to reflect expected return differences across the investment universe, taking long positions in expected relative winners and short positions in expected relative losers. This approach seeks to generate returns in the cross-section of markets, exploiting the spread in performance between long and short holdings in an environment where absolute market returns may be more muted.

Within BlackRock’s Global Equity Market Neutral Fund (BDMIX), we analyze over 7,000 global equities each day through a data-driven process that informs our long/short portfolio positioning. A relatively even split of long and short investments results in a net market exposure of close to zero, greatly reducing the influence of market direction on performance. Instead, returns are driven by our ability to forecast relative winners and losers as opportunities emerge—targeting an uncorrelated alpha return stream. In 2023, we saw this in practice as the strategy delivered a 14.58% return (versus 5.09% for the category benchmark) with just a 0.07 correlation to the S&P 500 Index. 1

Evolving portfolios with uncorrelated alpha

Economic and market dynamics have shifted post-COVID. Dispersion in company fundamentals and stock returns is rising, and static beta exposures may face headwinds relative to recent decades. This environment introduces an expansive opportunity set for strategies like BDMIX that can take advantage of higher dispersion to generate uncorrelated alpha—helping to evolve investor portfolios for a new era.

Copyright © BlackRock