by Kevin Flanagan, Head of Fixed Income Strategy, WisdomTree

02/14/2024

The last few years have presented interesting challenges for bond investors. In 2022 and 2023, fixed income portfolios were faced with how to position for what ended up being historic rate hikes. But now, the pendulum has shifted, and the investment profile has moved to how to position one’s bond allocation for rate cuts. Against this backdrop, I thought it would be useful to offer readers insights on how Treasury (UST) yields operate, especially in relation to the Fed Funds target.

Oftentimes, in conversations I have, there is a belief that whatever happens to the Fed Funds Rate will be passed along to the Treasury yield curve in a similar fashion. While, directionally, the idea of the Fed Funds Rate and UST yields moving up or down in tandem is somewhat accurate, the magnitude and timing of changes tend to be not so straightforward.

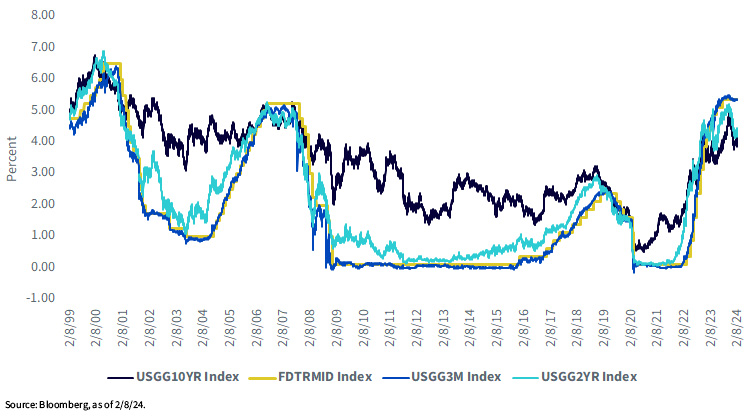

Fed Funds vs. UST 3-Mo, 2-Yr & 10-Yr Yields

Obviously, one begins with the Fed Funds target rate and/or range, which represents overnight money. As a result, the closer the maturity is to Fed Funds, the more positive the correlation is going to be. The above graph highlights the relationship over the past 25 years between the mid-point of the Fed Funds target range and the UST 3-month t-bill, as well as the UST 2-Year and 10-Year note yields. The UST floating rate note could also be considered in this analysis given the fact that it floats, or is referenced, to the weekly UST 3-month t-bill auction.

As you would expect given the above statement, the correlation between Fed Funds and the 3-month t-bill is extraordinarily tight, while the relationship with the 2-Year note is also very positively correlated. However, the positive correlation begins to lessen considerably the further one goes out on the yield curve, as illustrated by the spread between Fed Funds and the UST 10-Year note. While directionally these two rates tend to move in a similar way, the correlation in yields is noticeably lower when compared to maturities that are closer to Fed Funds.

Intuitively, this makes perfect sense. A maturity structure that is not too far removed from the Fed Funds Rate will be anchored and directly linked to trends in overnight money (Fed rate hikes/cuts). But, as you continue to move away from this anchor, other factors besides the Fed begin to come into play, and thus, investors demand a term premium, or an additional return or yield for the potential risk incurred by holding a security that is longer-term in maturity. In addition, inflation expectations also can play a visible role on this front.

Conclusion

In other words, just because the Fed may cut rates later this year, it doesn’t necessarily mean the UST 10-Year yield will move down in lockstep fashion. Indeed, history over the last 25 years is pretty clear on that front. So, when somebody says they expect rates to come down, it is important to be clear about which rate they are referring to exactly. Keep this in mind when, and or if, you are looking to position your bond portfolio for the potential Fed rate cuts that have been dominating the investment conversation.

Copyright © WisdomTree