by Belinda Boa, Head of Active Investments, Asia Pacific, & CIO of Emerging Markets, BlackRock Fundamental Equities

Japanese stocks were standout performers in 2023 after years of stagnation and deflation left Japan an unloved investment destination. Can the positive momentum continue in 2024? BlackRock’s Belinda Boa believes it can and sees the makings of a rags-to-riches story with staying power ― and abundant investment potential.

After a series of lost decades left Japan off the popular investing map, the long-beleaguered market is showing signs of resurgence. Belinda Boa, Head of Active Investments for Asia Pacific at BlackRock, joined The Bid podcast to examine the brightening prospects that she sees defining Japan's future on the global investing stage.

Riches to rags … to riches again?

Despite its more recent malaise, Japan was the picture of success in the mid-20th century. Its status as a rich agricultural hub in the 1960s and a center of engineering and innovation in the 1970s helped propel Japan to become the world’s second-largest economy by the 1980s. Economic success begot market success and at its peak in December 1989, Japan represented 45% of the world’s stock market capitalization.1

Few may recall this bygone Japan, as what followed was three decades of economic stagnation and deflation that sent the country’s market cap on a steep decline ― to roughly 6% today.2 Yet this number has been inching higher, particularly as Japan led global stock market gains in 2023 and has continued its positive momentum into 2024. Ms. Boa sees good reason to believe this thrust can continue amid what she terms a massive transformation.

We are now seeing efforts by policymakers and by corporates which are turning around what has been a very disinteresting environment for Japanese investors.

Supportive shifts afoot

In speaking with The Bid host Oscar Pulido, Ms. Boa outlined several shifts that are bringing real enthusiasm ― and real money ― back to the long unloved market:

1. Economic rewiring. After decades in a “deflationary spiral,” inflation is coming back. This, Ms. Boa says, will have a profound impact on households and corporates that previously had little incentive to invest amid persistent economic weakness. Now, instead of hoarding cash and worrying about costs, the return of inflation means companies will be able to increase prices, leading to margin expansion and enhanced profitability.

2. A global diversifier. Not only is Japan’s policy position different from the rest of the world, which has been in an inflationary environment with expectations for higher-for-longer interest rates, but the Japanese stock market also is a diversification play.

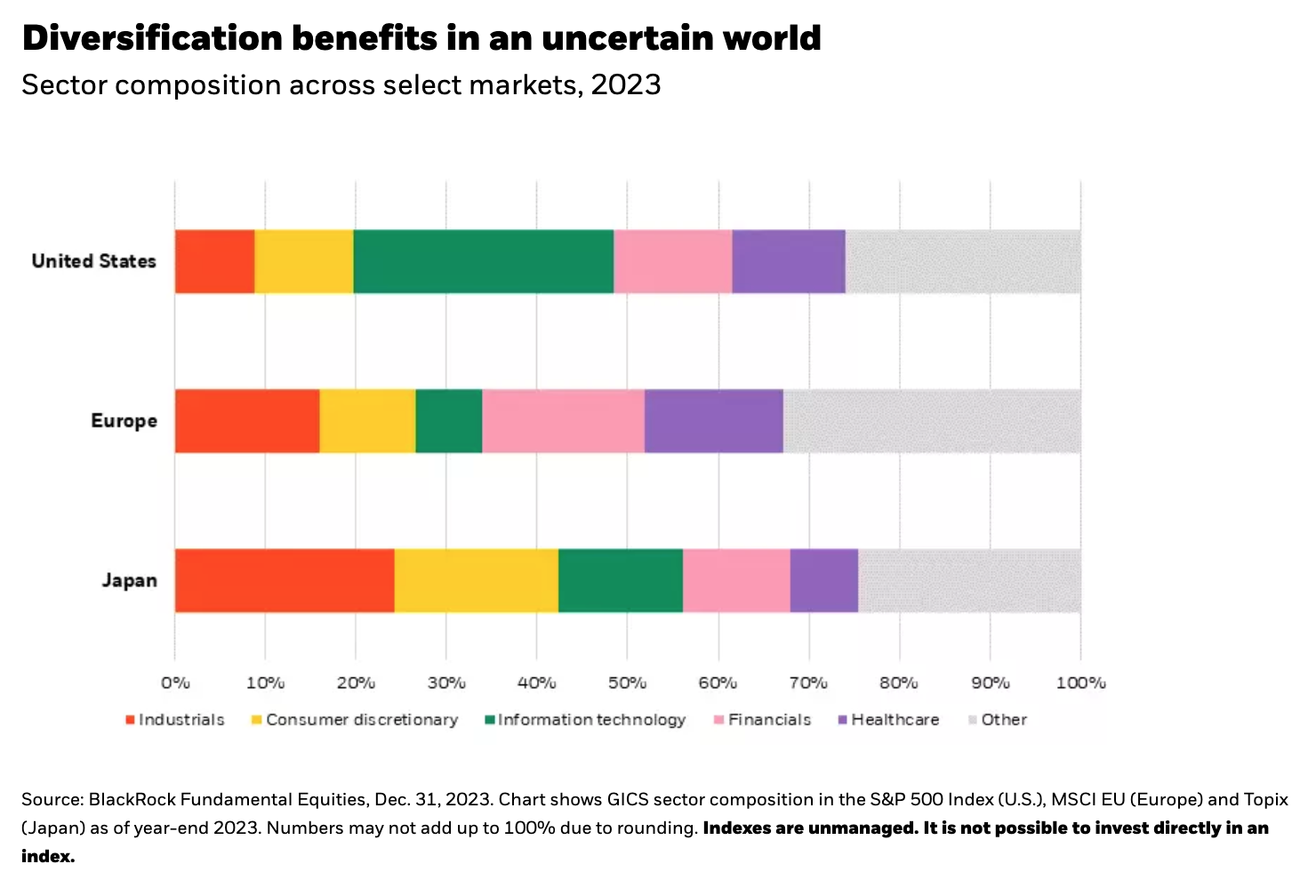

“The U.S. stock market is very concentrated in a number of tech names. Even Asia ex-Japan, when you look at Korea or Taiwan, has a very big concentration in semiconductors,” she says. Japan’s market is much more diverse. (See chart below.) Ms. Boa believes a global portfolio allocating to Japan can benefit from low correlation driven by macroeconomic policies, economic conditions and a stock market that are all inherently different from the rest of the world.

3. Government support. The Japanese government has overhauled its tax-savings scheme for households to encourage reallocation from cash savings into securities. While this will take time to play out, Ms. Boa believes the shift is meaningful considering the decades-long preference for cash and the magnitude of flows (with cash piles estimated at trillions of yen) that could make their way to Japanese equities.

4. Corporate transformation. Unprofitable conglomerates are getting a shake-up. “Japan used to have a significant number of conglomerates, or complex organizations with a number of listed subsidiaries. They were difficult to analyze, but also a lot of these were not profitable or had very low growth prospects,” Ms. Boa explains.

Many of these companies are now restructuring, spinning off non-core business. The result has been improved multiples, higher profits and positive reaction in equity prices. This is just the start, according to Ms. Boa, who sees a significant amount of embedded value yet to be unlocked from corporate reforms going forward.

5. Stock exchange steps. The Tokyo Stock Exchange has made changes to compel companies to invest in their businesses, grow and thereby improve shareholder returns. Efforts initiated in 2023 were focused on companies with low book values, requiring them to take steps to increase their value within a prescribed timeframe or risk delisting. The Exchange has more recently been calling out companies that fail to report on their plans and progress.

Ms. Boa observes that roughly half of the companies in Japan’s TOPIX index currently trade below book value (i.e., below the value of their assets). “So there's still a lot of upside here in terms of corporate transformation.”

A global force in mega forces

The opportunities in Japanese equities are broad and diverse. And in an ironic twist, Ms. Boa notes that many are driven by the headwinds that Japan has faced in recent decades. Among them:

Aging demographics. An aging population has meant a declining workforce since the middle of the 1990s. As a result, Japan has been focused on developing medical technologies and factory automation to address labor shortages. It is now home to companies that are leaders in these areas, providing services and factories not only domestically but around the world.

Decarbonization: The transition to a low-carbon economy is front and center for Japan, and according to Ms. Boa had been even before it gained popularity globally. The reason, she says, is a long focus on the scarcity of natural resources as well as social values formed out of the demographic changes:

“It is a country that has faced unbelievable earthquakes and tragic tsunamis over the years, and there is a deeply felt duty to protect and preserve the environment in Japan. That, combined with the country's expertise in engineering and innovation, has meant that it developed energy-efficient industries years before the rest of the world was starting to look at that.”

Given all the above, Ms. Boa, who is also CIO of Emerging Markets within BlackRock Fundamental Equities, expects broad interest in Japan to continue and investment to increase. Global CIO Tony DeSpirito shares her view, naming Japan as an area of interest in his recent appearance on The Bid, A stock picker’s guide to 2024.

Yet not all companies are ripe for the changing business environment and poised to benefit equally from the burgeoning transformations. This suggests that Japan is one market where you want to use active selection, Ms. Boa says, to ensure you can be on the “right side of that trade” in an effort to enhance returns in Japanese equities as the market makes important strides in its “fairy tale” revival.