by Campbell Harvey, Research Affiliates

Key Points

- The inverted yield curve indicator that I developed in my dissertation, has been Code Red for 15 months. The indicator has correctly predicted the last eight recessions without a single false signal. The severity of the predicted downturn is uncertain and ideally, we experience a soft landing with only minor stress to the economy.

- While the US delivered 2.5% real GDP growth in 2023 and 3.3% growth in the fourth quarter, that pace will likely slow substantially in the first half of 2024 as the economy faces a number of headwinds.

- Three key mitigating factors – excess labor demand, a healthy housing market, and the risk management impact of the yield curve – greatly reduce the likelihood of a deep recession.

- The Fed misread inflation twice in the last several years, leading to excessive tightening, particularly in 2023, that has increased the risk of a bad outcome. Such errors make it imperative they attempt to undo the damage of overshooting by quickly reversing course and cutting rates aggressively.

It is certainly a confusing economic environment. Jobs growth is strong yet there are constant reports of high-profile company layoffs. The yield curve is inverted suggesting a recession yet the stock market is at a record high. Let me try to unpack these seemingly contradictory indicators. The key question is whether the economy can achieve a so-called soft landing.

A soft landing means slower economic growth or a minor recession. This scenario is obviously much more desirable than a hard landing or a regular recession. I believe it is possible to achieve the soft landing should enough mitigating factors endure and the Fed awakes from its slumber. However, many pieces of the puzzle need to fall into place.

In the background is the inverted yield curve. This indicator of economic growth and recessions was unveiled in my dissertation many years ago. Since the 1960s, this indicator is eight out of eight in predicting recessions and has yet to experience a false signal.

“To get a soft landing, the Fed needs to undo the damage of their overshoot as soon as possible.”

In November 2022, the yield curve inverted (measured as the difference between the 10-year Treasury bond yield and the three-month Treasury bill yield). As a result, many expected a recession in 2023. Indeed, many have already concluded the yield curve has delivered a false signal.

Such conclusions are premature. Over the last four cycles, the yield curve inversion has provided an advance warning of 13 months on average. We are only in the 15th month, near the average. Further, over the last four cycles, the yield curve “uninverts” (short rates return to their normal pattern of being below long rates) before recessions begin. We are not in the uninversion yet.

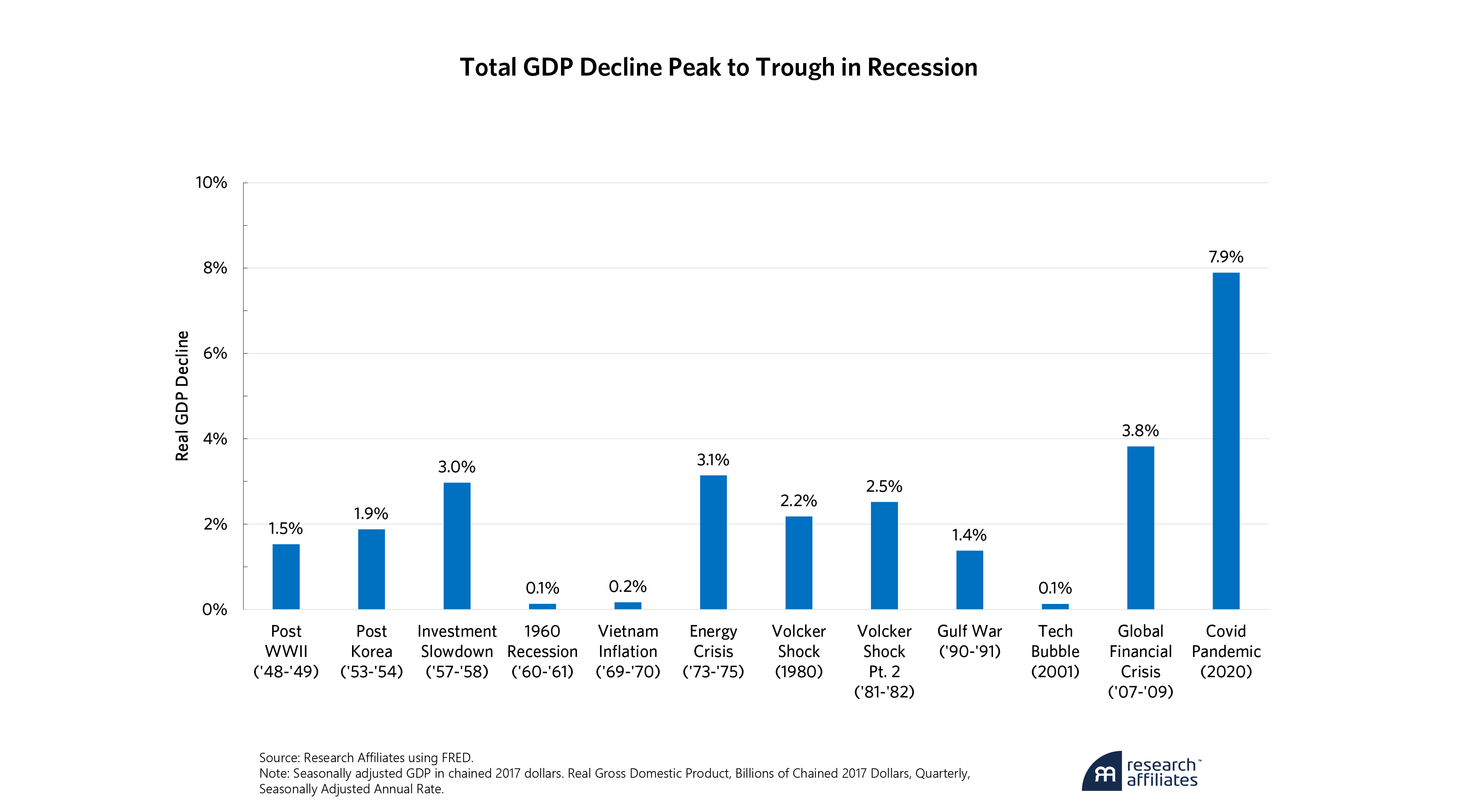

Given the track record of the yield indicator, it is with great peril to ignore it. The yield curve indicator suggests growth will substantially slow in 2024. This slow growth may or may not be associated with a recession. Even in the soft landing scenario, there is a chance for a minor recession. We have seen minor recessions before, in 2001 and 1990-91, where drawdown in GDP was around 1% (see chart below). It is crucial to avoid a deep recession like the one associated with the Global Financial Crisis (GFC).

The US economy delivered 2.5% real GDP growth in 2023 and 3.3% growth in the fourth quarter. I believe the pace of growth will substantially slow in the first and second quarters of 2024 because we face a number of headwinds.

Headwinds to GDP Growth

Here are some key indicators to monitor in 2024.

Consumer behavior

Personal consumption expenditures are the most important component of GDP, representing 68% of overall growth. The 2.5% year-over-year (YOY) growth in real 2023 GDP was mainly driven by robust consumer spending. Indeed, combining personal consumption spending with government spending accounts for 87% of the growth. Where did this strength originate? During the pandemic, consumers amassed $2.1 trillion in excess savings according to the Federal Reserve. There was a lot of pent-up demand plus generous government support programs and consumers have been drawing these savings down.

The robust consumer spending in 2023 is a result of this savings drawdown.

Another important category is investment, which did not benefit from the same type of government support. One could argue that investment is already in a recessionary state with year-over-year investment in 2023 negative.

It is important to look at the leading indicators of consumer savings because when the savings run out, spending will contract. One leading indicator that I closely watch is consumer loan delinquencies, for example, auto and credit cards. This indicator is intuitive. A consumer will only borrow on a credit card with rates in the 20% range if savings have run dry. Importantly, delinquencies have been trending upward, suggesting savings have been substantially depleted.

There are other technical factors. In October 2023, student loan repayments were reinstated. This impacts 40 million Americans and those payments come directly out of disposable income.

Overall, it is reasonable to expect a slowing of consumption expenditures in the first and second quarters.

Credit Conditions

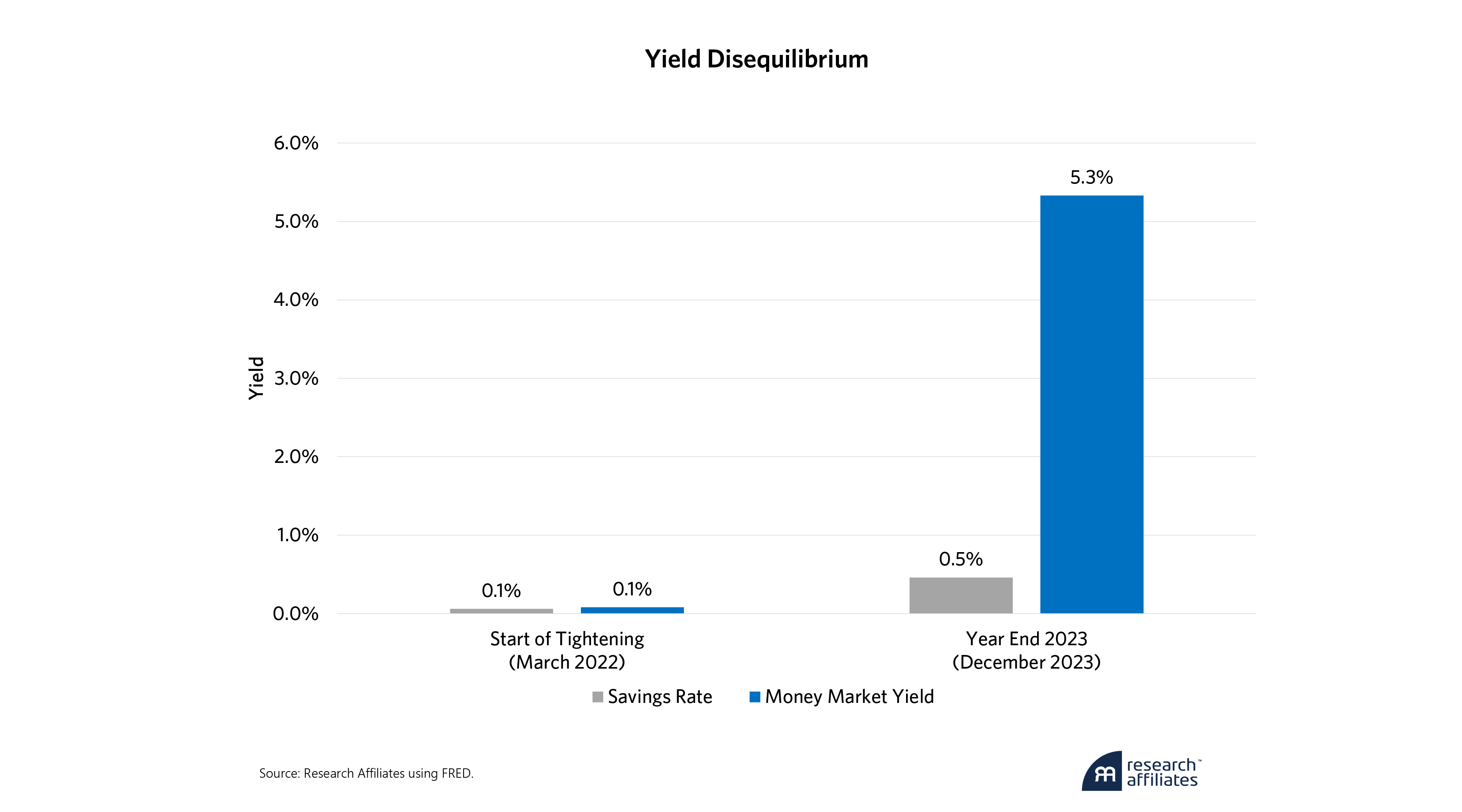

It is remarkable that the biggest banks offer only a few basis points in annual interest on a savings deposit. The overall average savings rate is about 0.5% and this is driven by somewhat higher rates at small and regional banks. This does not get much attention, but to me, it is a sign of bank weakness and is bad news for the economy.

Many transfer their money out of savings into a money market mutual fund (MMMF) where you can easily get more than a 5% rate of return. We have seen a large flight of capital to ultra-safe MMMFs. There are two implications.

First, as assets are transferred to MMMFs, this means less capital for banks to lend to consumers and businesses. While this effect is not immediate, it is reasonable to expect that credit conditions will tighten in 2024. Tighter credit conditions are associated with lower spending for both consumers and businesses. An obvious implication is the reduction in business investment as the cost of capital rises.

Second, many consumers do not transfer their assets to MMMFs. Some are unaware that the interest rate is only a few basis points in their savings account and others have small balances that might not qualify for the money market funds or enhanced savings rates at banks. These consumers are punished by the erosion of their modest assets given that savings rates are so far below the current inflation rate.

Commercial Real Estate

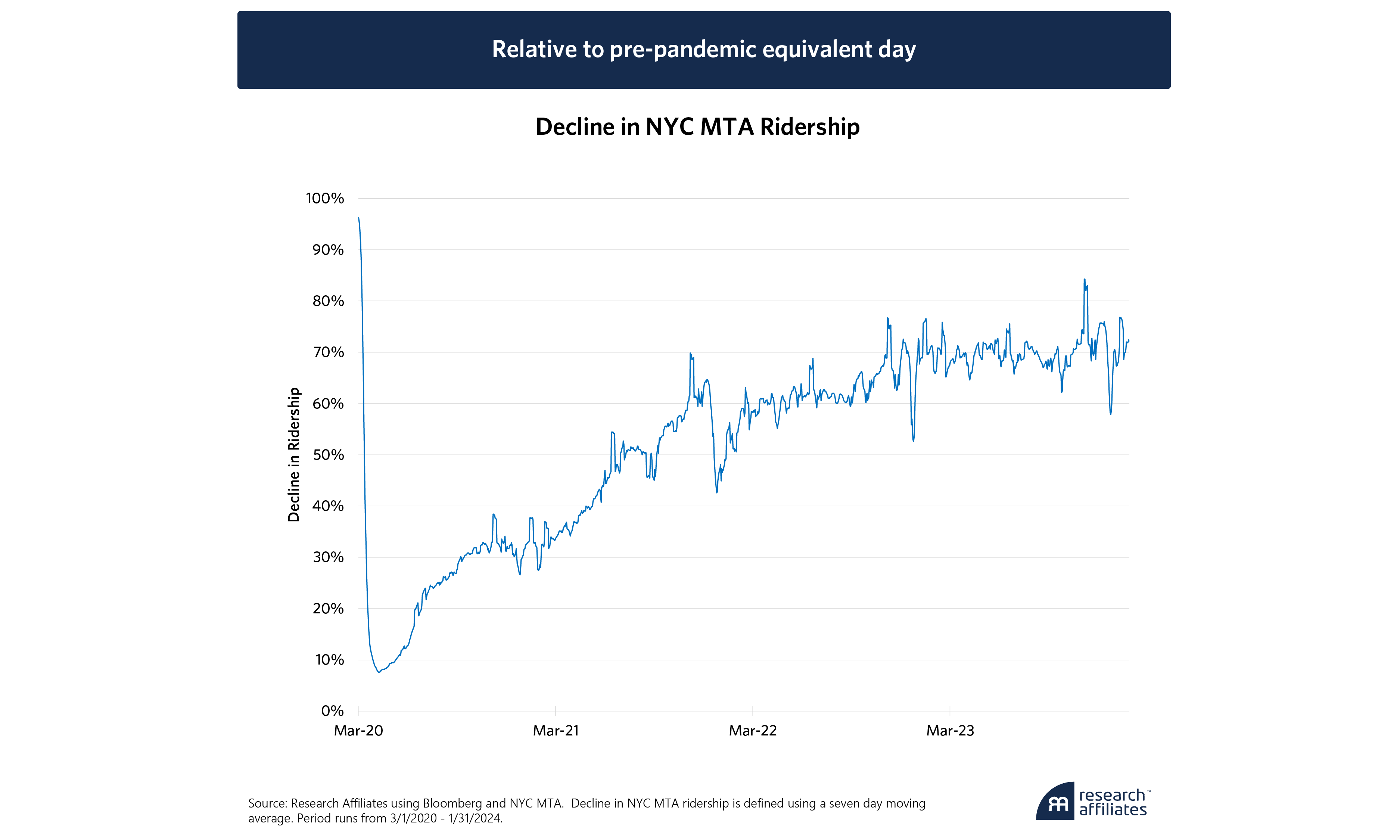

COVID produced a structural change in the way we work in the US, aka, work from home. Looking at statistics on public transportation use, there was a huge drop during COVID, then a recovery, but we are nowhere near pre-COVID levels. Indeed, the data are flattening out well below pre-COVID peaks consistent with a structural change.

Cities like San Francisco have enormous office vacancy rates. The commercial real estate (CRE) market will be a big story in 2024. While these problems existed in 2023, there was little talk in the media about this issue — probably because the loans did not come due — but they will. Refinancing will be necessary in 2024. This also poses a risk to banks as they are the main financiers of CRE. We saw new indications of stress at regional banks with the plunge in the value of New York Community Bancorp.

Interest Service Obligations on Government Debt

It is striking that the interest service on the net government debt is already over $700 billion. What is less well-known is that the average interest rate is only 3.11. Given short rates are at 5% and long rates over 4%, it is reasonable to expect that the average interest rate on government debt will sharply increase in 2024 as the government both rolls over existing debt and finances the current large deficit.

I forecast that the federal debt service will become the second largest government expenditure category this year, moving ahead of Medicare and defense spending. Indeed, we are effectively borrowing to pay interest — never a good idea. The ballooning debt and debt service put upward pressure on long rates, thereby impeding business investment and economic growth.

Potential Mitigating Factors

There are three key mitigating factors. In my opinion, these factors are important enough to greatly reduce the chance that a deep recession occurs.

Excess Labor Demand

The number of job openings is higher than those seeking work. In March 2022, the gap between job openings and job seekers was an astonishing 6 million(M). That gap has shrunk (which is consistent with slowing growth) but still stands at roughly 2.5M. This means even with slowing growth there is a buffer before unemployment starts causing a problem. When people are laid off, their consumption spending is substantially curtailed. Note that unemployment is a lagging indicator of recessions. Unemployment is always low before it gets higher during a recession. This is not my point. The fact that we have excess demand for labor reduces the risk that we experience a disruptive surge in unemployment.

Housing

Before the GFC, consumers and banks were highly levered. The amount of equity in the average house was very close to the amount of mortgage debt. As housing prices decreased, there was a surge in foreclosures and fire sales with this important market’s trauma fanning the flames of the recession, making the downturn the most severe since the Great Depression. The housing market is different today. Consumers and banks are less levered. There is substantially more equity than debt. This means even if a slowdown in 2024 sparks a decrease in housing prices, it is unlikely to cause foreclosure-led havoc.

“To me, policy must be based on real time data - not the relics of the past year.”

The Prophylactic Impact of the Yield Curve

It is hard to ignore the yield curve inversion. When an indicator is eight out of eight with no false signals, people take it seriously. Indeed, when I wrote my dissertation, the theory suggested that the yield curve reflected expectations of economic growth. Today, it is different. As my colleague Rob Arnott has repeatedly emphasized, the yield curve now causes economic growth. When businesses see the inverted yield curve, they take preventative action. This is not the time to bet the firm on a new expansion financed by debt. So, what happens? Businesses invest less (which we already saw in 2023) and engage in small-scale (5-10%) labor force reductions (which we already saw in 2023 and are seeing in 2024). This leads to slower economic growth and this is the mechanism whereby the yield curve is causal. This is also known as risk management. Companies that become leaner have a much better chance of surviving an economic slowdown. This risk management dampens the volatility of the business cycle which is a good outcome.

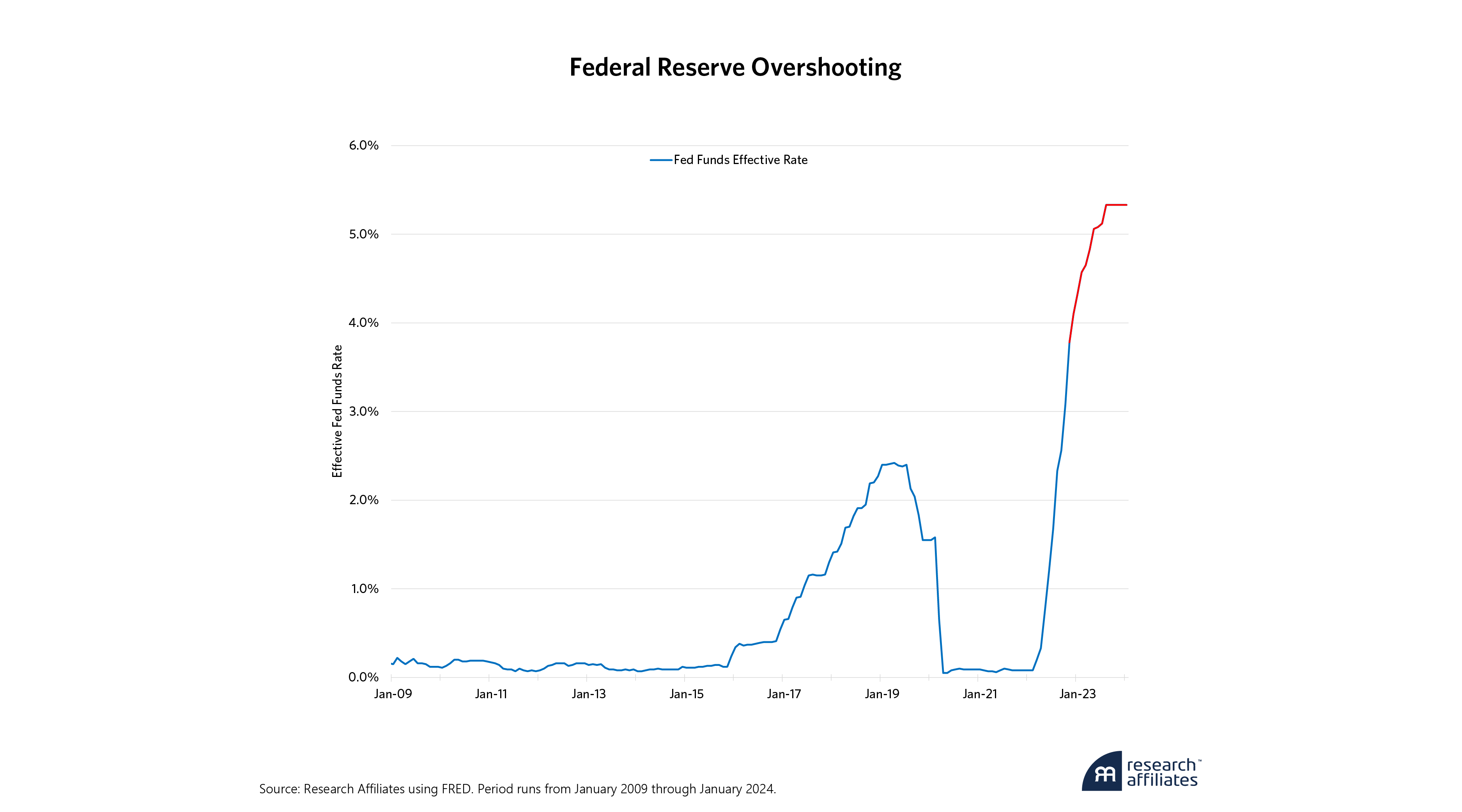

The Source of Risk is the Fed

It is generally agreed that the Fed was far too late to start raising rates. Indeed, rates were kept near zero for an unprecedented period of time that includes much of the longest expansion on record that began after the GFC. Indeed, rates were near zero when unemployment was low, economic growth was robust, and the stock market was at record levels. That does not seem right.

More recently, the Fed missed the inflation surge, mistakenly labeling inflation as “transitory.” At that time, I said the Fed was misreading the inflation data. The most important component of both the CPI and the Personal Consumption Expenditure deflator (the Fed’s favorite gauge) is shelter, which accounts for 35% of CPI and 40% of PCE deflator. Importantly, shelter inflation is measured using something called “owner’s equivalent rent” post-1982 - rather than relying on real time housing prices and rental rates. This calculation operates with a lag. Think of it as imposing a long moving average on the data. So, when rental inflation was in the double digits, it was obvious we were in for a surge in CPI — it was just a matter of time.

The Fed finally caught on and started a tightening cycle that was unprecedented in both speed and degree (relative to long-term rates).

It is extraordinary to me that they made the same mistake in misreading the inflation data in 2023. On January 4, 2023,1 I strongly advocated that the Fed stand down on rate hikes. I argued that inflation was under control if real time data were used.

Consider the most recent CPI print of 3.4% YOY. This appears to be well above the Fed’s target rate. However, the 3.4% is misleading because the shelter inflation is reported at 6.2%. The rate of shelter inflation reported in the CPI is totally disconnected from reality. Surveys report YOY rents at -2%. Suppose you make the conservative assumption that shelter inflation is running at +2%. A recalculation of the CPI delivers a 1.9% YOY inflation well below the Fed’s target. Indeed, through most of 2023 we were in the Fed’s comfort zone.

To me, policy should be based on real time data - not the relics of the past. The Fed raised rates 1% in 2023 and each time justified their actions with a false narrative that inflation remained high. The “high” inflation was an artifact of the way the Bureau of Labor Statistics calculates inflation. Shelter inflation was high because this reflected what happened 12 months ago. In short, the data were stale.

In my opinion, the Fed's actions, particularly in 2023, increased the risk that we go into a deeper recession. It is imperative that they attempt to undo the damage of their overshooting.

To me, the most effective mitigant for the recession scenario is for the Fed to quickly reverse course. Ideally, the Fed Funds rate is 3.5% by year end (from 5.25% today) and the cuts should start immediately. The Fed failed to act in the January meeting citing inflation risk an extraordinary eight times in their official statement. In the March meeting, they will likely include some wording that they had a discussion about reducing rates and we likely need to wait until the May or June meetings for some action - and the action will be 25 basis points.

The wait, wait, wait, then drip, drip, drip strategy greatly increases the chance of a recession. In contrast, the Fed should take decisive action. Wouldn’t it be nice to hear a statement like: We admit we were late to begin hiking rates in 2022 and our new analysis of inflation data suggests that we pushed too far in 2023. As a result, we are cutting rates immediately by 50 bps and we are actively considering additional cuts in the near term.

While such a statement would be refreshing from policymakers, I know it is unrealistic. Nevertheless, the Fed holds the key to the soft landing. The sooner they open the easing door, the higher the probability of a soft landing.

Growth Should be the Objective

A recession in 2024 would be a self-inflicted wound made by our policymakers. That said, there is a lot to like about our medium-term outlook. Once again, the US is at the forefront of key innovations: AI and decentralized technologies. These innovations hold the possibility of putting us on a higher growth path.

“The Fed’s wait, wait, wait, then drip, drip, drip strategy greatly increases the chance of a recession.”

Yes, there are serious structural challenges. Government debt eventually needs to be repaid or refinanced. Obviously, taxes could be raised, but that is toxic for economic growth. It is also possible to simply print money to pay off the debt, but that would be highly inflationary which is similar to a tax and also bad for growth. The best way out of our current situation is to grow and provide an environment where innovation thrives. Tax revenue increases when the economy is growing. It is essential that policymakers and regulators do not fumble on these once-in-a-generation innovations. The last thing we want is for our best ideas to move offshore. If that happens, the outlook will darken.

I still think we can achieve the Goldilocks scenario. Conditional on the Fed reducing rates in 2024, we can dodge the bad recession bullet and settle for slower growth and perhaps a trivial recession. However, too much focus is on the Fed and the short-term prospects. We need to look beyond. We have grown accustomed to 2% growth. Indeed, 2023’s growth of 2.5% was welcomed. We have lost our ambition. In the past, we have achieved 5% growth. Instead of expending our energy trying to guess the Fed's next move, let’s change the conversation: What do we need to do to accelerate U.S. growth to 5%. Let’s refocus.

Please read our disclosures concurrent with this publication: https://www.researchaffiliates.com/legal/disclosures#investment-adviser-disclosure-and-disclaimers.

Copyright © Research Affiliates