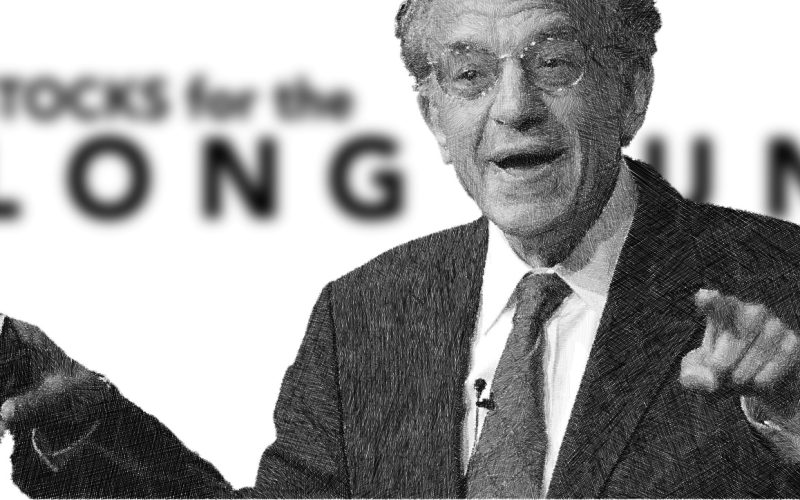

by Professor Jeremy J. Siegel, Senior Economist to WisdomTree and Emeritus Professor of Finance at The Wharton School of the University of Pennsylvania

Last week was filled with earnings reports that still, in my view, point to upward surprises to the full-year earnings outlook, but also we received some unusual jobs data. Friday’s jobs report was one of the strangest jobs reports I've seen.

The official increase in payrolls blew away the estimates and there were strong upward revisions to 2023 jobs numbers, but there was a huge plunge in hours worked. If you multiply the hours worked by the number of people working, the actual number of hours worked declined. The hours worked collapse changes the headline from a strong beat to a sharp decline in actual work hours. We tend to only see plunges like this during recessions.

Weather might have been an explaining factor as cold spells hit the Midwest that caused hours worked to plunge as employees couldn’t (or didn’t) go to work. It was reported that 588,000 workers were employed but not at work due to bad weather—a far outlier for this weather disruption. We will see if the hours worked bounces back in February. Nevertheless, bond yields soared on the strength of the new hires.

Secondly, the bond market could have been reacting to the sharp above-consensus growth in wages. But this also could be weather-related, as supervisors with higher pay showed up at work, but lower-level workers did not. Furthermore, I’ve stressed a very important variable that separates wages from inflation, and that is productivity. Productivity data came very strong last quarter—well ahead of expectations—and this could be continuing into January. Wage growth accompanied by strong productivity growth is not inflationary.

It is too early to ascribe higher productivity growth to diffusion of artificial intelligence (AI) into the workforce. Less turnover in the job market and more seasoned employees could be one simple explanation for the rebound in productivity, but it is very encouraging, and I expect to see this same above-trend productivity for a number of years. Higher productivity is one economic impulse feeding higher real interest rates in the medium-term outlook and it also impacts the eventual long-run rate the Fed will achieve. I have been stating that the natural rate of interest, R-star (R*), has moved up, and is now about 1.5% instead of the 0.5% thought by the Fed. I have also learned that Larry Summers, former Treasury Secretary, recently noted concern that the real rate has risen. Before he was predicting doom and gloom, but his head was turned by these strong numbers. Of course, we’ve been indicating that the economy is well tolerating these higher rates since last August.

We've been continuously stressing that there's no sign of a slowdown in this economy, even before the labor market report came in. Fed Chairman Powell indicated that the most recent data he has received does in fact confirm a slight uptick in activity, and that is why March is becoming increasingly unlikely to be the first date of a rate cut.

Inflation data also is trending very much in the Fed’s direction. Commodity prices are not showing a large amount of large stress, even with the turmoil in the Middle East and the supply chain issues that might create some inflation in goods prices.

What about earnings? The strongest reaction came from Meta, which embodies the productivity story we mentioned above. Meta cut over 20% of their workforce and had over 25% growth in revenues for the year. We can see more of this from big tech companies this year. Meta also announced its first dividend, and it will be interesting to see if this pressures some of the remaining large technology companies to allocate their cash not just for buybacks but for dividends as well.

I still believe we can have above $240 of earnings on the S&P 500 for the year, which puts the market at a reasonable 20 times earnings per share and 5% earnings yield which is over 300 basis points ahead of the corresponding TIPS yield. This is a normal measure of the equity risk premium—no current excess price of stocks relative to bonds.

We had some new fears surrounding regional banks and whether the souring commercial real estate loans will force another round of pressures like the Silicon Valley Bank blow up last year. I am not an expert on all the bank accounting issues, but I see this being more isolated. Some estimates say we have $1.2 trillion of write downs from commercial real estate coming. Aggregate wealth is $60-70 trillion in the U.S, so this $1.2 trillion hit is not a large deal for the economy as a whole. We might get more specific real estate write downs that do not create systemic issues in some banks, but I do not think this will be a major issue for stocks or the economy.

Copyright © WisdomTree