by Carl Tannenbaum, Vaibhav Tandon, Ryan James Boyle, Northern Trust

Heightened volatility will complicate central banks' path toward easing.

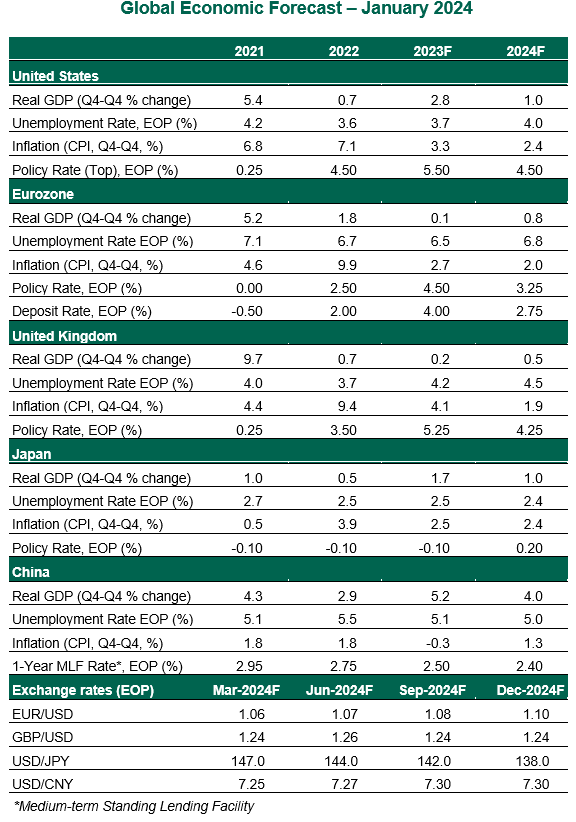

When we issued our first global economic outlook for 2023, we expected the U.S. economy to fend off a recession, Europe to stagnate and China to struggle in the aftermath of COVID-19. These forecasts proved correct.

This year, we predict a soft landing. Labor markets have loosened slightly, setting the stage for further moderation in the price picture. Continued cooling of inflation will allow consumers to regain some of their lost purchasing power, which will underpin demand. Markets are assuming an earlier and aggressive easing cycle in the West. But we expect central banks to be cautious.

Volatility and policy uncertainty will be elevated this year. An escalation of the conflicts in the Middle East and in Eastern Europe, further trade fragmentation and electoral dissonance are significant threats.

Here are our up-to-date perspectives on how major economies are poised to perform during this year and next.

United States

- Growth held up well at the end of the year, but we see fewer reasons for optimism about the year ahead. The labor market is cooling, and wage growth is moderating. And the primary impact of government stimulus is in the past. After outperforming in the fourth quarter of 2023, the expansion is likely to lose steam in 2024.

- At its December meeting, the Federal Open Market Committee provided economic projections showing that rate cuts are in store by year end. The exact timing remains unclear. We believe that market expectations of cuts as soon as March are overeager; we expect a hold until midyear, followed by a steady cadence of rate reductions.

Eurozone

- The eurozone likely ended the year with a mild technical recession, not a terrible outcome for a region that entered 2023 facing serious threats. The German economy and its industrial sector have been the weakest link. Data continues to paint a picture of a languid economy that lacks clear engines of growth. However, there are signs that the worst might be over. Improvement in surveys suggests that the fourth quarter of last year marked the trough of the cycle. Economic activity is expected to gradually improve as consumers regain their purchasing power and financial conditions ease.

- Recent European Central Bank comments have poured cold water on expectations for near-term rate cuts, stressing the need for more evidence to gain confidence in the return of inflation to the 2% target. Continued soft growth and further declines in underlying inflation should allow the central bank to pivot, but only in the middle of the year. The tension in the Red Sea could increase inflation, forcing the central bank to adopt a more cautious approach.

United Kingdom

- After flatlining for two years, 2024 will be a better year for the U.K. economy. The incoming data and surveys suggest that activity gained momentum at the end of last year. December's composite Purchasing Managers’ Index rose to a six-month high. Mortgage demand and unsecured lending improved in November. A sharp fall in inflation will boost household spending. The turnaround in the inflation outlook is increasingly being reflected in lower interest rates paid by households and firms.

- Inflation in the U.K. is set to touch the 2% mark in the coming months, much earlier than the Bank of England (BoE) expected. But the rapid decline will largely reflect the unwinding of higher energy and food costs along with softer core goods prices, rather than a sharp slowdown in domestically-generated services inflation. Labor market conditions have loosened a bit in the past year, but remain tight by historical standards. We expect a total of four cuts of 25 basis points from the BoE this year.

Japan

- Japan was one of the better-performing advanced economies in the first half of 2023, but lost momentum thereafter as high inflation and a weaker external backdrop took their toll. But the incoming data suggests momentum is returning. Consumer confidence, corporate sentiment and the outlook for business investment are improving. Consumption will get a modest boost as real incomes improve. The external outlook is unlikely to offer much support, with exports to China remaining on a downward trend.

- The Bank of Japan (BoJ) is maintaining its cautious posture, holding its overnight rate at -0.1% while allowing its wider range of yield curve control policies to take effect. In our view, the BoJ will be the only major bank which will move to make policy less accommodative this year. A high wage settlement in spring negotiations should allow the central bank to move rates gradually into slightly positive territory.

China

- China’s target of 5% economic growth was met in 2023. However, keeping the current growth momentum will require stimulus over the next few quarters. The room for further monetary policy easing is limited, as banking profitability is starting to take a hit. Fiscal policy is set to play a greater role in underpinning the economy, but it may not be enough to overcome cautious household outlays amid lingering property sector woes.

- China is not facing an imminent crisis. The economy is likely to muddle through a firmly managed clean-up process. But the road to reflation will be bumpy for China, and it may take considerable time to traverse.

Copyright © Northern Trust