by Monika Carlson, CFA | Senior Investment Strategist—Fixed Income, AllianceBernstein

Investors who wait too long to get off the sidelines may find they’ve missed out.

Bonds could see a big boost as central banks pivot toward rate cuts in 2024. Yet nearly $6 trillion is still sitting in money-market funds, a relic of the “T-bill and chill” strategy made popular in 2022, when central banks were aggressively hiking interest rates.

If you’re among the many investors sitting on the sidelines, now’s the time to get in on the action. Here’s why.

Don’t Miss Out: Get Ahead of the Rush

Rolling Treasury bills seemed like a sensible idea in 2022. Cash rates were high, and bond prices were falling as central banks hiked aggressively, trying to get a grip on runaway inflation. With so many investors agreeing that cash was king, money market funds reached a record US$5.8 trillion in assets by the end of 2023.

But since October 2022, when the Federal Reserve’s overnight fed funds rate hit 4%, cash returns have failed to keep up with the bond market. From October 2022 through December 2023, cumulative returns for the US Treasury Bill 1–3 Month Index were 6.1%, compared with 7.5% for the Bloomberg US Aggregate Bond Index. The Bloomberg US Corporate High Yield Index fared even better, posting 18.2% over the period.

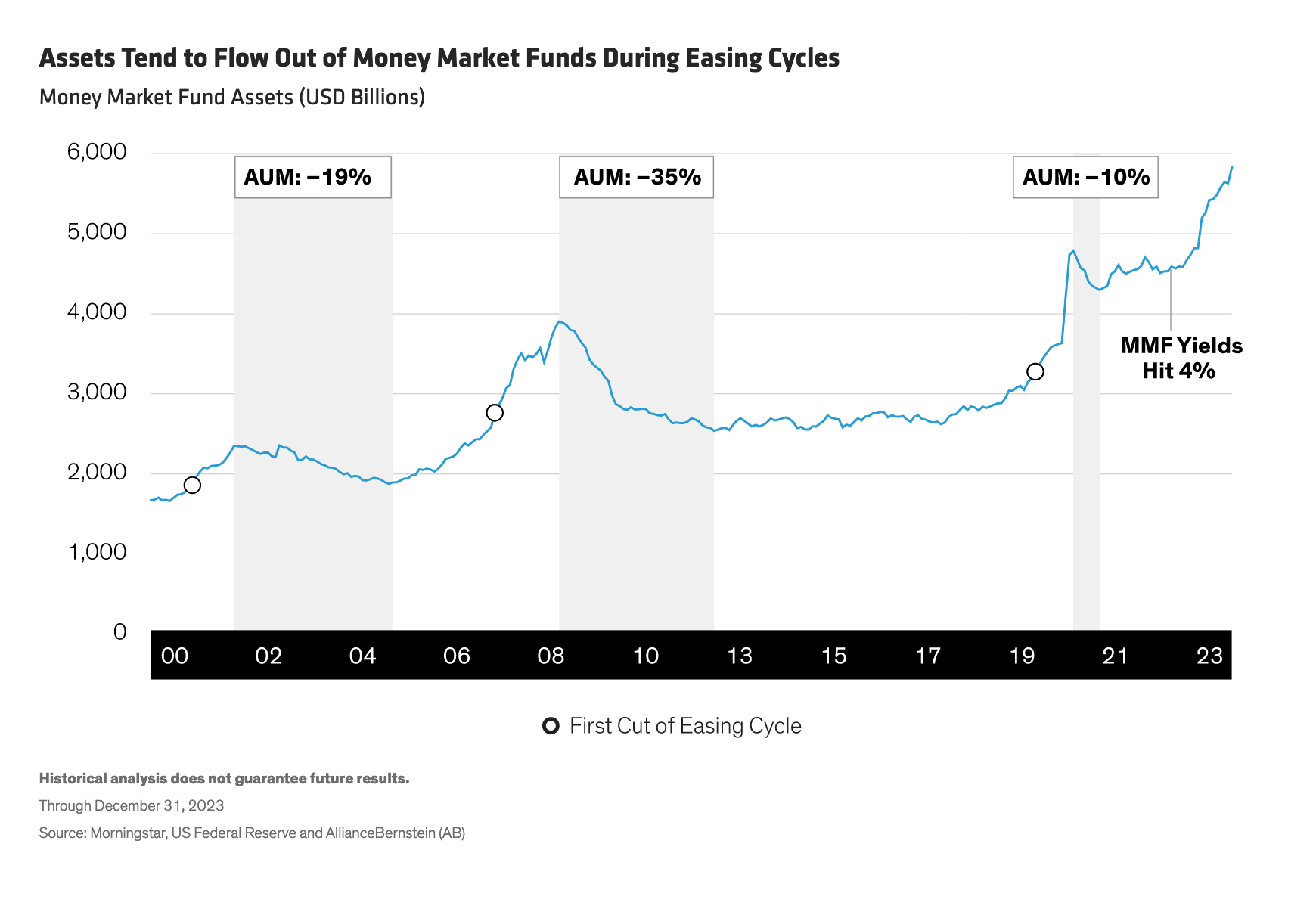

Now that the Fed appears poised to ease, many sidelined investors are looking to time their entry back into the bond market. Historically, as the Fed eased, cash flooded out of money markets and back into longer-term debt (Display).

The resulting surge in demand for bonds from such shifts in flows typically drives bond prices up and yields down, helping to reinforce the drop in yields that accompanies central bank rate cuts. Because the amount of cash sitting on the sidelines today is unprecedented, the potential surge in demand for bonds is exceptionally high.

To avoid missing out on the potential returns that represents, we think investors should aim to get ahead of the shift from cash to bonds. That means making the switch now, because government bond yields often fall—and prices rise—before the Fed takes action.

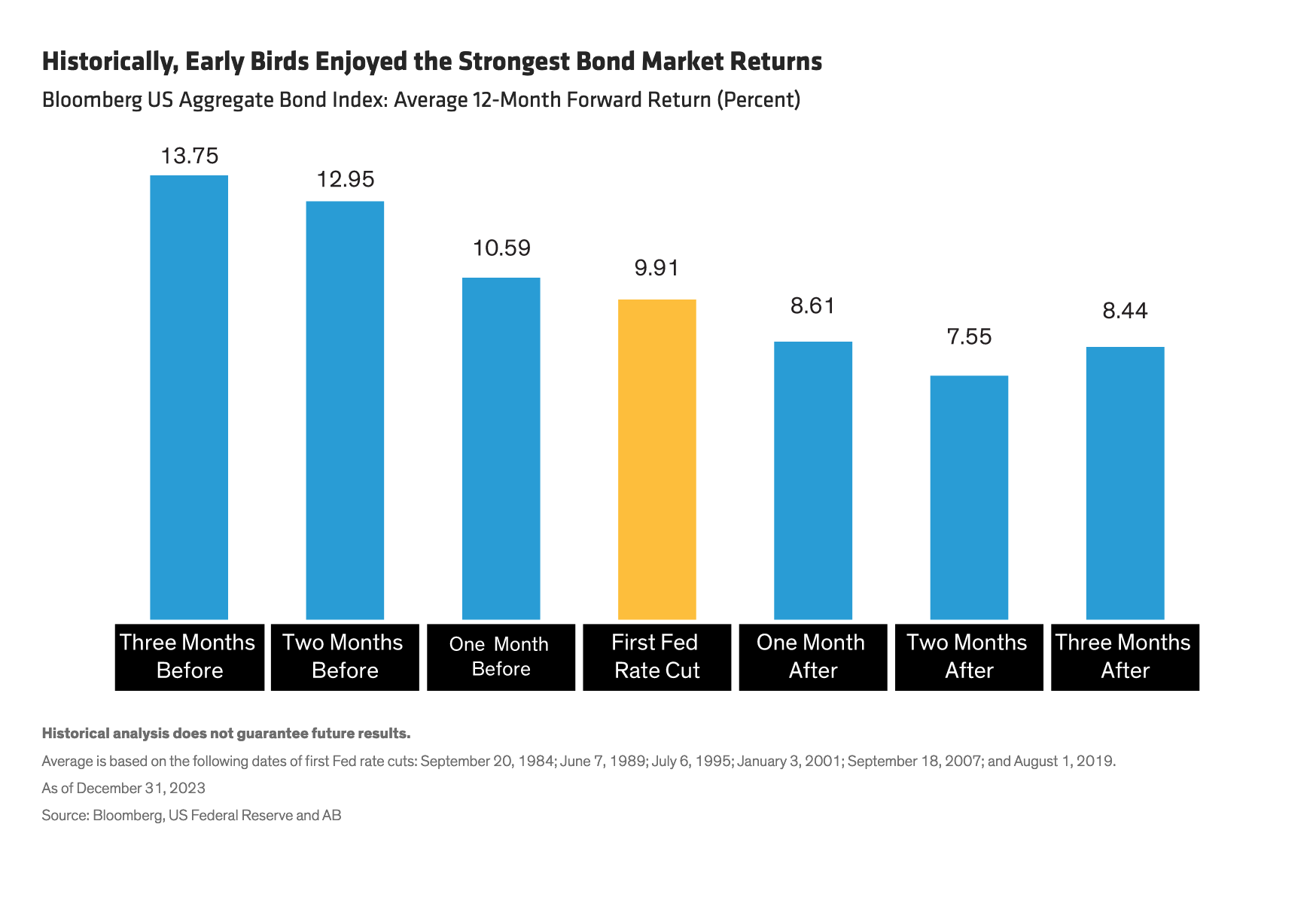

Historically, in the three months prior to the first Fed rate cut, the yield on the 10-year US Treasury fell an average of 90 basis points. That’s why past investors captured the biggest returns when they invested several months prior to the start of the easing cycle (Display).

The bond market already enjoyed a rally in late 2023 as investors anticipated an end to Fed rate hikes. But in our analysis, there’s plenty of room for yields to fall further—albeit with some bumps along the way—as growth slows and the Fed’s first rate cut nears.

Cash Yields May Disappoint

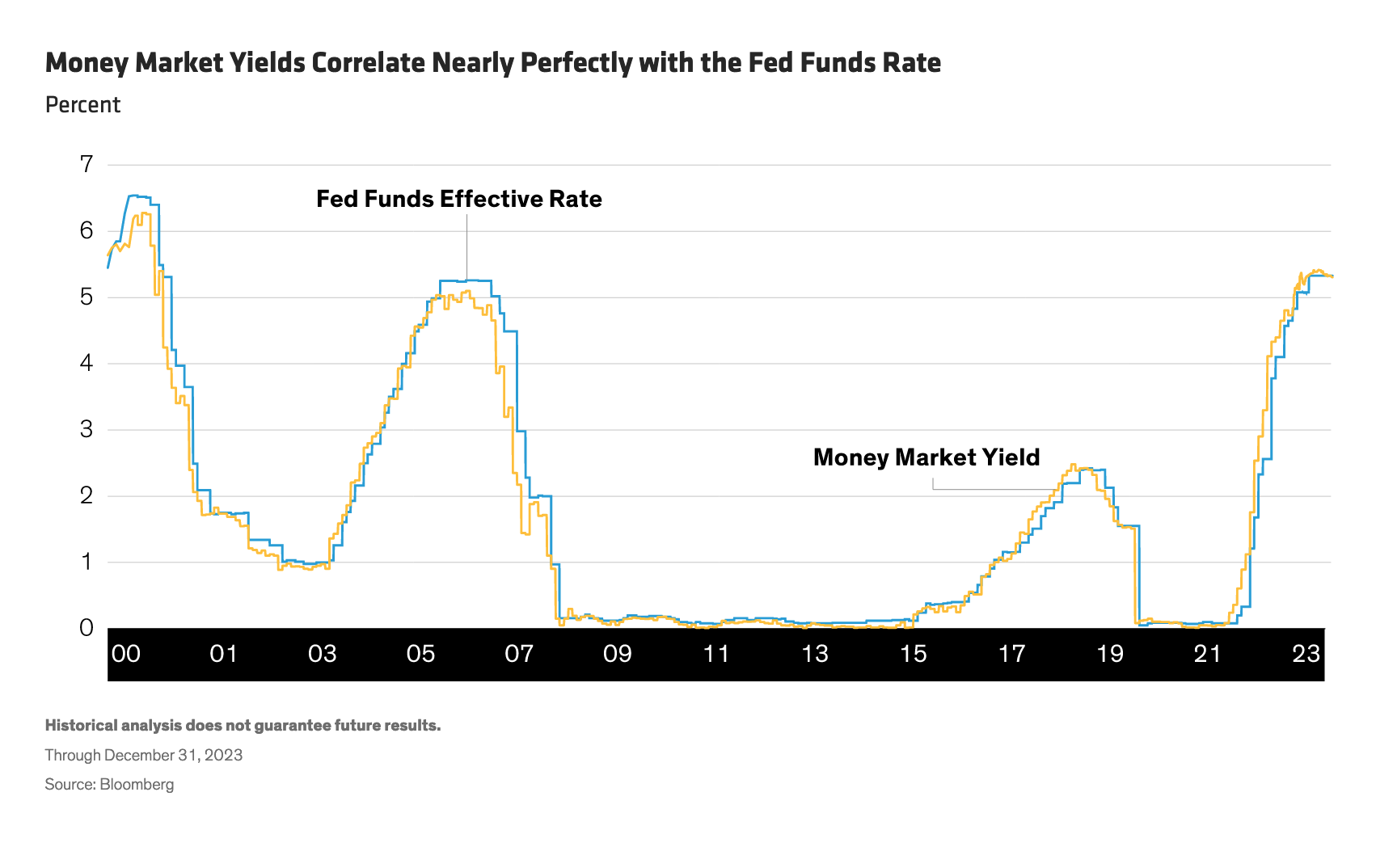

Meanwhile, investors who remain in money-market funds will likely see their cash yields decline, because cash yields are nearly perfectly correlated with the fed funds rate (Display).

The erosion of yield and potential return can be both immediate and dramatic, as the Fed tends to ease quickly. For example, in September 2007, investors who allocated to cash before the Fed started its easing cycle expected to earn a 4.7% yield over the following 12 months, given starting cash yield levels. Instead, because rates fell, they realized a yield of just 2.7%.

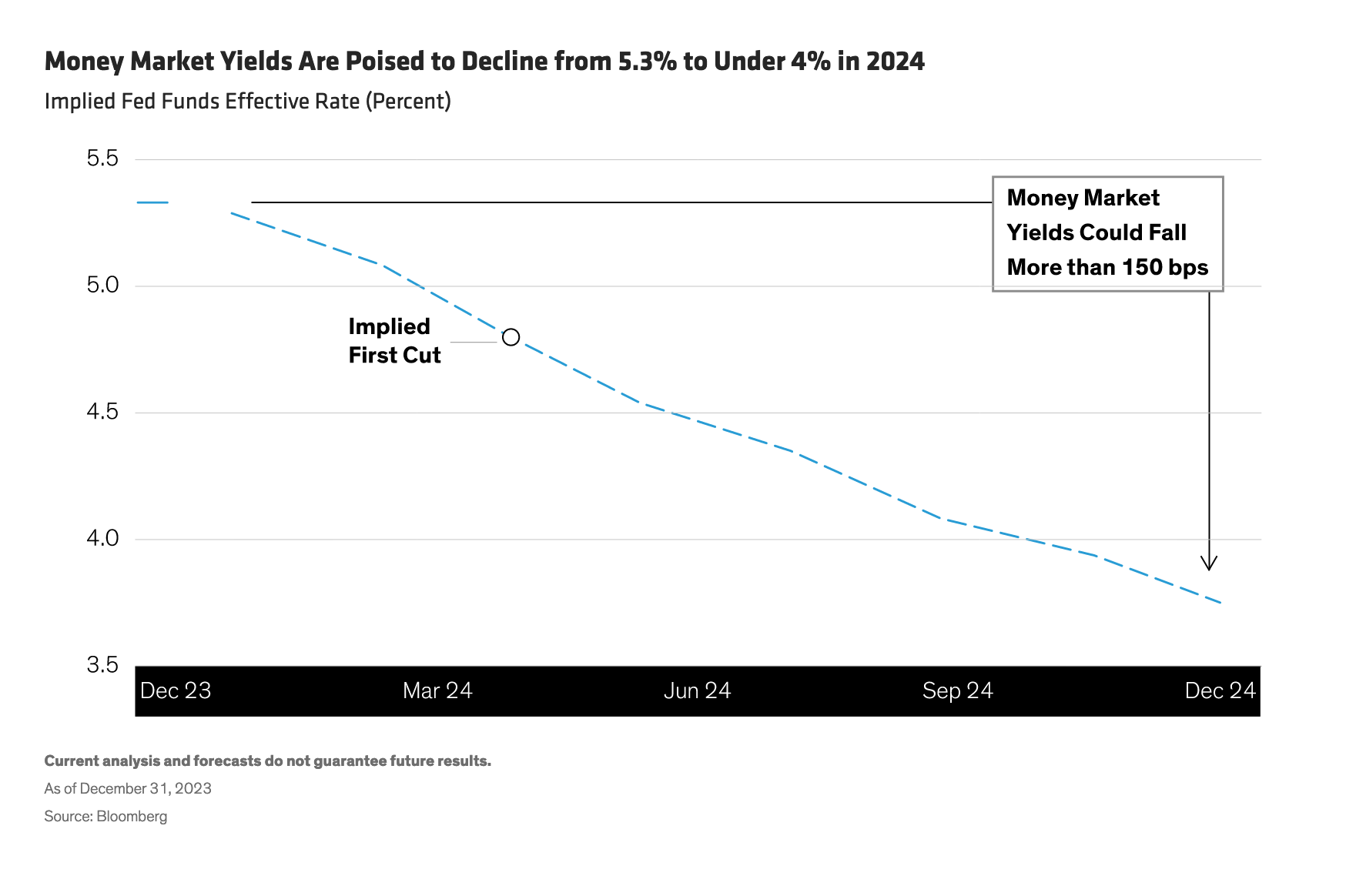

Today’s cash investors are similarly likely to experience an erosion of yield and potential return, given consensus expectations for a meaningful decline in the fed funds rate in 2024 (Display).

If Yields Rise, Asymmetry Is in Your Favor

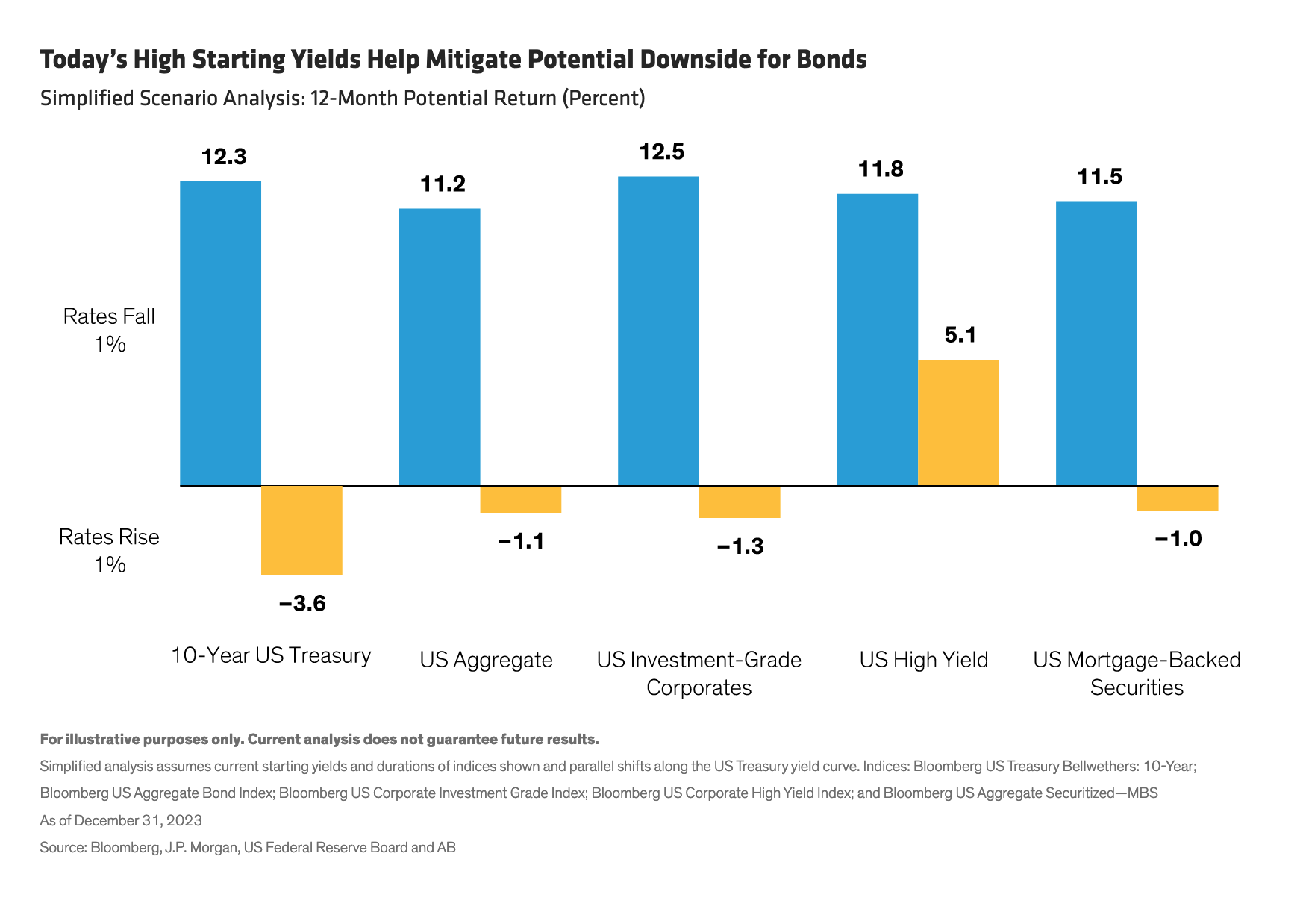

For all these reasons, we believe that bonds will outperform cash over the next year, assuming the Fed eases and yields decline, as most market observers expect. But what if yields rise instead? That’s a possibility—albeit a remote one—if inflationary forces reverse direction and the Fed renews its hiking cycle. But even in the event of rising yields, bonds are comparatively well positioned, thanks to today’s high starting yields. These ample yields help cushion against potential loss when bond yields rise.

A simple theoretical exercise illustrates how yield contributes to asymmetry of returns in the bond market. Assuming a parallel shift in rates along the yield curve, a 1% decrease in yields from today’s levels suggests double-digit potential returns across much of the bond market, while a 1% increase in yields—an unlikely scenario—suggests modestly negative returns at worst (Display).

Work Against the Clock

Investors can expect continued volatility as yields trend lower over the next few months. However, given a likely surge in demand for bonds and expected erosion of cash yields, investors who act now can position themselves for strong potential returns. That’s why, if you’re considering getting back to bonds, there’s no time like the present.

About the Authors

Monika Carlson is a Senior Investment Strategist for the Fixed Income team. In this client-facing role, she represents the market views and investment strategies of the firm's Fixed Income portfolio-management team. Previously, Carlson was a product director in Fixed Income product management and the head of the Luxembourg-domiciled Retail platform. Before that, she served as a senior portfolio manager associate in Fixed Income. Prior to joining AB in 2007, Carlson was a performance analyst at Neuberger Berman. She holds a BBA in finance from Baruch College at the City University of New York and is a CFA charterholder. Location: New York