Alfonso "Macro Alf" Peccatiello, founder and chief strategist of The Macro Compass, provides a compelling analysis of the current bond market dynamics. Peccatiello underscores the criticality of understanding these markets, especially now when macro and monetary policies are at a pivotal point. He analogizes, "Macro investing without deeply understanding bond markets is like eating soup with a fork. You can still somehow make it, but it’s cumbersome and unproductive."

This chart is getting a lot of attention:

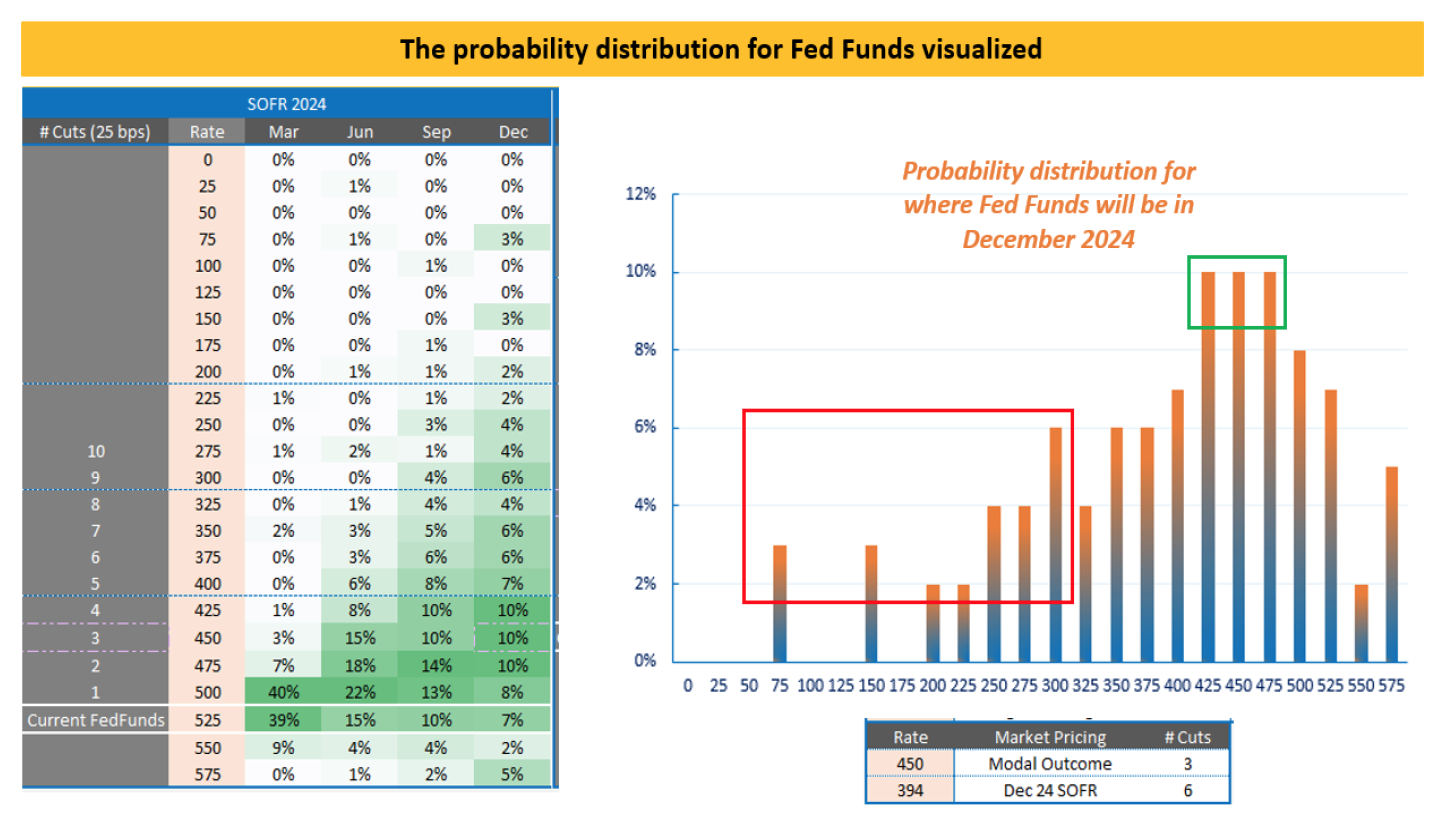

The market is pricing -165 bps of rate cuts, while the Fed is forecasting -75 bps in cuts this year.

Embracing a Probabilistic Approach

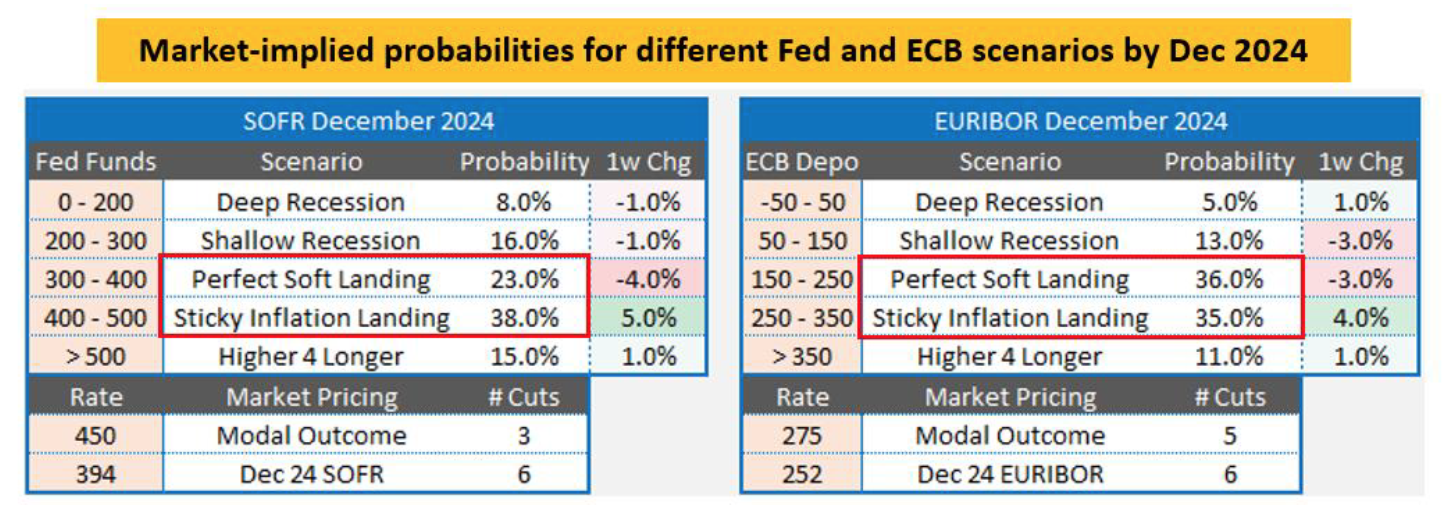

Peccatiello champions a probabilistic approach to dissecting market trends. He explains, "The option market allows us to isolate narrow scenarios and calculate market-implied probabilities for each." This method reveals insights that challenge superficial market interpretations, such as the expectation of fewer Fed cuts than initially presumed.

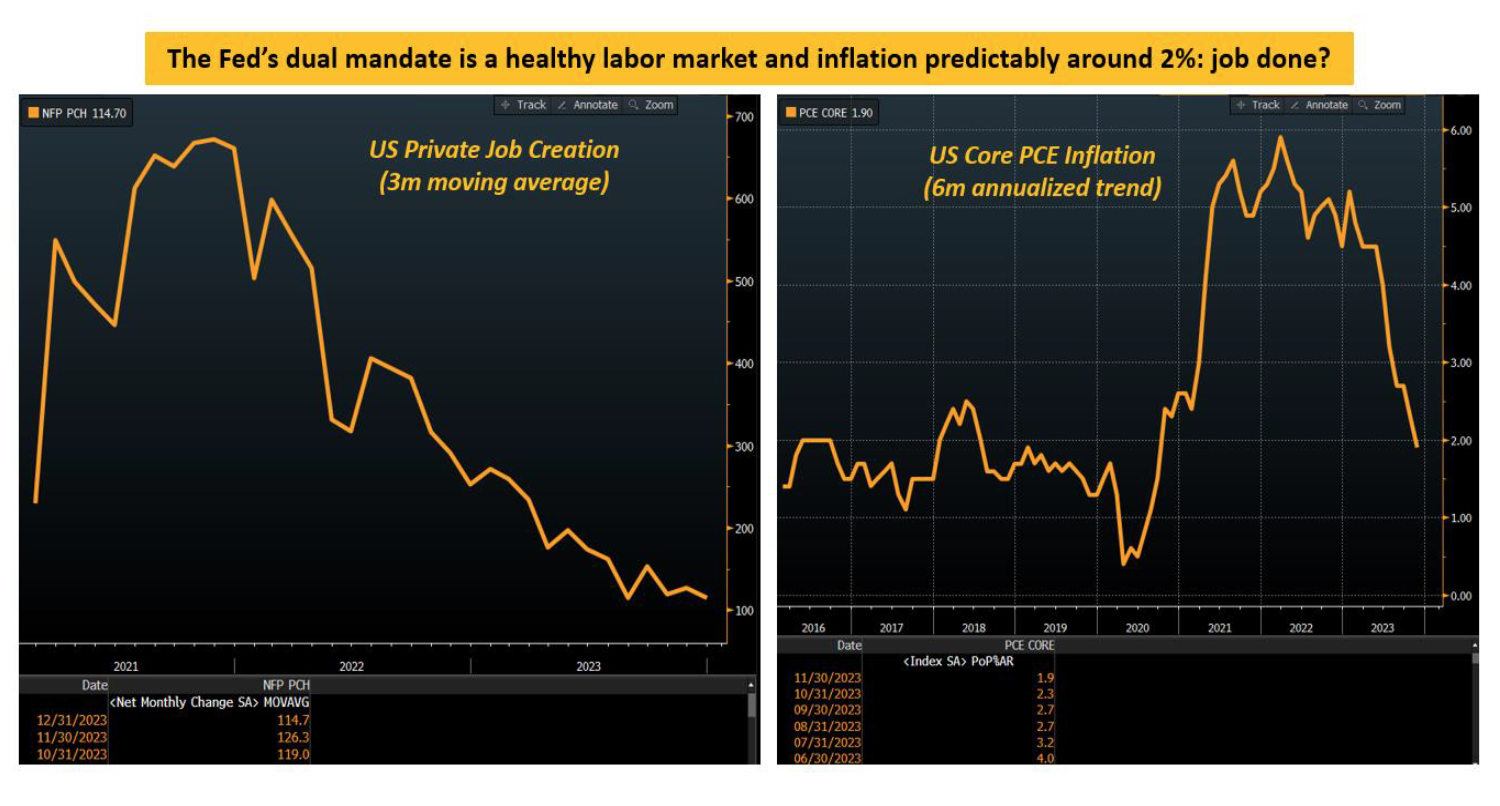

Fed's Mandate and Market Reactions

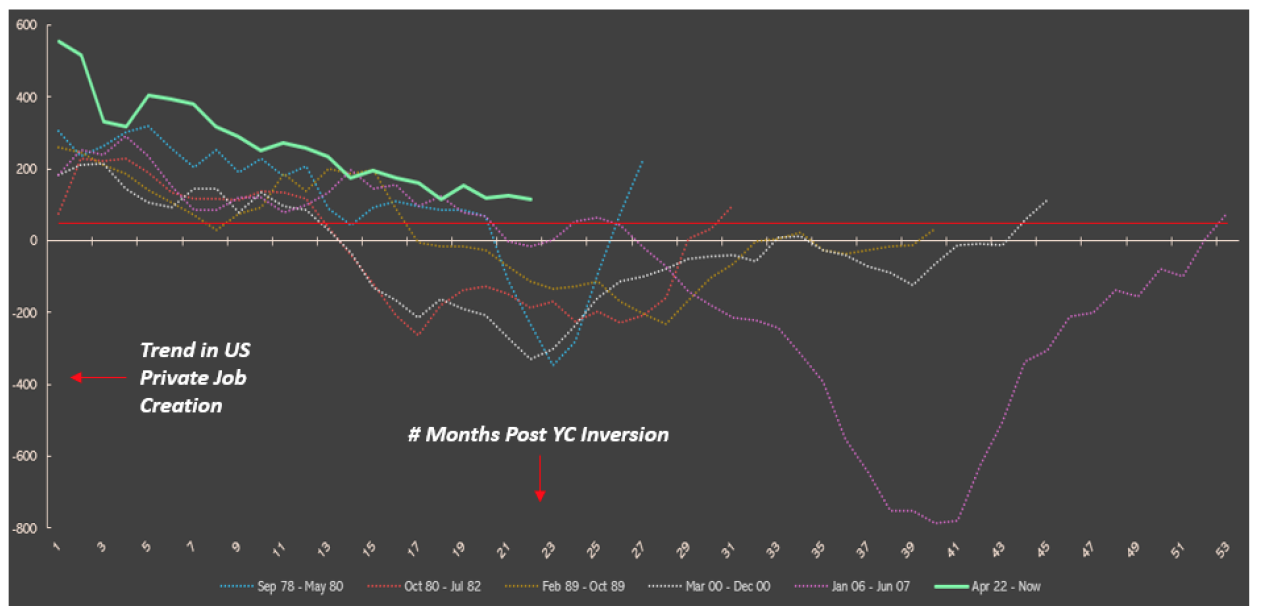

Discussing the Federal Reserve's role, Peccatiello observes, "The labor market is back in balance... and judging from the trend in private job creation... one could argue there are risks it’s weakening too much." This leads to his query: "The labor market isn’t remotely hot anymore: job done?" He also notes the alignment of core PCE with Fed targets, suggesting a potential completion of the Fed's mandate.

Market Dynamics and Future Projections

Peccatiello highlights the aggressive market pricing of 165 basis points of cuts over the next 12 months. He suggests, "This might be partially justified as judging from labor and inflation data the Fed’s job seems done." Looking ahead, he anticipates a shift in market expectations, stating, "I expect the probability distribution to move towards ‘Perfect Soft Landing’ as the base case soon."

Strategic Portfolio Management

In terms of portfolio strategy in the current market climate, Peccatiello advises a nuanced approach. He recommends, "Our Tilted Forever Portfolio starting from an equally weighted volatility contribution to internationally diversified assets... remains the go-to asset allocation framework here."

Alfonso Peccatiello's detailed analysis of the bond markets through a probabilistic perspective offers a sophisticated understanding of the current economic landscape. His insights challenge simplistic market interpretations and advocate for a deeper, more analytical approach to guide investment decisions.

Footnotes:

1 Adapted from source: Alfonso Peccatiello, What are Bond Markets Signaling?. The Macro Compass, Macro Research & Portfolio Strategy, January 9, 2024, TheMacroCompass.org